‘Taxing Corporations’ Might Be Good Politics, but It’s Still Bad Policy

Dear Capitolisters,

With one progressive victory in the bag, the Biden administration and congressional Democrats are now—as promised—itching for more. Over the last few days, details have emerged about the White House’s “infrastructure” (scare quotes intentional) bill and how Democrats plan to pay for some of it. As helpfully tabulated by economist Donald Schneider, the entire package includes about $3.75 trillion in new spending and $2.67 trillion in new taxes, thus generating another $1.1 trillion in new debt. These details, of course, are subject to change, but one part of the package seems very likely to stick: increasing the corporate tax rate to 28 percent from 21 percent—i.e., where the Tax Cuts and Jobs Act (TCJA) put it in 2017—and making a few other moves to increase taxes on multinational corporations and shareholders. It’s thus a perfect time to dig into the literature on corporate taxes and their economic effects—literature showing that, while “taxing corporations” might make for good politics and great soundbites, it’s pretty bad tax policy.

Where We Are

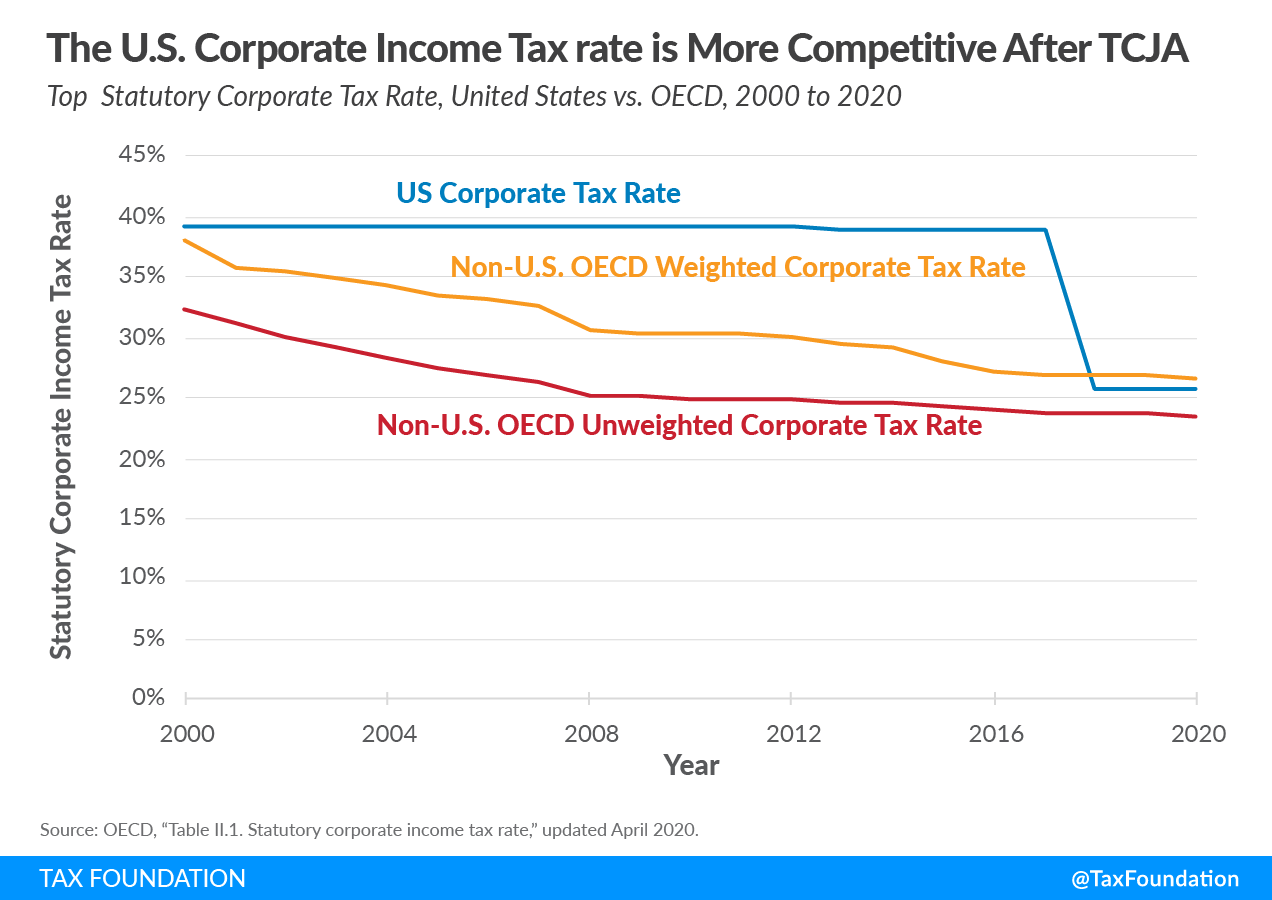

Prior to the passage of the TCJA, the United States had a combined federal-state corporate tax rate of 38.9 percent, almost all of which (35 percentage points) was at the federal level. Because many countries—including more “progressive” ones like Canada and Sweden—lowered their corporate tax rates over the last 40 years, the United States in the 2010s ended up with one of the highest statutory corporate tax rates in the developed world (and the highest in the OECD). Following the TCJA, which lowered the federal rate to 21 percent, corporate tax rates in the United States were more in line with the OECD average but certainly not “low” by any reasonable definition:

The TCJA also ended up lowering the effective corporate tax rate in the United States (meaning the average amount that corporations actually pay in income taxes), though this stat obviously varies a lot by company and calculation method. Regardless, the general trend is clear: Pre-TCJA, U.S. corporations faced an average effective tax rate that was higher than most peer countries; post-TCJA, it was better but still not world-beating. For example, the OECD calculates rates of 37.5 percent and 17.4 percent for respective average and marginal effective U.S. corporate taxes in 2017 and 24.6 percent and 11.2 percent rates, respectively, in 2019—basically in the middle of the OECD pack. Similar analyses have been completed here for just multinational corporations and here for just the United States.