In March 2024, Trump Media & Technology Group (Trump Media)—the owner of Truth Social—began trading publicly on the Nasdaq stock exchange after merging with the publicly traded shell company Digital World Acquisition Corp. Since then, the stock’s value—which often rises and falls with the fortunes of Trump himself—has fluctuated wildly and aggravated the sensibilities of traditional investors.

Earlier this month, a viral story on the financial news site Finbold reported that Trump Media’s stock (DJT) was “shorted heavily day before assassination attempt.” Short selling is a tactic, explained in more detail below, used by investors to profit off a stock’s decline. The story, which has been shared widely across social media, suggests that the allegedly unusual number of shares being sold short “[raise] concerns that some individuals may have had foreknowledge of a plot against former President Trump’s life and sought to profit from the expected turmoil.”

Simultaneously, reports surfaced that Texas-based private wealth firm Austin Private Wealth had purchased 12 million “put options”—a financial derivative that can be used to bet on a stock’s decline—for DJT on July 12, a day prior to the assassination attempt, leading to widespread chatter online that the firm had known about the attempt in advance.

Both stories are false. Finbold’s analysis mistakenly relies on old data, and Austin Private Wealth has clarified that its purported purchase was actually the result of a filing error with the Securities and Exchange Commission (SEC).

Understanding short selling.

Short selling is a trading strategy that allows investors to profit if a stock’s value decreases. In a short sale, an investor will borrow shares of a particular stock from a broker—to whom they pay interest for the shares—and then sell them on the open market. If the price of that stock decreases, the investor can repurchase the shares at a lower price before returning them, earning a profit.

Two main measures are used to determine how many shares of a particular stock are being sold short at any given time: short volume and short interest. Short volume measures the total number of shares of a security sold short on a specific trading day, while short interest represents the total number of outstanding short positions on a security at a specific point in time. Short volumes for shares traded on exchanges like the Nasdaq are reported by those exchanges, while off-exchange short volumes are reported by the Financial Industry Regulatory Authority (FINRA), a not-for-profit organization that is authorized by Congress to oversee brokers in U.S. financial markets and enforce compliance with federal securities laws. Member institutions to FINRA are required by FINRA rule 4560 to maintain a record of short positions in all customer and firm accounts. This information is reported to FINRA twice per month and compiled to determine a stock’s short interest.

In the Finbold article, journalist Elmaz Sabovic claims that DJT’s short interest rose substantially between July 1 and July 12, but immediately plummeted after the assassination attempt failed. “However, a fact bound to raise a few questions is that short positions against Truth Social stock doubled between July 1 and July 12, going from 7 to 15 million shares, in what was a record of shares shorted for DJT stock since its trading debut,” the piece reads. “Looking at the current level of DJT stock short-interest, it has subsided substantially … This means that the stock is no longer experiencing high short interest, as it did last week.”

Sabovic argues that DJT’s short interest may have risen before the assassination attempt because investors anticipated that the stock’s value would decline. He then furthers his point by showing that, after the assassination failed, the stock’s short interest decreased to just over 5 million. Sabovic, however, is misreading the data.

The story claims that short interest for DJT rose from 7 million to 15 million shares before the assassination attempt. However, when the story was published, DJT’s official short interest for the first half of July was not yet available. The story instead uses a chart showing the stock’s short volume, and mistakenly labels it as “DJT stock short-interest history.” Brokerage firms are required to report short interest to FINRA only twice per month—once in the middle of the month, and once at the end. Because this reporting is done with a weeklong lag, the first July short interest measure for DJT—which reported the total number of outstanding short positions for the stock on July 15—was published by FINRA on July 24, a full week after Sabovic’s article was published.

While there is no official short interest data available at a daily interval, some third-party providers do provide daily short interest estimates. On July 1, ORTEX, a financial intelligence and analytics firm based in London, estimated that DJT’s short interest was 7.16 million shares. By July 12, its estimate rose to only 8.86 million shares, far short of the 15 million claimed by Sabovic.

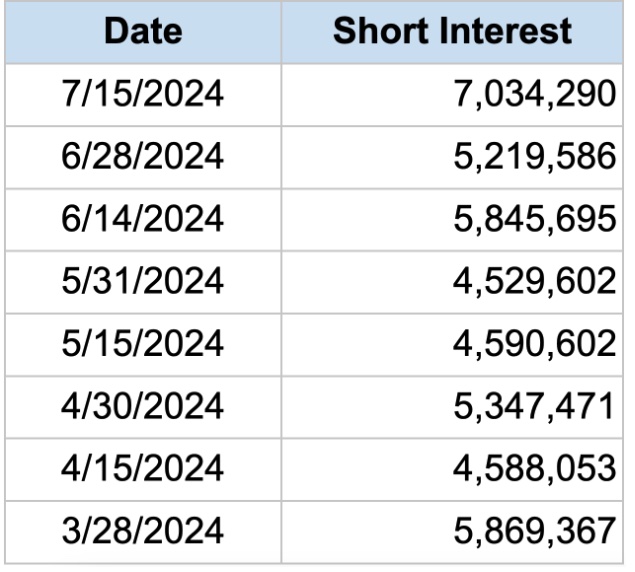

The story’s claims that DJT’s short interest fell to 5,219,586 following the assassination attempt is false. This number is actually the stock’s short interest as reported by FINRA on June 28, which was the most recent data available when the story was published. DJT’s only official short interest measure since the assassination, which was made on July 15 and published on July 24, stood at 7,034,290 shares.

Off-exchange short volume is recorded daily by FINRA, so it can offer better insight into short-selling trends for specific date ranges than short interest. Even though it does not include short sales executed on exchanges like the Nasdaq, off-exchange data provides an important comparison point for relative increases and declines in short selling of a stock. In the days prior to the attempt on Trump’s life, off-exchange short volumes for DJT were in line with prior trends.

The average off-exchange short volume for DJT has been approximately 1.88 million shares per day since the stock’s first full month of trading in April. In the week before the attempted assassination, DJT recorded off-exchange short volumes below its average: 1,378,393 on Monday, 973,407 on Tuesday, 959,411 on Wednesday, 844,494 on Thursday, and 916,884 on Friday. Had some investors known of the assassination attempt in advance and short-sold DJT shares in anticipation, the short volume would have been higher—not lower—than usual. More broadly, the stock’s average off-exchange short volume in July was lower than in two of the three full months since it began trading publicly. The Dispatch Fact Check contacted Finbold for comment, but no one from the publication responded.

Put options.

Austin Private Wealth clarified on July 17 that its purchase of 12 million shares worth of put options was the result of a clerical error by a third-party vendor.

In a July 12 SEC filing, in which Austin Private Wealth reported its client positions as of June 28, the correct contract amount of 12 was mistakenly multiplied to 120,000, making it appear as if the firm had purchased put options for 12 million shares of DJT stock. A standard put option contract covers 100 shares of the underlying stock. The firm amended the report on July 16 after being made aware of the error.

“The SEC filing which showed that Austin Private Wealth shorted a large number of shares of Trump Media & Technology Group Corp (DJT) was incorrect and we immediately amended it as soon as we learned of the error,” the firm wrote in a statement. “No client of APW holds, or has ever held, a put on DJT in the quantity initially reported. The correct holding amount was 12 contracts, or 1,200 shares — not 12 million shares, as was filed in error. In submitting the required report for the second quarter of 2024, a multiplier was applied by a third-party vendor that increased the number of the shares by a multiple of 10,000 for all options contracts (not just DJT).”

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.