What a week, huh?

Yes, Liz Lemon, it’s only Wednesday, so there’s still a couple days left to see more fluctuation in both the financial markets and the U.S. trade policy. The indirect relationship is clear, though: When tariffs (or the threat of them) go up, the markets go down. And there’s a lot of downturn as President Donald Trump continues to embrace more and harsher protective trade actions.

Despite announcing late last week that he was postponing the implementation of tariffs on imports from Mexico and Canada, the president has kept his foot on the gas, saying that the reciprocal tariffs he mentioned in his joint address to Congress will still kick in on April 2. Then on Monday, China announced it was going to impose new tariffs on American agricultural products in retaliation for Trump’s blanket 10-percent duty on Chinese imports. This contributed to Monday’s selloff that saw significant losses in all the major indexes.

Things didn’t get much better on Tuesday, which also ended with both the Dow Jones Industrial Average and the S&P 500 down by the time markets closed. And it’s not just stock prices tumbling—the Wall Street Journal reports the junk bond market is seeing prices tumble as well. That’s all happening against the backdrop of trade action volatility. In response to the Canadian province of Ontario putting a 25-percent surcharge on electricity it exports to some border states, Trump announced (on Truth Social, of course) that the steel and aluminum tariff wall with Canada was getting 25 percent higher. By end of day on Tuesday, though, Commerce Secretary Howard Lutnick had apparently extended an “olive branch” to the Ontario premier, Doug Ford, who announced the province would pull back the surcharge and that further talks would smooth things over. By the end of the day, Trump reversed himself on that particular tariff hike.

All the while, Trump and the White House are arguing all of this market volatility is just the cost of making America great and prosperous again. White House press secretary Karoline Leavitt called tariffs a “tax cut for the American people” and accused a reporter who challenged that idea of “trying to test my knowledge of economics.” Trump, meanwhile, is trying to sound copacetic. “Markets are going to go up and they’re going to go down, but you know what? We have to rebuild our country,” the president told reporters Tuesday.

The question for the next few days, weeks, and months is how much “rebuilding” of the country will voters tolerate? Voters may start to voice their disapproval of Trump’s tariffs über alles approach if their retirement savings and stock portfolios continue to drop while prices for goods stay high.

—Michael

Top Stories From the Dispatch Politics Team

The Trump administration’s answer to many problems—from the distribution of fentanyl and the flow of illegal immigrants to the federal budget deficit and national security concerns—is to embrace tariffs. Whether these protective actions are intended as a negotiating tactic or a policy end themselves is one of the enduring questions of the second Trump administration so far. But the impulse to go to the tariff well remains strong, even when America’s trade regime has little direct influence on the problem at hand.

Elon Musk’s partnership with Donald Trump has turned the technology mogul into a folk hero inside the Republican Party, with a political platform and relationship with grassroots voters all his own—second in popularity and stature only to the president. That both Musk and DOGE are under fire from Democrats and facing intense media scrutiny makes the Republican base love him more. It’s the same dynamic that helped Trump cultivate a loyal following on the right during his initial years as a politician.

On the first day of his second term in office, President Donald Trump issued an executive order mandating an immediate “pause” of new foreign aid while programs were evaluated for whether they were “fully aligned with the foreign policy of the President of the United States.” One program swept up in these broad orders has been wildly successful in combating the global HIV/AIDS epidemic since it was first signed into law by President George W. Bush in 2003. PEPFAR, the President’s Emergency Plan for AIDS Relief, costs $7.5 billion annually, or about 0.1 percent of the federal budget, and is credited with having saved an estimated 26 million lives over two decades.

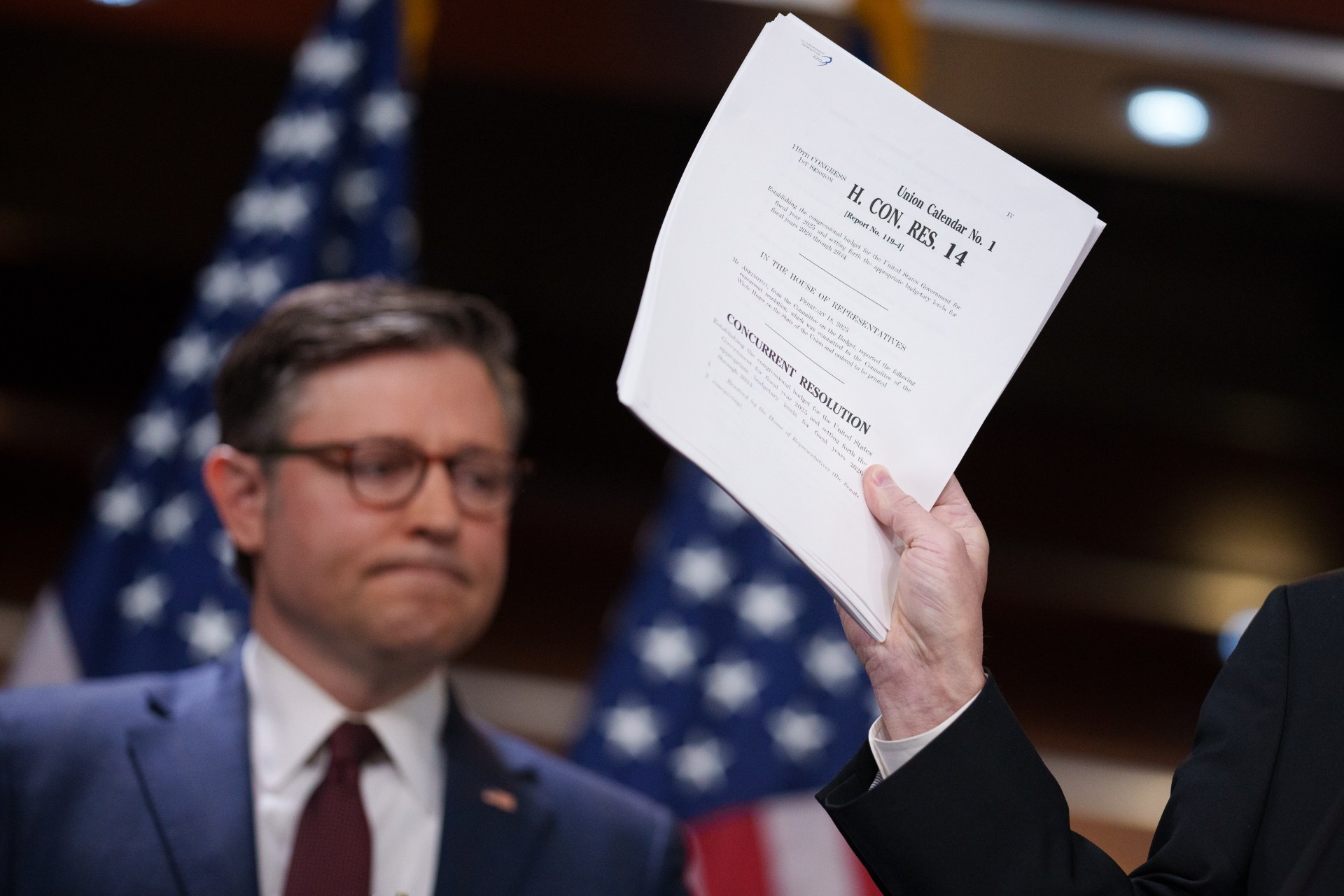

The White House’s guidance on how to achieve a balanced budget has not yet extended far beyond a scattershot of outrageous examples of abuse and ideas for jump-starting the economy. In order to reach this ambitious objective and deliver Trump a win, GOP lawmakers are otherwise on their own to identify where else to cut and make up the deficit. When it comes to the details, White House is taking a “hands-off” approach, as Republicans on the Hill have put it.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.