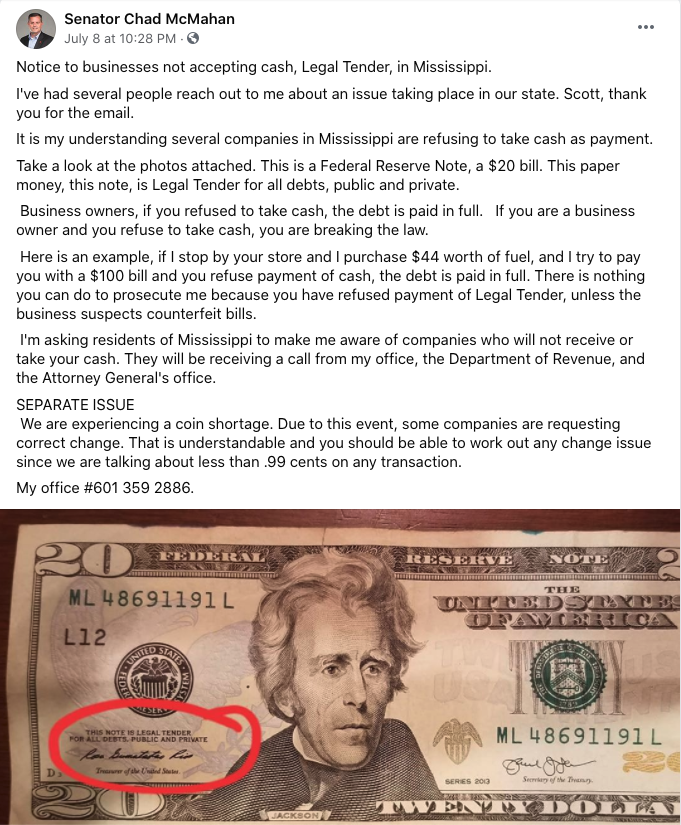

A number of viral Facebook posts (including one from Mississippi State Sen. Chad McMahan) claim that it is illegal for businesses not to accept cash payments for goods or services. The posts further claim that when cash is turned down, the debt is legally recognized as paid. These posts come at a time when some businesses are refusing cash payments due to concerns about coronavirus transmission.

Section 31 of U.S. Code 5103 states that “United States coins and currency (including Federal reserve notes and circulating notes of Federal reserve banks and national banks) are legal tender for all debts, public charges, taxes, and dues.” While the law recognizes physical currency as legal tender, that status does not make accepting such currency mandatory. The Board of Governors of the Federal Reserve System website even states: “There is, however, no Federal statute mandating that a private business, a person, or an organization must accept currency or coins as payment for goods or services. Private businesses are free to develop their own policies on whether to accept cash unless there is a state law which says otherwise.” Likewise, the Department of Treasury website says the same thing, and gives examples of a bus line “prohibit[ing] payment of fares in pennies or dollar bills” or a movie theater, convenience store, or gas station “refus[ing] to accept large denomination currency (usually notes above $20) as a matter of policy.”

Thus far, only two states—New Jersey and Massachusetts—have passed laws requiring businesses to accept cash. A handful of cities, including Philadelphia and San Francisco, have as well.

While the viral posts correctly identify cash as legal tender, they misunderstand the legal consequences of that status. Unless there is a state or local law prohibiting it, businesses are entirely within their legal right to turn down cash payments and claims to the contrary are false.

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Photograph by Nic McPhee/Flickr.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.