Happy Thursday! Our hearts go out to the Las Vegas wedding planners and city clerks bracing for a rush of newlyweds this New Year’s Eve. But we really can’t blame people for wanting an anniversary date—12/31/23, or 123123—that even a toddler could remember.

Quick Hits: Today’s Top Stories

- The Israeli Defense Forces (IDF) expanded its ground operations into refugee camps in central Gaza this week, deeming them “a new battle zone” in the campaign to destroy Hamas’ military and governing capabilities in the enclave. Civilians living in the Bureij and Nusairat camps have been directed to move to Deir al-Balah, a central Gazan town just south of the camps, and thousands fled there on foot yesterday—but Deir al-Balah has reportedly also been a site of continued fighting. “The war will continue for many more months,” said Herzi Halevi, chief of the general staff of the Israel Defense Forces, in a press conference on Tuesday. “There are no magic solutions or shortcuts in the fundamental dismantling of a terrorist organization, except persistent and determined fighting.”

- The U.S. Defense Department announced on Wednesday its final security aid package under existing drawdown authority to Ukraine, which includes up to $250 million in “air defense capabilities, artillery and anti-tank weapons, and other equipment.” Secretary of State Antony Blinken urged lawmakers to pass additional aid to continue American support to the embattled country. “It is imperative that Congress act swiftly, as soon as possible, to advance our national security interests by helping Ukraine defend itself and secure its future,” he said in a statement released yesterday.

- The New York Times filed a lawsuit on Wednesday against OpenAI and Microsoft over alleged copyright infringement, claiming that the companies exploited the newspaper’s content without permission or authorization to train their AI systems—including the chatbot ChatGPT—and “wrongfully benefited from” the Times’ journalism. “This action seeks to hold them responsible for the billions of dollars in statutory and actual damages that they owe for the unlawful copying and use of the Times’ uniquely valuable works,” the paper argued in the filing.

- The Michigan Supreme Court on Wednesday left a lower court ruling in place that keeps former President Donald Trump on the GOP presidential primary ballot. As in Colorado, the Michigan voters who brought the case argued that Trump should be barred from the ballot under the insurrection clause of the Constitution’s 14th Amendment. In a one-paragraph order, the justices wrote, “We are not persuaded that the questions presented should be reviewed by this court.” The ruling didn’t address whether Trump was eligible to appear on the general election ballot, but the U.S. Supreme Court is expected to decide that issue in the coming weeks.

- In a motion filed Wednesday, special counsel Jack Smith requested the federal judge overseeing his 2020 election case against Trump stop the former president and his legal team from “inject[ing] politics” into the trial and making unfounded claims to the jury about selective prosecution or election interference. Smith asked Judge Tanya Chutkan to block any attempts “to confuse and distract the jury” with questions or claims not relevant to the case. “The court should not permit the defendant to turn the courtroom into a forum in which he propagates irrelevant disinformation,” the filing read. “Much as the defendant would like it otherwise, this trial should be about the facts and the law, not politics.” Chutkan temporarily put the trial proceedings on hold earlier this month while a federal appeals court assessed Trump’s claims of immunity from prosecution.

Waiting for the (Economic) Ball to Drop

Being wrong is always frustrating, but being wrong in the company of a large number of well-qualified—though equally incorrect—experts must dull the blow slightly.

We hope that sentiment holds true for the economists Bloomberg and Financial Times surveyed around this time last year, asking whether they expected the U.S. economy to be in a recession by the end of 2023. In December 2022, the vast majority of those economists said, “You betcha.”

Should the wonks who missed the mark be eating crow, or is the triumphalism and public gloating by those few optimistic economists premature? Inflation continued to fall this year even as the U.S. economy has grown and the labor market has remained tight, giving some experts reason to hope 2024 may prove a passable 12 months for the U.S. economy. But as this decidedly recession-less year draws to a close, there are still some flies in the macroeconomic ointment that have a few economists and commentators urging caution heading into 2024. Who can blame the American people for their mixed feelings about the economy when even the experts have trouble predicting how the next few months will turn out?

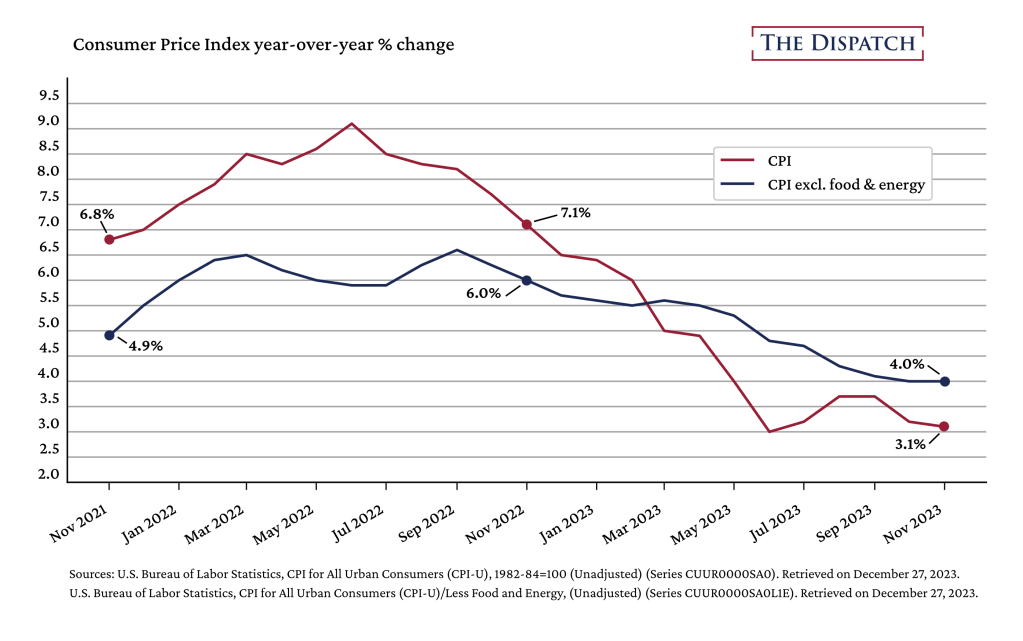

Inflation was, of course, the big economic story of the last two years. After prices ballooned in 2021 and early 2022, the Federal Reserve embarked on an aggressive rate-hiking spree starting in March 2022, raising interest rates 11 times since then—from practically zero at the beginning of 2022 to 5.25-5.50 percent as of the last rate bump in July of this year. The hikes were an effort to achieve the idyllic “soft landing”: using higher interest rates to slow the economy enough to stabilize prices, while also maintaining high employment.

And inflation has fallen. As a little Christmas gift to Fed Chair Jerome Powell, the Department of Commerce reported on Friday that the personal consumption index (PCE)—the Fed’s preferred inflation measure—was up just 2.6 percent year-over-year in November and fell by 0.1 percent from October to November, the first such month-to-month decrease in prices since April 2020. Excluding the more volatile food and energy figures, prices were 3.2 percent higher compared to November last year. The PCE index peaked in June 2022 at a 6.8 percent annual increase and has posted less significant price increases in the months since. The latest figures are approaching the Fed’s nirvana: 2 percent inflation.

The consumer price index (CPI), another key inflation measure, was up 3.1 percent annually in November—far below its recent high-water mark of 9.1 percent year-over-year growth in June 2022, though also not quite its lowest annual increase since then.

But just because inflation is easing doesn’t mean all those Christmas gifts you bought were dirt cheap. Prices are still elevated and generally still increasing—just more slowly and more normally than in years past. CPI may “only” be up 3.1 percent from November 2022, but it’s up 19.4 percent from November 2019.

Even as inflation has started to normalize in recent months, the economy itself has not slowed much. GDP growth cooled ever-so-slightly in the first two quarters of 2023, but shot to the moon in Q3 of this year. Economists’ predictions were once again off-base: Expectations over the summer of a 0.6 percent annual bump in GDP in Q3 gave way to the reality of a 4.9 percent increase year-over-year, driven mostly by strong consumer spending. (A group of economists surveyed by the Wall Street Journal predicts 0.9 percent growth in the final quarter of this year, but that mileage may vary.)

“I think the resilient consumer will carry through into 2024,” predicted Richard Barkham, global chief economist at CBRE, a commercial real estate services and investment firm, “which is why we’re a little bit optimistic [about 2024].” Many consumers, he told TMD, are locked into low-rate mortgages from 2020 and 2021—when rates were hovering around 3 percent and many refinanced—somewhat insulating themselves from the Fed’s interest rate hikes. Nevertheless, there are a few signs that consumer spending may cool in 2024: pressure on the unlucky homeowner who financed a mortgage at the current rate of around 6 or 7 percent, rising debt, and the end of COVID-19 stimulus and dwindling pandemic-era savings.

The labor market, too, remains healthy, with the unemployment rate sitting at 3.7 percent in November. “The labor market a year ago at this time was white-hot,” Stephen Miran, adjunct fellow at the Manhattan Institute and co-founder of asset manager Amberwave Partners, told TMD. “And then it slowed down from white-hot to blue-hot, and then blue-hot to red-hot. But it’s still pretty hot.”

Miran falls into a camp of economists arguing that those seemingly positive developments may bode ill for inflation in the coming year. “If the economy winds up reaccelerating and continues growing, continues putting up the GDP numbers that it seems to have been putting up over the course of the year,” he said, “then it’s very easy to see wage growth start to move even higher, pushing renewed inflation through the services channels of inflation.”

But that view isn’t shared by all. “For the last 20 years, there’s absolutely no correlation between labor market data, wage data, and inflation—it just doesn’t exist,” argued Brendan Walsh, a principal at Markets Policy Partners. For whatever it’s worth—in fairness, economics isn’t an exact science—only 24 percent of economists recently surveyed by the National Association for Business Economics said they saw a recession as more likely than not in the coming year.

There are other, more obvious potential pitfalls for the economy in 2024. Attacks by Yemeni Houthi rebels on vessels and tankers in the Red Sea—through which move about 3.8 million barrels of crude oil each day*—have forced major companies, like BP, to divert their ships around southern Africa, adding time and costs. “If [the Red Sea attacks] escalate and global shipping gets severely affected and oil prices move severely higher, that would undo a significant portion of the disinflation we’ve seen over the last year,” Miran told TMD. Oil prices averaged $99 a barrel in 2022 before falling to $83 in 2023.

While that could be bad news for prices—not just of gas, but of goods transported by vehicles that require gas—the U.S. is also more insulated than its European allies, for example, from the effects of such disruptions, since it’s the largest producer of oil and gas in the world. Nevertheless, the U.S. earlier this month launched Operation Prosperity Guardian, a multinational maritime coalition to protect the shipping lanes, and some companies have since indicated a willingness to return to the routes despite continued attacks.

Slowing economies overseas are another possible area of worry for the U.S. economy, and China’s economy is particularly sluggish. That could lead to more expensive Chinese exports bound for the U.S., but also weaken demand for U.S. exports. “American exports will feel that,” Barkham, the CBRE economist, told TMD. “That will feed through into the corporate sector, and corporates will be more nervous to invest, and might even be more inclined to lay off staff.”

At the December 13 meeting of the Federal Reserve, central bankers held rates steady for the third time in a row. But Powell signaled that rate cuts would be coming in the new year in his comments after the meeting. “The question of when will it become appropriate to begin dialing back policy, that begins to come into view and is clearly a topic of discussion now in the world and was also a discussion for us at our meeting today,” he said, adding that waiting until inflation fell to the desired 2 percent would be “too late.” On the other hand, the specter of the 1970s—when central bankers started cutting rates too quickly and inflation rebounded—looms large.

Economists—in large numbers—were wrong in their pessimistic view of 2023’s economy. What’s to say that the two-thirds of economists Bloomberg surveyed this month who hold an optimistic view of the next year aren’t wrong? “We’ve learned, I think, during 2023, that the economy has evolved,” Barkham told TMD. “And we’ve asked ourselves deep, searching questions: ‘Why did we get it wrong? How has the economy changed?’ And the research that we’ve done around that—I think it’s allowed us to get better in 2023.”

“But we can only predict on the basis of what we know now,” he added. “We can’t predict on the basis of unforeseen events.” Good thing we famously all know exactly how major events, like presidential elections, are going to turn out.

Worth Your Time

- Writing for the Wall Street Journal, David Harrison reported on the decline in long-distance bus access in the United States. “The intercity bus network, a cross-country web of regional providers connecting to Greyhound, allows passengers to reach thousands of destinations around the country on a single, relatively affordable ticket,” Harrison wrote. But cities—including potentially Chicago—are starting to give up their bus stations: “Intercity bus stations are closing throughout the country. At least eight cities have lost their stations so far, including Philadelphia, Ohio’s Columbus and Tampa, [Florida]. Passengers have had to wait on street corners and parking lots, causing tensions with local officials. … Intercity bus travel isn’t federally regulated and attracts less attention and public funding than passenger rail or air travel. Nonetheless, it plays a vital role for passengers who need cheap transportation or who are traveling to places with no air or train service.”

- The Atlantic recently published some of the winners of the 2023 International Landscape Photographer of the Year contest. Our favorite might be number 12, but that’s because we’re suckers for the Narnia series.

Presented Without Comment

Reuters: Turkey’s Erdogan Says Israeli Pm Netanyahu No Different From Hitler

Also Presented Without Comment

NBC News: [Kanye West] Apologizes in Hebrew to Jewish Community for ‘Unplanned’ Antisemitic ‘Outburst’

Toeing the Company Line

- In the newsletters: Scott argued (🔒) that 2023 was a banner year for films depicting free markets at work, Jonah explored (🔒) the problem of tribalism compelling partisans to defend the whackjobs in their ranks, and Nick bid farewell (🔒) to what is likely the last politically “normal” year we’ll have for a while.

- On the podcasts: Jonah is joined by psychologist Paul Bloom on the Remnant to discuss Freud, whether people are born with an innate political orientation, and what makes something taboo. On a crossover episode of Advisory Opinions, Sarah and David Lat review the year in law and make some predictions about 2024.

- On the site: Kevin compares the European and American approaches to “protecting the ballot” from illiberal candidates, while Luis reflects on the movie Her—and what it says about technology and loneliness—ten years after its release.

Let Us Know

Are you more or less optimistic about the state of the U.S. economy than you were at this time last year?

Correction, December 28, 2023: Approximately 3.8 million barrels of crude oil move through the Red Sea each day, not 3.8 billion.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.