In recent weeks, Democratic campaign officials have indicated that Vice President Kamala Harris largely supports the same tax increases proposed by the Biden administration in its 2025 budget. The proposal, which includes increases to top marginal tax rates, capital gains rates, and corporate tax rates, has triggered widespread online chatter about whether, under the plan, Americans would face a novel tax on “unrealized capital gains”—meaning a tax on the appreciation of assets that have not yet been sold.

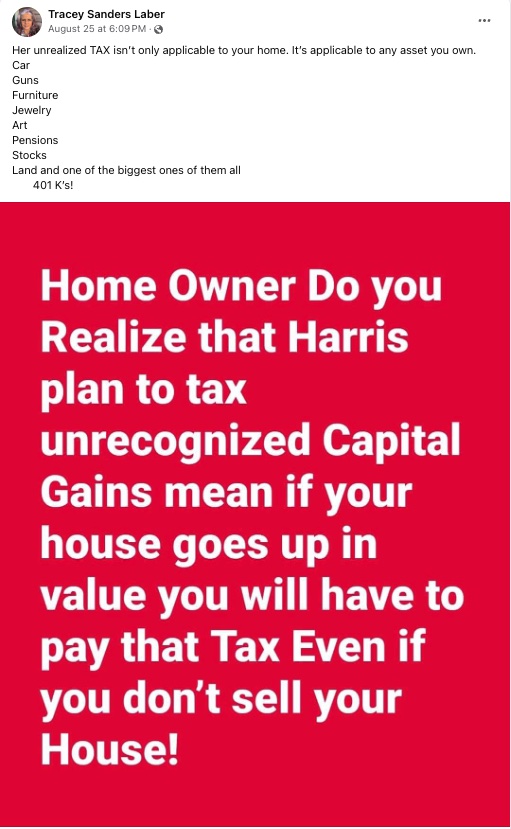

“Kamala’s proposed economic plan includes a new ‘unrealized capital gains’ tax. What this means is: If you have a house or a 401k retirement and the value goes up, even if it’s just on paper and you haven’t ‘realized’ the actual gain by selling, you will pay taxes on it,” reads one image. “Home Owner Do you Realize that Harris plan to tax unrecognized Capital Gains mean if your house goes up in value you will have to pay that Tax Even if you don't sell your House!” says another.

The claims are false. The Harris campaign did endorse a plan that would tax unrealized capital gains, but it would apply only to a subset of high-net-worth Americans worth $100 million or more.

What are capital gains, and how are they taxed?

Capital gains occur when the value of an asset—such as a stock or piece of real estate—increases beyond its acquisition price. For example, if shares of a stock that were purchased for $500,000 rise in value and are sold for $750,000, the owner would record a capital gain of $250,000 on their investment.

In the U.S., capital gains are only taxed after a “realization event”—the sale of an asset, for example. The rate at which these realized gains are taxed depends on two things: A person’s total taxable income and the length of time that investment was held before being sold. Short-term capital gains—meaning those applying to assets held for less than one year—are taxed at various rates between 10 and 37 percent, depending on a person’s total taxable income. Long-term capital gains are taxed at a flat rate of 15 percent for individuals with taxable incomes between $47,026 and $518,900, and at 20 percent for individuals making $518,901 or above.

How would unrealized gains be taxed?

The tax on unrealized capital gains endorsed by the Harris campaign comes from the Biden administration’s fiscal year 2025 budget proposal, which was published in March of this year. The budget introduced several proposed changes to U.S. tax law, including an increase in the top marginal income tax rate, an increase in the corporate tax rate, and an increase in capital gains taxes paid by the wealthiest Americans.

The budget also proposed a new “billionaires tax” that would impose a 25 percent minimum tax rate on all taxpayers with a net worth above $100 million. The measure specifies that its definition of “total income” is “generally inclusive of unrealized capital gains,” meaning capital gains on an asset would be subject to taxation even if that asset had not actually been sold.

“This is a novel definition of income that has never been subject to tax in the United States in this way,” Adam Michel, director of tax policy studies at the Cato Institute told The Dispatch Fact Check. “Then they apply a 25 percent tax rate to this new definition of income.”

Unrealized capital gains have not traditionally been subjected to taxation for several reasons. For one, unrealized gains on an asset have not actually been “locked in,” and the value of the asset could go on to decrease, eliminating any profits from the investment. Additionally, while some assets like publicly traded stocks and bonds can be easily priced, determining valuations for assets like real estate, interest in a private company, or artwork is often complicated and inprecise. “Valuing non-regularly traded assets is incredibly difficult,” Michel explained.

Proponents of the tax argue that the current system of capital gains taxation incentivises wealthy Americans to hold assets indefinitely to avoid taxation on appreciation. Likewise, subjecting unrealized capital gains to taxation would help raise revenue for other administration priorities. The budget proposal estimated that its 25 percent minimum income tax on the wealthiest Americans would raise approximately $503 billion between 2025 and 2034.

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.