Readers of Capitolism surely know by now that I try to keep things light and impersonal here, but American Compass’ Oren Cass has encouraged me to make today’s column an exception.

The organization’s self-ordained chief economist is—when he’s not redefining inflation or praising progressive regulation—a vocal supporter of protectionism and critic of “globalization,” which in his view has inflicted widespread damage upon the U.S. economy. His newsletter last Friday was more of the same, except that it specifically targeted me, my employer the Cato Institute, and the Faces of Globalization video project that we just published. I won’t bore you with too many lines from his piece—you can read it all for yourself, if you want—but it’s chock-full of sneering, selective quotation, and empty assertion. Even worse, it’s just bad policy analysis—at odds with mainstream economics, modern industrial organization, and good ol’ market reality.

I wish I could say I was surprised.

A Quick Note About Our Project

For starters, Cass seems to have missed that our new video series was just one part of our institute-wide Defending Globalization project that started in September 2023. The project has produced a boatload (trade pun not intended) of original content related to the cross-border movement of things, people, capital, and ideas (aka “globalization”). This includes new public opinion polling, video chats with experts, summaries of new academic research, and literally dozens of new essays from in-house and outside scholars on the history, economics, geopolitics, law, cultural influence, and other facets of globalization.

The project also, however, has sought to put a face on this wonky stuff for two reasons. Most obviously, many folks prefer stories to charts (sad!) and videos to written works, so since Day 1 we’ve planned to supplement the D.C.-oriented wonkery with short videos for a lay audience documenting some of the real people living in the global economy—hopefully in ways that challenge conventional wisdom and that maybe even get the normies to dig deeper into the complex issues raised in the project’s other parts. To claim that the videos are our “best possible case for globalization” not only misunderstands the mechanics of high-quality video production, but also ignores the videos’ connection to a much bigger well of information. On the same day we released the new videos online, in fact, we published a 500-plus page book containing some of the most timely and relevant essays that the project has produced—and we handed out dozens of copies of the book at the videos’ recent launch event.

Anyone making even a cursory scroll of the web pages hosting the videos would grasp the depth and breadth of the project immediately. Cass somehow didn’t.

The second reason we made the videos is, as I discussed when launching our project 15 months ago, that many people—especially pundits and politicians disconnected from the real world—have erroneously turned “globalization” into nothing more than a thing, cooked up in a lab by politicians (probably in Davos) a few decades ago and since then brutally raining down goods upon helpless workers around the world. Yet, as Deirdre McCloskey explained in her 2023 essay for the project, this simply isn’t true: Humans have been engaging in long distance commerce and migration since the dawn of recorded history. She, along with economist Vincent Geloso in a separate piece, explores earlier eras of globalization that were stalled only by large-scale government interference (typically war or totalitarianism). Modern trade agreements like NAFTA certainly play a role in globalization today, mainly by undoing government barriers to these human activities. But they fundamentally remain human activities, and people have been buying and selling and interacting for basically ever. My colleague Colin Grabow reinforces this point in his essay documenting how technology—containerized shipping, the internet, and so on—has arguably played as big a role in modern globalization as government policy, simply because it enables people to do what they already want to do.

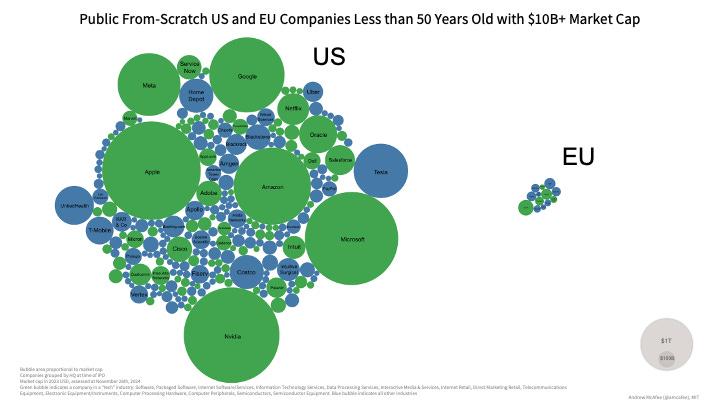

Modern globalization is also about a lot more than just trade in goods. As I explain in the book’s new introduction, services trade has exploded in recent years—especially online (hence, our new video on the gaming economy)—and it powers some of the biggest and most important companies in the world, many of which are American (and which fuel the United States’ trade surplus in services, if you’re into that kind of thing). Globalization is surely also about ideas and culture, whether it’s medical research or food or film or fashion or, yes, even video games.

Cass calls all this stuff “ridiculous” and asserts that real globalization actually is just governmental agreements and trade balances because that’s the “what the debates are about” (in Washington, natch). But it’s also surely because talking about NAFTA and the goods-trade deficit serves his interests: It sounds scary and conspiratorial, plays into long-standing biases against foreigners and positive-sum interactions, and ignores all the parts of globalization that are obvious American success stories or enjoyed by normal people every day. It’s far easier to sell tariffs and other government restrictions on global commerce when they’re couched as protecting American communities from shadowy “globalist” agreements that have “crushed” them, instead of what—as former GOP Rep. Jeb Hensarling notes in his essay—conservatives have known protectionism to be for decades: big government taking from one American and giving to his well-connected neighbor (and harming the economy along the way).

I guess I should thank Cass for proving our point.

Of course, trade agreements and trade balances and tariffs are surely also a part of the globalization debate today, so that’s why our project has essays and blog posts and articles on all of it—and a few more on the way. If Cass would like to challenge any of that stuff, he’s welcome to do so and I’ll even host. His subsequent policy points, however, don’t exactly inspire confidence in his future success.

Behold, the Ravages of Globalization

So what, exactly, has all this global integration gotten us? Well, for Cass globalization “has eviscerated American industry, hollowed out communities across the country, and devastated millions of lives.” Later, he analogizes 25 years of globalization to an “unprecedented epidemic of crime and disorder”—pretty dark stuff! Yet, even a cursory examination of the data reveals the emptiness of such demagoguery. Yes, the removal of barriers to international trade and the new competition it allows will temporarily hurt certain domestic companies, workers, and communities—just as any market-based (or government!) disruption will. We’ve taken that issue head-on, however, because the overall tide has undeniably been rising for the vast majority of American workers and places.

The U.S. economy has been on a tear in recent years (see here for more), and median American wages and incomes have been increasing steadily since the “hyperglobalization” era began in the 1990s. The vast majority of American workers are also satisfied with their jobs, which—contra the populist narrative—have decent benefits and aren’t less secure “gig work” arrangements. And according to brand new research from the American Enterprise Institute’s Scott Winship, moreover, the rosy figures above likely understate the wage gains for American workers since the 1990s—when NAFTA, the WTO, and the “China Shock” supposedly “crushed” them—by a significant amount.

The gains get even better, Dan Griswold details in his project essay, when you add in “nonwage benefits—bonus pay, health insurance, paid leave, contributions to retirement savings, etc.—that have made up an increasing share of total compensation in recent decades.” Griswold’s essay, which argues against the kind of economic nostalgia Cass peddles, adds that the U.S. middle class has been “shrinking” only because American households have been getting richer (again adjusting for inflation), and points to improvements in both the average Americans’ consumption of basic necessities and all sorts of non-economic areas—workplace safety, female and minority participation in the formal economy, life expectancy, infant mortality, food supply, education, environmental quality—versus our less globalized past. Marian Tupy’s essay on our modern, globalized “superabundance”—along with Cato’s broader Human Progress site—adds even more.

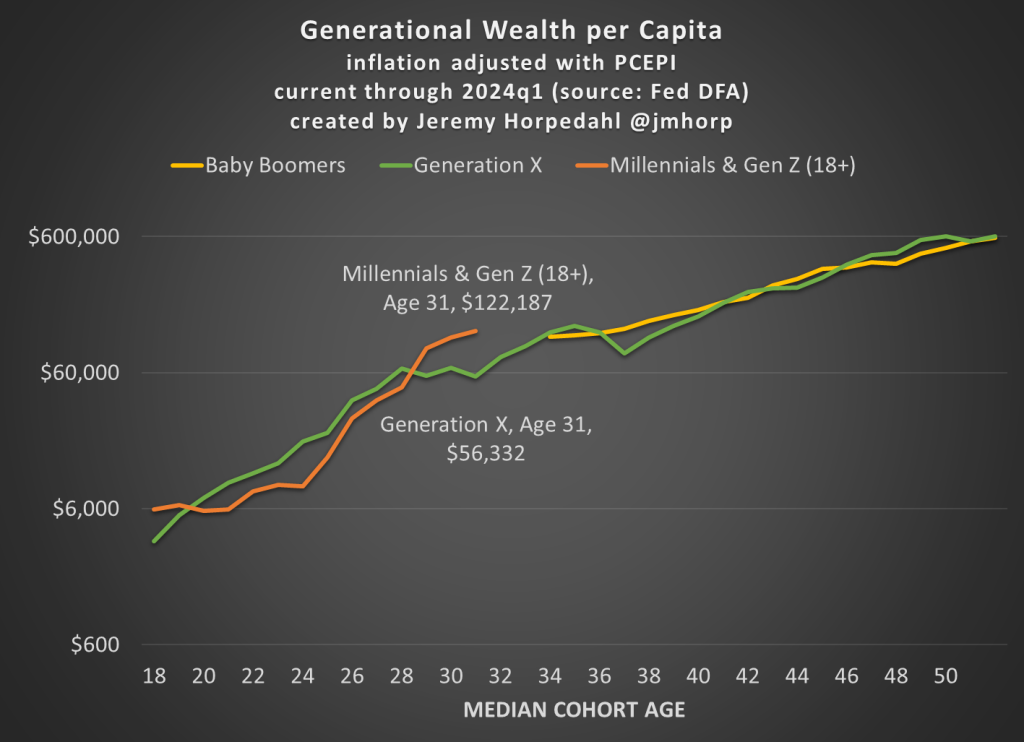

Elsewhere, economist Jeremy Horpedahl finds that younger generations are today building as much wealth as their older counterparts:

And George Mason University’s Don Boudreaux reminds us that other signs of American wealth, such as capital stock, are also much bigger or better today than in the past. Plenty of other research adds even more.

Not everything is perfect out there for all Americans, and surely the gains aren’t all owed to globalization (however you define it). But the losses aren’t all, or even mainly, owed to globalization either: Factories shut down, people lose jobs, and there’s no instant and miraculous renaissance that follows. Overall, however, the United States simply isn’t the charred wasteland that populists like Cass portray, and globalization has supported the nation’s long, slow, and uneven advance.

As Johan Norberg’s essay on the “race to the bottom” details, there’s a close connection between a nation’s economic openness and the quality of both its labor market and environmental conditions. In general, as people get richer, life gets better—and globalization helps us get richer. In the United States specifically, moreover, another essay shows that trade agreements, though imperfect, have generally liberalized trade and provided net economic gains for the country and most workers. Many of today’s most innovative and globally dominant companies are deeply enmeshed in the global economy—especially in technology and, as Gary Winslett’s essay or this longer Cato paper details, digitally delivered services. In a recent blog post, I (and the White House’s Council of Economic Advisers) note recent research showing that American companies engaged in goods trade drove the majority of job creation since the Great Recession. This includes, by the way, many small businesses—not just giant corporations. And, as Winslett just detailed on Twitter, even the much-derided “China Shock” generated substantial net benefits for most American workers. (You can read my project essay on the China Shock for even more.)

But what about those communities? Well, as I explain in another piece, the portrayal of American communities as uniformly destroyed by globalization is misleading at best. For one thing, many places in the country have boomed because of globalization and those much-maligned trade agreements. This includes, a brand new Financial Times piece shows, large cities like Houston and, as I detail, smaller ones like Laredo:

Laredo’s population has doubled over the past three decades, spurred by the signing of the North American Free Trade Agreement in 1994, which lifted most barriers to trade and investment between Mexico, the United States, and Canada. “Laredo pivoted and started growing substantially,” said Ignacio Urrabazo, a longtime Laredo resident and bank executive. “Restaurants, all the hospitals are looking for doctors. Clinics are opening up. The schools are growing; they’re recruiting teachers. All of that, the multiplier effect down the line affects all sectors of the economy.”

I add that most older industrial cities—the ones most pressured by increased goods trade and always mentioned by protectionists—have long since moved on from past challenges, with fewer than 20 percent still economically “vulnerable” (per Brookings) as of 2016.

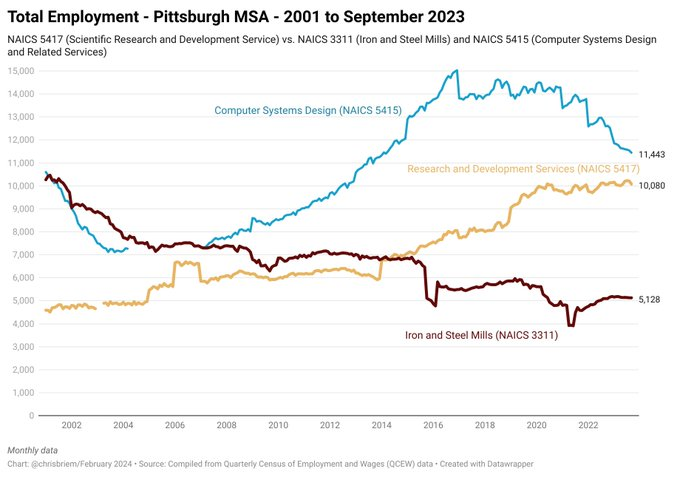

We featured West Point, Georgia, in the video that Cass disparaged because it provided a new and slightly different angle on this story, but we easily could’ve gone to Montgomery or Tuscaloosa, Alabama; Beaumont, Texas; Waterloo, Iowa; Bethlehem, Pennsylvania; Hickory or Winston-Salem, North Carolina; Warsaw, Indiana; or perhaps my personal favorite, Greenville-Spartanburg, South Carolina. Some regained their footing via new manufacturing investments (often by foreigners), but others—like “Steel City” Pittsburgh or the Boston and New York suburbs—are now mainly services towns, rebutting Cass’ odd claim that American localities need manufacturing to “anchor” local development. (Someone please tell Dallas or Atlanta or Raleigh or Charlotte or Nashville or Cincinnati or Denver or … I could do this all day.) Time and resources permitting, we’ll visit more of these places in the months ahead.

Since the pandemic, there’s been even more improvement. As we recently discussed here, many other once-struggling American places have been revived by the remote work revolution (digital trade), which—along with the ubiquity of cheap consumer electronics (goods trade)—has made it easier for people to live where they want to live instead of where their main office might be located. Finally, there’s the important (and totally ignored) fact that many of the places still struggling today are doing so for reasons other than international trade—including interstate competition from places, like my home state of North Carolina, that have lower costs, better weather, better companies, and superior economic and labor policy.

Ironic that a newsletter called “Understanding America” misses all of this, isn’t it?

Missing these facts, of course, is what Cass must do, and why he implores his readers to isolate manufacturing, long-past disruptions, and hollow statistics like the trade deficit (we have two essays and a longer paper on that, by the way). It’s much easier to persuade people to embrace government interventions intended to “fix” those disruptions when you ignore both the benefits of U.S. economic openness and the recovery and adjustment that most Americans make.

Manufactured Nonsense

Yet even for goods trade and American manufacturing, Cass is mistaken. First, the U.S. manufacturing sector is far from “eviscerated.” As Grabow details in his essay and as we’ve discussed, the United States in 2022 ranked second behind China in global manufacturing output at almost $2.7 trillion, greater than the next four countries (Japan, Germany, South Korea, and India) combined. The United States also is among the world leaders both in output per worker and in various forms of complex, capital-intensive manufacturing, such as motor vehicles, aerospace, and defense goods. Both aggregate industrial output and capacity have hovered at or near record highs for years now, though such data aren’t ideal—in part because they actually understate American manufacturing prowess by lumping in low-margin, labor-intensive, or shrinking industries (paper, tobacco, apparel, etc.) with ones that actually matter for national security, such as the three above and several others (metals, medical equipment, energy, chemicals, pharmaceuticals, etc.) There are arguably some weak spots and surely some market-oriented tax, trade, immigration, and regulatory policies—along with non-economic stuff like defense procurement—that Washington could and should implement to improve the U.S. industrial base, but portraying the sector as “eviscerated” is ludicrous.

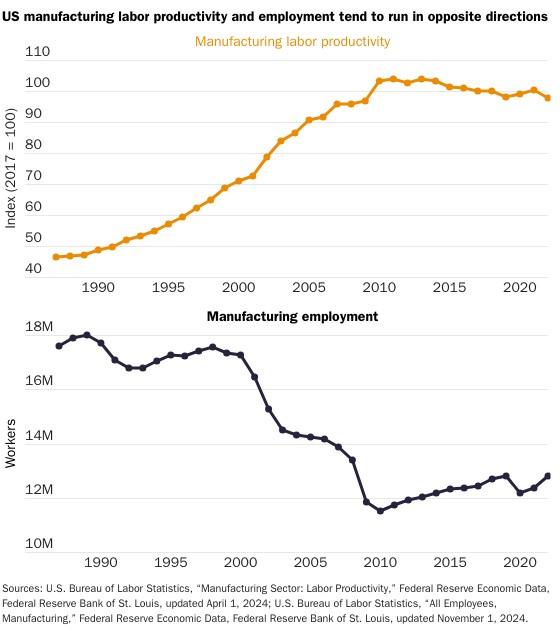

American manufacturing employment has indeed declined, but this trend long predates NAFTA, China’s admission to the WTO, or any other common protectionist villain—and it hasn’t really accelerated in recent years. According to GMU’s Don Boudreaux, in fact, the average monthly decline in U.S. workers in manufacturing as a percentage of total nonfarm employment was, from its peak in November 1943 through May 2000 (when China got permanent trade status) 0.158 percent. From June 2000 through October 2024, the monthly average decline was just 0.163 percent—just a hair more. (And if you move the deadline to December 2001 when China joined the WTO, modern manufacturing job destruction is actually slower than the historic average—0.166 percent to 0.143 percent.)

Trade undoubtedly plays a role in this decline (which is a relatively small part of overall U.S. labor market churn). But the biggest overall drivers are nontrade factors such as productivity gains (making more stuff with fewer people) and changing consumer habits. My paper has lots more on these data, but Grabow’s essay provides perhaps the best chart of all:

Combined, these factors are why the “American” manufacturing job trend is happening in basically every industrialized country in the world—including ones with persistent trade surpluses like China or Germany. Here’s a brand new chart on this fact from the FT’s Martin Wolf:

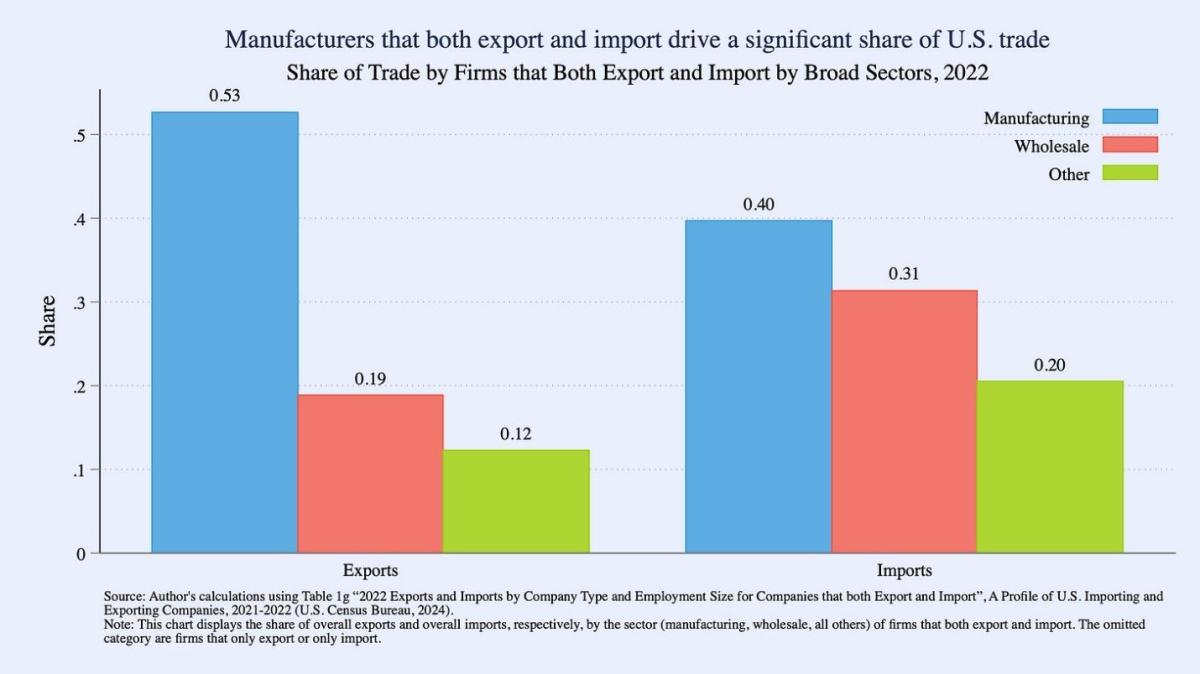

More important than these basics, however, is the critical fact that American manufacturing today greatly benefits from—and indeed depends on—modern globalization and the services jobs that Cass seemingly wants us to ignore. As international trade economist Faria Kamal just documented, around half of all U.S. imports are “industrial supplies and capital goods that are used as intermediate inputs by manufacturers,” and U.S. manufacturers that both export and import are responsible for half of all American exports and 40 percent of imports, “underscoring the complementarities between exports and imports in U.S. production.”

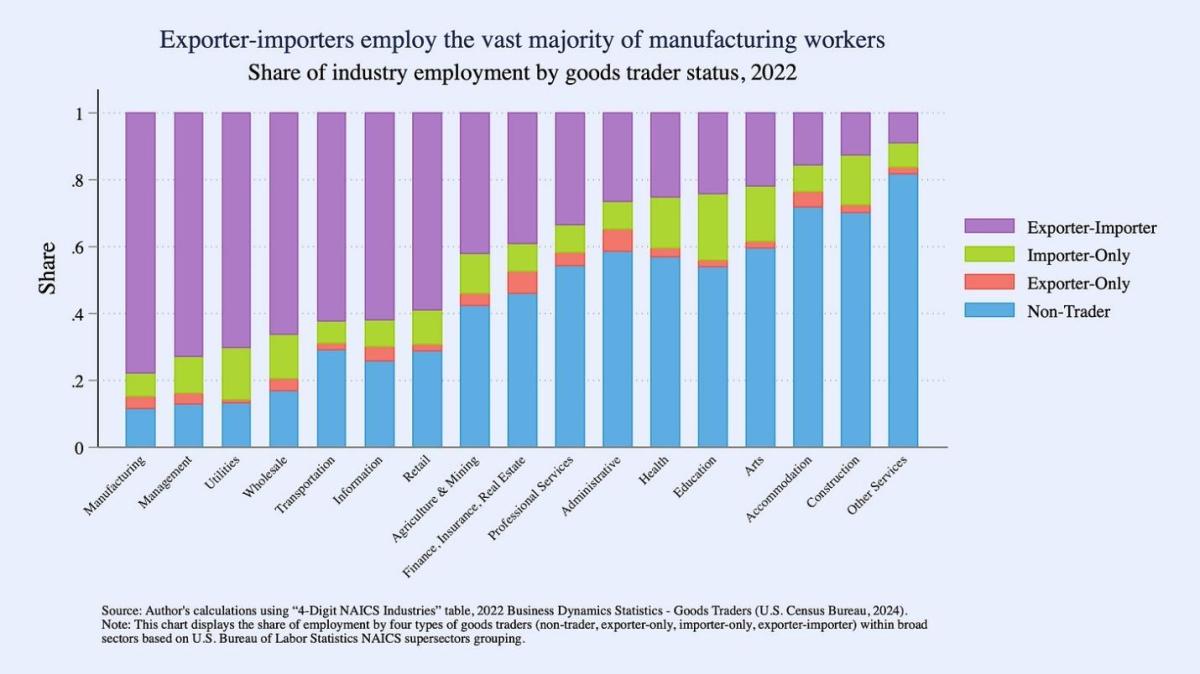

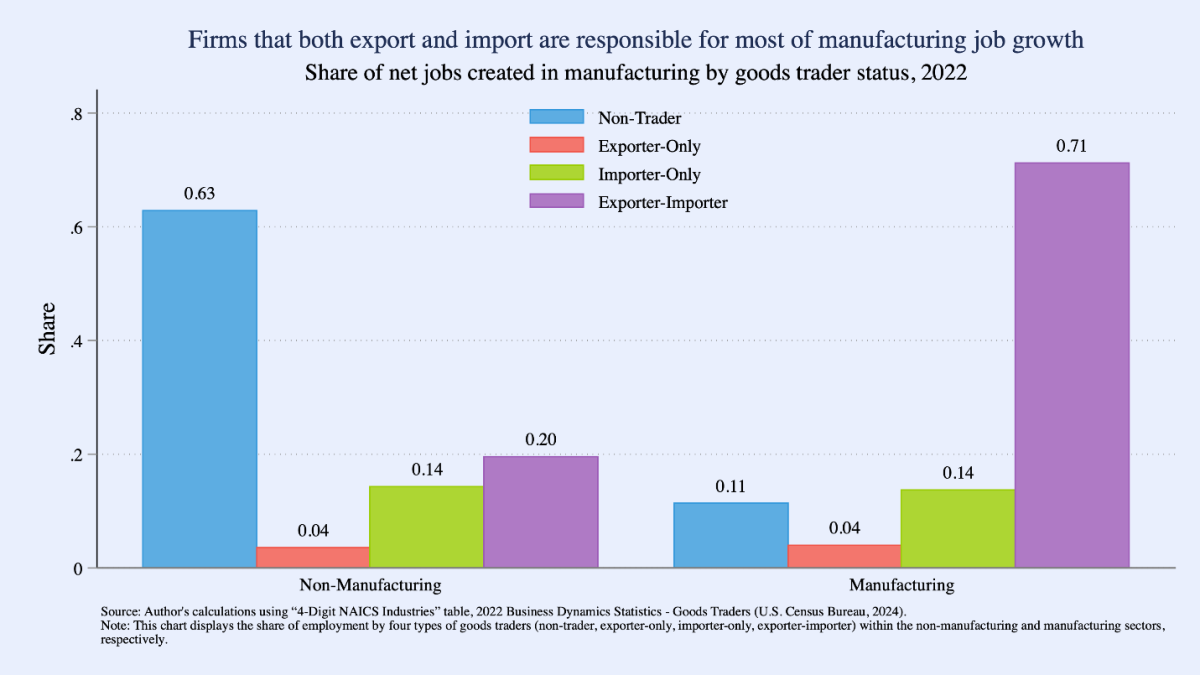

These global firms also drive modern U.S. manufacturing employment. Kamal calculates that “exporter-importer” companies in 2022 employed more than 80 percent of all American manufacturing workers and were responsible for more than three-quarters of all net new jobs created in the manufacturing sector.

The tight relationship between imports and exports—well-known by trade experts but ignored by modern mercantilists—is a big reason why broad-based tariffs like the ones Cass defends are so foolish as an industrial strategy. In fact, Kamal notes, “the dramatic rise in U.S. import tariffs between 2018 and 2019 lowered exports and employment in the U.S. manufacturing sector.” Oops.

Cass also seems oblivious to how modern globalization actually works, both in terms of where factories locate and the connection between American jobs and multinational investment here and abroad. He waves away, for example, the “substantial benefits” that can arise from “foreign firms setting up shop in new countries to serve their domestic markets,” but then bizarrely adds that—

That’s not what globalization has in fact meant, or for the most part delivered. Under the model promoted at Cato, the United States runs a $1 trillion trade deficit, representing foreign production serving American consumers in lieu of anything at all being produced here. Meanwhile, Foreign Direct Investment in new projects totals only $5 to $10 billion per year. (Incidentally, the leading source of new investment these days is in semiconductors, thanks to the CHIPS Act, which folks like Lincicome oppose.)

Later, Cass adds that our video about making textiles in Guatemala shows that “globalization” simply means “cheap stuff and jobs for others somewhere else.”

This is all quite wrong. Of course, “globalization” includes multinational investment, whether by U.S. companies abroad or foreign companies investing in the United States (just ask Oren Cass). Our project essays cover cross-border investment repeatedly because it’s so integral to the modern global economy and also because protectionists so routinely demonize it—whether as American investments abroad (aka the dreaded “outsourcing” or “offshoring”) or foreigners’ investments here (which populists now want to restrict or even ban).

Yet, as any freshman economics major knows (and as we cover in a short explainer right below the West Point video), the U.S. trade deficit that protectionists hate is generally matched by an inflow of foreign capital into the United States—money that often goes into the U.S. manufacturing sector, whether as foreign direct investment (FDI) or as portfolio investment in U.S. capital markets, which also can bolster American companies and workers (and our 401(k)s):

For almost every year since the 1970s, the United States has been the top destination in the world for investments like the ones the Kia/Hyundai group delivered to West Point. The bulk of this FDI comes from traditional allies like Japan, Germany, and South Korea and goes into the US manufacturing sector. Overall, total FDI (“stocks”) in manufacturing hit $2.22 trillion in 2023, about double the amount in 2013. All this spending is the flipside of the United States’ often-derided trade deficit: Dollars that overseas investors like Kia put into the United States originally came from American purchasers of foreign goods and services.

Cass dismisses most of this FDI because it often doesn’t entail building new facilities (so-called “greenfield” investment), but the explainer covers some of the reasons why this is a meaningless asterisk:

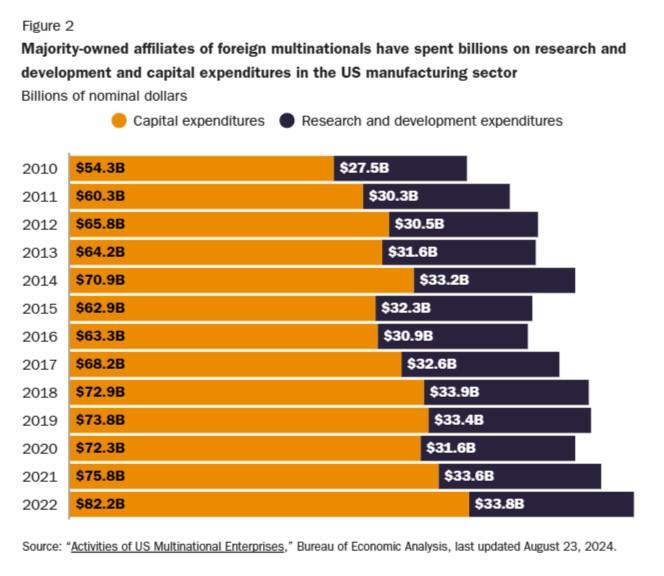

This foreign capital has been shown to deliver big benefits to American companies and workers like those in West Point. In 2021, majority-owned affiliates of foreign multinationals employed 7.9 million Americans and contributed $1.16 trillion to US gross domestic product that same year. These same companies also spend hundreds of billions of dollars per year in the United States on research and development and capital expenditures (machines, equipment, etc.), with the biggest shares again going to manufacturing—much of it in the US Rust Belt and Sunbelt, where major foreign automakers like Kia are located (Figure 2).

A recent study of Hyundai’s investments here reinforces these findings, but the benefits of FDI aren’t just about foreign affiliates spending money here:

Foreign multinationals also improve their US-based operations in other ways, such as by changing management or business practices, implementing proprietary technologies, and linking into new supplier, distribution, and consumer networks. Foreign-nameplate automakers stateside, for example, commonly import core parts and use new innovations from their factories abroad and then export finished vehicles to those and other foreign markets. And Kia is no exception.

These business practices collectively boost US firm performance and employee compensation. Research shows that foreign affiliates in the United States pay more, export more, and are significantly more productive, on average, than similarly situated domestic firms. One recent paper found that these companies pay about 19 percent more than domestic firms on average and that American workers would have been roughly $36 billion poorer in 2015 if domestic firms had magically replaced all foreign affiliates in the United States. Just as important, the study found (as did prior research) that foreign multinationals benefited local communities, companies, and workers too.

The flipside of FDI, American investment abroad, can also deliver big benefits for U.S. companies and workers. Research shows that U.S.-headquartered companies that invest in manufacturing facilities abroad tend to have lots of American employees (blue collar and white collar, services and manufacturing), lots of production and sales (U.S. and global), and lots of innovation. Many of these companies have factories here—factories that often depend on imports from and exports to affiliates abroad—but many others are “factoryless,” choosing instead to focus on innovation and other “knowledge” work. Those American firms—companies like Apple, Qualcomm, Nvidia, Google, and Amazon—not only employ millions of Americans, but are today at the leading edge of the global technological frontier, spending billions at home in the process.

You needn’t look to multinational giants like Apple to understand how this division of labor can benefit American workers. Instead, just consider our project documenting the real-world supply chain of a real “Made-In-Guatemala” T-shirt, which shows that a large majority of the shirt’s cost originated in the United States, in work like design, sourcing, logistics, transportation, marketing, and online sales. In general, the fashion industry estimates that around 70 percent of the value of "imported" clothing stays in the U.S.—consistent with other research on how imports support millions of American workers. Thus, contra Cass, even this simple form of globalization means not just jobs for some of the poorest people on the planet (a good thing for Americans too, by the way) and affordable clothing for American families (also good!), but also plenty of jobs here, too. It’s win-win-win, not the zero-sum wasteland in protectionists’ fever-dreams.

American investment abroad also confounds simplistic trade deficit moaning. As recent research has noted, in fact, if you included U.S. multinationals’ non-U.S. sales of goods made overseas and their U.S.-origin services and intellectual property embedded in those products, the U.S. trade balance would shrink substantially.

Is this fake globalization too?

Yet, even with all this non-U.S. activity and investment, there remains little evidence of the “giant sucking sound”—Ross Perot’s warning that post-NAFTA U.S. companies would flee the country en masse for low-cost places like Mexico so they can sell stuff back to us—that Cass mentions in his piece. As the Congressional Research Service (CRS) documents, some companies certainly do this kind of outsourcing, but it’s relatively limited overall:

Most [U.S. direct investment abroad] is in developed economies, and most production by foreign affiliates is consumed where it is produced and is part of a strategy to access markets abroad. Foreign affiliates on average sell most of their output in the country in which they are located or to neighboring countries; about 12% of foreign affiliate sales was to their U.S. parent companies in 2021 (latest data). Economists generally attribute the decline of manufacturing jobs to broader factors, including economic recessions and improvements in productivity that have allowed the sector to produce more with less labor.

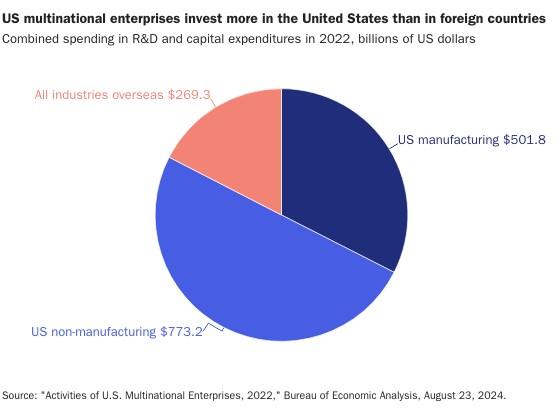

In 2022, in fact, U.S. multinationals spent far more on capital expenditures and R&D here than abroad (and more in U.S. manufacturing alone than all foreign spending combined)—just as I found a decade ago when first debunking the “sucking sound” myth and showing how these companies’ overseas investment usually supported their domestic activities and employment.

CRS adds that, between 2005 and 2022, total foreign investment in the United States exceeded U.S. investment abroad by around $3 trillion, with the largest share of 2022 FDI going into manufacturing. This, too, is consistent with previous periods, so the only “sucking sound” we’ve heard in recent years is capital getting hoovered into, not out of, the United States.

Our Global Automotive Reality

Automobiles, it turns out, are a great example of these economic realities. Drill into the supply chain of any modern vehicle, including the ones made in the United States, and you’ll find mind-blowing complexity and components from numerous countries. Maia Mandel’s new piece on the problems with tariffs in our modern era of global supply chains provides a great example:

Given how complex supply chains have gotten, [Trump’s tariff proposal] is not an especially good idea - it would hit a large number of links across multiple industries all at once. For example, General Motors had 856 “tier 1” suppliers, which had a whopping 18,000 suppliers of their own (“tier 2") - if the rate of expansion continued, “tier 3” would be around 380,000 firms, and tier 4 would be well into the millions.

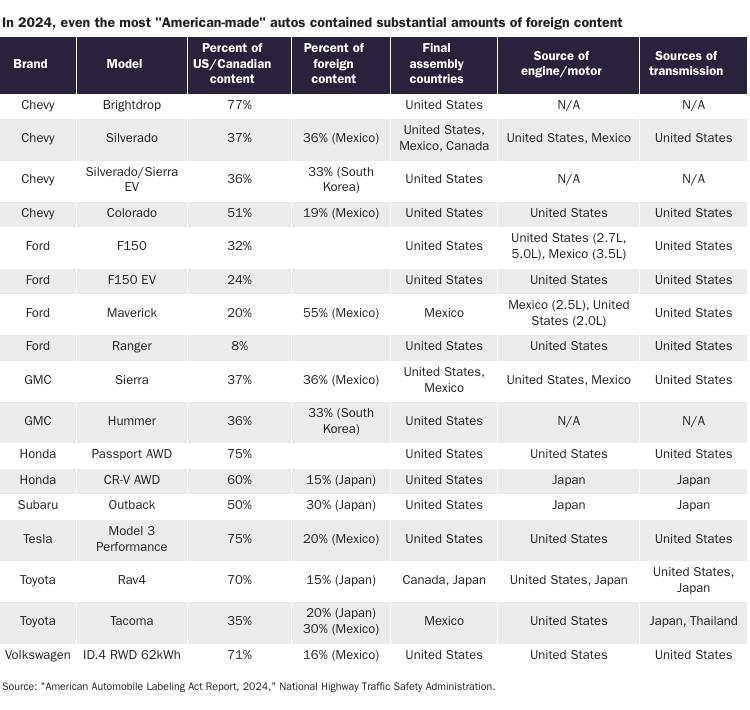

Even tariff-protected American pickup trucks are global today, with many popular models having just around 35 percent U.S. or Canadian content, per the National Highway Traffic Safety Administration (NHTSA).

(As an aside, it always makes me laugh to see that the U.S. and Canadian automotive economies are now so integrated that the NHTSA just lumps them together in its sourcing data.)

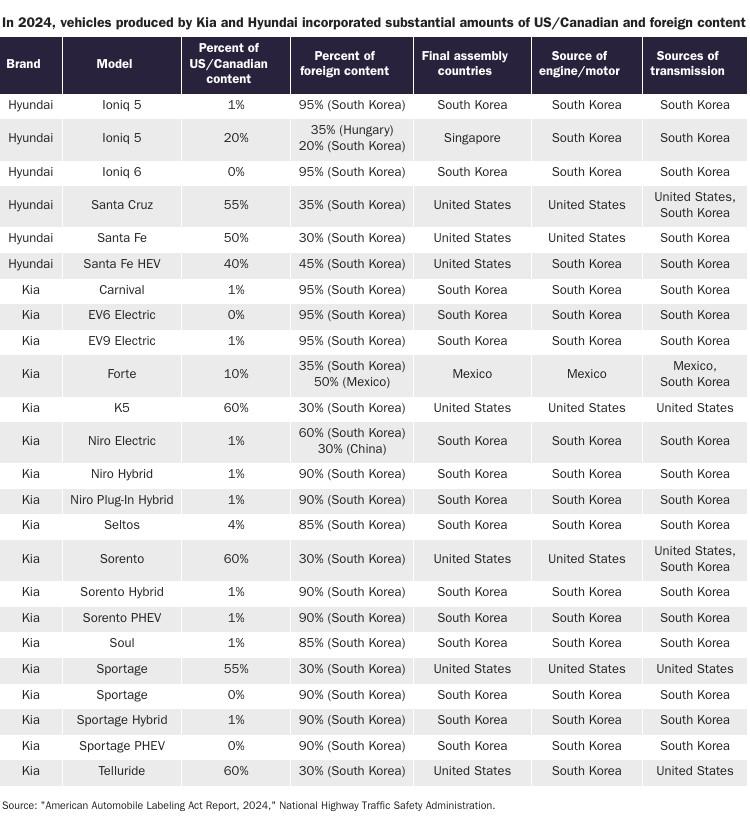

American-made Kias and Hyundais, meanwhile, also contain lots of foreign content, mainly from Korea:

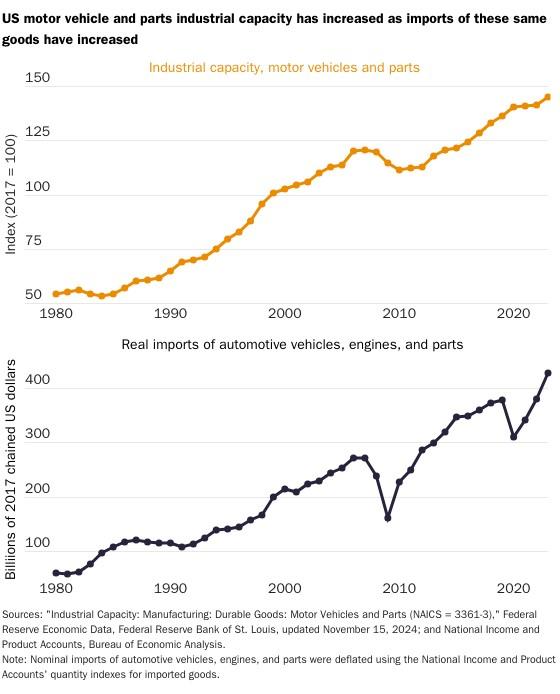

Automotive imports and exports are—like overseas investment—more complementary than zero-sum, and they tend to grow with each other and with U.S. automotive production overall. An expanding U.S. trade deficit in automotive goods has also long coincided with gains in domestic output and production capacity.

For these and other reasons, it’s widely acknowledged by automotive industry experts that freer trade and investment have generally fueled the growth and stability of North American automotive production since the 1990s—not, as Cass claims, costly Reagan-era quotas on Japanese cars (a claim that has been repeatedly debunked, by the way). By permanently reducing trade barriers, trade agreements have been credited with attracting more foreign investment and boosting overall industry competitiveness by lowering production costs (e.g., via imported inputs), utilizing national comparative advantages, and opening overseas markets. In fact, U.S. automotive manufacturing output and employment were stronger in the 1990s and early 2000s than in the quota-ridden 1980s and stronger than U.S. manufacturing overall during that latter period.

Protectionist trade policy can play a role in determining where car companies locate, but it’s typically not the main driver. Instead, just as CRS documented generally, multinational automakers tend to locate production near their biggest customers. With the U.S. a “saturated” market and shipping costs high, this naturally means investment abroad, whether in China or Latin America or anywhere else. Thus, Cass errs again when he cites a relatively small amount of Kia exports—or Tesla’s investment in China—as respective proof of the failures of globalization and wisdom of tariffs. (And, for the record, we at Cato have long cautioned against using exports as the primary measure of free trade’s benefits.)

The U.S. auto industry’s need for open markets explains why experts have warned that Trump’s new Canada/Mexico tariff threats would not only raise American car prices but actually harm U.S.-based automakers (“There is probably not a single assembly plant in Michigan, Ohio, Illinois, and Texas that would not immediately be affected by a 25 percent tariff.”) And it’s why, when Trump threatened new tariffs on automotive goods in 2018, basically every major U.S. business group—the Alliance of Automobile Manufacturers (which includes Detroit automakers), the Association of Global Automakers, the Motor and Equipment Manufacturers Association, the National Association of Manufacturers, the U.S. Chamber of Commerce, and the Business Roundtable—opposed them.

Big automakers did too, including Kia, Hyundai, and their U.S. affiliates, which each warned that the tariffs would severely damage their American operations. Longtime Hyundai manufacturing employee John Hall even testified to the U.S. government about how much the company has invested in the region, how many cars they make in Alabama (to sell mainly in the U.S. but also abroad), and how “vital” imports were to the company’s U.S. operations—open access, he notes, that was secured by the U.S.-Korea FTA. Hall concludes that he’s “one of thousands of American workers whose livelihoods would be put at risk by a substantial tariff on automotive goods.”

So, when Cass further claims that “without free trade, Kia could still have set up a plant in Georgia to serve the American market, in fact it would have been more likely to do so,” he has no idea what he’s talking about.

The Unstated Stagnationist Alternative

It remains true, of course, that times got tough for people in West Point, but in expressing sympathy for the life of “economic distress” our protagonist Whitney endured as a child (thanks entirely to NAFTA, of course), Cass reveals one final, and more fundamental error: the notion that life in West Point would somehow be better if the agreement had never been signed and “globalization” somehow wished away.

For starters, the history of West Point reveals—like many other places supposedly crushed by “globalization”—that the problems in its anchor industry started long before NAFTA and went beyond cheap imports, including recession and mismanagement. Given these events and other seismic economic forces, simply forgoing NAFTA wouldn’t have saved the town from distress. As anyone who knows the long history of textiles and apparel in the United States knows, the labor-intensive industry’s move offshore was—like many “late-stage industries”—decades in the making, having first moved from the American northeast to the deep South in the never-ending quest for cheaper production.

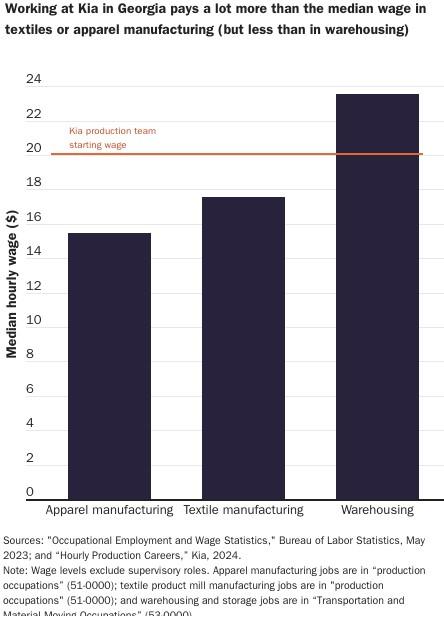

Furthermore, the few remaining textile and apparel jobs in the United States are not exactly what you’d call great jobs—even with high U.S. trade barriers on imports from most of the nation's largest foreign suppliers like China, Vietnam, India, and Bangladesh. (Mexico is fifth.) In fact, it pays Georgians more today to work at a place that ships T-shirts (like Amazon) than one that makes those same products—and more to work at import- and FDI-dependent Kia in West Point, too. People there have thus moved up the economic ladder, just as the literature predicts.

A worldview obsessed with using blanket tariffs to indiscriminately boost manufacturing jobs misses this reality, along with the significant costs associated with such protection—not merely higher prices for American consumers, but less economic dynamism, innovation, and growth as finite resources are dedicated to low-value activities like making cheap T-shirts. It also misses that—as our project’s polling, U.S. manufacturers’ continued difficulties with finding workers, and related anecdotes demonstrate—many Americans don’t want to work in a factory. It misses that, even with tariffs, jobs making textiles or toasters will keep disappearing (in the U.S. or anywhere else). And it misses that, thanks to our relatively free and open economy, there will be plenty of other, good-paying jobs out there—in manufacturing and services and in industries we can’t even imagine today.

Wanting people to stay in yesterday’s jobs isn’t just bad economics; it’s also weirdly paternalistic, as shown by Cass’ open disdain for our gamer Jalon Az. A young woman of color living in Los Angeles, Jalon started out in film production but moved into gaming and streaming because of the pandemic and because it paid better and offered her a better quality of life than her old job. She’s now an independent entrepreneur and has made a career out of entertaining thousands around the world. Even if you’re an oldster like me, Jalon’s life and career are pretty neat, yet Cass dismisses them instantly as neither a “compelling” story nor one that has “anything to do with globalization” more broadly.

As tech analyst Juan Londoño details in the accompanying project essay, however, Jalon is a small part of a global video game industry that’s more than three times the size of music and movies combined, and one that supports both U.S. innovation and hundreds of thousands of American jobs. Semiconductor powerhouse Nvidia, for example, got its start making chips for video games and today is leading the AI revolution (and leaving industrial policy darling Intel in the dust, by the way). Gaming is also part of the larger digital trade ecosphere, which as noted above and in the explainer attached to Jalon’s video, generates trillions of dollars of economic activity each year.

All of this, Cass proclaims, is to be “skipped.”

Is video gaming, despite its size and economic impact, not a real business? Are other leisure activities meaningless too? Should Jalon accept lesser-paid and less-desirable work—in a factory (or in the kitchen maybe?)—because a handful of people in Washington don't value her choices? Is the stuff she generates, despite being lucrative and loved by millions, not valuable too like, say, a T-shirt or a toaster? And should the federal government really be involved in this young woman’s life and work choices, or in intentionally slowing the churn that accompanies economic openness—much to the United States’ overall benefit?

Adjustment to disruption, whatever the form, is a real challenge. Reasonable minds can debate whether past adjustment—in West Point or anywhere else—should have been easier or faster, and we can debate how to help Americans today cope with future challenges. (I unsurprisingly suggest you start with all the government obstacles.) But it’s either foolish, insulting, or disingenuous to pretend that Americans’ future lies in labor-intensive manufacturing, that—despite their clear preferences and personal successes—they’d be better off in a decaying textile factory than behind a screen, that the world’s inevitable churn can be stopped, or that somehow freezing the 1950s U.S. economy in amber would be best for them (or the nation).

In some cases, I guess, it can be all three.

Chart of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.