Happy Thursday! Citizens can apparently be trusted with access to either the U.S. Capitol or the Supreme Court—but not both. Weeks after the Freedom Convoy-inspired non-scalable fencing around Congress came down, it’s going back up around the court “to prepare for any potential demonstrations” following this week’s leaked draft opinion overturning Roe v. Wade. Healthy country!

Quick Hits: Today’s Top Stories

-

An Associated Press investigation published Wednesday found Russia’s March 16 bombing of the Donetsk Academic Regional Drama Theater in Mariupol actually killed closer to 600 civilians, about double the number of casualties originally reported. The United Nations’ Human Rights Office has confirmed 3,238 civilian deaths and 3,397 civilian injuries since Russia’s invasion of Ukraine began—but it continues to believe the actual figures are “considerably higher.”

-

European Commission President Ursula von der Leyen on Wednesday outlined the bloc’s sixth Russian sanctions package, proposing an EU-wide ban on imports of Russian crude oil within six months and a ban on more refined oil products by the end of 2022. The package—which will require sign off from all 27 member states—would also remove three major Russian banks from the SWIFT financial-messaging system, ban several Russian state-owned broadcasters from the EU, and impose sanctions on Russian military officials accused of war crimes in Bucha and elsewhere. Hungary and Slovakia have signaled they won’t support a broader ban on Russian energy.

-

Several thousand Finnish troops are conducting a two-week military exercise alongside American, British, Estonian, and Latvian soldiers in anticipation of Finland’s forthcoming NATO application. Major General Joe Hartman—head of U.S. Cyber National Mission Force—told reporters yesterday the United States sent cyber forces to Lithuania to help defend against Russian cyber threats.

-

North Korea conducted another ballistic missile test on Wednesday, according to Japanese and South Korean military officials. The projectile reportedly traveled about 310 miles before landing in the sea, and the launch comes just days before South Korea is set to inaugurate its new, more hard-line president.

-

President Joe Biden on Wednesday signed an executive order and issued a national security memorandum aiming to advance the United States’ development of quantum computing technologies, establishing a National Quantum Initiative Advisory Committee and directing federal agencies to “pursue a whole-of-government and whole-of-society approach” toward harnessing the economic and scientific benefits of quantum information science. The memorandum also directs government agencies to update their cybersecurity capabilities by transitioning to quantum-resistant cryptographic standards.

-

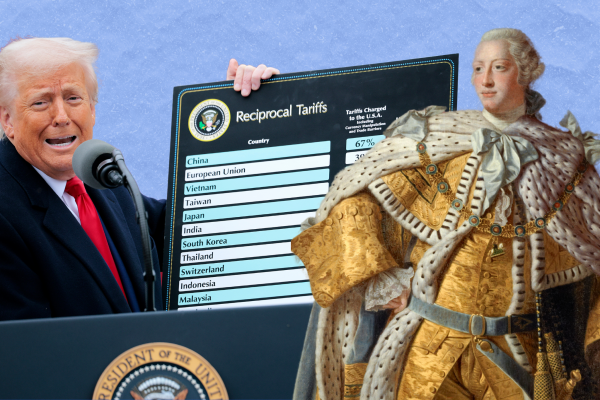

The Census Bureau reported yesterday the United States’ international trade deficit in goods and services hit a record high in March, increasing 22.3 percent month-over-month to $109.8 billion. Imports increased more than 10 percent in March, with clothing, computers, and cars driving much of the surge.

Fed Hikes Rates and Trims the Sheets

Federal Reserve Chairman Jerome Powell had some shocking news yesterday: “Inflation is much too high.”

In fairness, Powell wasn’t trying to break new ground. He was emphasizing the Fed’s shift from months of “don’t worry, this inflation is transitory” to the more recent “OK, yikes, inflation is eating Americans’ wallets and we should do something.”

“We understand the hardship it is causing, and we’re moving expeditiously to bring it back down,” Powell said. “We have both the tools we need and the resolve it will take to restore price stability.” And so, as previously telegraphed, the Fed hiked interest rates on Wednesday by 50 basis points, or half a percent—the highest jump since 2000.

The Fed had already raised rates a quarter percent in March, its first hike since 2018. But it’ll take much more than that to bring inflation under control. The central bank’s favored price index reported 6.6 percent year-over-year inflation in March, more than triple the Fed’s goal of 2 percent. Powell said continued strong employment numbers—U.S. job openings reached a record-high 11.5 million in March—give him confidence the Fed has room to cool the market and slow hiring without triggering mass unemployment.

The central bank may raise interest rates another half a percent at each of its next two meetings in June and July, but Powell dismissed suggestions of an even more aggressive hike of 75 basis points, or three quarters of a percent. “A 75 basis point increase is not something the committee is actively considering,” he said, sending the stock market jumping for joy. The S&P 500 and Dow Jones Industrial Average both had their strongest trading day since 2020, climbing 3 and 2.8 percent, respectively. But the Fed could change its mind if inflation stays hot. “My suspicion is they find the need to put [75 basis points] back on the table,” said John Fagan, financial analyst at Markets Policy Partners.

The Fed also announced it will start tightening its balance sheet, which ballooned over the course of the pandemic. “When the economy was in deep recession [in 2020], when the financial markets were falling apart, they went in and they bought bonds like crazy,” Desmond Lachman, an economist at the American Enterprise Institute, told The Dispatch. He’s not exaggerating: The Fed upped its asset holdings—mostly treasury and agency securities—from around $4 trillion in late 2019 to nearly $9 trillion by April 2022. Now, instead of reinvesting as bonds mature, it will let $47.5 billion roll off each month for three months starting in June, and increase that to $95 billion monthly in September.

The Fed hasn’t tightened its balance sheet this aggressively in recent memory—and certainly not during the price shocks and general economic disruption we’re experiencing now—so it’s hard to predict exactly how it will play out. “I would stress how uncertain the effect is of shrinking the balance sheet,” Powell said. But based on strong jobs numbers and wage growth he predicted the economy could handle the Fed’s hawkish moves: “The economy is strong and is well-positioned to handle tighter monetary policy. We have a good chance to have a soft or soft-ish landing.”

We’ll see. “The happy talk about the economy is, of course, the spoonful of sugar that helps the rate hikes go down,” Fagan said. “The Fed is going to stay as positive about the growth situation for as long as possible to help underwrite and bolster and smooth over their tightening cycle. But we think that a cyclical slowdown is [coming] in the U.S.”

Lachman agreed. “The chances of their getting a soft landing are pretty negligible,” he said, noting the Fed has never managed to bring inflation down 4 percentage points—its current goal—without triggering a recession. “They’re having to do this policy tightening at the same time that they’ve got equity prices and housing prices and the credit market all looking like [they’re] in bubble-like condition. So as soon as they raise interest rates, then you’ll see these markets slumping, and that often produces a nasty recession.”

The central bank is “engaged in a dash to get rates back to neutral territory by the end of this year,” said Brian Coulton, Fitch Ratings Agency’s chief economist. “With inflation pressures ongoing, the risk of monetary tightening prompting a significant growth slowdown or even recession in 2023 is growing.” Several former Fed officials have expressed similar sentiments in recent days, suggesting overall economic pain could have been minimized had the central bank moved faster in ending its easy money policies.

Powell didn’t quite come out and admit on Wednesday that he and his colleagues had erred, but he came close. “It’s really the Fed that has responsibility for price stability,” he said in response to a question about whether the White House and Congress bear any blame for the current situation. “We need to stay in our lane and do our job. When we get inflation back under control, then maybe I can give other people advice. Right now we need to just focus on doing our job.”

Punditry With Sen. Mitt Romney

Sen. Mitt Romney had some choice words for the Federal Reserve on Wednesday. “The Federal Reserve is primarily responsible for maintaining the integrity of our monetary system,” he told Steve on yesterday’s Dispatch Podcast. “They were far too loose, far too long.” Here are some additional highlights from the conversation:

On the Biden administration’s contributions to today’s inflationary environment.

My guess is that would not have been the problem it was but for the fact that COVID threw off the supply chain in ways that were far more extreme than any would’ve anticipated. But then added to that, you had the president do a couple of things that really added fuel to the fire. One was the $1.9 trillion that went out in March, and that was just after the $900 billion that had gone out in January. So just a couple of months after $900 billion went out, he sent out $1.9 trillion.

I was speaking yesterday with the Secretary of Health and Human Services in one state, not my state, but another state. She said that her state’s budget for childcare for the indigent was $55 million a year. She received a check on the American Rescue Plan for $500 million for that program. She said, “What are we supposed to do with all this money?” And that happened in state after state.

I don’t think the White House anticipated the impact of what they had done, what the Fed had done, and the supply chain would be as great as it is. And the American people are suffering as a result of that.

On the United States’ approach to Russia’s invasion of Ukraine.

We’re politically smart to ascribe credit where credit is due. And I think with regards to Ukraine policy, by and large, the Biden administration has done a pretty good job. I start by saying they were wise, in my view, to collaborate with our allies and to say, “We’re going to do this together. We’re not going to go off half-cocked just as the United States and rattle our saber and then complain that no one else is following us.” Instead, we’re going to work to get everybody together, we’re going to make sure that we don’t scare away the Germans or the French. And that was, I think, a smart thing to do. That meant that the sanctions we put in place would have more bite. I mean, look, a couple of decades ago, we represented almost 40 percent of the world’s economy. Now we’re about half that. So to have the economic clout we want to have, we want to link arms with our allies, and they did that well.

They were a little slow on the weapons front, but of course, so was the Trump administration. That was one of the reasons Trump was impeached, was holding off providing weapons to Ukraine. And so the Biden administration likewise was hesitant to do that. I’m sure they had their reasoning, they were probably worried that they would create an excuse for Putin to enter, who knows. But they got on board and they’ve been providing weapons. And they have done that in part by getting nations in NATO that have old Soviet-era equipment, getting those things to the front, which is, which is all encouraging.

On whether he’d endorse J.D. Vance after his victory in Ohio last night.

Oh, no! I’d like to see a Republican Senate, but I’m not endorsing candidates one by one. I don’t want to communicate that somehow I endorse everybody’s points of view on every topic. And you should note, there are not many people that ask me for my support, particularly in primary season. I guess after primary season is over, it’s a different matter. But I jokingly have said that there are a few people that I dislike enough that I was thinking about endorsing them just to hurt their prospects.

There’s no question President Trump has by far the most significant impact on whether someone is going to become a nominee in the Republican Party, certainly in Ohio, and probably true in many other states, if not all. We’ll see what happens in other states. I’m a little surprised by the governor’s primary in Georgia, where Gov. Kemp continues to lead in the polls, that could change as well. But look, President Trump has an enormous impact on the Republican voters today. I don’t see that as dissipating, I know some think it will or think it already has. I frankly don’t see that.

Worth Your Time

-

It may seem like everything’s coming up Republican ahead of November’s midterms, but Noah Rothman argues in Commentary the GOP could very well still blow it. “Despite the many advantages Republicans enjoy today, a bad candidate can still lose a winnable race,” he writes. Robert Regan—GOP candidate for a Michigan House seat—pushed to decertify the 2020 election, suggested Ukraine deserved to be invaded by Russia, pushed antivaxx rhetoric, dabbled in anti-Semitism, and “joked” about telling his daughters to “lie back and enjoy it” if they are raped. And this week, he lost a special election in a +26 Republican district that had never elected a Democrat. “The GOP’s primary voters got what they wanted: not a lasting political victory at the polls but a thumb in the eye of those who dared warn against touching that hot stove. This cautionary tale could have broader relevance with primary season now fully upon us.”

-

In a piece for National Review, Kevin Williamson does his best to answer pro-choice critiques of overturning Roe v. Wade. “The Constitution says what it says even if 70 percent of Americans wish it said something else. The Constitution says what it says even if 99 percent of Americans wish it said something else,” he writes. “If 95 percent of Americans don’t like the First Amendment or 100 percent want to reinstitute slavery, that doesn’t change what the Constitution says. It means that the majority can go jump in a lake—which is what constitutions are there to do. That being said, if it really were the case that overwhelming majorities of Americans wanted the same abortion rules that Planned Parenthood wants (meaning, essentially, none) then having the elected representatives of the people take up the question in the legislatures and vote on it seems like it would be a winning outcome for the pro-abortion side. The fact that the pro-abortion side is terrified of working out the question democratically tells you that they know they do not have the support they claim to have.”

Something Fun

Presented Without Comment

Also Presented Without Comment

Toeing the Company Line

-

In this week’s Capitolism (🔒), Scott is starting to wonder if the Biden administration is actively trying to boost inflation. “Inflation may be the nation’s top economic challenge and may be top of mind for most American voters, but it plays second fiddle to the narrow interests of certain groups—unions, environmentalists, college grads, etc.—that the White House sees as essential for political success this fall and beyond,” he writes. “So those squeaky wheels will continue to get the oil, regardless of the insular decisions’ broader economic effects.”

-

President Biden publicly said the word ‘abortion’ out loud this week for the first time in his presidency. “I think the reason for this is pretty obvious. Most people don’t like abortion,” Jonah writes in Wednesday’s G-File (🔒). “[Biden] may be locked in, as a political matter, to abortion rights maximalism, irrespective of his personal views. But the White House has decided that this is not the way it wants to frame the issue. Democrats want to say that if ‘they’ come for abortion tomorrow, ‘they’ll’ also come for privacy, gay marriage, etc., tomorrow. … And because Biden can’t say ‘safe, legal, and rare,’ he’s blocked off from a popular position on abortion.”

-

What can J.D. Vance’s victory in Ohio tell us about Trump and the 2022 midterms? “Based on my read of the available data, Trump’s endorsement was worth about 3-5 percentage points in terms of people who immediately switched their vote,” Sarah writes in this week’s Sweep (🔒). “But the real value was with undecided voters.” Plus: The electoral effects of overturning Roe, 2024 GOP primary “lanes,” Evan McMullin and Mike Lee in Utah, and which political coalition has shifted more in recent years.

-

In a bonus Wednesday Uphill, Haley uncovers another House Democrat abusing proxy voting to campaign for higher office back home. “[New York Rep. Tom Suozzi] has voted in person only five times since the start of the year, over the course of three days in January,” she writes. “Suozzi voted in person once on January 18, once on January 19, and three times on January 20. Beyond those three days, Suozzi has had colleagues cast votes on his behalf under the House’s proxy rules 134 times out of 141 roll call votes in 2022 thus far.”

Let Us Know

Who are some other lawmakers you hope to hear on the Dispatch Podcast in the future, and what topics would you like to ask them about?

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.