Good morning and welcome to the latest in our series, “The Biden Agenda.” We’ve invited some of the smartest thinkers and subject-matter experts we know to contribute to what will become an occasional series on what a Biden presidency might look like. Today, Brian Riedl, a senior fellow at the Manhattan Institute, breaks down Biden’s various spending proposals. Please see our past entries from Scott Lincicome on trade, James C. Capretta on health care, and Steven F. Hayward on climate change.

Despite an unprecedented $24 trillion in budget deficits projected over the next decade, Joe Biden is promising the largest spending spree since Lyndon Johnson. And despite the deepest recession in 80 years, Biden is demanding the largest permanent tax increase since World War II. Can gridlock save taxpayers and the federal budget from these exorbitant costs?

First, the numbers. Biden has proposed $11 trillion in new spending over the decade. His $1.4 trillion health care plan would expand the Affordable Care Act, bring a “public option” to the health exchanges, and expand long-term care assistance. More recently, Biden proposed reducing the Medicare eligibility age to 60, at an estimated cost of $300 billion. He also has proposed new spending on climate and infrastructure ($2 trillion), Social Security and Supplemental Security Income ($1 trillion according to the Progressive Policy Institute), college, K-12 education, and preschool aid ($1.5 trillion), family leave assistance ($550 billion), “Buy America” investments ($700 billion), housing aid ($640 billion), and combatting opioid addiction ($125 billion). Finally, Biden has endorsed the $3 trillion in stimulus spending passed by the Democratic House.

He would pay for one-third of this new spending with $3.6 trillion in new taxes over the decade—which, at 1.3 percent of the economy, would represent the largest permanent tax increase since World War II. This includes a $2.1 trillion corporate tax increase that would more than reverse the $330 billion tax cut that corporations received in 2017. Biden would also restore the pre-2017 tax rates for high-earning families (including phasing out the tax deduction for pass-through businesses), cap their tax deductions, and approximately double the top capital gains tax rate. The full 12.4 percent Social Security payroll tax (which currently applies to wages up to $137,700) would be re-imposed at wages above $400,000. Overall, a typical middle-income family would see a $300 tax increase (rising to approximately $1,200 in 2026 if the 2017 tax cuts also expire), versus $300,000 in annual new taxes for the richest 1 percent of earners. Marginal income tax rates would reach 64 percent for some taxpayers when including state taxes, and the tax on inflation-adjusted investment returns would exceed 60 percent for many taxpayers.

That Biden was portrayed as a moderate during the Democratic primary is a testament to how far left his party has galloped. While his proposed $11 trillion in new spending is significantly less than that proposed by Elizabeth Warren and Biden running mate Kamala Harris ($40 trillion each), or Bernie Sanders (an unfathomable $97 trillion), Biden’s figure still represents an 18 percent spending hike over the already-accelerating spending baseline. It also dwarfs the previous three Democratic presidential nominees—John Kerry, Barack Obama, and Hillary Clinton—who each proposed federal spending expansions of between $1 trillion and $2 trillion over the subsequent decade. Those candidates also proposed roughly equivalent tax increases (with varying credibility) to at least give lip service to controlling the deficit.

Similarly, President Obama signed legislation cumulatively adding $1 trillion in new spending over the decade (in addition to $4 trillion in tax cut extensions), and his budget submissions regularly proposed (but did not successfully enact) another $1 trillion in new spending over the decade. In this context, Biden’s $11 trillion in new spending is radically far to the left of any Democratic presidential nominee in recent memory—likely back to Lyndon Johnson in 1964.

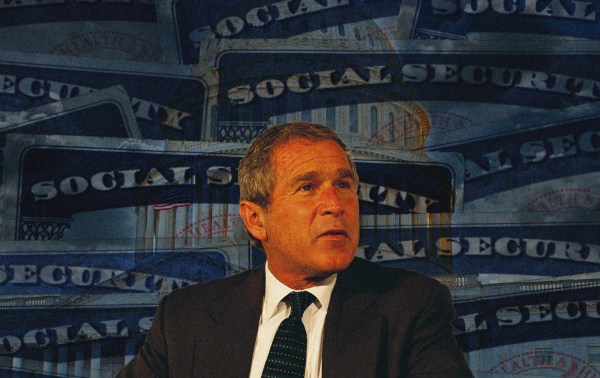

Biden proposes this new spending at the precise moment when the United States can least afford it. Even before the coronavirus pandemic shut down much of the economy, the annual budget deficit was already on pace to surpass $1 trillion this year, on the way to $2 trillion within a decade under current policies. The main debt driver is the retirement of 74 million baby boomers into Social Security and Medicare—causing these programs to run an estimated cash shortfall of $11.5 trillion over the next decade. Additional deficit contributors include $2.5 trillion from the Trump tax cuts (if renewed), $2 trillion in higher discretionary spending, and now a staggering $8 trillion (and counting) in higher spending and less tax revenue from the current recession.

Altogether, the national debt held by the public—which was $17 trillion at the end of 2019—is projected to exceed $35 trillion by 2030 under a current-policy baseline. At 114 percent of GDP, that debt level would easily surpass the previous record set at the height of World War II. And it will continue growing steeply in future decades due to the projected $100 trillion cash shortfalls projected for Social Security and Medicare over the next three decades.

In that context, pouring $11 trillion of additional gasoline on that fire (even if offset by $3.6 trillion in taxes) is breathtakingly irresponsible. Even at record-low interest rates, the interest on this debt would likely surpass $1 trillion annually by the end of the decade—plus $500 billion for each percentage-point increase in the average interest rate paid by the federal government (that is $3,600 per household annually for each percentage point).

Essentially, Biden and the Democrats are gambling that building the largest government debt in world history will not endanger the economy, and that interest rates will remain low forever. If they are wrong, the costs to taxpayers and in economic growth could be devastating.

How many of these new promises would be enacted under a Biden presidency likely depends on the partisan makeup of the Senate.

First up would surely be a massive economic stimulus package—just as President Obama proposed (with Vice President Biden’s close assistance) when entering office during a deep recession in 2009. Even if the economy has “reopened,” a $2 trillion or $3 trillion stimulus bill would reflect the Democrats’ Keynesian orthodoxy, and provide a legislative vehicle to stuff with infrastructure and other campaign proposals—without the pressure to match them with messy tax increases. While congressional Republicans famously united against Obama’s 2009 stimulus, Biden may be able to pick off some Republicans. He has historically been a successful bipartisan negotiator who would not likely repeat what famed author Bob Woodward called the 2009 partisan “bulldozing,” in which nearly every Republican stimulus suggestion earned the response “we have the votes, (expletive) ‘em” from then-White House Chief of Staff Rahm Emanuel. Republicans have already approved trillions in pandemic spending, and several of them may be bought with infrastructure spending and targeted tax cuts. Although if Republicans still control the Senate, one of those supportive Republicans would have to be Majority Leader Mitch McConnell, who largely determines which bills come to the floor.

After that, the Biden tax-and-spend agenda hits more obstacles. If Republicans control the Senate, proposals like expanding the ACA and trillion-dollar investments in climate, education, and Social Security become non-starters—especially if paired with mammoth tax increases. Smaller proposals like family leave and combating opioid addiction may have more success. Essentially, Washington would return to President Obama’s second term, with congressional Republicans happy to block a liberal president’s tax-and-spend agenda (especially if the runaway spending of the Trump era induces a “Tea Party 2.0” as soon as a Democrat becomes president).

The only leverage the president and Democrats would have over Republicans would be in discretionary spending—where neither side may want to risk a government shutdown if they deadlock—and the late 2025 expiration of much of the Trump tax cuts for families (with business expensing provisions expiring earlier). But even on the tax cuts, the most likely outcome is a repeat of the 2013 “fiscal cliff” deal that made permanent nearly all Bush tax cuts except for those earning around $400,000 or more.

The story becomes more complicated if Biden is granted a Democratic Senate majority. Such a majority could, by itself, pass a tax and spending reconciliation bill each year (and they could double up in 2021, since none will have been enacted in 2020). Reconciliation bills cannot be filibustered and thus require only 50 votes (plus a tie-breaking vote by the vice president) to pass. However, congressional rules limit such bills to adjusting spending and tax dials rather than creating complicated new programs. Reconciliation bills also cannot increase long-term budget deficits or alter the Social Security program.

For Democrats, the lowest-hanging fruit would pair Biden’s proposed ACA and health expansions with the proposed 28 percent corporate tax rate, 39.6 percent individual tax rate, and a phase-out of the small business tax deduction. Such a package could likely fit within the reconciliation rules, and may achieve the near-unanimous Senate Democrat support that would be necessary without GOP votes.

Note the parallels with the Obama administration: A budget-busting stimulus bill followed by a controversial, partisan health expansion. And like the Obama administration, the bold liberal agenda may not extend far beyond that point. After trillions in stimulus and health care spending, it is difficult to imagine red state Democrats like Sen. Joe Manchin also casting the deciding votes for additional trillions of dollars in (likely unpaid-for) climate spending, education investments, and Buy America spending. The proposed Social Security package trading $1 trillion in new payroll taxes for an equal benefit expansion may also be blocked by lawmakers coming up for re-election in 2022.

More liberal Democrats will continue to push for wealth taxes, financial taxes, carbon taxes, and 70 percent income-tax rates. Yet this party of upper-middle class families, Silicon Valley billionaires, and (increasingly) Wall Street executives will be careful not to push too far against those interests. More likely is a restoration of the full state and local tax (SALT) deduction, benefitting mostly wealthy blue state taxpayers.

If history is any guide, nearly all major domestic legislation will be enacted within the first two years of a Biden presidency, after which the exhausted majority party is routed in a backlash midterm election.

One danger is that, Biden having inherited a one-year budget deficit spike to $3 trillion, even a natural return to $1 trillion deficits will be hailed as a deficit-reduction victory worthy of more spending (much like the Obama post-recession deficits that nevertheless far exceeded those of his predecessor). No matter who is president in 2021, conservatives must reclaim their fiscal conservative identity and protect taxpayers from this path towards a fiscal crisis.

Brian Riedl is a senior fellow at the Manhattan Institute. Follow him on twitter @Brian_Riedl.

Photograph by Olivier Douliery/AFP/Getty Images.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.