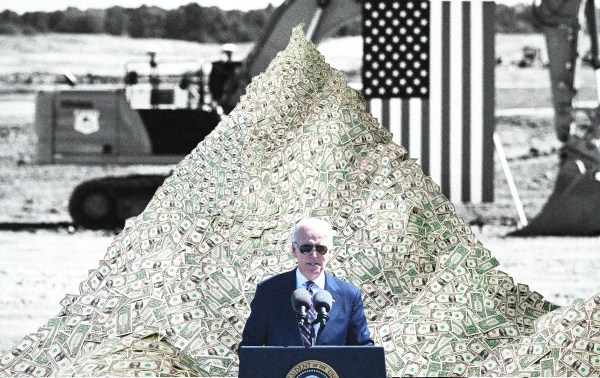

Anticipating the Bureau of Economic Analysis’ release of second-quarter gross domestic product (GDP) numbers on Thursday, the White House released a statement last week arguing that two successive quarters of negative real GDP growth do not officially qualify as a recession.

Soon after, the administration faced criticism for “redefining what a recession is,” in the words of Fox News correspondent Jacqui Heinrich.

So what is a recession? It’s a sustained period of economic decline often popularly understood to mean at least two consecutive quarters of negative growth in real GDP—GDP adjusted for inflation. Journalists and analysts often refer to it as a “technical recession.”

If Thursday’s GDP numbers are negative, they will mark the beginning of a technical recession. This year’s first-quarter GDP decreased by 1.6 percent.

Journalists, commentators, and the general public regularly use the technical recession definition. The Associated Press stylebook identifies it as “a common definition.” It’s what “most commentators and analysts use, as a practical definition of recession,” according to a 2009 note from two International Monetary Fund economists. Other countries, such as the United Kingdom, use the technical recession definition as their official definition.

While the technical definition may be the most common, it’s not the only definition of a recession.

In the U.S., recessions are authoritatively determined by the National Bureau of Economic Research’s (NBER) Business Cycle Dating Committee (BCDC), referred to by some as the “official” definition.

Though the terms “technical” and “official” are useful shorthand references, neither is completely accurate. The “technical” definition is less technical than the much more complicated “official” NBER definition, and the “official” definition’s source doesn’t even claim it’s “official.”

“The NBER makes no claim to being the ‘official’ determiner of recession and expansion dates,” Charles Radin, a spokesman for the organization, told The Dispatch in an email.

Radin acknowledged journalists and commentators often describe it as such (as did the White House in its statement), but Radin said that’s because of the BCDC’s longstanding reputation of expert, nonpartisan knowledge, not an official affiliation with the federal government.

The NBER is a nonprofit, nonpartisan economic research organization based in Cambridge, Massachusetts, founded in 1920.

The BCDC, which now determines the dates of recessions, was formed in 1978. It consists of eight macroeconomic experts appointed by NBER’s president. Massachusetts Institute of Technology professor James Poterba is NBER’s current president.

“The NBER has just become the unofficial recession dating [authority] because it generally speaks for a broad consensus of economists,” Brian Riedl, a senior fellow at the Manhattan Institute, said.

How does the NBER define a recession?

According to the NBER website, the BCDC defines a recession as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” That definition includes three components: “depth, diffusion, and duration.” It measures recessions month-to-month, not quarter-to-quarter. A peak is the month when economic activity is greatest before a subsequent decline. A trough is the month when economic activity is at its lowest before rising again. The period starting the month after the peak lasting through the month of the trough is a recession.

All this amounts to a much more ambiguous definition than the technical definition. To decide if the economy meets it, the BCDC considers a litany of metrics: real personal income minus transfers (an economic term that primarily refers to government welfare payments), real personal consumption expenditures, and nonfarm payroll employment. (Farm workers are excluded due to measurement challenges arising from seasonal workers, undocumented workers, and self-employment in the sector.) The BCDC also weighs “wholesale-retail sales adjusted for price changes, employment as measured by the household survey, and industrial production,” among other measures.

“There is no fixed rule about what measures contribute information to the process or how they are weighted in our decisions,” according to the NBER website.

NBER determinations can often take months, as the committee waits for more complete data to be available, and sometimes determinations don’t come until the recession is over.

Today, these numbers tell a complicated story. Most predictions suggest that the second-quarter GDP numbers to be released Thursday will be negative for the second quarter in a row. But many of the metrics that the BCDC says it considers are either flattening out or slipping slightly. Wholesale-retail sales peaked in January and nonfarm employment is still rising.

This last measure in particular has been central to arguments that the U.S. is not in a recession.

“We have a very strong labor market,” Treasury Secretary Janet Yellen recently said on Meet the Press. “When you are creating almost 400,000 jobs a month, that is not a recession.”

Riedl thought a small drop in real GDP might later be adjusted upward into a small increase as better data become available. He also warned that the difficulty of measuring and adjusting for inflation could affect the accuracy of GDP numbers.

Even if this isn’t a recession, that doesn’t mean it couldn’t turn into one. A June survey from the Financial Times and the Chicago Booth School of Business found that while only 2 percent of responding macroeconomists thought the NBER would declare a recession in 2022, 68 percent expected one in 2023.

“I think there is a significant risk for a clear and obvious recession to come as the year continues or even early next year,” Riedl said. “That would be driven by rising inflation that in turn causes the Federal Reserve to have to hit the brake pedal so hard that essentially we stop economic activity and go into a real recession in order to stop inflation.”

When historians and economists of the future study this period, they’ll likely be using the NBER’s standard of a recession due to its precision and specificity.

“Any serious academic policy research on recessions uses NBER definitions,” Riedl told The Dispatch. “That being said, moving forward, people often look at two consecutive quarters of declining GDP as a quick rule of thumb [suggesting] that you’re probably going to be classified into a recession.”

The technical and official definitions often overlap. As Michael Strain, director of economic policy studies at the American Enterprise Institute, pointed out on Twitter, the past 10 times the U.S. economy experienced two consecutive quarters of negative real GDP growth all took place in recessions.

Still, not every event that the NBER calls a recession has been accompanied by a technical recession. The eight-month recession the NBER identified as starting after March 2001 did not include two or more consecutive quarters of negative real GDP growth.

If the NBER ultimately decides the current economic state is not a recession, it would be the rare technical recession that is not an official recession.

“Surely the Biden administration is gonna work the refs on the question of a recession, regardless of the economic circumstances,” Riedl said. “We would expect the Biden administration to be moving on politics in order to avoid a recession designation. At the same time, that doesn’t mean that the facts of the case are necessarily against them in this case.”

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.