Hello and happy Saturday. To give you a peek behind the curtain, things got a little dicey around here Wednesday. Scott Lincicome had written a concise history of President Donald Trump’s longstanding affection for tariffs for his Capitolism newsletter. Given that Trump’s sweeping global tariffs had just been implemented that morning, Scott described them in the present tense. After I returned Scott’s edited newsletter to him but before I could get it into the publishing system and hit “send,” most of the tariffs went … “poof.” The president had paused them. Luckily, Scott was able to make some updates to his newsletter, and the pause didn’t undermine his larger point. (Spoiler alert: Trump really, really, really likes tariffs.)

Whiplash was the theme of the week. The Dow Jones and the S&P 500 were down on Monday, the third straight trading day of losses for both indices. It was more of the same on Tuesday, except that the Nasdaq also suffered a drop. But something more ominous was going on. Usually when there is a downward trend in the stock markets, investors turn to bonds—specifically, U.S. Treasury bonds, which are considered more stable. However, the bond markets were also down. As this helpful CBS News piece explained, “Turmoil in the bond market creates very real pressures on the nation’s finances. Because the Treasury Department pays interest to debt holders, any increase in yields puts more financial strain on the nation’s coffers.”

As Trump paused most—but not all—of the tariffs, he also escalated the trade war with China. As we noted in The Morning Dispatch (🔒) : “By Friday, the outlines of the new new U.S. trade policy had emerged: a whopping 145 percent tariff rate on Chinese goods; a baseline 10 percent tariff on the rest of the world; and 90 more days of profound uncertainty as American trade partners—and American businesses—scramble to determine their next move.”

The stock market remained volatile all week: up on Wednesday after the tariffs were paused, down on Thursday, up on Friday. Bond yields remained up on Friday, and the dollar is weaker. None of those are good signs.

Nick Catoggio argues in Boiling Frogs (🔒) that investors are signalling a lack of faith in the United States, and that it’s about more than a trade war:

Anything can happen in an America led by Donald Trump. The United States is an increasingly risky place to do business—or even to visit—and that risk is now being priced into treasuries. The more the president behaves like a third-world caudillo—by ignoring court orders, say—the higher the risk premium markets will demand to invest here. We will not remain the world’s reserve currency after placing dimwitted Orbánists at the helm of the most powerful country in history, nor should we—2029 is a long way away.

If you’re hopeful that maybe the economic advisers with whom Trump has surrounded himself might use their expertise to steer him toward a better path—Treasury Secretary Scott Bessent is a former hedge fund manager and Commerce Secretary Howard Lutnick was chairman of Cantor Fitzgerald, a financial services firm—well, Kevin Williamson has some bad news for you. He noted that in a speech to the Economic Club of New York Bessent said, “Access to cheap goods is not the essence of the American dream. … The American Dream is rooted in the concept that any citizen can achieve prosperity, upward mobility, and economic security.”

That might make for a good cable-television soundbite, but as Kevin points out in his piece, wages are only truly higher if they are higher relative to prices. “It surely was not lost on the members of the Economic Club of New York, sniggering discreetly into their pinstriped lapels, that lower real prices and higher real wages are, in the technical terminology of academic economics, the same goddamned thing,” he wrote. “I don’t mean that one is as good as the other or that one is a useful substitute for the other—they are the same thing in the same way that 3+2 is the same thing as 2+3.” His verdict? “Our treasury secretary is an economic illiterate.”

Maybe keep avoiding a peek at your 401(k), but be sure to check out our other work on Trump’s trade war. John McCormack reports on Utah Sen. Mike Lee’s changing stance on free trade, Michael Warren wrote about how Democrats are responding, and Jonah Goldberg interviewed Scott Lincicome on The Remnant. Thank you for reading and have a great weekend.

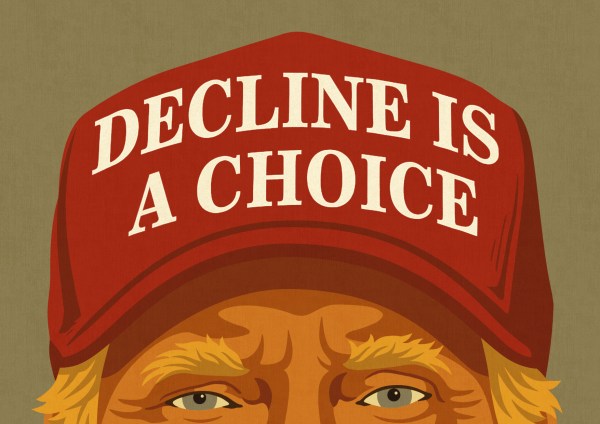

Slouching Towards Tyranny

Gardening in the Demon-Haunted World

The Best and the Worst

Best of the Rest

Torpedo Bats, Explained

Ron DeSantis Hasn’t Changed, But the World Around Him Has

Institutional Failure or Societal Shift?

Kharkiv: Under Fire but Out of the Spotlight

Loving Your Neighbor’s Job

Looking for Purpose in Thailand

Motherhood Can’t Be Maximized

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.