Vice President Kamala Harris has proposed offering first-time homebuyers up to $25,000 in federal funds for a down payment as part of her plan to make it easier for Americans to purchase homes.

Recently, a social media post claiming that reducing interest rates would do more than a subsidy to lower mortgage payments has gone viral across several platforms.

“A $325k home with a $25k tax credit bringing the cost to $300k with a 7% interest rate is $1991 a month,” Facebook user Jason Dean Longo posted. “A $325k home at 3.25% is $1414 a month. That’s a $577 a month difference and over 30 years a savings of $207,720.”

Texas real estate agent Ashley Taylor Cooper reshared Longo’s post, and her post has been shared more than 29,000 times on Facebook and made its way to X.

The post’s theoretical example gets the math right in terms of how monthly payments are calculated. However, according to Federal Reserve Economic Data, the 30-year fixed rate mortgage average in the United States is 6.2 percent and was at 6.99 percent as recently as June 6.

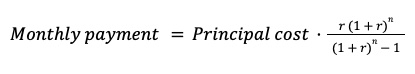

Monthly mortgage payments can be calculated with the following formula, where r is the monthly interest rate and n is the number of months of payment.

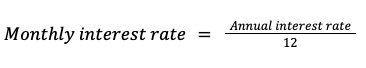

Although the interest rate figures used in the example are likely annual rates—not monthly rates that banks tend to use—that figure can be easily converted by dividing by the number of months in a year, 12.

Therefore, the respective interest rates of 7 percent and 3.25 percent cited in the viral post convert to monthly interest rates of 0.58333 and 0.27803, respectively.

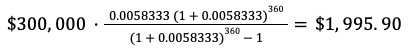

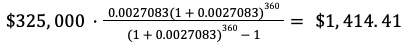

Assuming a 30-year fixed interest rate—with 360 monthly payments—we see how Longo arrived at the monthly costs used in his example.

Example A, 7 percent interest rate with $25,000 down payment assistance:

Example B, 3.25 percent interest rate:

It’s true that lower interest rates are a better solution for reducing the purchase cost of a home, but it’s worth noting that this is not a tool that politicians can wield. The Federal Reserve sets monetary policy autonomously and its decisions are not subject to government approval. Likewise, while changes to the Federal Reserve’s federal funds rate do impact home loans indirectly, mortgage rates are tied more closely to the 10-year Treasury yield, which is predominantly determined by market forces.

Various nongovernmental factors also play into the mortgage interest rate like decisions from financial institutions and Black Swan events, such as the COVID-19 pandemic. Mortgage interest rates also vary from borrower to borrower based on a number of factors, including the homebuyer’s downpayment, credit score, and geographical location, to name a few.

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.