As the Trump administration loosens regulatory burdens on the cryptocurrency industry and walks back prosecutions against prominent crypto firms and proponents, critics are questioning whether the president’s embrace of digital assets will—or already has—presented opportunities for influence peddling, self-enrichment, and favoritism.

The world of crypto is massive—and confusing. Since Bitcoin’s creation in 2009, thousands of cryptocurrencies, crypto projects, and crypto investors have popped up across the globe.

The term “crypto” refers broadly to all things blockchain—a type of decentralized, digital ledger that records transactions across many computers in a way that ensures the data is secure, transparent, and nearly impossible to alter. These ledgers are then used by digital currencies like Bitcoin to transfer value without banks, by non-fungible tokens (NFTs) to verify ownership of unique digital assets like units of art or music, and by decentralized finance (DeFi) platforms to enable financial services like lending, borrowing, and trading without traditional intermediaries.

Trump’s forays into the fast-growing cryptocurrency industry—an industry that he and his administration are largely in charge of regulating—have already taken several forms, including through the takeover of a DeFi company, creation of a novel cryptocurrency token, and sale of collectible NFT trading cards. And there’s still more to come. In March, a firm owned largely by the president and his family announced that it would soon issue a type of cryptocurrency tied to the value of the U.S. dollar called a stablecoin, and, earlier this month, Truth Social’s parent company, Trump Media & Technology Group, announced that it had entered an agreement with crypto trading platform Crypto.com to launch a series of cryptocurrency exchange-traded funds geared toward retail investors.

For some, the president’s embrace of crypto may come as a surprise. Only a few years ago, Trump was an open critic of the technology. In 2021, Trump said that Bitcoin—the largest digital currency in circulation—seemed “like a scam,” and that the industry should be highly regulated. “I don’t like it because it’s another currency competing against the dollar,” he told Fox Business’ Stuart Varney in an interview.

However, by the end of 2022, Trump had warmed to digital assets, or at least to blockchain technology more generally. The trend began when Bill Anker, co-author of Trump’s book Think Big and Kick Ass, pitched the former president on a line of “digital trading cards” featuring patriotic images of Trump. The NFT cards used blockchain technology to record the assets’ unique ownership, making the cards a form of digital collectors item for those who purchased them.

The cards were eventually released in December 2022 at a price of $99 each, and their purchase included the opportunity to win prizes, including dinner with Trump himself. The 45,000 NFTs sold out quickly, earning the project and its creators nearly $4.5 million.

The trading cards were only a start.

By the time Trump’s 2024 presidential campaign was in full swing, he had become a convert to the religion of crypto. In June 2024, Trump pitched himself as the “crypto president” at a fundraising event in San Francisco, and in July 2024, he headlined the annual Bitcoin Conference in Nashville,Tennessee, telling attendees that he would appoint a pro-crypto chair to the Securities and Exchange Commission (SEC), make the U.S. the world leader in digital currencies, and even create a strategic crypto stockpile. In January, Trump issued an executive order declaring his administration’s policy “to support the responsible growth and use of digital assets, blockchain technology, and related technologies across all sectors of the economy.”

Trump did not become a crypto backer out of nowhere—he was courted for years by some of the industry’s biggest players. The crypto industry was one of the largest political spenders in American politics during the 2024 cycle, with its top political action committees dropping around $135 million on more than 50 congressional races in support of pro-crypto candidates. And, while crypto PACs did not donate directly to either Trump or Biden, several high profile crypto proponents including Jesse Powell, the co-founder of the crypto exchange Kraken, and the Winklevoss twins, founders of a crypto company called Gemini, made large personal contributions to Trump’s campaign.

World Liberty Financial.

Last fall, the Trump family took control of World Liberty Financial (WLF), a crypto firm focused on decentralized finance (DeFi). “DeFi is the idea of using blockchain technology to do the things that traditional finance does,” Jim Harper, a senior fellow at the American Enterprise Institute and expert in cryptocurrency, said. “It’s a shared resource that anyone can use to prove ownership or create and prove the existence of transactions.”

WLF was founded by crypto entrepreneurs Zak Folkman and Chase Herro, who were introduced to the Trump family by Steve Witkoff, a New York real estate investor and longtime friend of Trump who now serves as the United States special envoy to the Middle East. Trump and his family own 60 percent of the holding company that controls WLF.

In October, WLF announced that it was selling a a coin called $WLFI. It’s a “governance coin” that would allow holders to vote on proposals and changes to the WLF platform, but are non-transferable once purchased and do not grant any share in the firm’s profits to their holders. Instead, they grant owners limited influence in how the underlying technology behind WLF will change moving forward. In March, WLF said that it had raised $550 million from sales of the tokens, most of which were purchased by buyers outside of the U.S. According to Reuters, the Trump family can claim 75 percent of net revenues from the sales.

The substantial demand for the tokens sparked concerns over whether investors may choose to invest in crypto projects linked to the Trump family in order to curry favor with the president. Worries peaked in February when the SEC asked a court to pause its prosecution of Justin Sun, a Chinese crypto entrepreneur who was sued by the SEC in March 2023 for allegations of fraud. While there is no clear evidence of a quid pro quo, the request for a pause occurred after Sun publicly purchased $75 million of $WLFI, which made him the token’s largest single holder.

In March, WLF also announced that it would launch a stablecoin known as USD1, extending the Trump family’s crypto portfolio. Stablecoins are designed to maintain a 1-to-1 value with fiat currencies like the dollar or euro, making them an ideal vehicle for activities like executing quick payments or trading between cryptocurrencies. This consistent value is usually maintained in one of two ways: By being backed—or claiming to be backed—by real assets like Treasury bonds, or by using algorithms to automatically adjust supply and demand to keep prices stable. For example, if an issuer wanted to peg a stablecoin 1-to-1 with the dollar, and there were 100 million tokens in circulation, it might choose to hold $100 million in cash or cash alternatives as a reserve to preserve the token’s value. Or, the stablecoin could use an algorithm that automatically creates or removes tokens when their value rises above or falls below $1—maintaining a consistent price over time.

When successful, both collateralized and algorithmic stablecoins can avoid the hypervolatility often associated with traditional cryptocurrencies—though algorithmic stablecoins are generally riskier, and can even fail entirely. In 2022, Terra, an algorithmic stablecoin, and Luna, its sister token, collapsed, wiping out $45 billion in market capitalization between the two and sending the broader crypto market into a quarter of a trillion dollar tumble.

Collateralized stablecoins, however—especially those backed by fiat currencies—have proven more reliable, and their operators can turn a tidy profit. For example, if a stablecoin is backed by U.S. Treasuries, whoever holds those Treasuries in reserve receives interest payments on them. That interest is rarely, if ever, passed on to the holders of the stablecoin itself. “If someone puts a billion dollars with you to use your stablecoin, you're sitting there getting around 5 percent interest on Treasuries,” Harper said. “That's like a money printing factory—being a stablecoin issuer is a great place to be right now.”

Administration ties.

Trump isn’t the only member of his administration capitalizing on stablecoins. Howard Lutnick has deep business ties to stablecoins through Cantor Fitzgerald LP, the financial services firm where he served as chairman and chief executive officer before stepping down to become Trump’s secretary of commerce. For the past several years, the firm has held most of the U.S. Treasury bonds that back the more than $140 billion worth of Tether tokens—a stablecoin pegged to the U.S. dollar—currently in circulation worldwide.

Tether, which is the third-largest cryptocurrency by market capitalization behind only Bitcoin and Ethereum, has become a key part of the global cryptocurrency ecosystem since its creation in 2014. Its relative stability and high liquidity has made it a safe haven for cryptocurrency investors and a common medium of cross-border exchange for tech-savvy citizens of countries with volatile fiat currencies. However, it has also become a medium of choice for international fraudsters, criminal and terrorist organizations, and sanctioned governments which can use the technology to move large sums of money across borders with relative anonymity. Russian oil companies, for example, have used cryptocurrencies like Tether to circumvent sanctions in the dollar-dominated global economy.

Last week, Cantor Fitzgerald—which is now chaired by Howard Lutnick’s son, Brandon Lutnick—announced that it was also launching a Bitcoin venture alongside Tether and Japanese investment firm SoftBank. The new company, called Twenty One Capital, will accumulate Bitcoin and be traded publically, giving the company’s investors public market exposure to the world’s largest cryptocurrency. While Howard Lutnick is no longer directly involved in Cantor Fitzgerald, his position in the administration presents opportunities to influence policies that lead to sizable paydays for his son and former firm.

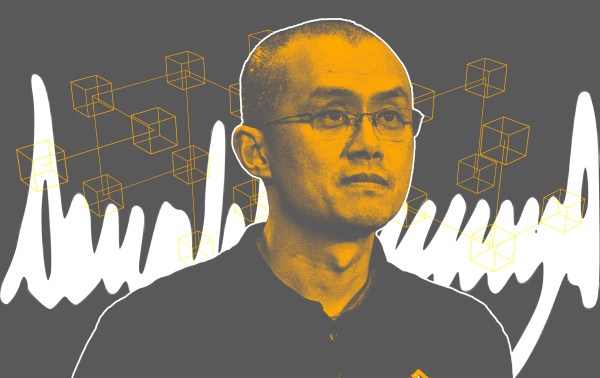

Trump’s appointee to lead the SEC, Paul Atkins, is also a longtime crypto ally. Atkins, who previously served as an SEC commissioner during George W. Bush’s presidency, has taken advisory roles with cryptocurrency firms and personally owns between $1 million and $6 million in crypto assets, according to recent ethics disclosures. Atkins, who was confirmed last week, replaces Gary Gensler, Biden’s appointee to the post who resigned on the first day of the new Trump administration. Gensler had become a bogeyman for the crypto industry during his tenure, as the SEC pursued enforcement actions against numerous crypto firms including Coinbase, Binance, and Gemini in an effort labelled as “regulation by prosecution” by crypto supporters. “Gensler took after crypto and really made an enemy in that sector,” Harper said.

Trump had previously campaigned on a promise to replace Gensler, telling the crowd at a July Bitcoin conference that he would pick a crypto-friendly regulator. “I pledge to the Bitcoin community that the day I take the oath of office, Joe Biden and Kamala Harris’ anti-crypto crusade will be over,” he said. “On day one, I will fire Gary Gensler and appoint a new SEC chairman.”

Memecoins.

Trump’s most prominent foray into digital assets, however, is his official $Trump memecoin—an official crypto token released by Trump on January 17, 2025, three days before his inauguration. A similar memecoin was announced by first lady Melania Trump only two days later.

Unlike a stablecoin or governance token, memecoins like $Trump offer no intrinsic utility or value beyond their novelty. Traditional cryptocurrency “coins” like Bitcoin and Ethereum are native assets of, and therefore some derive value from, their unique underlying blockchain technologies. Memecoins, however, are almost always created as “tokens,” meaning they operate on existing blockchains and offer no technological innovation of their own.

Ethereum, for example, allows users to build and deploy decentralized applications that run on its blockchain without relying on a central server as well as create smart contracts, which are self-executing agreements that automatically carry out actions like transferring funds based on pre-set conditions. As a result, even though some investors buy or sell Ethereum based only on market speculation, the coin also holds some value based on the fact that it has actual real-world—or at least digital—applications. The value of a memecoin, on the contrary, is usually based entirely on factors like social media virality and celebrity endorsements, making them a cultural phenomenon more than an economic or financial one.

“Memecoins don't have any lasting value, they don't have any real technical use,” Harper said. “They're a tchotchke. A cool tech-kind of tchotchke—but they're not much different from something like a commemorative plate.”

Despite this lack of utility, memecoins can soar in price as speculators try to ride the hype and make a quick buck before prices—almost inevitably—crash. In its first two days of trading, $Trump appreciated by nearly 20x, making small fortunes for early investors. The coin’s price has since fallen by nearly 80 percent, but still has a market capitalization of more than $2.8 billion. According to the coin’s official website, entities tied to Trump own 80 percent of the 1 billion $Trump memecoins created. While 200 million of the coins were initially released in January, more will come available for public sale in regular intervals over the next few years.

In February, Reuters reported that entities behind $Trump had made around $100 million in trading fees during the first two weeks following the coin’s release. It isn’t clear who exactly pocketed the earnings—the ownership details of the coin are shrouded in mystery by limited liability companies like Fight Fight Fight, which owns the coin’s website, and CIC Digital, an affiliate of the Trump Organization that receives trading revenue from the coins. The website promoting the $Melania memecoin is owned by MKT WORLD LLC, a limited liability company registered in Florida to Melania Trump.

With the Trump Organization making direct trading revenue from the coins and insiders benefiting from the coin’s appreciation, critics have highlighted opportunities for corruption. Last week, Trump announced that the top 220 holders of the $Trump memecoin would be invited to an exclusive dinner with the president at his Trump National Golf Club in the suburbs of Washington, D.C. This type of event is not new for Trump—last year, then-candidate Trump similarly hosted a dinner at Mar-a-Lago for owners of his NFT trading cards.

The dinner, scheduled for May 22, has prompted action from Democratic senators. On Friday, Sens. Adam Schiff and Elizabeth Warren sent a letter to Jamieson Greer, acting director of the Office of Government Ethics, arguing that the dinner “raised grave ethics and legal concerns, including the severe risk that President Trump and other officials may be engaging in ‘pay to play’ corruption.”

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.