One of the good things about social media is that it can show the current zeitgeist on almost any economic issue. Anodyne tweets on inflation, jobs, supply chains, or any number of other wonky things often elicit, ahem, passionate responses (#engagement) from random others who concur or feel differently. The responses might be factually incorrect, of course, but they do often give a sense of the national mood, especially among people who don’t stare at charts for a living.

Perhaps no issue elicits more such responses than the finances of millennials (the generation of Americans born between 1981 and 1996), which are widely understood to be just terrible thanks to multiple calamities—war, recession, etc.—occurring during their formative earning years. Post something neutral or (gasp!) even positive about the generation’s economic situation, and you’re sure to be treated to widespread (and often surly) disagreement. Millennials, so the narrative goes, had it particularly rough during the last couple decades and are still struggling today, especially compared with other generations. So just spare them your avocado toast jokes, okay?

A few years ago, such claims were for the most part correct. A global financial crisis, sluggish labor market, inflationary education and housing markets, plus all sorts of political and geopolitical turmoil, surely weighed on many millennials’ financial prospects. But then a funny thing happened: Millennials started getting richer. And today, in fact, they’re doing better in many ways than other generations at the same age. It’s time we updated the narrative accordingly.

But Let’s Start With the Bad (Housing)

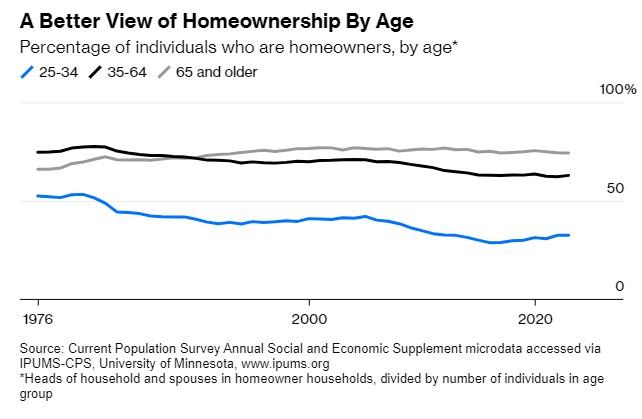

Before we get to that, however, let’s first acknowledge one important thing many millennials still rightly complain about: housing. Yes, the homeownership rate among the millennial cohort has improved a lot in recent years, approaching rates that GenXers and boomers enjoyed at the same age. However, as numerous experts have shown, this statistic is an imperfect measure of actual homeownership because it includes people living with parents or roommates. When you consider just head-of-household homeowners, it’s clear that fewer young people own homes today than they did in decades past:

Given the recent and substantial increase in home prices over the last decade or so—one that, as we’ve discussed repeatedly, is owed in large part to bad government policy—and that many millennials were just hitting the market when home prices really took off, some level of generation-specific frustration here is indeed warranted. However, there are also many reasons why it shouldn’t end the discussion.

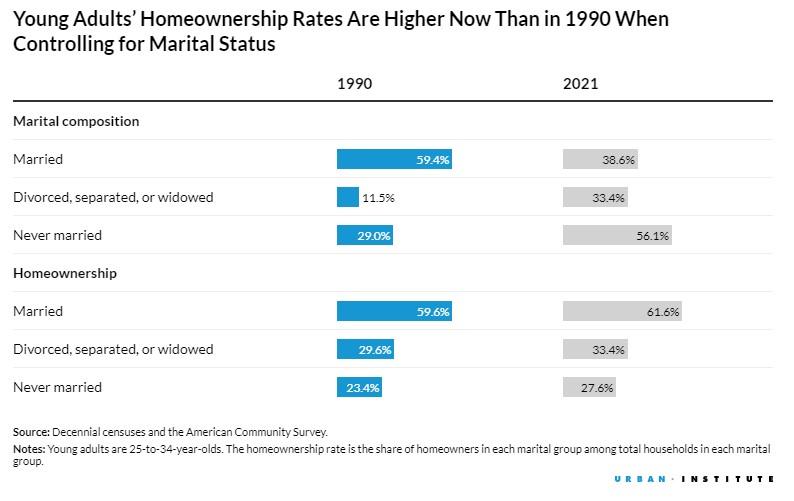

First, part of the homeownership trend stems from the simple fact that millennials are, consistent with generations before them, settling down later—especially when it comes to getting married and having kids. When you control for marriage, in fact, homeownership rates among young people were actually higher in 2021 than they were in 1990:

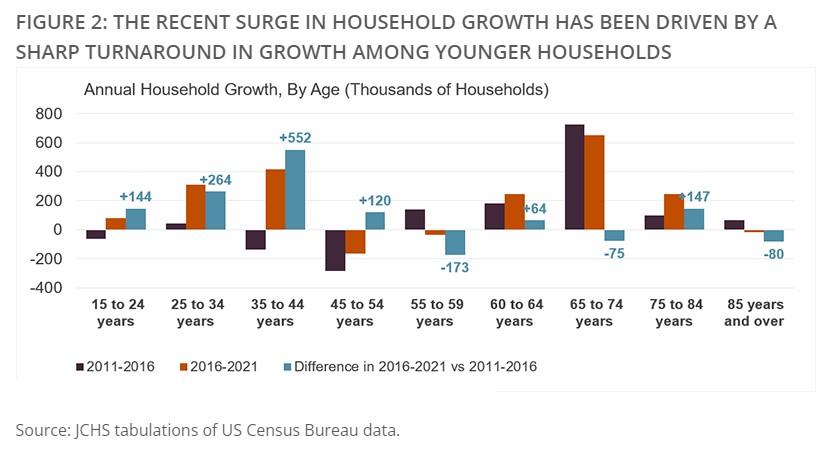

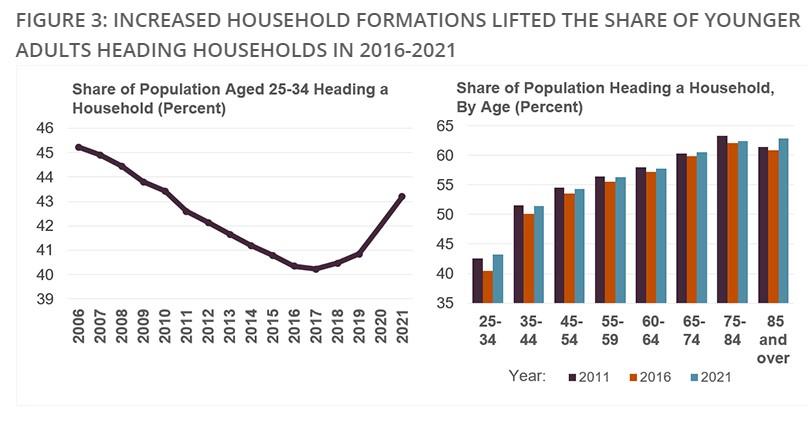

Second, and probably related to the first point, millennials have rapidly accelerated their homebuying in recent years. As the following chart shows, the biggest household growth between 2016 and 2021 was among young adults (ages 25 to 44):

Importantly, this includes young people heading their own households (aka the “headship” rate), which again rose most quickly for young adults who had seen big declines earlier in the decade. Thus, “by 2021 headship rates for most age groups had recovered nearly all ground lost during the Great Recession and were back to levels from 2011.”

Equally important, there are good reasons to think that—even with high mortgage rates and home prices today—real millennial homeownership will continue to surge in the future. According to the National Association of Realtors’ 2024 Home Buyers and Sellers Generational Trends report, “the combined share of millennials, both younger (ages 25 to 33) and older (ages 34 to 43), now make up a combined 38% of the home buying market,” a big increase over 2022 and one that made millennials the largest demographic of home buyers last year. Another good sign: 75 percent of young millennial home buyers in 2023 were buying their first home. Thus, while millennial complaints about high home prices and a lack of inventory are somewhat warranted, even here things are looking up.

Where Millennials Are Shining

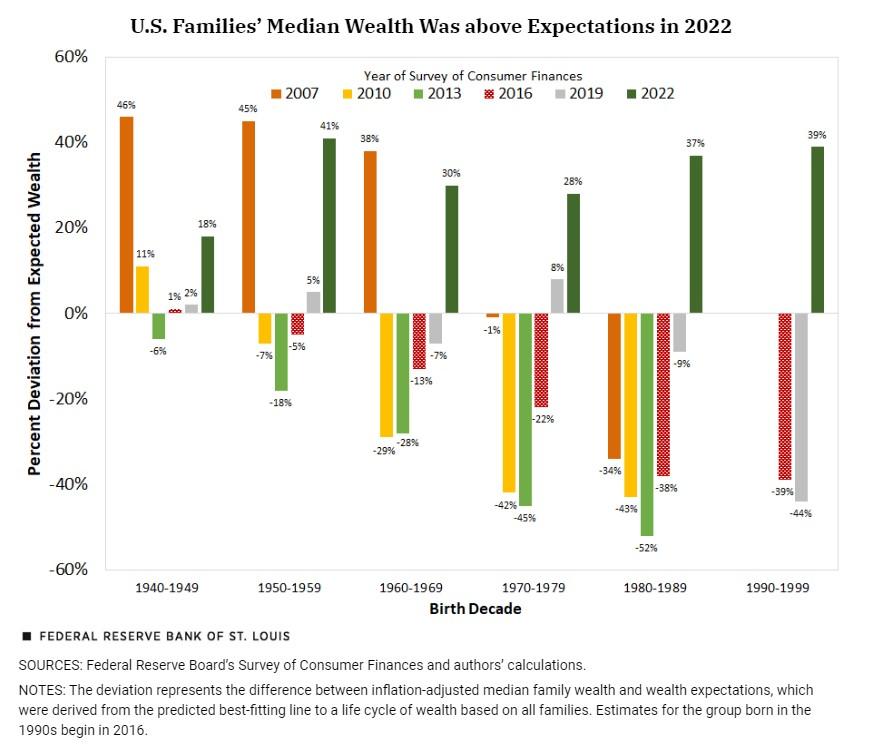

Things are looking even better away from the housing market—and looking better overall. According to a new St. Louis Federal Reserve Bank analysis of the latest Survey of Consumer Finances data, young people have recently made “remarkable gains in median wealth” (which includes almost all assets and liabilities) and now are doing better than expected—a remarkable turnaround since the Bank’s 2016 review of the same data. Back then, the economists openly wondered whether millennials, in particular older ones, would be part of a “lost generation” financially. Not so anymore:

As it turns out, older millennials experienced a sharp swing in their relative standing with median wealth expectations in 2022. Whereas for much of their adult lives, their wealth had been below where we would have expected it to be based on all generations at the same age, in 2022, their wealth was 37% above expectations—a 46 percentage point swing…. At age 38, the average age of older millennials in 2022, our model predicted that the typical family would have about $95,000 in median wealth based on how all generations fared at the same average age. Instead, the typical older millennial had over $130,000.

Younger millennials and older Gen Zers (Americans born in the late 1990s) saw an even sharper improvement, with their expected wealth swinging 83 percentage points—from 44 percent below expectations to 39 percent above expectations—between 2019 and 2022, and their median wealth more than quadrupling (to $41,000) over the same period.

The economists go on to note that these wealth gains were driven by substantial gains in housing wealth—another sign that millennials are catching up in this regard but also a cautionary note that future wealth gains will probably be less exceptional (because home price inflation has cooled, though that’s obviously a good thing for potential home buyers).

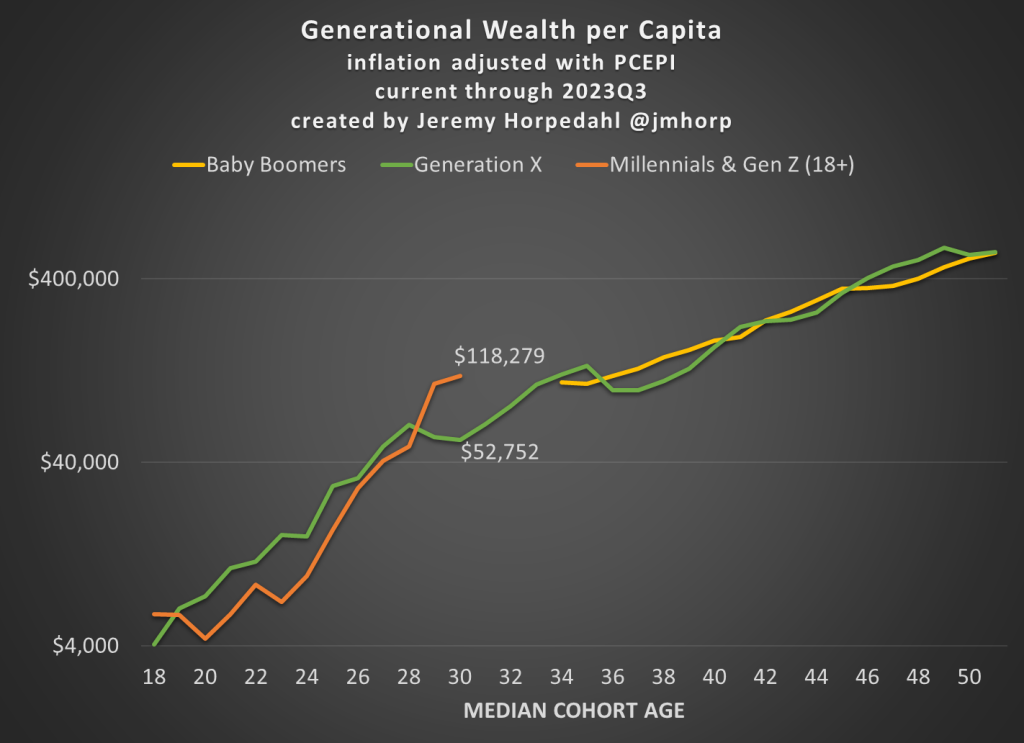

Economist Jeremy Horpedahl finds a similarly sanguine outlook for millennial wealth when examining the same dataset and comparing average wealth across generations (and, yes, adjusting for inflation). As you can see from the following chart, young people as of the third quarter of 2023 had more wealth on average than either Gen X or boomers did at the same age:

Since this chart includes Gen-Z, moreover, it biases the wealth figures downward (because young people are usually poorer than older people). Horpedahl thus breaks out millennials’ average wealth at the median age of 35 and finds it’d be $183,000, compared with just $134,000 for Gen X and $107,000 for boomers at the same age.

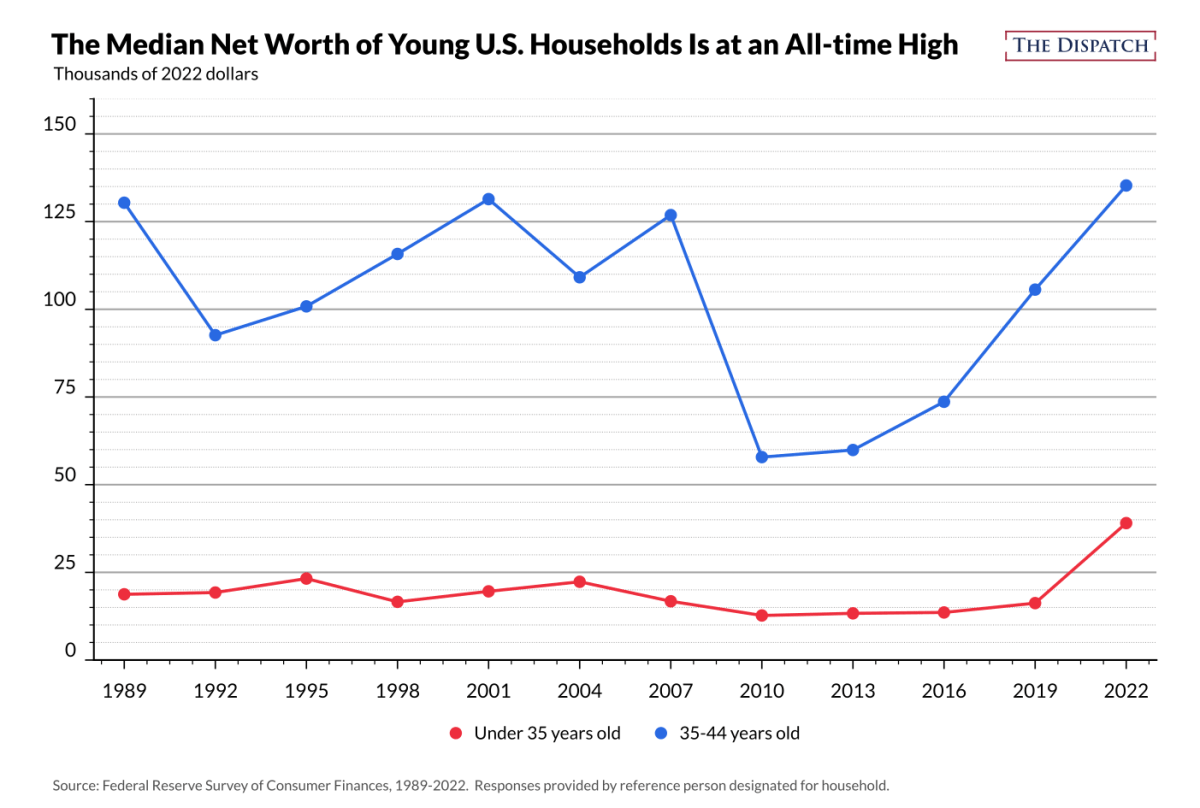

To check his work, Horpedahl concludes by pointing to other Fed data showing that both the median and average net worth of Americans ages 35-44 (mostly older millennials) and under 35 (a combination of millennials and Gen Z) is “the highest it has ever been” (again adjusted for inflation):

“Yes BUT,” some millennial readers are probably yelling, “this is biased by housing wealth and ignores millennials’ lower incomes!” Yet here, too, there are good things to report.

As Jean Twenge noted in The Atlantic last year, millennial incomes definitely struggled after the Great Recession but have rebounded dramatically since then. By 2019, “households headed by Millennials were making considerably more money than those headed by the Silent Generation, baby boomers, and Generation X at the same age, after adjusting for inflation.” And by 2021, millennial incomes were at “historic highs”:

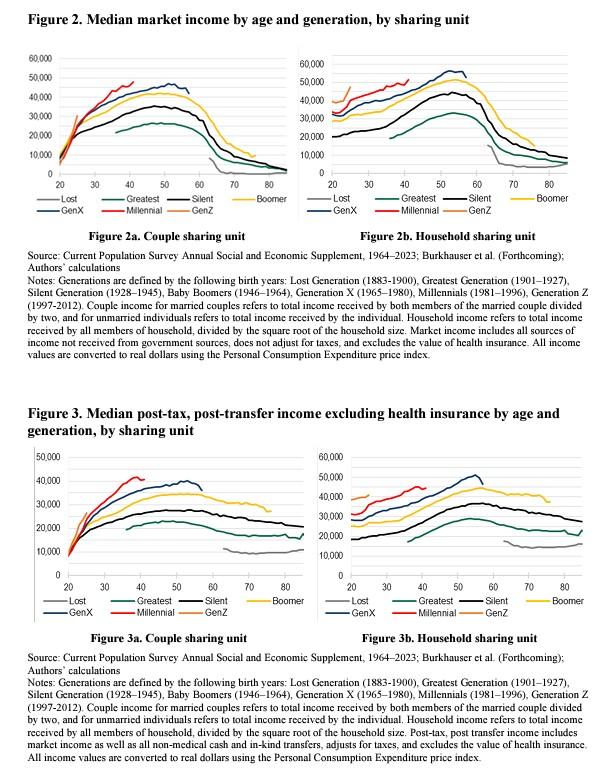

Since then, there’s been even more good news. A new paper from the American Enterprise Institute’s Kevin Corinth and the Federal Reserve Board’s Jeff Larrimore examined generational incomes (both “market income” and income after taxes and transfers, all adjusted for inflation) and found that older millennials (age 36–40) had “a real median household income that was 18 percent higher than that of the previous generation at the same age”—part of long-term trend in which “each of the past four generations of Americans was better off than the previous one.”

(Before you ask, health insurance was excluded from Figure 3 for very wonky methodological reasons, but the authors show that including a widely used proxy wouldn’t radically change their conclusions—see Figure 8 in the paper.)

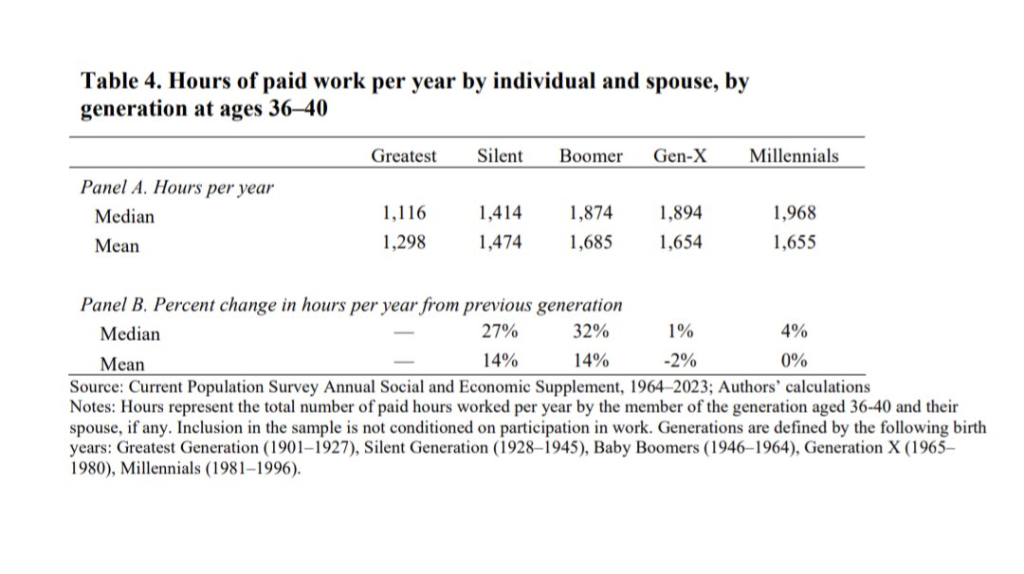

As Horpedahl notes in his comment on the paper, the millennial income premium we see in these data doesn’t come from households working more jobs or longer hours, whether as a dual-income family (the much-ballyhooed “two-earner trap”) or with one earner working multiple jobs. Instead, “younger households have roughly the same number of working hours as Boomers did during prime working years.” They’re just making more money.

Finally, Corinth and Larrimore dispel another millennial myth—that any financial gains are owed to them all living in their parents’ basements. The economists instead show that this living arrangement did indeed matter for the incomes of many millennials in their 20s, but, “[b]y age 31 … less than 10 percent of Millennials are still dependent on their parents and by then their own market incomes exceed that of previous generations.”

But Muh Loans

“Yes BUT,” a few remaining millennial doubters are probably screaming, “this doesn’t consider our giant and uniquely terrible student loans!” Yet here, too, the complaint falls flat.

For starters, the SCF wealth data analyzed in the above studies accounts for household debts, including student loans (“education installment loans”). Those data do indeed show that student loans have been rising in recent years for younger generations, but the debts have been more than offset by increases in these same households’ assets (hence, rising generational wealth overall). And, to be clear, it’s not just about housing: Corinth and Larrimore, for example, acknowledge that millennial homeownership still lags that of previous generations but add that “the share of 35–44 year olds who hold stocks reached 64 percent in 2022, up from 39 percent in 1989.”

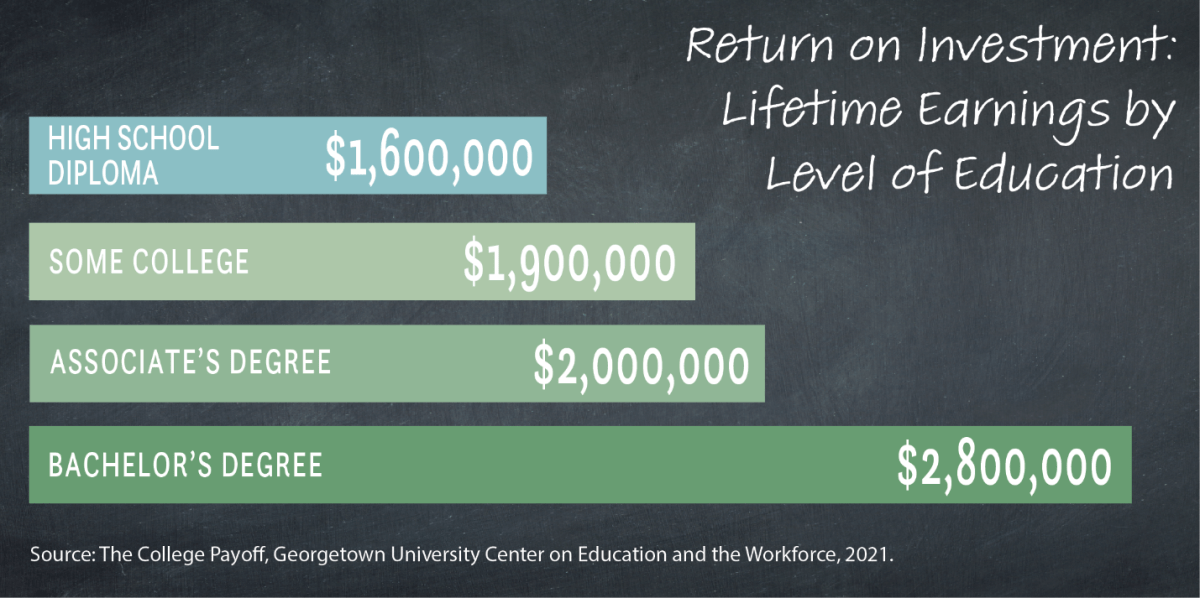

Second, and just as importantly, we should generally expect millennials’ student debt to mean even better income growth in the future—growth that outpaces that of generations with fewer college/graduate degrees (and less debt). That’s not always the case, of course, but current student loans are typically an investment in future earnings by increasing human capital or, if you want to be more cynical, buying a magic piece of paper that gives holders access to better jobs. Either way, it translates to the potential to earn higher incomes in the future, which the data generally show:

This obviously doesn’t work out for everyone who takes on debt to go to college, and it certainly doesn’t mean the government needs to subsidize student loans or push people into costly four-year degrees. But in general, the investment—even today—tends to pan out (hence, why student loan “forgiveness” tends to favor the wealthy). Indeed, Horpedahl to his credit predicted a few years ago that millennials’ student debt would eventually translate into higher earnings and wealth, and the latest data support him.

Corinth and Larrimore agree, noting that GenX has already seen a similar benefit over boomers and predicting that millennials—who have more college and graduate degrees—will do the same over GenX, even with a much more expensive education bill:

In 1975–1976, when a Baby Boomer born in the middle of the generation turned 21, the average tuition, fees, room, and board in the United States cost $7,824 (in 2019 dollars) … This compares to an average cost of $10,811 when a member of Generation X in the middle of their generation turned. Hence, for a four-year education, someone in the middle of the Generation X cohort would spend approximately $12,000 more than someone in the middle of the Baby Boomer generation. This represents just 6 percent of the $198,000 33-year income gain for Generation X over Baby Boomers through age 57. While we do not yet observe Millennials above the age of 41 in our dataset to have a sense of their more complete lifetime incomes, the higher annual incomes of Millennials suggests that their income gains over Generation X will also far outweigh their higher educational investments. The four-year educational cost for Millennials exceeds that of Generation X by about $38,000. This is equivalent to about eight times the $4,600 one-year income gap between Millennials and Generation X with a Bachelor’s degree in their late-30s. Additionally, despite having many working years left, between ages 25 and 41 alone the median income of Millennials exceeded that for Generation X by just over $60,000—more than 50 percent above the increase in education costs between these generations. (emphasis mine)

They add that, because millennials spend more time in school and because student loan repayment tends to happen earlier in a borrower’s career, younger millennials today might not feel like they’ve made generational gains, but—barring some sort of economic calamity—they’ll almost certainly get there eventually.

Summing It All Up

And that “eventually” is really the biggest economic lesson to be learned from millennials’ greatly improved financial situation today. In 2016, a person born in the mid-1980s had very justifiable complaints. She went from an increasingly expensive college to a persistently terrible labor market and then to an increasingly unaffordable housing market, especially in the places with actual jobs. And then, just as things may have finally settled down, she got the pandemic, inflation, and—of course—endless political drama to boot.

But all generations go through bad stuff (much of it together), and all generations enjoy or suffer through historically unique economic conditions. This GenXer, for example, left college right before the tech bubble popped, bought a house (with a costly adjustable-rate mortgage, LOL) right before the housing bubble popped, and then watched dozens of friends and colleagues get fired in the wake of the Great Recession. It wasn’t a fun few years. (And don’t even get the boomers started about the 1970s or the Cold War.) But people and markets adjust, and the U.S. economy—for all its warts—chugs ahead, even for those miserable millennials.

That doesn’t mean that every millennial is today doing great, or that we should stop trying to improve public policy and living standards for ourselves and our kids. But it does mean we should be a lot more sanguine about our own futures and the future of the American Dream.

Even on social media.

Chart(s) of the Week

The Links

Three great new essays from our Defending Globalization project: tariff facts and fictions (by the Tax Foundation’s Erica York); globalization and climate change (by CGD’s Charles Kenny); and the moral case for globalization (by Atlas Network’s Tom Palmer)

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.