Among the more common economic tropes of the last 15 years has been the U.S. “retail apocalypse.” Giant e-commerce companies, so the story goes, have killed traditional brick-and-mortar establishments in the United States, forcing American shoppers—particularly low-income ones—to travel farther for fewer (and lesser) retail opportunities and leaving them worse off overall. Communities have, in turn, supposedly suffered from a loss of jobs and tax revenue, as well as a blight of empty storefronts and shopping malls. And, thanks to pandemic-era lockdowns, it’s only gotten worse in recent years.

Fears of the retail apocalypse have fueled not only piles of breathless reporting on certain store closures and their national economic implications, but also government policy, as states and localities across the United States have responded with subsidies for local businesses, new taxes on online sales, bans on “big box” stores, and so on. Yet, even a decade ago, there were clear signs that the “retail apocalypse” wasn’t actually happening—that brick-and-mortar retail was changing, not dying, and that Americans were basically fine with the result. Now comes a great new paper from the National Bureau of Economic Research (NBER) confirming the early pushback and strongly cautioning against efforts to regulate American retail businesses now or in the future.

The Retail Apocalypse Never Actually Happened

Economist Yue Cao and colleagues tested the retail apocalypse thesis by first examining changes in general merchandise stores—25 different national chains and several smaller regional outlets—in 18 metro areas between 2010 and 2019. Then, using these figures and smartphone geolocation data for more than 2.7 million devices, they estimate whether Americans in these places were better or worse off (in terms of “consumer surplus”) in 2019 than they were 10 years earlier.

They found, first and contrary to the conventional wisdom, the number of general merchandise stores in the United States actually increased in the 2010s, from 49,089 to 52,807, as dollar stores, supercenters, and discount department stores more than replaced certain traditional department stores and regional chains.

Second, Americans’ access (defined as having a store within 10 miles) and proximity to the retail chains examined also improved from 2010 to 2019, with dollar stores again being a big driver of the improvement but also gains—dots on the left side of the line in the chart below—at Target, Walmart, and my personal favorite, Costco.

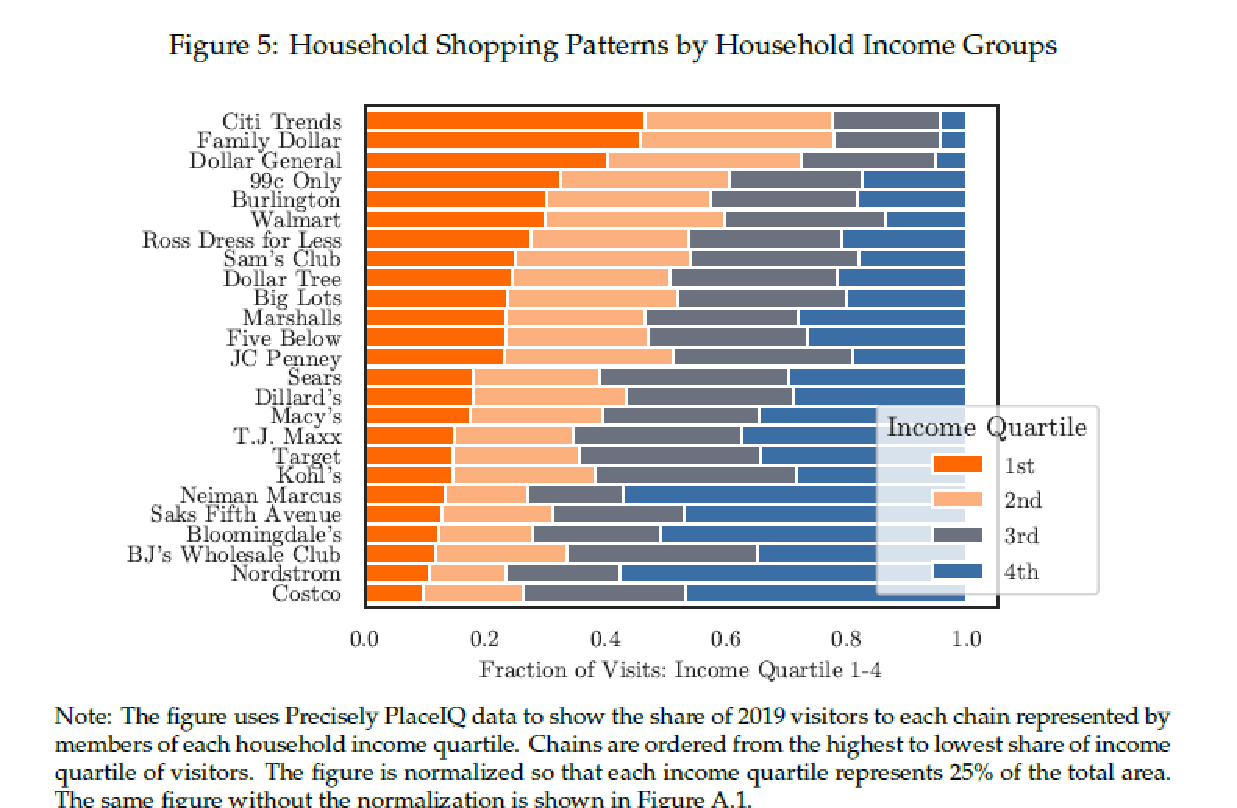

As you’d expect, Americans’ choice of retail establishment differed greatly according to their incomes, with this difference driven by both consumers’ preferences and the stores’ locations. Among the most “egalitarian” (meaning a roughly equal share of store visits by rich, poor, and middle income) stores were Ross, Sam’s Club, Marshalls, and Five Below (which my daughter loves, btw):

Next the authors examined Americans’ preferences for various retail establishments, measured by their willingness to drive to a certain store in their general vicinity. (If you’re willing to drive a few extra miles for similar stuff, you very likely prefer the place selling it.) Here, they found that Walmart was the most preferred general merchandise store among both low-income and high- income Americans, while everyone basically hated traditional department stores. (And, seriously, who can blame them?) Other consumer preferences were pretty much what you’d expect, with lower-income consumers preferring discount chains and wealthier ones frequenting warehouse clubs and higher-end department stores like Nordstrom. And others still were weird/surprising (e.g., wealthier people preferred Dollar Tree over other dollar stores).

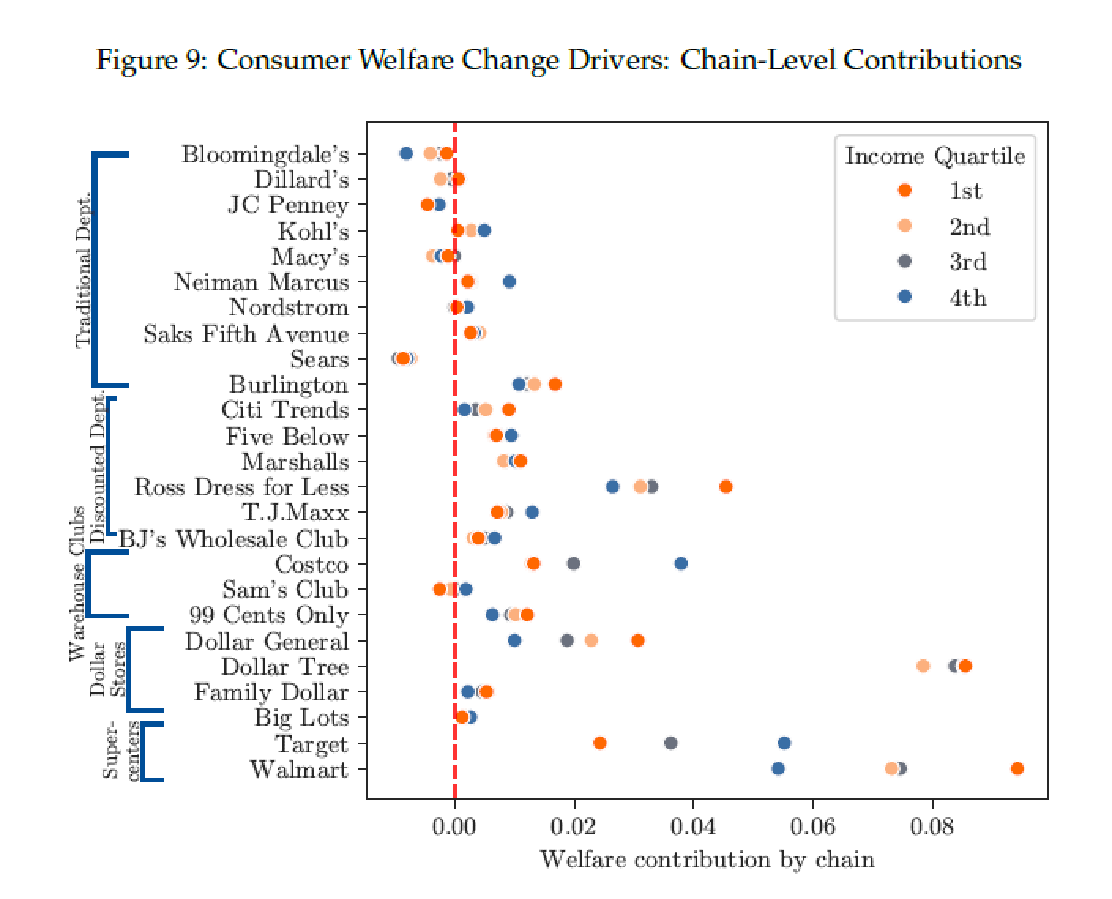

Finally, the study used all these data to calculate American consumers’ change in welfare between 2010 and 2019. For example, if consumers were visiting all the same stores in both years but traveling less/more distance to patronize them in 2019, their welfare would increase/decrease accordingly. They’d also be better/worse off if making the same number of trips or traveling the same distances in 2019 but visiting more/fewer of their preferred stores than they were in 2010. Based on these calculations, the authors debunked the prevailing “retail apocalypse” narrative: “Consumer surplus per trip to general merchandise stores did not significantly decline from 2010 to 2019.” Instead, higher-income consumers were actually better off at the end of the decade, and the welfare of the lowest-income Americans was basically unchanged because the loss of department stores and regional chains was offset by Walmart (their most-preferred option) and discount/dollar stores (the chains seeing the highest growth):

Put simply, the U.S. brick-and-mortar retail environment did change a lot between 2010 and 2019, but the “apocalypse” narrative focused only on the seen losses of certain department stores and regional chains while avoiding less-noticed gains—including places people preferred—in the very same localities. Account for the latter, and suddenly American consumers’ losses disappeared (and, depending on their incomes, they actually did a little better).

It’s (Probably) the Same Story Today

The most obvious rebuttal to these findings is that they preceded the pandemic, which scrambled the retail space and further boosted e-commerce at brick-and-mortars’ expense. Yet, if anything, it’s more likely that the opposite is true—that the much-derided “Big Retail” has continued to boost the fortunes of American consumers.

For starters, the explosion in e-commerce that occurred (by necessity) in 2020-21 receded greatly when the pandemic ended, effectively returning to its pre-pandemic trend in 2022 and staying that way ever since. Over the last year or so, in fact, brick-and-mortar retail has been making a big comeback, and several large national chains (e.g., Toys “R” Us and Barnes & Noble) that people thought were killed off by online shopping and previous “apocalypses” have recently reopened physical locations. Discount retailers Burlington, Ross, and TJ Maxx collectively opened 339 stores last year, while Nordstrom Rack increased its store count by 8.5 percent. Even much-derided malls and shopping centers got a small boost last year, with U.S. foot traffic increasing 1.5 percent and 1.7 percent, respectively, versus 2023. And the Wall Street Journal reports that “[r]etail availability sits near record lows” and commercial rents are rising, thanks to a dearth of new construction and surging “demand from expanding retailers.”

This doesn’t mean the retail landscape is the same today as it was even five years ago: Companies have come and gone, and others have evolved. Burlington Coat Factory, for example, is now just “Burlington” and actually sells few coats. It’s opening 400 new stores over the next four years but with “much, much smaller” footprints. The chain hopes to eventually boost its store count from 1,103 today to 2,000, often by snapping up real estate from bankrupt retail chains like Bed Bath & Beyond, Big Lots, and Conn’s, and by locating in busier (pricier) areas that feature other national chains, including competitors. The Journal adds that Burlington isn’t the only retail store now booming, in part by avoiding a direct fight with e-commerce giants like Amazon:

The 53-year-old company’s evolution encapsulates how bricks-and-mortar retailers are adapting to changing customer habits and the rise of e-commerce. After decades of big-box domination, many companies now want smaller footprints in well-located, busy shopping centers. Inside, retailers seek to draw in shoppers by offering an experience they can’t get online.

The playbook appears to be working. … Off-price retail, which gobbled up both market share and real estate over the past two decades from declining department stores and bankrupt big-box chains, has only gained momentum since the pandemic. The sector benefits from a “virtuous circle” of growing customer demand convincing more brands to sell their inventory to discount stores, fueling more customer demand. … That treasure-hunt experience has allowed Burlington and other off-price retailers to largely avoid e-commerce. Online sales account for less than 2% of TJX sales, and Burlington ended its e-commerce operations entirely after [CEO Michael] O’Sullivan took over.

“Our price points are very low,” he said. “If you add free shipping and free returns to a $10 or $15 piece of apparel, as an e-commerce retailer you’re going to lose a fortune.”[block]

Walmart and Costco have also been on a tear since the pandemic, adding locations and customers at a rapid clip (and increasing wages, too), while keeping prices lower than the competition—just the kind of “consumer surplus” our economists saw in the previous decade.

As one industry watcher recently put it, “The message is loud and clear: retail didn’t just survive—it’s thriving.”

Apocalyptic Predictions Suffer from the Same Old Problems

Folks peddling the retail apocalypse narrative miss the U.S. market’s fluidity. They assume high walls between different stores, instead of overlapping and constantly changing palates of various goods and services. They assume markets won’t quickly adjust—either through new entrants or modified incumbents—to changing consumer tastes, new innovations, a certain company’s exercise of market power, or its bankruptcy. And they assume American shoppers don’t adapt when the retail landscape changes (e.g., by a store’s closure or its deteriorating quality/prices). In reality, of course, all of these things are happening every day, and they’re a big reason why dire predictions of market doom rarely, if ever, materialize.

This kind of myopia extends into other kinds of retail, as well. The feds blocked grocery giant Kroger’s merger with Albertsons in December on the grounds that the combined entity would reduce market competition and, among other things, lead to higher grocery prices. Yet, since at least the time the merger was first announced in 2022, it’s been clear that competition in the U.S. grocery space was alive and well, albeit different from the old school version federal regulators had in mind. Instead, these two traditional supermarket giants have been steadily losing ground to newer, less-traditional players—especially Walmart, Costco, and others like them:

Grocery stores accounted for about two-thirds of food-at-home spending in the U.S. in 2000, but their share shrank to 54% in 2023, according to the U.S. Department of Agriculture. Over the same period, warehouse clubs and supercenters such as Costco and Walmart nearly doubled their market share to 23% …

In 2024, groceries at major supermarket chains were on average 21% more expensive than an equivalent basket at Walmart, while dollar stores were 9% pricier than the retail giant, according to a report from BofA Securities.

Speaking of dollar stores, they’re not only better on price and growing rapidly, but getting more into the grocery game and—as we discussed a year ago—expanding their fresh food offerings. Even convenience stores and gas stations have “doubled down on fresh food, and customers are buying in.” Amazon and other online grocery options are also available and growing (though still not wildly popular for fresh food).

Finally, there’s the new kid on the American grocery block, German-owned Aldi. After taking over about 400 Southern grocery stores in 2023, it added 120 stores last year and plans another 225 this year. At more than 2,400 stores, Aldi is today the third-largest grocery chain in the country and should reach No. 2 before the end of the decade, behind only Walmart (which Aldi is also challenging on price). The Economist adds that the federal government’s block of the Kroger-Albertsons deal, which would have “create[d] an efficient rival capable of driving a hard bargain with suppliers,” has boosted Aldi’s growth—and Walmart’s too. (So, instead of getting three hyper-efficient grocery giants competing for consumers’ wallets, we only get two. Oops.)

Overall, things remain so dynamic and competitive in the American grocery space today that, as the Journal just wrote, many supermarkets today sell eggs at a big loss—they buy them for $7 a dozen and price them at $5—just to get shoppers in the door. This is hardly an anticompetitive hellscape in need of federal intervention—especially one based on an outdated version of how and where Americans do their grocery shopping today.

Summing It All Up

So, in terms of the availability of brick-and-mortar retail stores and Americans’ actual revealed preferences, there was little sign of a nationwide “retail apocalypse” last decade, and things appear to be headed the same direction during this one. That doesn’t mean, of course, that every general merchandise (or grocery) market is doing great, or that the loss of certain local favorites doesn’t sting. But in terms of being able to shop for the everyday things most Americans need—clothes, housewares, toys, food, etc.—we still have plenty of in-person options within a relatively short distance of where most of us live (and plenty of other online options too, by the way). The market today surely looks different from what it looked like in 2010, but consumers’ needs are still being met and—as long as markets remain open and relatively unencumbered by the state—we should expect this to continue in the future.

That “as long as” is the rub, of course. Politicians at all levels itch to fix visible-but-temporary economic disruptions that are wrongly characterized as an enduring market “apocalypse” in desperate need of government help. Yet their remedies can often harm the very people the regulators say they’re trying to help. The NBER paper’s authors, for example, caution that their results “suggest that regulations that restrict the siting of large big-box supercenters, particularly Walmart, could have disproportionate negative impacts on low-income consumers”—i.e., the ones supposedly most harmed by last decade’s “retail apocalypse.” Recent moves by “dozens of towns and cities” to zone away dollar stores might have similar harms, and blocking big supermarkets’ efforts to stay competitive in a changing grocery landscape could—if recent trends continue—leave us with fewer, not more, places to shop.

Market “apocalypses” might make for great headlines, but it’s usually the government fixes doing the real damage.

Capitolism will be off next week.

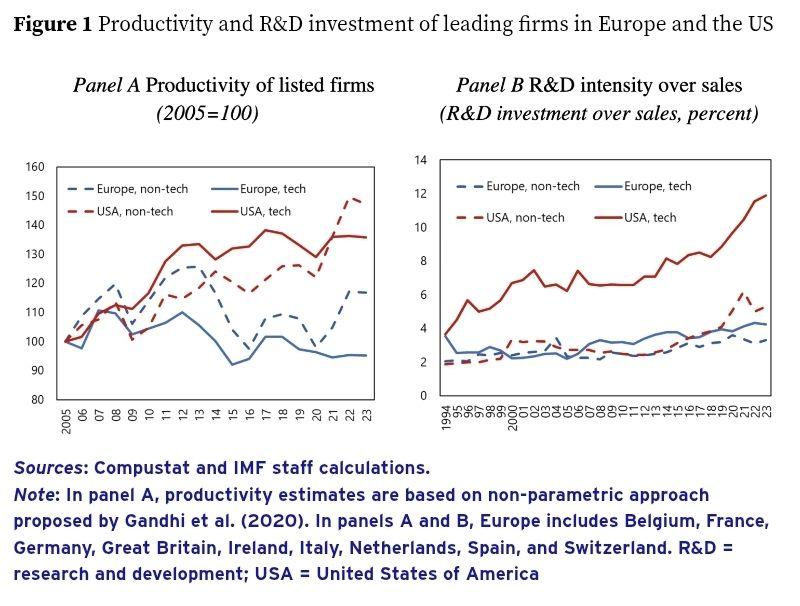

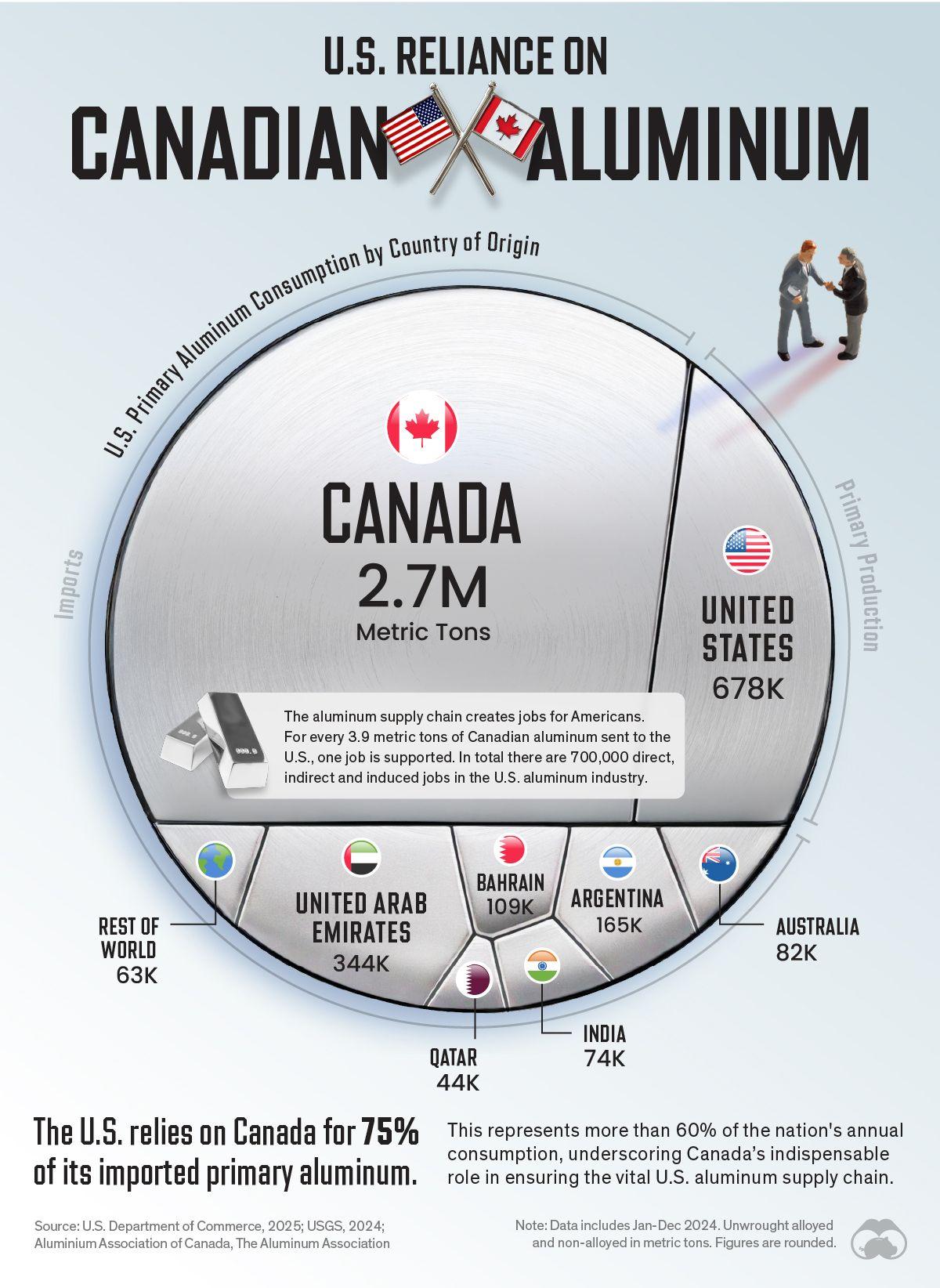

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.