This week has illustrated, better than most, the promise and peril of biblical arguments over public policy. It all started on Wednesday, when President Joe Biden announced his student debt forgiveness plan.

The plan is relatively simple. All student borrowers who possess household incomes of less than $125,000 for single people and $250,000 for married people would be entitled to $10,000 of debt relief. Those who went to college on Pell Grants would receive $20,000 in relief. In addition, the plan would cap monthly loan payments at an amount equal to five percent of the borrower’s monthly discretionary income and forgive remaining loan balances after 10 years of payments, provided the remaining balance is $12,000 or less.

Biden also extended the pause on student loan payments—first granted during the COVID emergency—through the end of the year. Student borrowers would resume payments in 2023.

Importantly, Biden’s plan is not a legislative proposal. He’s not asking Congress to enact this reform. He’s initiating it through the executive branch only, asserting that the so-called HEROES Act, passed after the 9/11 attacks, grants him the authority to forgive student debt “in connection with a war or other military operation or national emergency.”

The reaction was intense, even for our polarized times, and part of that intensity was directly related to faith. Hours after Biden’s announcement, progressive pastor John Pavlovitz tweeted this:

It was an obvious Twitter shot, but it was rooted in something real. The concept of debt forgiveness—including the forgiveness of monetary debt—is all over the Bible. Indeed, debt forgiveness is built into Mosaic law. Deuteronomy 15 declares, unambiguously:

At the end of every seven years you must cancel debts. This is how to cancel debt: Every creditor is to cancel what he has lent his neighbor. He is not to collect anything from his neighbor or brother, because the Lord’s release of debts has been proclaimed.

Leviticus 25 also sets aside every 50th year as a “Year of Jubilee,” when slaves are set free and debts are released.

Roger Nam, a Hebrew Bible professor at Emory’s Candler School of Theology wrote a helpful piece for the Religion News Service in which he described the Old Testament’s commands of debt forgiveness as embodying a “spirit of compassion” that helped lift the poor from grinding poverty, debt slavery, and oppression:

The same spirit is embedded in narratives like the fourth chapter of 2 Kings, when Elisha gives vessels of oil to a widow so she can rescue her two children from debt slavery. The Judeans embrace a similar sentiment in Nehemiah 5:1-13 as they commit to complete forgiveness of debt because “some of our daughters have been ravished” (Nehemiah 5:5). This spirit of compassion undergirds the line from the most famous prayer of the Gospels, “And forgive us our debts, as we also have forgiven our debtors” (Matthew 6:12).

Debt forgiveness figures directly in one of Jesus’s most famous parables—the parable of the ungrateful servant. It relates the story of a servant who begs for his king to forgive a crushing loan debt, the staggering sum of 10,000 talents. The king forgives and the servant rejoices, only to immediately refuse to forgive a tiny sum owed him.

It’s a lesson in forgiveness that’s grounded in a reality that the people of Israel would understand. Forgiving debt can be an indispensable element of biblical justice. But does that mean it always is? Does that mean Christians should support Biden’s policy?

Not so fast. I think there’s a Christian argument for Biden’s policy, but there’s also an argument against, and that argument against is also grounded in biblical conceptions of justice. In other words, the issue is complicated.

First, let me say that I’m not persuaded that scriptures like Romans 13:7 (“Pay your obligations to everyone: taxes to those you owe taxes, tolls to those you owe tolls, respect to those you owe respect, and honor to those you owe honor”) or Ecclesiastes 5:5 (“It is better that you should not vow than that you should vow and not pay”) are all that relevant. They’re admonitions not to default. They’re not commands to refuse forgiveness.

Thus, I think this—from Dave Ramsey’s radio program—is bad advice. A caller who stands to benefit from Biden’s debt relief is told to “write a check” and pay off her loan debt rather than accept loan forgiveness.

The “principle” at stake isn’t “pay off loans no matter what.” Rather, it’s “pay off debts that you owe,” and a debt that’s forgiven is not a debt that you owe.

But while I think Christians can disagree in good faith, I see something out of alignment with the biblical precedents for debt forgiveness. The biblical precedents point time and again to debt forgiveness as relief for profound oppression. In his essay on biblical justice, Tim Keller highlights the biblical necessity of both “radical generosity” and “life-changing advocacy for the poor” as both individual and corporate responsibilities of Christians.

I agree. Yet Biden’s program doesn’t meet those requirements. It’s radically generous, yes, but the generosity is backwards. It’s taking from those who have less and giving to those who have more.

Rather than, say, a discharge of debts in bankruptcy—which relieves debts for the destitute—the decision to forgive student loans benefits America’s wealthiest and most powerful citizens. Earlier this year, CNN reported that the income gap between workers with college degrees and workers with high-school diplomas reached an all-time high.

In July, the unemployment rate for recent college graduates was a paltry 2.9 percent. The total lifetime wage premium for a college education is $900,000 for men and $630,000 for women—an amount that’s many multiples of average college debt.

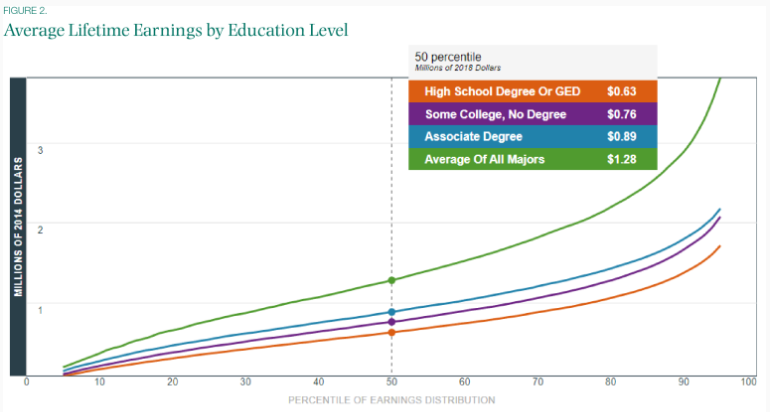

And while lifetime earnings vary by major, the stereotype of the impoverished art history graduate just isn’t true. A 2020 Brookings study showed that there was a significant lifetime wage gap “for all 98 majors studied.” The long-term benefits of a college degree are easy to see:

The reality is that the Biden debt relief plan will take money from those in the orange line (high school graduates) and transfer that money straight up to the green line. The total cost is estimated at roughly $500 billion. Moreover, that $500 billion is being spent in a time of terrible inflation, which hits poor families harder than those who have the resources to absorb cost increases.

Why does this matter? In a Q&A in The Atlantic, Jason Furman, a former chairman of President Barack Obama’s council of economic advisers, put it like this:

One group is getting $500 billion. And they’re going to spend more. They’re going to buy more housing. They’re going to be better off. The problem is that the economy is already producing the most it possibly can. If anything, the Fed wants it to produce less, not more. What will happen is that they will spend more and it will drive up the price of houses and everything else. Due to that inflation, every household will end up spending $200 more a year on what they need.

There isn’t free money out there. There are consequences. Once you frame it as 320 million people paying for a benefit for 30 million people, it makes you think a lot harder. You’re giving a benefit to someone making $200,000 a year. How important is it to give them relief?

Harvard Law School professor Laurence Tribe made the economic realities inadvertently stark when he tweeted on the day of Biden’s announcement, “Good news for thousands of my former students. I’m grateful on their behalf, Mr. President.”

I’m a former Harvard Law Student, and I graduated with almost $80,000 in debt (in 1994 dollars). It was a tough burden for a time, and I didn’t pay off every loan until 2008. I was serving in Iraq, and Nancy literally sold my truck to pay off the last bit. I came home debt-free and truck-free.

I passed up much cheaper options (including scholarships) to go to HLS. I did not for a moment believe that struggling families should endure one ounce of additional difficulty to ease my debt burden.

Yes, Harvard Law students are an extreme case, but one of the fundamental flaws of the Biden plan is that it doesn’t just help those who need help. Instead, it imposes costs on those who need help to provide a substantial benefit to thousands upon thousands of college and graduate school graduates who don’t.

In addition, the Biden plan might make the problem of college costs worse. Again, here’s Furman:

There’s the expectation that debt relief will happen again. That will lead to shifts in the college-financing system, toward loans and away from grants. It will also raise college tuition, as colleges move to capture some of this spending. Our goal should be getting more people into college. It is not obvious that Biden’s plan helps with that goal. It might even hurt that goal.

Finally, as I discuss all the time, the “how” of a policy can matter just as much as the “what,” and the legality of Biden’s plan is dubious, at best. In July 2021, House Speaker Nancy Pelosi argued that Biden did not have the authority to forgive student debt. Here’s what she said:

Here’s the thing. People think that the president of the United States—is this more on the subject than you ever want to know? Well, you’ll let me know. People think that the president of the United States has the power for debt forgiveness. He does not. He can postpone. He can delay. But he does not have that power. That has to be an act of Congress.

Pelosi was correct. As stated above, the alleged legal basis for Biden’s $500 billion plan is found in a novel reading of the post 9/11 HEROES Act, which does grant the secretary of education broad authority to “waive or modify any statutory or regulatory provision applicable to the student financial assistance programs under title IV of the [Higher Education Act] … as the Secretary deems necessary in connection with a war or other military operation or national emergency.”

But even if one accepts the dubious proposition that this language includes the ability to waive payment entirely, the Biden administration would still have to show that the COVID emergency justifies the action. It certainly justified loan forbearance during lockdowns. But now the economy is fully open, and college graduates are sitting at 2.9 percent unemployment.

Do we want presidents of any party stretching statutory language so far to spend $500 billion? According to the Committee for a Responsible Federal Budget notes, Biden’s plan will “consume nearly ten years of deficit reduction from the Inflation Reduction Act.” My friend Ian Bassin, a former Obama administration attorney and now the head of Protect Democracy, tweeted this:

I’m not opposed to all debt relief for college graduates. For example, I’d favor legislation that adopts the Biden proposal to lower monthly payment limits to 5 percent of discretionary income. As income grows, so would the amount of payments. And if for some reason a graduate continues to struggle, the monthly debt burden would remain light.

I’m also open to the proposal of forgiving debt after 10 years of payments—provided the debt forgiveness was targeted at truly low-income borrowers. Both of these policies are better representations of the “spirit of compassion” than a unilateral, half-trillion dollar benefit aimed at the cohort of Americans who possess the most economic opportunity in the wealthiest and most powerful nation in the world.

At the opening of this newsletter, I mentioned how the student loan debate illustrated both the promise and peril of biblical debates over public policy. The peril is obvious. The only thing worse than social media shouting matches is social media shouting matches infused with religious intensity.

The promise lies in the richness of the biblical text and the inherent compassion of the biblical moral framework. When applied properly, they don’t necessarily dictate specific policy outcomes. (After all, economic issues are hard.) But they do certainly teach us to apply certain principles. And one of those principles is that we should not hurt the poor to benefit the rich. Our nation violates that principle all too often. But that’s not a reason to violate it once more.

One more thing …

I think you’ll like this episode of Good Faith. Curtis and I talk with Notre Dame philosophy professor Meghan Sullivan on college, God, and the good life. Professor Sullivan teaches one of the most popular courses at Notre Dame, and it will take you approximately five seconds of listening to her to understand why. This episode is about what we should expect from a college education, including a segment on how college can and should increase our sense of hope and belonging in the world.

One last thing …

It’s been a long time since I ended with this song, by Jonathan McReynolds. It’s so perfect for a contentious time. Enjoy:

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.