President Biden’s student loan forgiveness executive action has revealed both the crude self-interest of progressive politics and the policy fecklessness of the Republican Party.

America’s growing progressive movement has increasingly defined itself as champions of poor families held back by an economic system rigged for inequality. Framing politics as a battle of “the people versus the powerful,” progressives demand that government direct more resources toward working class and poor families. However, as working-class families have drifted rightward, and the professional class has moved leftward, progressive priorities have accordingly shifted to their new coastal, upwardly-mobile voter base. Much of the Democrats’ legislative push against the 2017 tax cuts has focused on restoring the full state-and-local tax (SALT) deduction that overwhelmingly benefits high-income coastal families. The American Rescue Plan spent heavily on rebates to upper-middle-class families that had suffered no pandemic income losses. The recent (and misnamed) Inflation Reduction Act spent most of its resources on climate policies that are championed largely by progressive students and professionals.

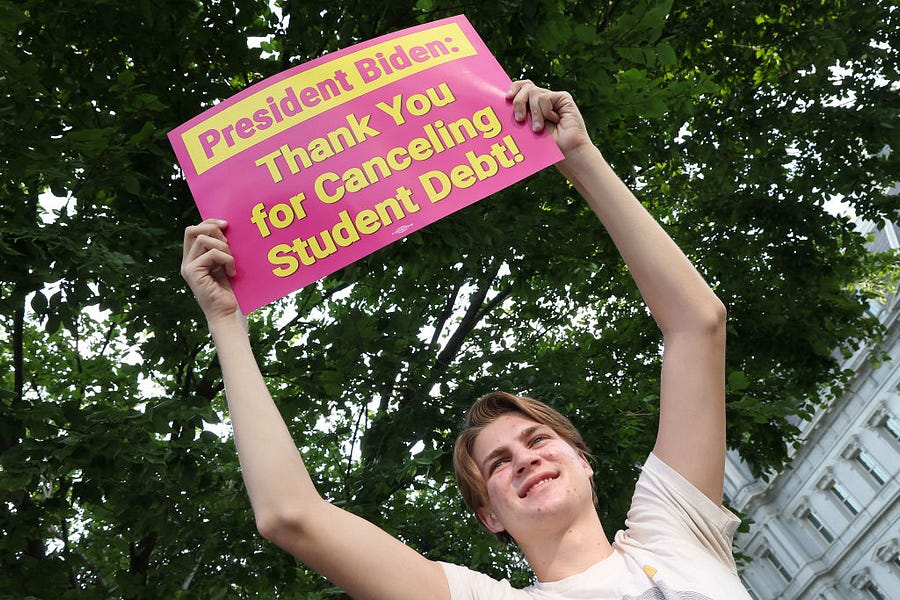

And now, President Biden wants to spend as much as $600 billion providing student loan bailouts as large as $40,000 to families earning as much as $250,000 annually. This is a pure redistribution from the working class to wealthier college graduates. Two-thirds of millennials carry no student debt because they did not attend college or were able to avoid loans. Of those who did borrow, the typical student graduated with a $30,000 student loan for a bachelor’s degree that will raise average lifetime incomes anywhere from $1 million to $2.8 million (although these returns vary widely with the major). At a 4 percent interest rate, those typical loans require monthly payments of $182 for 20 years, or approximately 4 percent of the typical earnings. Only 6 percent of student borrowers take out more than $100,000 in loans, and they are heavily concentrated in law school and medical school.

If Washington is looking to spend $600 billion to alleviate economic hardship, it is baffling to target upwardly mobile college graduates. Nearly half of all student loan debt is held by individuals with graduate degrees—including doctors, attorneys, and MBA business executives—who borrowed as an investment in high future incomes that make the debt affordable.

President Biden has framed student loan forgiveness as helping lower-income college graduates whose loans are holding them back from buying a home or affording child care. If that were truly the purpose, the White House could have capped eligibility well below $125,000 per person ($250,000 for a couple)—nearly quadruple the median family income—and set an income cap that largely excluded doctors, lawyers, and business executives. Even the president’s income cap understates the upward tilt of the policy, because many holders of lucrative degrees who currently earn less than $125,000 will earn raises and have substantial lifetime incomes.

When combined with the $300 billion cost of the student loan payment moratorium first implemented by President Trump but repeatedly extended by Biden, the total bailout to collegiate borrowers could reach $900 billion, according to the Committee For a Responsible Federal Budget. This executive action creates more debt than that generated by all but a handful of laws passed by Congress over the past 50 years. And according to former Obama White House chief economist Jason Furman, the inflationary effects of the additional bailout could cost families as much as $200 each in higher prices—in addition to the higher government interest payments on this debt, which will eventually translate into higher taxes. This added inflation will also likely force the Federal Reserve to raise interest rates higher than otherwise, costing jobs and increasing the risk of a recession.

This student loan bailout does nothing to curb the rapid tuition hikes that forced students to borrow more money. In fact, it will drive tuition and student debt even higher. Current and future students will feel liberated to take out even more student loans on the assumption of future bailouts. Colleges and universities—who typically raise tuition enough to capture 60 percent of all student aid—will likely raise tuition again to capture much of the future borrowing. Consequently, student debt will return to today’s levels within four years, leading to calls for another round of taxpayer bailouts in an unending cycle.

We cannot neglect the moral case against a student loan bailout. This bailout violates the premise that borrowers have a moral obligation to repay their debts—especially when the borrower will profit handsomely from that investment. It redistributes money up the income ladder to affluent professionals. And it makes chumps and suckers out of the Americans who (as Bill Clinton famously said) “played by the rules” and paid back their student loans, or worked their way through college to avoid excessive borrowing. In short, a student loan bailout violates nearly every tenet of progressive rhetoric, and simply represents the same crude, transactional redistribution to one’s (non-needy) voter base that Democrats railed against in the GOP’s 2017 tax cuts.

The bailout is also brazenly illegal, violating the Antideficiency Act that requires all executive branch spending to first be appropriated by Congress. The president cannot unilaterally appropriate hundreds of billions of dollars.

So where is the intense, mobilized Republican opposition? As Democrats increasingly prioritize their upwardly mobile professional base, Republicans should have an easy time blasting student loan forgiveness on behalf of their increasingly working class voters. Instead, most GOP politicians and leaders have been relatively half-hearted in their opposition.

This reflects a broader evolution of the Republican Party away from public policy in favor of cultural grievance. Much of the conservative discussion today is dominated by topics such as Donald Trump, critical race theory, gender issues, and liberal bias across the media, Hollywood, corporations, universities, and public schools. Many of these topics are important—with progressives often acting as the aggressors—yet this focus has come at the expense of traditional issues such as taxes, spending, size of government, strong foreign policy, and rule of law. Two decades ago, conservative media allocated most of its time to debating and analyzing the traditional policy issues of the day. Turn on conservative media in 2022 and you are more likely to hear about Donald Trump or woke corporations. For better or worse, this is where the conservative energy is today.

Republicans are also fighting less on economic policy because its transition from Paul Ryan-style free markets to Trumpist populism—with its support of big spending, tariffs, and regulations—has left Republican lawmakers off-balance and unsure where their voters stand on most economic policies. The GOP’s economic energy has traditionally prioritized: 1) pro-growth policies to create jobs and lessen inflation, 2), tax relief, and 3) fighting against spending programs that redistribute income either downward (welfare programs) or upward (bank bailouts). Big Democratic spending bills have traditionally triggered tax, inflation, and redistribution fears and thus energized conservative opposition.

However, as both parties have become more tolerant of budget deficits, Democrats have dropped most of the middle-class tax increase proposals, and then focused their deficit-spending on areas like infrastructure, science, veterans, and middle-class relief checks that failed to rouse conservative opposition. And as conservatives shifted focus elsewhere, they elected lawmakers more as cultural totems rather than legislative policy experts.

This means that as the Democrats impose a student loan bailout that is truly redistributive, expensive, inflationary, and offensive, Republicans seem ill-equipped to rouse significant grassroots, legislative, or legal opposition. Nor have they laid the legislative groundwork for such opposition by first building a policy narrative around the drivers of rising student debt (bureaucracy-heavy universities building billion-dollar endowments while taking advantage of federal student aid to drastically hike student tuition levels that cover too many useless majors), or to rally around alternative policies to rein in the universities and help the small minority of borrowers who are truly unable to repay their student loans.

Democratic spenders continue to reveal themselves as truly representing upper-middle class professionals rather than the low-income families they claim to prioritize. And Republicans have seemingly become too bored and rudderless on economic policy to mount much of an opposition to wasteful government giveaways. This is how a nation buries itself in government debt.

Brian Riedl is a senior fellow at the Manhattan Institute. Follow him on twitter @Brian_Riedl.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.