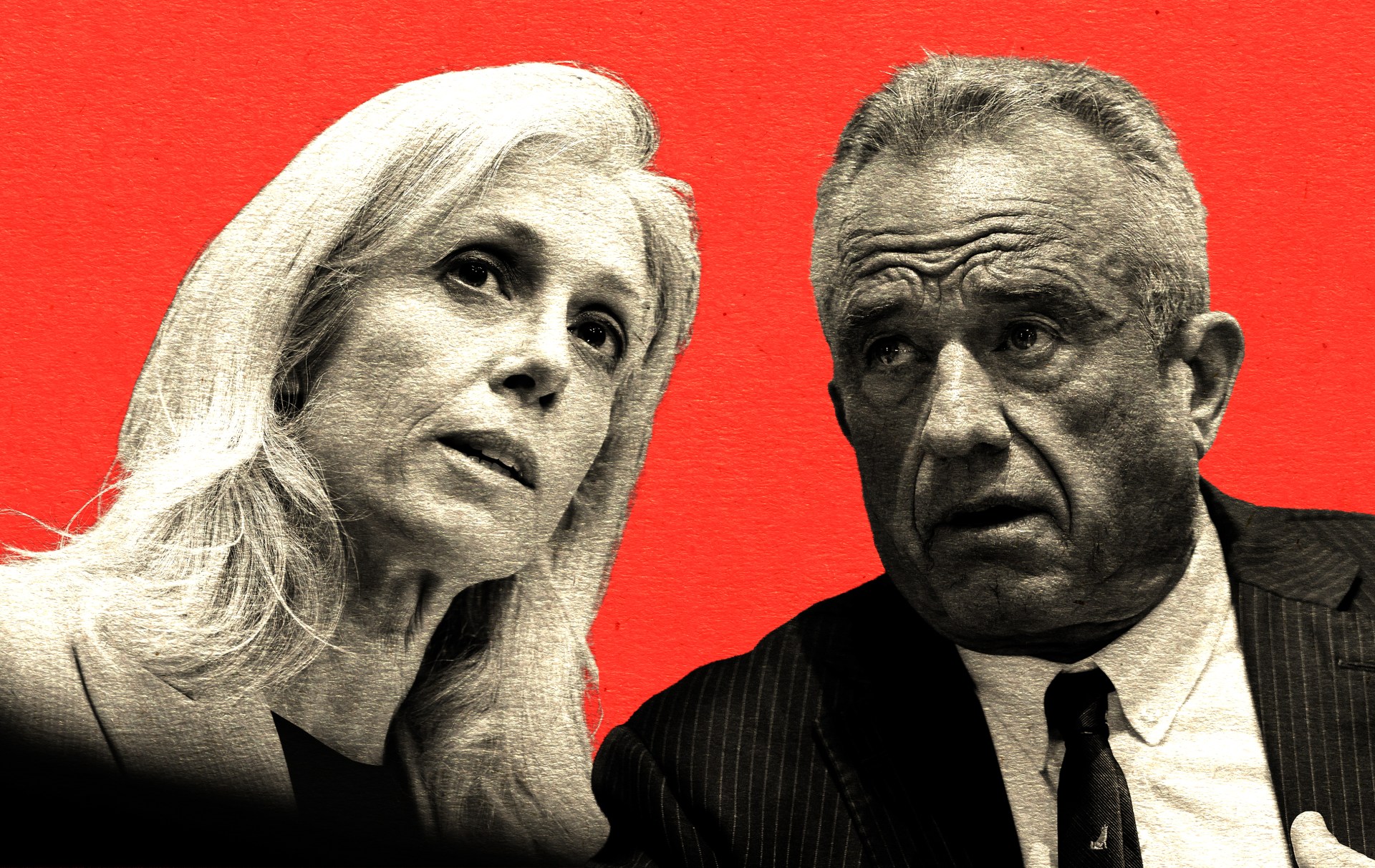

On Wednesday evening, the Trump administration announced CDC Director Susan Monarez, who had been confirmed by the Senate just last month, was out of a job. In the hours that followed, several of the agency’s top leaders resigned as well, though as of this writing Monarez’s lawyers maintain that she was not legally fired. The morning following this chaotic defenestration of Monarez, the secretary of Health and Human Services appeared on Fox News to defend how his department is running the CDC. “We need to look at the priorities of the agency, if there’s really a deeply, deeply embedded malaise at the agency,” said Robert F. Kennedy Jr. There is indeed a malaise at the CDC headquarters in Atlanta, current staff say, but Kennedy and the Trump administration’s political appointees are the source of the infection, not the cure.

Hello and happy Saturday! By the time you read this, the first full college football Saturday will be well underway, and I’ll be glued to a bank of televisions at a sports bar in Athens, Ohio. The day will be bittersweet–-and not just because we’re here to celebrate the birthday of our oldest son, who’s a senior at Ohio University and about to embark on a military career that could limit our chances to see him. Today also happened to mark Lee Corso’s final appearance on ESPN’s College GameDay.

I tend to wrap this newsletter on Saturday mornings. And during the fall, College GameDay is the only acceptable background noise. Corso, 90, and his crew have been must-see TV for decades. Their three-hour show concludes with a round of predictions for the day’s games, and Corso always makes the final pick of the final game. At an Ohio State game back in 1996, he announced his choice by donning the head of Brutus the Buckeye, the OSU mascot. It kicked off a tradition that has endured. Today, fittingly, GameDay was back in Columbus for Corso’s last hurrah. The Buckeyes rolled out the red carpet for him before their game against Texas: They welcomed the crew onto the field for his last headgear pick, with the OSU marching band spelling out CORSO behind him. No pressure there! Perhaps unsurprisingly, he donned the Brutus head. Wise choice, and best wishes, Coach.

As for the news, well. I’ve seen more than a few people joking this week that, “They told me if I voted for Kamala Harris, the president would seize the means of production, and darn it, they were right!” A week ago Friday, the Trump administration announced it would take a 10 percent stake in Intel, the struggling chipmaker.

It’s not the first such deal the administration has made: Back in June, after the president initially expressed hesitation about Nippon Steel’s planned acquisition of U.S. Steel, the administration negotiated a “golden share” giving the U.S. government a certain amount of control over the company’s decisions. Our own Scott Lincicome was no fan of that decision, and he doesn’t like anything about the Intel one either. He highlights how the company has struggled despite being propped up by subsidies, and he explains how the government’s investment could be bad for Intel’s customers, its competitors, and even the company itself. He writes:

Overall, federal investment in Intel might paradoxically undermine the very economic and security objectives the equity deal purports to advance—and do so by Washington’s own standards. And, as is so often the case, there were many other ways to achieve the government’s economic and security objectives—market-based and government-backed—that don’t raise the risks that state investment raises.

Defenders of the deal have pointed to the Troubled Asset Relief Program, which sought to stabilize struggling financial institutions amid the 2008 financial crisis, or to the auto bailouts that the Obama administration carried out. Not so fast, writes Kevin D. Williamson.

The bank and nonbank bailouts of the TARP era were different from what Trump is doing in many important ways: The GM shenanigans probably were illegal, but the overall bailout program was, for good or for ill, duly authorized by Congress (it was the Emergency Economic Stabilization Act of 2008) and other relevant authorities, and the program was kept on a reasonably short leash—and by the very modest criterion of having prevented a total worldwide credit collapse, you might even call it a short-term success. We are not in a comparable crisis now. And Trump, being Trump, is pretty vague about the legal authorization for his moves at Intel and elsewhere.

Some have described the deal as “socialism,” while others have referred to it as state capitalism. In the G-File (🔒), Jonah Goldberg notes that the latter is more correct, but that it can lead to the former:

The reason state capitalism, patrimonialism, kleptocracy—pick your label—sometimes lays the groundwork for more robust socialism is that the arguments for having politicians pick winners and losers based on political priorities rely on the same logic. “We know better than the market” is the starting point for every -ism that seeks to supplant the market with the personal preferences of politicians and activists. The motives for substituting human judgment—whether the human is a singular leader or a vast coterie of experts—can vary, from simple greed to utopian or nationalistic visions. But the original error is the same.[

Thanks for reading and have a great weekend.

The original muscle car era began, in most tellings, in 1964 with the production of the Pontiac GTO. Competitors—including the Ford Mustang, Plymouth Barracuda, Dodge Charger and Challenger, Chevrolet Camaro and Chevelle—soon appeared on the scene. While sports cars can be foreign or domestic, muscle cars by definition must be American-made, with a powerful engine in a lightweight body. Though there’s some debate about what separates muscle cars from domestic sports cars, muscle cars also prioritize straight-line speed over handling and agility and have that, well, know-it-when-you-see-it muscular look (which is why many don’t consider the sporty Corvette to be a muscle car). It is no coincidence that the muscle-car era began when the oldest baby boomers turned 18. This phenomenon was a direct result of America’s post-war economic boom. “The war created money,” Tom Wolfe wrote in the introduction to his 1965 collection of essays. “It made massive infusions of money into every level of society. Suddenly classes of people whose styles of life had been practically invisible had the money to build monuments to their own styles.”

Hollywood screenwriter William Goldman once said, “Nobody knows anything.” He meant that there were no reliable rules about how to make a successful movie because audiences were fickle and the film industry unpredictable—but his insight was truer than he knew. If no one knows anything about making hit movies, we know even less about the vagaries of human politics, especially international politics. I want to make an argument about Israel and the Palestinians. The main point is that no one knows anything—that you, dear reader, know less than you think you know—because it is almost impossible to trust any information about the war in Gaza and because of the power of narratives in shaping how we think about it.

The Alamo became a central component of a secular religion. Consider the vernacular Texians employed. They celebrated William B. Travis, James Bowie, and David Crockett as the trinity of heroes; they eulogized the sacrifice of the defenders and the redemption of San Jacinto. The martyrs offered their lives in an abandoned mission, on consecrated ground as it were. Indeed, as if by divine design, they died on a Sunday. After the Republic of Texas agreed to be annexed by the United States in 1845, Texans began to embellish the narrative. By the end of the 19th century, the parable became the central scene of a Lone Star State morality play, a melodrama in which slain champions served as elemental types.

Best of the Rest

The Idea of Order at the Iowa State Fair

On big pigs, blue ribbons, and the purpose of the state.

Shattering the Separation of Powers

Presidential impoundment Is dangerous and unconstitutional.

DNC Meeting Highlights Party’s Divide Over Israel

Chairman Ken Martin seeks to head off infighting after a resolution calling for an arms embargo fails.

The Sports Gambling Backlash Is Here

Gamblers are ruining their lives, and Americans want action. What can we do?

Feudalism Was Hell for the Poor

Actually, Tucker Carlson is wrong.

La Vie en Commune

The struggle between the old and new in rural France.

Conserving Liberalism | Interview: Cass Sunstein

‘We should celebrate the liberal tradition.’

Political Retribution? | Interview: Saikrishna Prakash

Breaking norms like the Kool-Aid Man breaking through the wall.

The New Three Legs of Conservatism | Interview: Matt Lewis

Authoritarianism takes over the GOP.