In his 70-minute State of the Union address Thursday night, President Joe Biden addressed several contentious issues, including immigration, Social Security, and the ongoing wars in Ukraine and Gaza. A number of his claims have drawn scrutiny. Here’s a rundown of a few of those claims—and the facts behind them.

Claim: Billionaires pay a lower federal tax rate than most Americans.

Throughout the speech, Biden routinely criticized corporations and billionaires for not paying as much as they should in taxes. “There are 1,000 billionaires in America,” Biden said. “You know what the average federal tax is for these billionaires? They are making great sacrifices: 8.2 percent. That’s far less than the vast majority of Americans pay. No billionaire should pay a lower federal tax rate than a teacher, a sanitation worker, or a nurse.”

But the assertion that billionaires pay an average tax rate of only 8.2 percent does not align with most conventional economic analysis. “No, billionaires do not pay an average tax rate of 8 percent. This has been repeatedly debunked,” Brian Riedl, an economist at the Manhattan Institute, told The Dispatch Fact Check. “The president’s math invents its own definition of income, and then calculates their taxes as a percentage of this fake income number.”

Biden’s 8.2 percent figure comes from an estimate made in September 2021 by Greg Leiserson, a senior economist in the Council of Economic Affairs, and Danny Yagan, chief economist of the Office of Management and Budget. Leiserson and Yagan measured income by looking at changes in estimated net worth among those listed in the Forbes 400—a ranking of the 400 richest Americans. They then compare these changes to IRS data on total income taxes paid by those on the Forbes list to calculate an effective average federal tax rate.

This calculation, however, includes unrealized capital gains (i.e., the change in the value of an asset such as a stock or bond that has not yet been sold) as part of a person’s income. Capital gains—which are not included in conventional measures of income—are typically taxed only after an asset is sold and are generally subjected to a 20 percent rate for high earners, not standard income tax rates.

Estimates by the Treasury Department and the Tax Policy Center in 2020 and 2021, respectively, which don’t include unrealized capital gains, estimated that the average federal income tax for the highest-income families in America was 23 and 25 percent.

Claim: The U.S. has the lowest inflation rate in the world.

Another dubious claim by Biden concerned how America’s inflation rate compares to that of other countries. “Wages keep going up. Inflation keeps coming down,” he declared. “Inflation has dropped from 9 percent to 3 percent—the lowest in the world and trending lower.”

While the U.S. inflation rate has dropped over the past year, it is not the lowest in the world. The Bureau of Labor Statistics’ most recent consumer price index (CPI) report was released last month, finding inflation had slowed to a 3.1 percent annual rate in January before seasonal adjustment, down from a 6.4 percent annual rate in January 2023.

In January 2024, the European Commission estimated that Euro area inflation stood at 2.8 percent year-over-year, while Canada and Japan recorded annualized CPIs of 2.9 and 2 percent respectively during the month. Some countries are even experiencing deflation according to their most recent measures. Although Chinese Communist Party economic statistics should be viewed with a degree of skepticism, China’s National Bureau of Statistics recorded an annual CPI change of -0.8 percent in January 2024.

Claim: COVID-19 created the worst economic crisis in a century.

Biden said that he took over the presidency after the U.S. experienced its worst economic crisis in 100 years. “Four years ago next week, before I came to office, the country was hit by the worst pandemic and the worst economic crisis in a century,” he said. “Remember the fear, record losses. Remember the spikes in crime and the murder rate.”

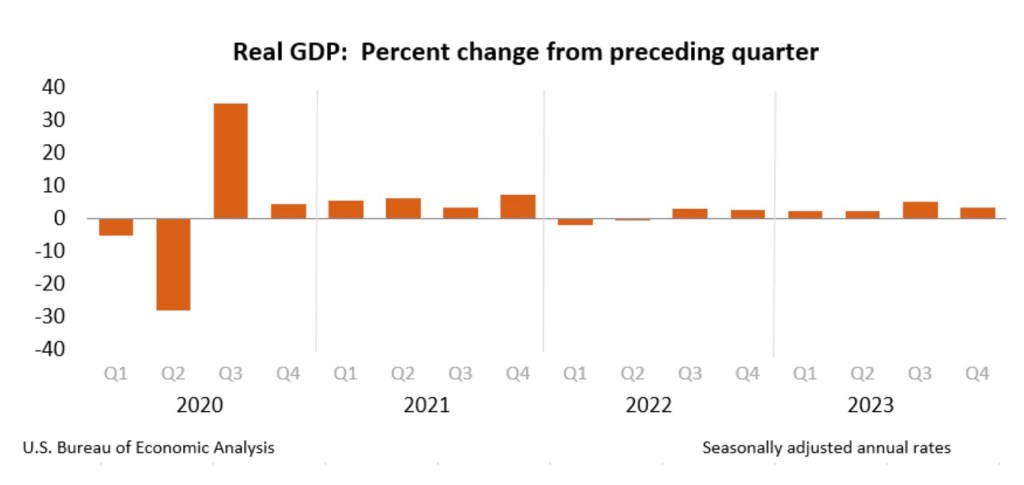

Biden is correct that the COVID-19 pandemic was the worst in a hundred years—the even deadlier Spanish flu pandemic had mostly subsided by the end of 1920—but it did not bring about the worst economic crisis in a century. In fairness to Biden, he may have used the term “century” figuratively and not as an exact measure of 100 years. However, if he did mean to say that the COVID-19 pandemic caused the worst economic crisis since 1920 exactly, that assertion would be incorrect.

It’s difficult to directly compare economic crises today to those before the U.S. began measuring GDP in 1947. However, the Great Depression, beginning in 1929 and lasting until around 1939, remains the deepest and longest economic downturn in American history in the eyes of most economists. “Of course, the COVID-19 recession was nowhere as close as large as the Great Depression,” Riedl said. “No economist would suggest otherwise.”

While the nation’s GDP contracted significantly during the first and second quarters of 2020 at the onset of the COVID-19 pandemic, this contraction was relatively brief and a slow recovery began by the second half of the year.

During the Great Depression, however, the U.S. economy continued to contract for more than three years after its initial crash, and the crisis did not end until the onset of U.S. involvement in World War II ten years later.

Claim: Americans pay the highest prices for prescription drugs.

After speaking on economics, Biden turned to health care, where he criticized large pharmaceutical manufacturers for high drug costs. “Americans pay more for prescription drugs than anywhere else,” Biden said. “It’s wrong and I’m ending it.”

Biden’s assertion is mostly correct: Research has shown that Americans do pay higher prices for prescription drugs than in any other developed country, though there are some important caveats. “There have been many studies looking at relative pricing of prescription drugs and the consensus is that the U.S. does pay the highest level, on average,” James Capretta, a senior fellow studying health care policy at the American Enterprise Institute, told The Dispatch Fact Check. “The reason is that there are far fewer governmental controls on pricing in the U.S. than elsewhere, especially in the commercial insurance market.”

A 2021 study published by the RAND Corporation found that, even after rebates and other discounts, U.S. prescription drug prices were, on average, nearly twice as high as those in countries including Canada, France, Germany, Japan, and the United Kingdom. A 2024 study, also conducted by the RAND Corporation for the Office of the Assistant Secretary for Planning and Evaluation, similarly found that 2022 drug prices in the U.S. were nearly three times higher than those in the 33 Organisation for Economic Co-operation and Development (OECD) countries used in the comparison.

However, the study also found that, on average, unbranded generic drugs were about a third cheaper in the U.S. than in other comparison countries, meaning Americans are actually paying less for these drugs than they would elsewhere. “This finding suggests that robust price competition in U.S. unbranded generic markets continues to drive savings for consumers and health care payers relative to spending on these drugs in other countries,” the study said. Even though generic drugs make up 90 percent of U.S. prescription volume, the substantially higher cost for brand-name drugs still results in a higher average cost for all drugs in the U.S. than elsewhere, according to the report.

Claim: The Alabama Supreme Court Relied on Dobbs in its IVF ruling.

Biden also addressed the recent decision by the Alabama Supreme Court declaring that embryos conceived through in vitro fertilization are protected under the state’s wrongful death statute, which prompted some IVF clinics in the state to suspend some services. Since then, the Alabama state legislature has passed a bill—signed into law by the governor this week—that protects IVF providers by granting them civil and criminal immunity for deaths of embryos in the course of IVF treatment.

“Joining us tonight is Latorya Beasley, a social worker from Birmingham, Alabama. Fourteen months, 14 months ago, she and her husband welcomed a baby girl thanks to the miracle of IVF,” Biden said. “She scheduled treatments to have that second child, but the Alabama Supreme Court shut down IVF treatments across the state, unleashed by the Supreme Court decision overturning Roe v. Wade.”

However, IVF treatments in Alabama were not technically shut down, and the decision that overturned Roe v. Wade’s constitutional protection for the right to an abortion—Dobbs v. Jackson Women’s Health Organization—was not actually at the root of the Alabama Supreme Court’s decision in LePage v. Center for Reproductive Medicine.

The Alabama court’s ruling held that frozen embryos are considered children under the state’s Wrongful Death of a Minor Act, which allows for punitive damages if “the death of a minor child is caused by the wrongful act, omission, or negligence of any person.” This decision led many IVF clinics in the state to temporarily suspend IVF procedures because it left IVF clinics open to potential lawsuits if frozen embryos were destroyed. While the application of this act to frozen embryos is new for the state, Alabama already allowed wrongful death suits for unborn children years before the U.S. Supreme Court’s decision in Dobbs, meaning its application to frozen embryos was an extension of existing legal theory and not a novel product of Dobbs. In a 2011 decision—Mack v. Carmack—the Supreme Court of Alabama ruled that “the Wrongful Death Act permits an action for the death of a previable fetus,” and in the 2012 case Hamilton v. Scott, it said that “Alabama’s wrongful-death statute allows an action to be brought for the wrongful death of any unborn child, even when the child dies before reaching viability.”

“Years before Dobbs, Alabama and other states allowed wrongful-death suits for the death of an unborn child from conception forward. The Alabama Supreme Court held that rule does not have an exception for in vitro embryos,” Ed Whelan, a lawyer and senior fellow at the Ethics and Public Policy Center, told The Dispatch Fact Check. “There is nothing in its ruling that depends on Dobbs, and there is no reason to think that its ruling would have been any different if Dobbs had never been decided.”

If you have a claim you would like to see us fact check, please send us an email at factcheck@thedispatch.com. If you would like to suggest a correction to this piece or any other Dispatch article, please email corrections@thedispatch.com.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.