Both Donald Trump and Kamala Harris are running on policies that would push budget deficits toward $4 trillion a decade from now—and hoping for a same-party Congress that rubber stamps their expensive agendas. For voters who still worry about unsustainable government debt (all eight of us), navigating various election outcomes is not always straightforward. In recent decades, however, combining a Democratic president with a Republican Congress has produced the most fiscally restrained outcomes.

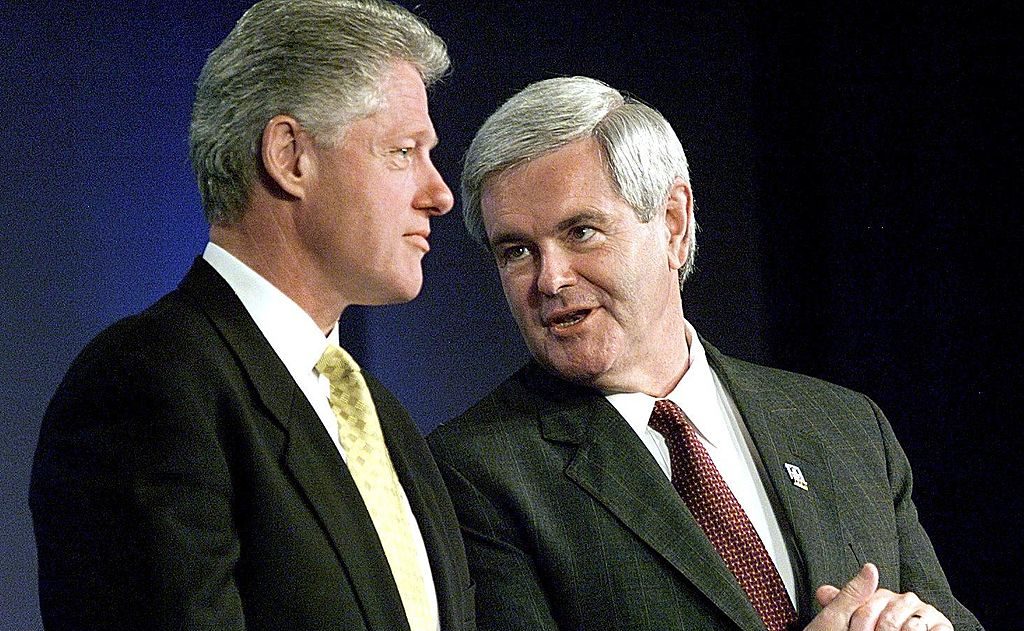

When a Republican Congress is paired with a Democratic president, both the GOP’s natural deficit-hawk rhetoric and its partisan aspirations of curbing the president’s ambitions point in the same direction. After House Speaker Newt Gingrich and the Republican Congress took power in 1995, they declared war on President Bill Clinton’s business-as-usual spending, shut down the government twice for a total of 26 days, and later negotiated the 1997 budget deal that contributed to budget surpluses in 1998. Clinton and Gingrich also negotiated a historic deal to fix Social Security that was mere days away from an announcement when the Monica Lewinsky scandal broke and blew up their bipartisan collaboration.

Similarly, a backlash against President Barack Obama’s spending contributed to the “Tea Party GOP” winning control of the House in 2011. The subsequent fight over raising the debt limit induced months of bipartisan “grand deal” deficit negotiations that resulted in the 2011 Budget Control Act. Although some of the BCA’s spending caps were later relaxed, the 2011-2016 period saw net spending cuts relative to the baseline cost of continuing current policies (and saw Republicans win a Senate majority in 2014). Opposing a Democratic president’s spending ambitions is easy politics for a GOP Congress—achieving partisan ends while condemning “big government.”

For a third example, the new Republican House majority in 2023 took away the credit card from a free-spending President Joe Biden and his Democratic Congress. Republicans ended the Biden spending spree and used the debt limit to force through the Fiscal Responsibility Act with its two years of discretionary spending caps.

Yet when the tables turn—a Republican president paired with a Democratic Congress—the result is much worse for deficit hawks. While congressional Republicans are more comfortable opposing government expansions—particularly those proposed by Democratic presidents—Republican presidents have operationally been more interested in providing new benefits to voters. And congressional Democrats have been generally eager to make a deal if they can share in the benefits. “Compassionate conservative” President George W. Bush teamed up with congressional Democrats to enact the No Child Left Behind Act education spending legislation, a massive farm subsidy expansion, and even won over several Senate Democrats to help pass the 2001 tax cuts. After Democrats won back control of Congress in the 2006 midterm elections, Bush agreed to hike discretionary spending by 17 percent over two years.

After President Donald Trump was given a Democratic House majority following the 2018 midterms, there were again no problems bringing a Republican president and Democratic Congress together on expensive new initiatives. In 2019, both parties teamed up to essentially repeal the remaining Obama-era Budget Control Act spending caps as well as many of the taxes originally enacted to pay for the Affordable Care Act, at a combined cost of $700 billion. The following year, partisan cooperation produced a $3.3 trillion pandemic response and $160 billion tax cut extension. Once again, a Republican president wanted to cut taxes and spend money, and Congressional Democrats were happy to help.

The most fiscally irresponsible outcomes have occurred when Republicans or Democrats win control of both Congress and the White House. While President Clinton pushed through a modest deficit reduction law in 1993, he spent most of 1994 pushing his Democratic Congress to pass an expensive overhaul of the nation’s health system (unsuccessfully) and a bloated crime bill (successfully). President Obama joined with a Democratic Congress in 2009 and 2010 to pass an $800 billion economic stimulus law as well as the Affordable Care Act. President Biden and his Democratic Congress outdid their predecessors with a $1.9 trillion American Rescue Plan, a 23 percent discretionary spending hike over two years, and $1 trillion for (mostly bipartisan) infrastructure and veterans’ expansions. All three of these unified Democratic periods pushing for dramatic government expansions brought ferocious taxpayer rebukes and a loss of their presidency-House-Senate trifecta after two years.

Republican trifectas have not been any more fiscally responsible. President Bush’s mid-presidency trifecta brought an expensive new Medicare drug entitlement and continued steep discretionary spending increases for both the wars in Iraq and Afghanistan and domestic priorities. President Trump entered office with a Republican trifecta and proceeded to cut taxes by $1.5 trillion and expand discretionary spending by 13 percent in a single year. Ultimately, despite deficit-hawk rhetoric, unrestrained Republican governments have prioritized: 1) aggressively cutting taxes; 2) significantly expanding defense spending—including buying Senate Democratic support to avert filibusters with equal domestic discretionary spending hikes; and 3) buying off more constituencies and lobbyists with social spending, infrastructure, and pork.

2024 election implications.

At first blush, this historical record suggests that deficit-weary voters should prefer pairing a Harris presidency with a Republican Congress. To be sure, it is likely that congressional Republicans would rediscover their deficit hawk rhetoric and block most of Harris’ expensive initiatives. The resulting gridlock would be far less irresponsible than an unrestrained President Trump and GOP Congress fulfilling pledges to dramatically increase defense, veterans, and border spending while aggressively cutting taxes. Gridlock is also less irresponsible than a Democratic House and Senate aggressively rubber stamping and expanding a President Harris’ spending expansions, while (as was the case in earlier Democratic trifectas) rejecting nearly all of their president’s accompanying tax increases. As for the relatively unlikely scenario of President Trump and a Democratic Congress, the 2019 and 2020 period already showed their collaborations cutting taxes and expanding spending (even before the pandemic).

However, this analysis is complicated by two factors. First, the proliferation of executive orders has considerably affected spending and revenues and rendered Congress less relevant in fiscal matters. According to the Committee for a Responsible Federal Budget, Biden’s executive orders in areas such as student loans, SNAP, and health care will cost $1.2 trillion over the decade. (This tab would have been even higher had the Supreme Court not blocked larger student loan bailouts.) Trump used executive orders to significantly increase tariffs and then distribute much of that revenue to farmers and other groups affected. Moving forward, a Democratic president will likely continue to expand spending with executive orders, while President Trump would use executive orders to more aggressively raise tariffs and then spend the proceeds. Trump has also promised to use impoundment—an illegal and almost surely unconstitutional refusal to spend money that has already been provided in law—and in the past floated using an executive order to cut capital gains taxes by inflation-adjusting the returns before the tax rate is applied. Regardless of who wins the presidency this year, Congress’ ability to block potential fiscal initiatives will likely continue to weaken.

The other complicating factor is the coming expiration of the 2017 Tax Cuts and Jobs Act (TCJA). There is a broad bipartisan consensus in favor of extending the tax cuts for earners under $400,000 that will almost surely prevail regardless of partisan control of the government. Thus, even a “gridlocked” Congress likely begins its work with a tax cut of roughly $3 trillion over the decade, possibly with additional tax cuts based on the election results.

Ultimately, in today’s irresponsible populist political environment, fiscal responsibility is not on the ballot. However, history suggests that a Democratic president and Republican Congress may minimize the fiscal damage.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.