The summer months have confirmed the importance of securing safe and effective COVID-19 vaccines to end the pandemic and return to economic normalcy. Containing the virus with social distancing is proving to be both too difficult to sustain in some cases (i.e., in the United States) and too expensive to finance indefinitely. The only real alternative to vaccination is herd immunity through natural infection, which would entail intolerable levels of human suffering and mortality.

Fortunately, there are reasons to hope that good vaccines are on the way. The World Health Organization is tracking the progress of 167 candidates, of which 29 are now being tested in humans. Developers of six of the leading efforts have begun Phase III trials involving tens of thousands of patients; several other candidates are expected to reach this final stage in the regulatory approval process in the coming weeks.

The rapid advancement of the most promising COVID-19 inoculations is unprecedented in medical history. It normally takes years, and often decades, to move potential vaccines from the lab to regulatory approval, but the goal in this pandemic is to do so in 12 to 18 months. That this is not unrealistic reflects the sophistication of the global biopharma research network, the scale of the investments being made by governments and private enterprises, and the urgency of the moment.

As various vaccine candidates have advanced through the clinical trial process, the world’s richest countries, and groups of countries, have been lining up potential supplies. They are signing advance procurement deals for hundreds of millions, and even billions, of doses. In addition, two nonprofits, working with the WHO, are trying to ensure the world’s poor and middle-income countries have access to adequate supplies too.

The pace of the deal-making since June has been so intense that it has been difficult to stay abreast of developments. The following is intended to provide a guide to where things stand, as of mid-August, on an endeavor that is of utmost importance to every country around the world.

The competing platforms.

COVID-19 vaccine candidates fall into four broad categories based on the platforms they use to induce an immune response: genetic coding, viral vectors, inactivated viruses, and protein subunits.

The gene-based vaccines (several based on messenger RNA, and which I’ll refer to as mRNA vaccines from here on out) are novel and promising because of the speed with which they can be designed and scaled for manufacturing, but none has ever been licensed for use to combat a disease. The mRNA candidates inject genetic coding from the SARS-CoV-2 virus into the vaccinee, which then induces the body to create part of the virus to attack with an immune response. In other words, through genetic coding, the body itself produces a component of the pathogen, which then primes the body to attack the full virus if it later presents itself.

Viral vector vaccines using adenoviruses are also more novel than traditional vaccine platforms. Viral vector vaccines use a genetically engineered virus that is not the vaccine target to deliver into the cells of a vaccinee the genetic instructions to produce a protein of the targeted virus, which then induces an immune response. The European Medicines Agency (Europe’s counterpart to the U.S. Food and Drug Administration) recently approved an adenovirus vaccine (with a booster) for the prevention of Ebola.

The other two vaccine platforms—inactivated viruses and protein subunits—have been used for many different previous vaccines, and therefore come with less uncertainty about their strengths and weaknesses, but they take longer to develop and scale up for mass production.

The U.S., the U.K., the European Union, China, and others recognize that it is not possible to know in advance which of the primary vaccine platforms will prove most suitable to halting the spread of the SARS-CoV-2 virus (or which platforms might work best for various subpopulations, such as the elderly). Therefore, they are hedging their bets by pursuing multiple candidates simultaneously, and thus increasing the odds that, come 2021, they will have in hand at least one vaccine that works and can be approved by the appropriate regulatory bodies.

The current U.S. portfolio.

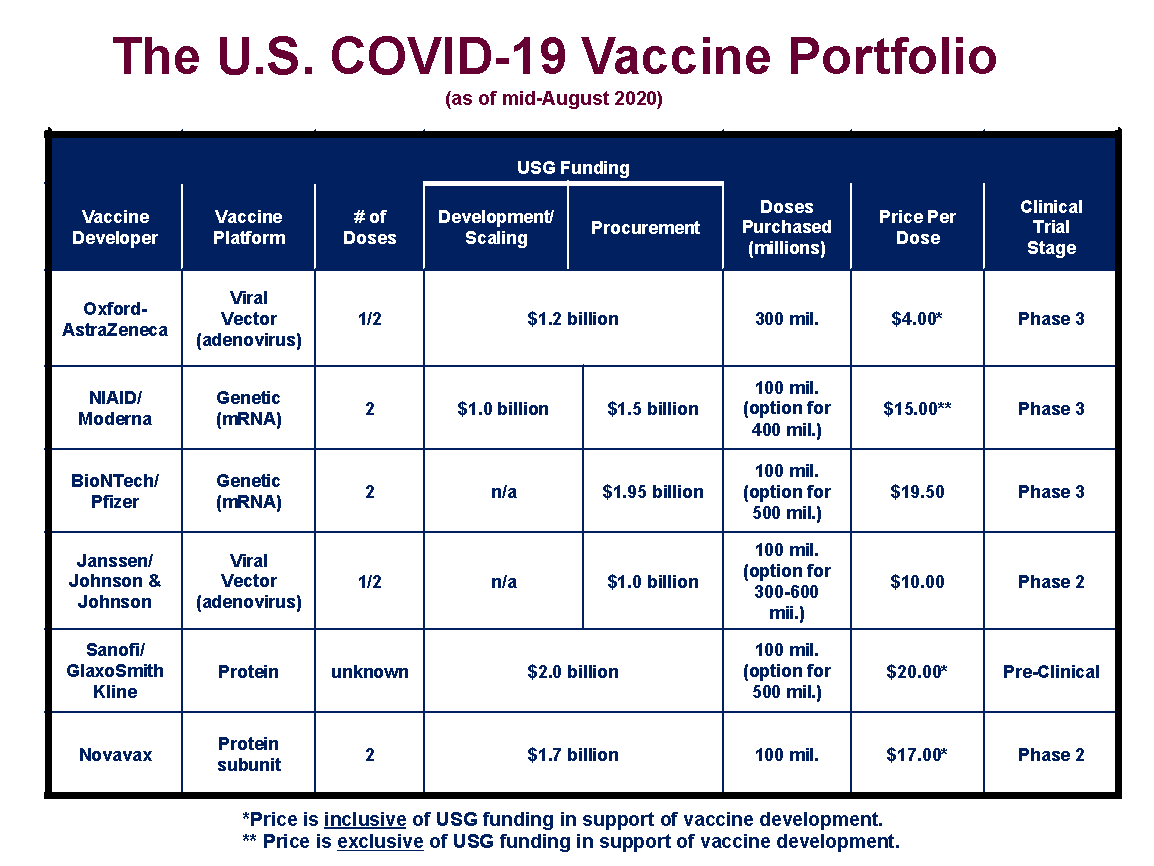

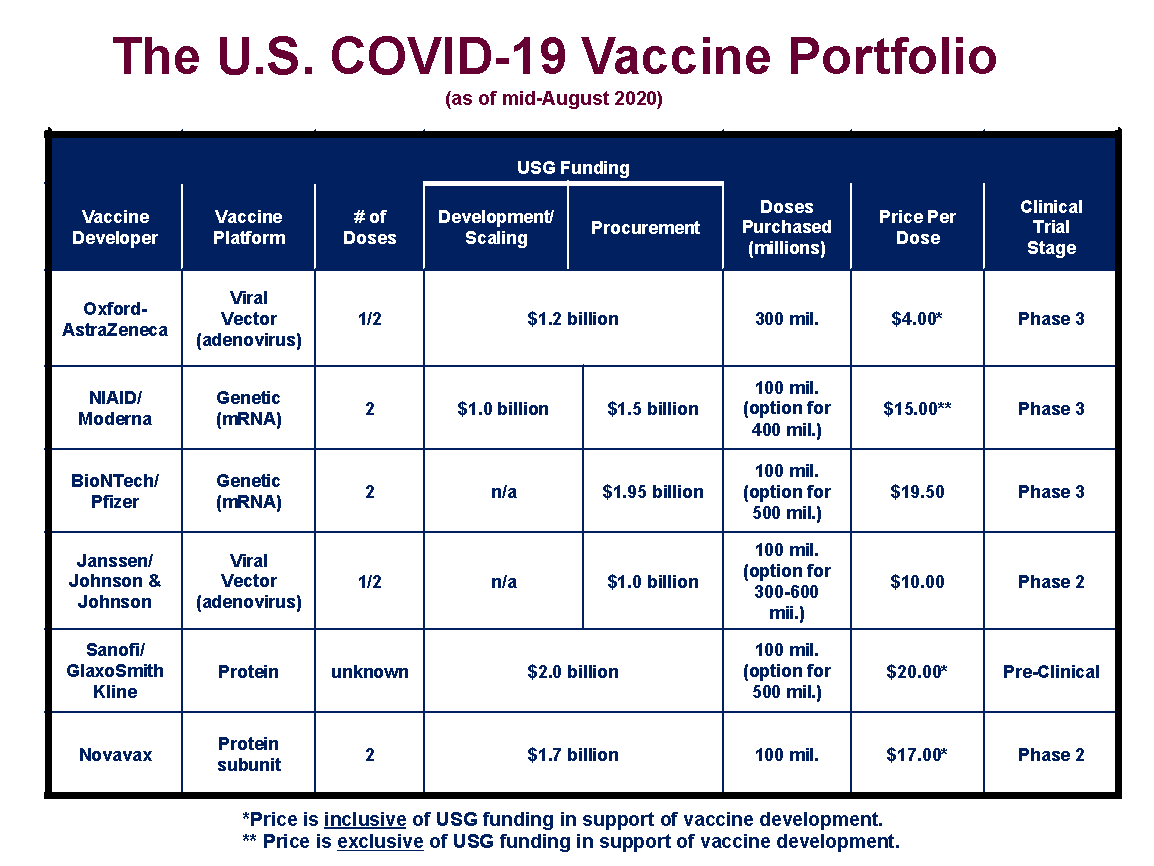

The U.S., through its Operation Warp Speed initiative, has already invested more than $10 billion in six different vaccine candidates, as shown below.

The agreements with the vaccine developers are not uniform in their provisions. Four (those with Oxford/AstraZeneca, Moderna, Sanofi/GlaxoSmithKline, and Novavax) provide funding to support bringing the vaccine candidates through the final stages of the regulatory process and to scale up manufacturing capacity. Two of the contracts (for BioNTech/Pfizer and Janssen/Johnson and Johnson) are strictly advance purchase orders for a specified number of doses of the candidate vaccines. Four of the contracts come with options for the U.S. to secure additional supplies if the vaccines gain regulatory approval.

All totaled, with the options included, the U.S. has lined up manufacturing capacity for 2.8 billion doses of COVID-19 vaccines. As most of the candidate vaccines are likely to require two doses to achieve sufficient immunity, these contracts could potentially vaccinate 1.4 billion people (or in excess of 1 billion people beyond the number residing in the U.S.). However, it is unlikely that all of the vaccine candidates will gain regulatory approval, and, even if they all do, some may be superior in terms of their safety and efficacy than others, and thus better suited for additional purchase orders.

For the Moderna, BioNTech/Pfizer, and Janssen/Johnson and Johnson vaccines, the U.S. has paid prices per dose of $15, $19.50, and $10, respectively. Moderna has also received $1 billion for development and manufacturing costs, separate and apart from its contract to deliver finished vaccines. For the other three candidates (Oxford/AstraZeneca, Sanofi/GlaxoSmithKline, and Novavax), the U.S. has combined into a single contract per manufacturer additional development and manufacturing support along with funding for the purchase of an initial supply of doses. The implied prices for these vaccines are $4 for Oxford/AstraZeneca, $20 for Sanofi/GlaxoSmithKline, and $17 for Novavax. It should be noted that BioNTech/Pfizer and Janssen/Johnson and Johnson could be including vaccine development costs in the purchase prices they have charged to the U.S. government. All of the vaccines procured directly by the federal government under these agreements will be made available to the public without charge (practitioners administering the vaccines will be allowed to charge a small fee for that services, which will be billed primarily to insurance plans).

The Oxford/AstraZeneca candidate is the clear global frontrunner for regulatory approval. The vaccine began a Phase III trial in July in the U.K., Brazil, and South Africa and began a separate Phase III trial in the U.S. this month. Not far behind are mRNA vaccine candidates from Moderna (which was developed in conjunction with the National Institute of Allergy and Infectious Diseases) and BioNTech/Pfizer. The Moderna vaccine began its Phase III U.S. trial in July, and the BioNTech/Pfizer candidate is expected to follow close behind with a trial beginning this month or next. The Janssen/Johnson and Johnson and Novavax vaccines are expected to begin Phase III trials in the fall, while the Sanofi/GlaxoSmithKline may begin its trial later in the year.

Phase III trials are crucial to the regulatory process because they require testing vaccines in tens of thousands of patients for both safety and efficacy. The U.S. is currently requiring its vaccine candidates to run Phase III trials with 30,000 patients (either 15,000 receiving the vaccine, and 15,000 a placebo, or, in the case of the Oxford/AstraZeneca candidate, 20,000 getting the vaccine, and 10,000 getting a placebo). The Food and Drug Administration has stated that it will consider a vaccine candidate for approval only if it achieves at least 50 percent efficacy, measured by the reduction in the number of patients receiving the vaccine who become afflicted with the COVID-19 disease. Anthony Fauci, the director of the National Institute for Allergy and Infectious Diseases, has stated his hope is for an initial vaccine that is at least 75 percent effective.

Expectations have been building that one or more vaccines might be available sometime late this year or early in 2021. That might be true, but only if the Oxford/AstraZeneca, Moderna, or BioNTech/Pfizer candidates clear regulatory approval, because the other candidates are not on timelines that would allow a Phase III trial to be completed by then. If the three current leaders all fail to secure regulatory approval, the U.S. will be waiting for a vaccine into 2021.

Operation Warp Speed has also entered into large contracts to expand U.S. domestic manufacturing capacity for whatever vaccines emerge from the regulatory process, to secure supplies of syringes and other materials necessary to ready inoculations for mass deployment, and for shoring up existing distribution channels.

It is also possible that the U.S. will enter into additional agreements with other vaccine developers. It should be noted that the U.S. does not currently have a contract with a manufacturer that is using inactivated virus to produce a vaccine. Further, officials have spoken of Merck—an industry leader in vaccination technology—as a potential supplier, although the company has made it clear it believes a slower timeline for development is necessary to ensure a quality vaccine. In addition, Inovio, CureVac, Imperial College London, and others have promising candidates that might become targets for U.S. procurement contracts in the coming months, particularly if the current portfolio falls short of expectations on efficacy in their Phase III trials.

What’s happening outside our borders.

Around the world, other high-income countries are building portfolios of vaccine candidates from the same roster from which the U.S. has been making its procurement decisions (see Figure 2 for a summary of purchase commitments). July and August have been particularly busy in this regard.

The governments lining up significant procurement deals are under pressure to move quickly because of the limited global capacity for vaccine production. The developers of each of the leading candidates have been scrambling to line up additional manufacturing facilities and to secure the necessary input supplies to produce their products. Even so, their projected monthly production rates are expected to fall well below global demand through 2021. The lack of transparency around many of the deals being signed makes it difficult to know for certain which countries are at the front of the lines and which ones will be forced to wait a bit longer to receive their shipments. However, it stands to reason that countries that committed to the manufacturers early will receive their supplies first, followed by those that waited somewhat longer to make a decision. Even so, there is no reason to believe at this point the manufacturers have overcommitted in terms of their aggregate production commitments.

-

European Union: After a slow start, the EU (total population of 450 million) has entered into (or is near to completing agreements) with four leading candidates (Oxford/AstraZeneca, Janssen/Johnson and Johnson, Sanofi/GlaxoSmithKline, and CureVac). The combined procurement is for over 1 billion doses, with an option for 100 million more from Oxford/AstraZeneca. It is expected that more agreements will be announced in the coming weeks. The financial terms of the EU deals, and the prices paid per dose, have not been disclosed.

-

United Kingdom: After deciding not join with the EU in procuring its vaccines, the U.K. has been aggressive in signing deals with six developers, including five that are also in the U.S. portfolio (Oxford/AstraZeneca, BioNTech/Pfizer, Janssen/Johnson and Johnson, Novavax, and Sanofi/GlaxoSmithKline). In addition, the U.K. has a deal with Valneva for its inactivated virus vaccine candidate. All totaled, the deals are for 400 million doses of vaccines (including options for added purchases) for a country with a population of 67 million. Like the EU, the U.K. has not disclosed the financial terms of their vaccine contracts.

-

Japan: To date, Japan has signed three deals with developers, for a combined purchase of 490 million doses (Japan has a population of 127 million). The agreements overlap with both the U.S. and the U.K. portfolios (Oxford/AstraZeneca, BioNTech/Pfizer, and Novavax). The deal with Novavax is for a Japanese-based biopharma company (Takeda) to produce the vaccine candidate under a licensing agreement.

-

COVAX Facility/Gavi: As high-income countries have lined up potential vaccine supplies, concern has increased that low and middle-income countries will be unable to secure vaccinations for their populations. Two nonprofits supported by the Gates Foundation—the Coalition for Epidemic Preparedness Innovations (CEPI) and Gavi, the Vaccine Alliance—have taken the lead, alongside the WHO, in developing a coordinated international financing framework for securing vaccines for populations outside the 20 or so richest countries. The financing construct—called the COVAX Facility—has sealed two contracts to date, with Oxford/AstraZeneca and with the Serum Institute of India (SII). SII has become the world’s largest producer of vaccines in part because of its strategic relationship with Gavi. It produces massive quantities of vaccines at very low cost by working with the major biopharma countries to sell their products only in countries that otherwise could not afford them. SII has agreed to produce 1 billion or more doses of either the Oxford/AstraZeneca or Novavax vaccines, or possibly both, depending on regulatory approval. In addition, Oxford/AstraZeneca has agreed to provide 300 million vaccines to COVAX-participating countries out of supplies it produces through its own manufacturing facilities.

These deals, while significant, will likely leave COVAX short of its stated goal of securing 2 billion vaccines by the end of 2021. For the most part, rich countries have opted to sign bilateral deals directly with the manufacturers rather than work through the WHO-aligned procurement mechanism. As candidate vaccines secure regulatory approval, it is possible that many high-income countries will have excess supplies of vaccines under contract. At that point, one might expect the EU, Japan, and (one hopes) the U.S. to coordinate a donation system to COVAX to ensure a robust and largely concurrent COVID vaccination campaign in all of the countries around the world.

-

China: Three of the six vaccines now in Phase III trials are being developed by labs located in China. It is possible, and maybe even probable, that China will have the first candidate or candidates that successfully demonstrate efficacy in a large-scale test. Sinovac (a privately owned lab) and Sinopharm (a state-owned company) have between them three inactivated virus candidates now in Phase III tests around the world. In addition, CanSino—also state-owned—has a viral vector vaccine candidate that has already been approved by the Chinese government for use in military personnel. It is expected to enter Phase III testing soon.

Although it is sponsoring several of its own candidates, China is also actively working with international pharma companies to secure additional supplies. It has signed an agreement with Oxford/AstraZeneca for 200 million doses of its vaccine, and Shanghai-based Fosun Pharma has signed a deal to manufacture the BioNTech/Pfizer candidate for distribution in China.

So far, the U.S., the EU, and Japan have not shown any interest in the vaccine candidates developed in China. One major obstacle is divergence on regulatory standards. The high-income Western countries adhere to negotiated protocols for shared, cross-national approval of biopharma products. China, Russia, and many other countries follow a different (and less rigorous) set of standards. Consequently, even if the Chinese vaccines are first to successfully show efficacy in clinical trials, the U.S., in particular, is unlikely to get in line for an acquisition request. However, that resistance may wane if the U.S. portfolio underperforms.

-

Russia: Russian President Vladimir Putin surprised the world when he announced this month that his country would soon start using an inoculation developed by the country’s Gamaleya Research Institute for Epidemiology and Microbiology. The financing for the development of the vaccine candidate has come from the nation’s sovereign wealth fund. Russia has given licensure to it even though it has yet to be shown as safe and effective in a Phase III trial. The clinical results from recently completed Phase I and II trials also have not been published in peer-reviewed journals. A Phase III trial is scheduled to begin in Russia, Saudi Arabia, and the United Arab Emirates (UAE) this month. Russia has also indicated it plans to sell the vaccine around the world and is engaged in procurement and manufacturing discussions in multiple countries.

Vaccine development is a notoriously uncertain undertaking. Only about 15 percent of candidates entering human trials secure regulatory approval. This explains why the U.S. and many other countries are taking the unprecedented step of investing in multiple candidates well before it is known if they will work or not. The more bets that are placed, the better the odds of having a vaccine by 2021 that can be used to protect their populations and end the pandemic.

There are costs to this strategy. Many vaccine candidates are likely to fail, and the doses purchased under bilateral contracts will have to be discarded. U.S. taxpayers have already spent more than $10 billion on vaccine development and procurement, with more to come. But these costs are minor in comparison to the toll the pandemic is inflicting on human health and economic well-being. The most cost effective thing a government can do at this point in the crisis is to speed the delivery of an effective COVID-19 vaccine. If most of the targeted vaccine candidates turn out not to work, that is a small price to pay as long as at least one of them does.

James C. Capretta is a resident fellow and holds the Milton Friedman chair at the American Enterprise Institute.

Photograph by Chandan Khanna/AFP/Getty Images.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.