Dear Capitolisters,

I hope you all had a great holiday and have jumped into 2021 with the unbridled enthusiasm of a recently vaccinated supercentenarian. While we were away, a minor kerfuffle—no, not that one—erupted when a Walmart social media employee accidentally used the corporate Twitter account to taunt Sen. Josh Hawley after he announced his (depressing, cynical) plan to object to the election results. The senator responded in typical fashion, calling on the company to “apologize for using slave labor” and “for the pathetic wages you pay your workers as you drive mom and pop stores out of business.” In doing so, he echoed other leaders of Trumpen Proletariat, who have recently taken to the interwebs to lament how Walmart and other large retailers (especially e-commerce sites like Amazon)—fueled in part by pandemic-induced lockdowns—have destroyed small businesses and, in turn, the local communities that supposedly depend on them.

If such commentary had remained on the populist right (and, of course, the populist left before it), I may have left it alone. However, only a couple days before Hawley’s Sanders-esque eruption, GOP Ways and Means Committee ranking member Kevin Brady took a similar, albeit less hostile, angle when he complained on the House floor that increased COVID relief payments wouldn’t stimulate local economies because recipients would merely be making “new purchases online at Walmart, Best Buy or Amazon.” Heaven forbid.

Given this newfound bipartisanship, now seems as good a time as any to dig into the reality—good and bad—of Walmart, big box retail and e-commerce in the United States. So that’s what we’ll do today.

‘Slave Labor’ and the World’s Poor

Hawley’s comment about Walmart and “slave labor” is likely a throwaway line about China trade generally, but it’s still good to note that Walmart hasn’t actually been linked to the most recent claims of Uighur forced labor in China. Nevertheless, Walmart has had to deal with these claims in the past, and the issue of trade, China and forced labor remains an important one, given its serious moral and ethical implications and recent headlines. So let’s run down some basic points.

First, some perspective. Contrary to what you may hear or read, forced labor is not merely, or even mainly, a “China manufacturing problem” (though China is a major source). According to a 2017 report from the International Labor Organization, for example, approximately 20 million people—16 million by private actors and 4.1 million by state actors—were at that time engaged in some form of “forced labor,” spanning every continent. Most of this, however, is unrelated to trade or “sweatshops”: 70 percent of private “forced labor” is “debt bondage” (meaning someone is forced to work to pay off a debt); manufacturing accounted for only 15 percent of all cases (most were domestic work or construction); and the ILO further estimates that 10 percent to 28 percent of this labor is actually linked to trade. Total annual profits from all forms of forced labor (about $150 billion in 2015), moreover, are a relatively small share of global GDP ($76 trillion that same year).

Furthermore, U.S. law already bans imports of “merchandise mined, produced or manufactured, wholly or in part, in any foreign country by forced or indentured labor—including forced child labor”—a longstanding provision that Congress actually tightened in 2015. Pursuant to this law, the federal government regularly issues new enforcement actions, either independently or as a result of a private petition, against products and specific companies found to have engaged in forced labor. (Several of these actions relate to China, but dozens of others don’t.)

It’s therefore misguided to pretend that unchecked imports of goods made by slave labor are somehow flooding the U.S. market. They exist, and they certainly warrant attention, but the problem is already addressed under the law and not nearly as pervasive as some (ahem) would have you believe.

Second, it’s pretty misguided to think that things would be much better if places like Walmart (or Amazon or Target) didn’t exist or if Hawley had his way and, as he’s proposed, started snooping through their supply chains. For one thing, whether for moral or simple public relations reasons, Walmart and other large multinational companies have evolved to take “slave labor” and related allegations pretty seriously—constantly auditing their supply chains (usually via independent third-party auditors) and terminating contracts of suppliers found in violation of various labor rules. (For a deep dive into Walmart’s practices in this regard, see this recent review from Norway’s Government Pension Fund, which reinstated the company’s eligibility in its socially responsible investment portfolio.) Given the size and complexity of large retailers’ supply chains and supplier networks, things will inevitably slip through the cracks, but these companies do make an effort and react quickly when problems arise.

More importantly, there’s a wide body of evidence showing that global trade has contributed to dramatic improvements in working conditions around the world and that efforts to cut it off would make things worse for the global poor. For example, the last few decades have seen massive declines in child labor and the number of people working in extreme poverty, as well as disproportionate improvements for women and girls. Walmart was a pioneer in this area, establishing incredibly efficient supply chains that rely on developing country workers, but it also led the way in delivering these very same goods to the world’s poorest people. As Charles Kenny explained a few years ago when arguing that Sam Walton deserved the Nobel Prize, “many [of the world’s poorest] have more access to goods and services than they did only a few years ago… in part because companies around the world have figured out how to make and ship the stuff that poor people want at lower cost, which makes lives better. Call it the global Walmart effect.” Scholarly research backs this up, with the arrival of foreign retailers in developing countries found to increase competition and substantially decrease locals’ cost of living.

And as I explained in a recent blog post, both economic theory and recent history—in particular the reporting requirements for “conflict minerals” in the 2010 Dodd‐Frank Act that forced companies to map their supply chains—show that onerous regulations like the ones Hawley has proposed for “forced labor” would make things worse, not better for the global poor. This is because multinationals would most likely work to avoid new disclosure requirements by moving their supply chains from poor and needy countries—not just China—to wealthier places clearly free of sketchy labor practices. This is precisely what happened with Dodd-Frank, encouraging more—not less—conflict and misery in the Democratic Republic of Congo, and it’s why most human rights advocates typically oppose such measures (and other forms of protectionism). Although we can and should lament that forced labor still exists around the world, it’s essential to have a clear head about what can and can’t work to alleviate the problem. Discouraging trade and “big box” retail probably can’t.

But What About Mom and Pop?

That leaves Hawley’s other criticism—the one apparently shared by Brady and others—that Walmart and other retailers are destroying “mom and pop” businesses and harming American workers. Leaving aside that these large companies employ millions of Americans across the country, there is a nugget of truth to the complaint: Economic research shows that Walmart’s arrival in a local community causes a small but significant reduction in local retail establishments and total retail jobs. Other studies show similar trends, attributing big box stores’ growth to their stability and productivity (which are good things!). Just as surely, e-commerce has thrived during the pandemic, while many retail establishments have suffered.

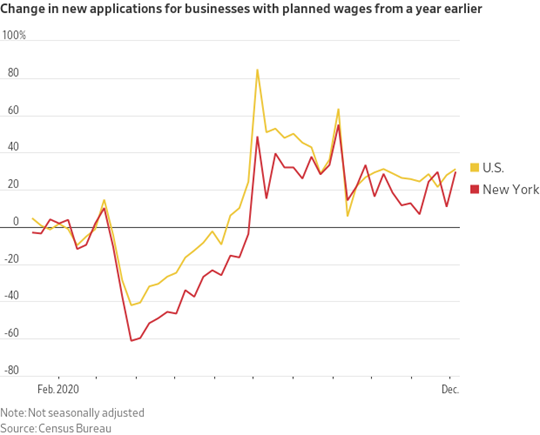

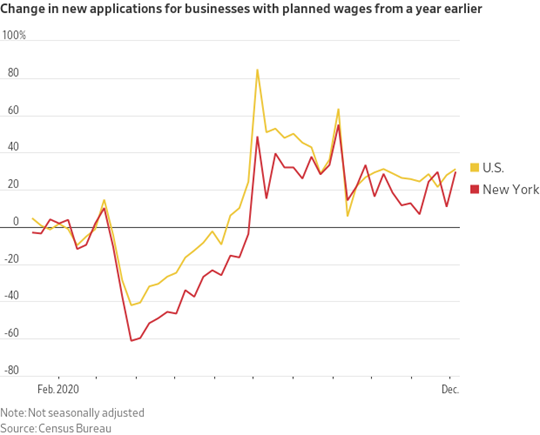

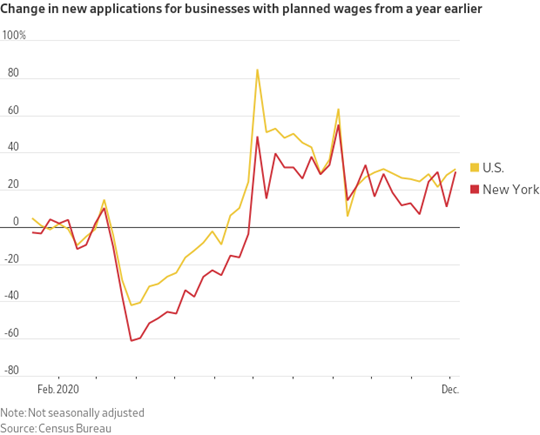

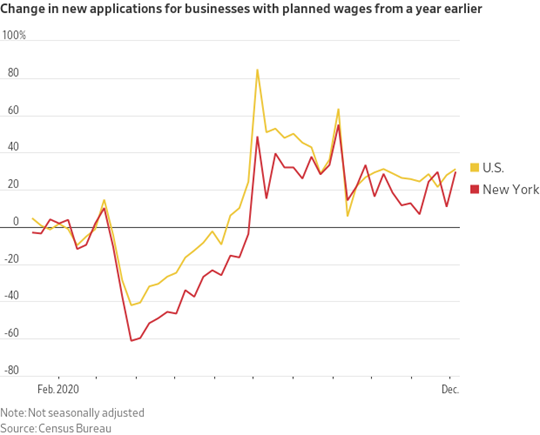

However, the Death of Brick-and-Mortar Independent Retail has also been oversold, with high-profile bankruptcies masking new business entry and evidence of smaller businesses improving or diversifying in the face of heightened competition. Even last quarter, only 14.3 percent of all retail sales were online, and initial data show new businesses replacing ones that unfortunately went under during the lockdowns.

Furthermore, there is strong evidence that Walmart and other big box retailers are a net positive for workers and consumers. For example, a 2014 paper found that large retail chains like Walmart and Home Depot “pay considerably more than small mom-and-pop establishments,” and provide good opportunities for promotion into even-higher-paying managerial roles. As a result, “the growth in modern retail, characterized by larger chains of larger establishments with more levels of hierarchy, is raising wage rates relative to traditional mom-and-pop retail stores.” This remains true today: Entry level wages of Walmart, Target, Costco and other large brick-and-mortar retailers range from $12 to $17 per hour (well above the federal minimum wage of $7.25), while retail or warehouse salaries start around $30,000/year and go much higher. Several of these retailers also provide benefits like health insurance or 401(k) plans, or training systems for low-skill workers to help with their advancement—programs that mom-and-pop stores likely wouldn’t have (due to lack of resources or positions).

Things look even better when moving to e-commerce, where retailers like Walmart (and, of course, Amazon) are currently focused. As explained in a recent piece by the Progressive Policy Institute’s Michael Mandel, during the “e-commerce era” (2013-19), hourly earnings for production and nonsupervisory workers in the warehousing industry increased 11.5 percent (inflation-adjusted)—a much better pace than brick-and-mortar retail, manufacturing, health care, and other industries. In the last year, moreover, wage gains in retail/warehousing/delivery (5.2 percent) outpaced private sector wage gains (4.4 percent).

In fact, Mandel finds that “blue collar” and administrative jobs in e-commerce/warehousing now pay better than in manufacturing or the private sector overall, while the “picking and packing” jobs done by e-commerce fulfillment workers “are clearly better paid than the typical jobs in the brick-and-mortar retail sector, by about 30 percent.”

With e-commerce fulfillment centers popping up all over the country—there are 110 Amazon centers in the U.S. alone, and they’re planning 1,000 more (to compete with Walmart!)—these jobs are increasingly “local,” too. (Mandel highlights one such center in Mercer County, NJ; there’s another huge one a few miles from my home here in Raleigh.)

Beyond the benefits for workers, Walmart, Amazon, and other large retailers also help American consumers. Economist Jason Furman, for example, calculated that Walmart alone generated savings of $2,329 per U.S. household in 2004. A more recent (2018) study found that Walmart Supercenters significantly improve food insecurity in the United States, with the largest benefits accruing (unsurprisingly) to low-income households and children. Competition between Walmart, Amazon, and other large retailers should help maintain or increase these consumer benefits in the future. Other studies show benefits for local home prices and the environment. (Walmart reportedly cut 230 million tons of greenhouse gas emissions from its supply chain in 2018 and is battling Amazon for renewable energy bragging rights.)

Finally, it’s important to note that trying to regulate mom-and-pop stores into competitiveness won’t necessarily work. In fact, economist Rafaella Sadun found that a U.K. prohibition on big box stores in the 1990s actually harmed independent retailers: “Instead of simply reducing the number of new large stores entering a market, the entry barriers created the incentive for large retail chains to invest in smaller and more centrally located formats, which competed more directly with independents and accelerated their decline.” The market … uh … finds a way.

Where Real Problems Arise

None of this is to say, of course, that big box retail and e-commerce are faultless. Beyond the disruption that can surely prove painful for certain companies and workers, these companies also have been known to lobby for new regulations that harm their (usually smaller) competitors. For example, Walmart in 2009 reportedly lobbied for a federal law requiring companies to provide a government-defined health benefit package to their workers, at least in part because it would hurt Walmart’s chief competitor, Target (not to mention companies with even shallower pockets). Amazon and Walmart have also lobbied for higher federal minimum wages, which many have speculated is motivated (again, in part) by a desire to hobble smaller brick-and-mortar competitors. Given the aforementioned data on wages and mom-and-pop retail, it’s easy to see why this might be the case.

So, by all means, criticize these large companies for this (and other) legitimate anticompetitive behavior, or when there’s solid evidence of them knowingly encouraging or engaging in illegal activities (including the importation of goods made from slave labor). But maybe tone down the baseless populist insults in the meantime.

Chart of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

You are currently using a limited time guest pass and do not have access to commenting. Consider subscribing to join the conversation.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.