Dear Capitolisters,

All eyes are back on Congress this week and the gripping (impossible to follow) drama of whether the House will pass one or both of President Biden’s domestic policy priorities—the $1 trillion bipartisan infrastructure bill and the $3.5 trillion “reconciliation” package. Since both of those bills are chock-full of industrial policy—especially subsidies for “green” technologies like electric vehicles—now seemed like a good time to debunk another common justification for our renewed embrace of industrial policy: other countries’ many successes. As I explain in a new paper out this week, however, there are several reasons why—even if you ignore the economic and practical problems with past U.S. industrial policies—the purported “industrial policy successes” of countries like Japan, Taiwan, South Korea, and China can’t justify similar policies here.

Different Systems Mean Different Outcomes

For starters, significant political and economic differences limit the extent to which the industrial policy experiences abroad can inform similar efforts undertaken here. For example, several recent economics “literature reviews,” which summarized and assessed empirical studies of industrial policy, found that there haven’t been a ton of analyses undertaken and that, of the few published studies that were, they tended to assess specific cases, industries, and policy episodes (instead of broader, economy-wide analyses). Thus, these papers can’t really predict whether the analyzed cases might translate to the United States. As researcher José Luis Ricón Fernández, whose Nintil blog has done some incredible deep dives into various industrial and R&D policy efforts, put it earlier this year: “If there is one conclusion from the recent empirics of [industrial policy] it’s that it’s pretty much dependent on which industry, which country, in which period of development it is applied.” Pulling broader lessons from this research is thus pretty suspect.

Another reason to avoid simply cutting-and-pasting industrial policy lessons across jurisdictions is our differing political systems. As economist Nathan Lane explained in his 2020 literature review, “Without a doubt, future research must do more to understand the interaction between political economy and industrial policy. Because industrial policy is state policy, its success, scope, and efficacy is sensitive to institutional context.” He adds that, thus far, few economics papers have really examined how politics affects industrial policy, leaving it an open question.

As we’ve discussed here repeatedly in the context of “public choice theory,” the question looms especially large in the United States, as our system of government is particularly vulnerable to having politics turn theoretical industrial policy successes into real-world industrial policy failures. Several factors, such as the short duration of many elected federal positions and our well-developed lobbying and special-interest group system, heighten the politicization of U.S. policy formulation and implementation. Thus, the long history of American industrial policies (1) getting watered down or corrupted while working their way through Congress; (2) directing public subsidies or protection based on lobbying expenditures or political connections, not technological promise; (3) lasting years after their failures have been established (and costing a fortune in the process); or (4) smashing head-first into a wall of other (also politicized) laws and regulations—such as Buy American restrictions, ethanol subsidies, or the Jones Act—that inflate the industrial policies’ costs and undermine their efficacy.

These issues, combined with more practical ones like the U.S. economy’s size, diversity, and level of development (all of which limit industrial policy lessons offered by small or developing economies) greatly diminish assertions that industrial policy can “work” in the United States because specific programs “worked” in other countries. It’s just not that easy.

But What About [Insert Country Here]?

Even if it were that easy, moreover, most industrial policy successes abroad have been exaggerated, while most of the failures have been ignored. We covered this phenomenon a few weeks ago regarding Chinese industrial policy, so I won’t rehash that evidence here again. But I will note two additional points: First, recent economic turbulence in China (e.g., the government crackdown on tech companies, the Evergrande mess, the foreign investor trepidation, the power outages, and Xi Jinping’s ideological campaign against private enterprise) underscore the uncertainty of China’s supposedly inevitable global economic dominance. Second, as I explain in my new paper, there’s little chance the United States could emulate Chinese industrial policy even if we wanted to:

China’s industrial policy model is unique: the Chinese government controls a large share of the economy and therefore has an enormous amount of money at its disposal. As [China expert Barry] Naughton explains, this “puts limits on the degree to which industrial policies can impose costly distortions on the economy.” The U.S. system—thankfully—lacks such characteristics and would therefore suffer far more damage from “China‐style” industrial policy interventions. … [T]he United States also differs from China in that our political system is less tolerant of costly public failures, particularly in the commercial (as opposed to, say, national defense) arena. Popular backlash, which the U.S. system fortunately permits (again, unlike China), would be all but guaranteed.

Beyond China, there’s little to indicate that other countries’ past industrial policy efforts—even the widely touted “successes” of Japan, Israel, South Korea, and Taiwan—justify the United States doing the same.

Japan. Numerous analyses have punctured the myth that Japanese industrial policy was primarily responsible for the country’s impressive growth and productivity during the 1970s and 1980s. The Peterson Institute’s Marcus Noland found, for example, that “The [Japanese] government’s selective industrial policy interventions have had little, if any, positive impact on productivity, growth, and welfare. Most resources have gone to large, politically influential ‘backward’ sectors, suggesting that parochial politics determined these resource transfers.” Noland most definitely isn’t alone. In fact, even Japan’s own Ministry of Finance admitted back in 2002 the government’s interventionist and protectionist policies had “eroded the competitiveness of the industries the government had sought to support.”

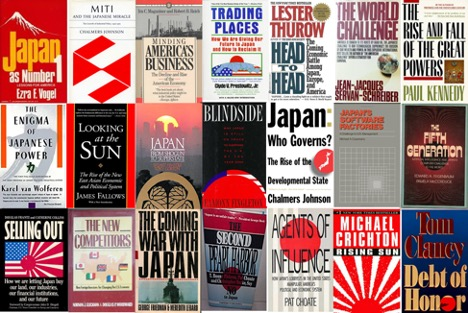

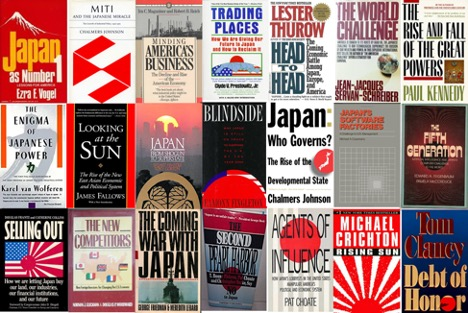

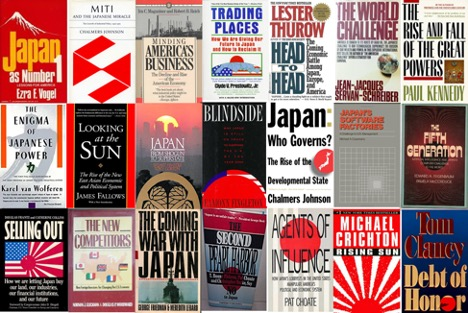

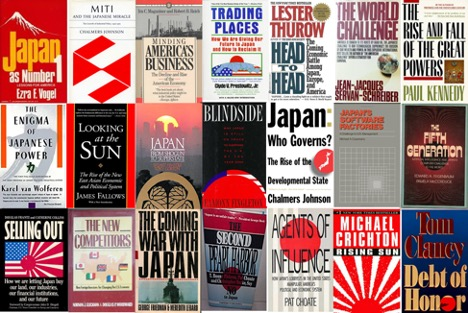

On the bright side, it did sell a lot of bad books and movies here at home:

Israel. Though Israel’s history and size caution against a U.S. comparison, it’s still worth noting that its oft-hyped industrial policies have had their share of concerns too. For example, economist Saul Lach’s 2003 assessment of much-heralded R&D subsidies for Israeli manufacturers found that such funds did benefit small firms but had negative effects on large firms. And because most subsidies went to the large firms, they generated statistically insignificant improvements in company-financed R&D. In other words, Israeli subsidies just rearranged the deck chairs a little.

Taiwan. As documented in the 2019 book, Free Trade and Prosperity, Taiwan’s rapid, manufacturing-led economic growth in the mid- to late-20th century should have been attributed to a general shift in national policy away from import substitution toward trade and investment liberalization, particularly for industrial inputs, and to various domestic policies, such as political stability, labor market flexibility, macroeconomic stability, infrastructure expansion, and secondary education. Industrial policy played a minor role and didn’t produce economic outcomes that would’ve differed under a less-interventionist policy regime. (Dartmouth’s Doug Irwin concurs in a new paper, finding that changes in currency policy—in particular, moving to a market-based exchange rate and eliminating foreign currency controls, thus boosting manufacturing exports and imported inputs—drove Taiwan’s growth, not industrial policy.)

Furthermore, the book finds that the sectors of Taiwan’s economy that had the best export performance in the 1960s and 1970s were labor intensive ones not subject to government targeting (via industrial policy), and that the share of manufacturing output attributed to government efforts actually declined over the period examined. Even in semiconductors (where Taiwan is today a global market leader), industrial policy’s influence has been exaggerated: as Acton’s Sam Gregg recently detailed, for example, the Taiwanese government was involved in getting superstar TSMC off the ground, but the idea and the technology came from the United States and private—not government—capital and personnel drove the company’s success.

South Korea. Free Trade and Prosperity also takes on the South Korean government’s industrial policies—export promotion, import restrictions, subsidies, etc.—from the 1950s through the 1970s. It shows that the exported goods that grew rapidly during the 1960s—plywood, woven cotton fabrics, clothing, footwear, and wigs—were low-tech industries not subject to state targeting, while the heavy and chemical industries (HCI) prioritized between 1974 and 1982 performed poorly, with relatively low productivity as compared to unsupported industries. (Irwin, in a separate paper, documents how Korea didn’t really prioritize industrial policy in the 1960s but did embrace it in the 1970s “HCI drive.”)

As documented in the book (and a shorter summary paper), Korea’s economic growth rate was significantly lower during its peak industrial policy (HCI) years than the rates achieved during previous, less-interventionist periods. Economic growth returned to the higher levels (and heavy/chemical industries’ performance improved) only after the government ended specific support for those industries, ceased promoting strategic industries more broadly, and liberalized both import restrictions and the country’s financial sector.

Irwin cites several papers coming to similar conclusions, noting that “[m]any Korean economists believe that excessive capital investment was forced into heavy industry, leading to the stagnation of Korea’s labor-intensive manufactured exports.” But a new NBER paper really hits this home: Using new and detailed data, the authors find that Korean industrial policy helped a few heavy/chemical industry factories but slowed overall productivity in the targeted industries/regions (relative to no industrial policy at all), while boosting big, less-efficient establishments—aka “Chaebol” conglomerates that would become a big problem for Korea years later. (The Links section below provides a longer blog post on this paper.)

In most of these “success” cases, the economic evidence leaves those crediting industrial policy with growth or tech superiority to argue not that government interventions produced better results than those that a more liberalized regime would have produced, but instead that such market-beating outcomes can’t be ruled out. That’s hardly a ringing endorsement of industrial policy (which is specifically intended to fix “market failures”). Yet even this conclusion may be too kind. Free Trade and Prosperity finds, for example, that the more interventionist South Korea grew more slowly than less-interventionist neighbors like Singapore, Hong Kong, and Taiwan (compared to South Korea). Other work shows that South Korea’s HCI policies were a drag on economic growth because they erected barriers to entry that allowed bloated incumbent firms to jack up prices at consumers’ expense. And, of course, all of these economies still trail the United States in things like GDP per capita and innovation.

Finally, industrial policy successes must be balanced against the numerous failures of such policies in countries around the world. This includes not only the U.S. policies that I’ve detailed in previous columns (and even more in my new paper), but also well-known debacles abroad. This includes European industrial policy failures in the 1960s and 1970s like British Leyland automotive; the Concorde; French machine tools; and various British and French attempts to beat IBM and other American tech companies with their own national champions. As the Mercatus Center’s Adam Thierer and Connor Haaland documented earlier this year, moreover, subsequent European efforts to catch U.S. supremacy in internet, GPS, streaming video, and other tech industries also failed miserably.

And then there’s Argentina’s hilarious and costly national initiative to make 100 percent “made in Argentina” smartphones and other consumer electronics; and numerous iterations of Brazilian automotive policy; and Tunisia’s “Ben Ali” firms (which were owned by the country’s leader and his family); and India’s Planning Commission and License Raj between the 1950s and early 1990s; and on and on and on.

Surely, not every industrial policy effort ends in a costly fiasco like British Leyland or Argentina’s ¡ay!Phone (haha), but plenty do. And they’re an essential complement to the foreign industrial policy successes that supposedly justify U.S. mimicry.

Summing It All Up

Although we commonly hear that industrial policy successes abroad justify U.S. proposals like semiconductor subsidies, “green energy” loans, and “strategic investments” in “critical industries,” caution is warranted. Even assuming we ignore the numerous industrial policy failures abroad or the difficulties with cross-country comparisons, tons of studies raise two key questions that advocates rarely ask: First, what economic effects did a policy have outside of a targeted factory or industry? Second, what would have happened in the absence of the policy? And here, again, the answers are bleak for the pro-industrial policy side: while there may be some discrete benefits for certain workers or firms, they’re outweighed by the broader economic harms (even in the targeted industry!), and the gains would’ve been even better under a freer, less-interventionist policy regime.

No wonder the advocates rarely ask them.

Chart of the Week

Foreigners move from buying government debt to buying corporate debt and stocks, thus fueling the U.S. trade deficit (source):

Bonus Chart of the Week

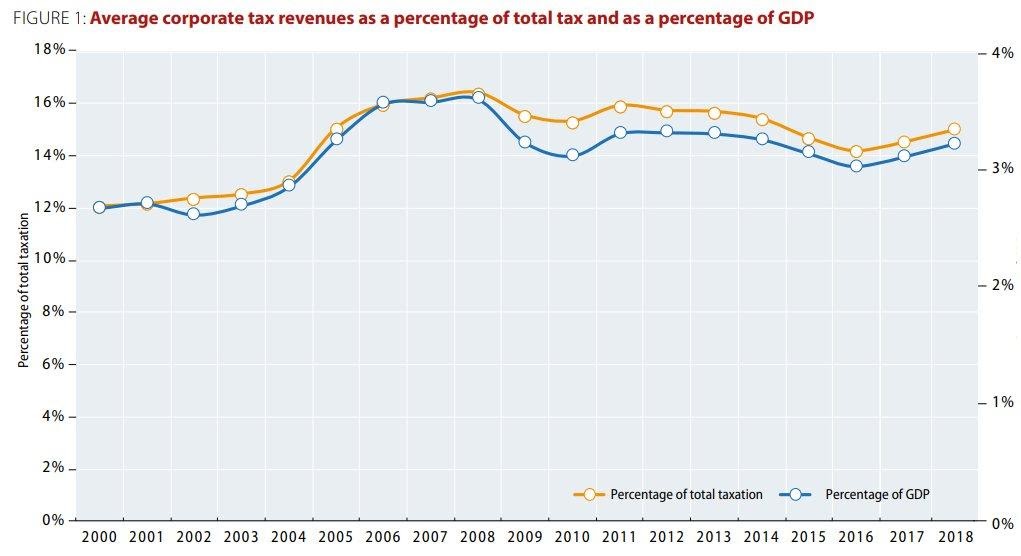

Race to the bottom! (source)

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

You are currently using a limited time guest pass and do not have access to commenting. Consider subscribing to join the conversation.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.