Happy Thursday! LeBron James hit an off-balance 3-pointer with the shot clock expiring last night to lead the Los Angeles Lakers past the Golden State Warriors 103-100 and put the defending NBA champs into the playoff bracket. Don’t worry: Cubs updates will return next week.

Quick Hits: Today’s Top Stories

-

As Israel and Hamas continued into their 10th day of fighting on Wednesday, President Joe Biden told Israel’s Prime Minister Benjamin Netanyahu in a phone call that “he expected a significant de-escalation today on the path to a ceasefire,” according to a White House readout of the conversation. Netanyahu rejected Biden’s support for a ceasefire, tweeting Wednesday that he is “determined to continue this operation until its goal is achieved, to restore peace and security to you, the citizens of Israel.”

-

The House of Representatives voted 252-175 Wednesday to create a bipartisan commission to investigate the January 6 attack on the U.S. Capitol. Thirty-five Republicans voted in support of the bill—bucking GOP House leadership, which had urged the conference against it. The bill now goes to the Senate, where it will need at least 10 Republican votes to pass.

-

Before the House vote, Senate Minority Leader Mitch McConnell announced he would follow the lead of his colleagues in House leadership by opposing the commission legislation. “It’s not at all clear what new facts or additional investigation yet another commission could lay on top of the existing efforts by law enforcement and Congress,” McConnell said on the Senate floor Wednesday.

-

Federal Reserve officials signaled Wednesday that the Central Bank could adjust its easy-money monetary policy in the near future.“A number of participants suggested that if the economy continued to make rapid progress toward the committee’s goals, it might be appropriate at some point in upcoming meetings to begin discussing a plan for adjusting the pace of asset purchases,” read the minutes from the Fed’s meeting from late April that were released Wednesday. The Fed has kept interest rates near zero over the past several months, and it has previously said that it won’t adjust its monetary policy until the economy reaches its targets of 2 percent inflation and full employment.

-

Texas Gov. Greg Abbott signed a bill on Wednesday banning abortions after a fetal heartbeat can be detected, which is as early as six weeks into a pregnancy. The law empowers private citizens to sue abortion providers who violate the measure, a novel strategy proponents say is intended to make the measure harder to block in court.

-

The European Union announced Wednesday that it will open its borders to fully vaccinated Americans and other international travelers. EU officials said Wednesday that the new protocol will likely take effect sometime within the next week or two.

-

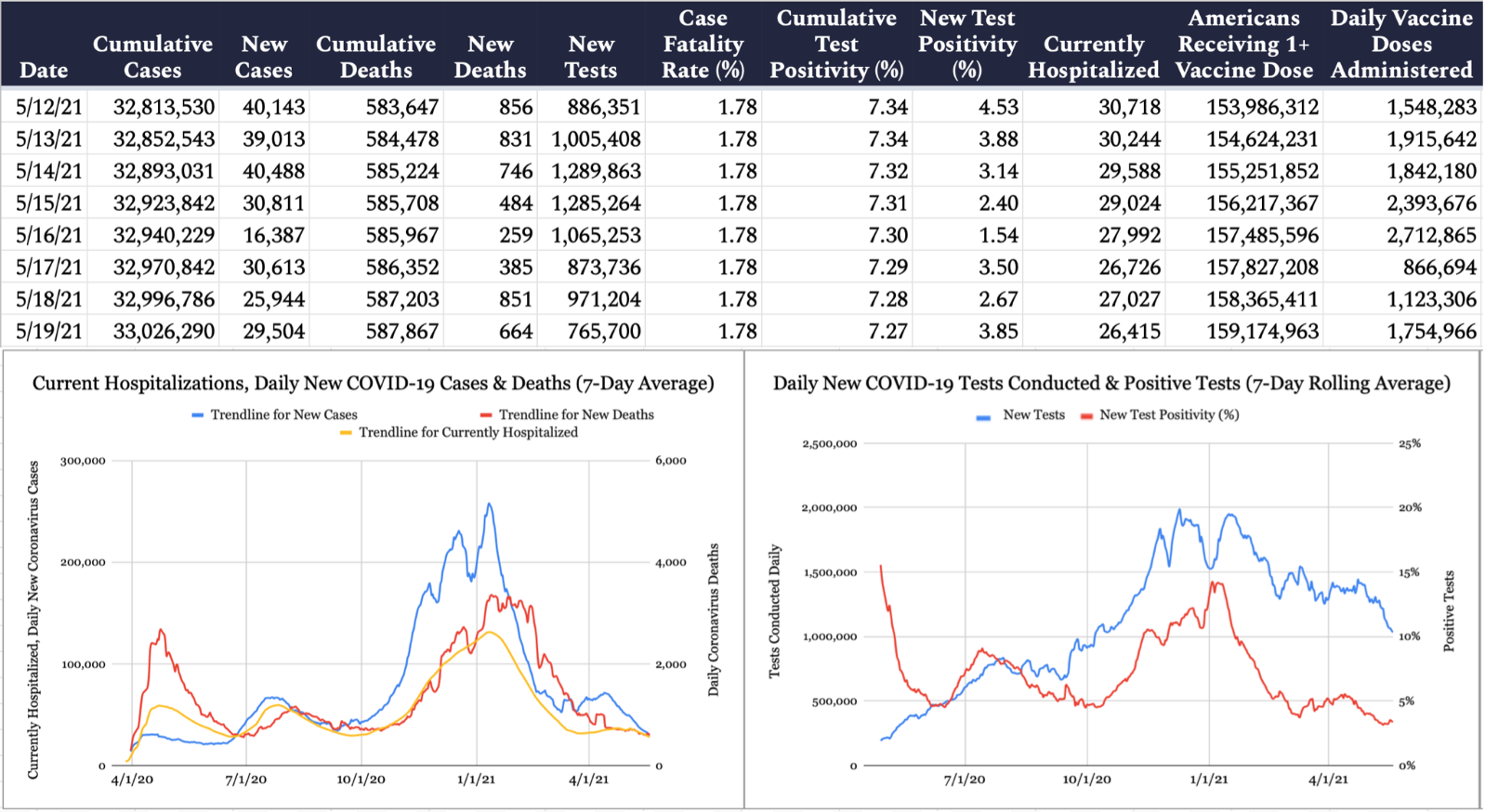

The United States confirmed 29,504 new cases of COVID-19 yesterday per the Johns Hopkins University COVID-19 Dashboard, with 3.9 percent of the 765,700 tests reported coming back positive. An additional 664 deaths were attributed to the virus on Wednesday, bringing the pandemic’s American death toll to 587,867. According to the Centers for Disease Control, 26,415 Americans are currently hospitalized with COVID-19. Meanwhile, 1,754,966 COVID-19 vaccine doses were administered yesterday, with 159,174,963 Americans having now received at least one dose.

Bitcoin Takes a Plunge

Over the past year, the value of cryptocurrencies like Bitcoin and Ethereum has skyrocketed due to a combination of factors: an increasing number of companies accepting them as payment, celebrity businessmen like Tesla’s Elon Musk talking them up as promising technology, and retail investors with stimulus money to burn and dollar signs in their eyes piling into shares of the coins.

But in recent weeks, all has not been sunshine and roses in the crypto market. Cryptocurrencies took another hit Wednesday when Bitcoin, the highest-valued digital currency worldwide, nose-dived to nearly $30,000 a coin for the first time since January. Between mixed signaling from Elon Musk about Tesla’s investment portfolio and efforts by the Chinese government to curtail the purchase of foreign digital assets, the crypto market lost valuable footing in May that it had gained earlier this year.

Bitcoin dropped about 50 percent from its April high of $65,000 yesterday morning, but crept back up to about $39,300 by 6 p.m. Like tech stocks, cryptocurrencies are speculative assets, meaning they are more susceptible to dramatic swings in the market.

When its value soared over the course of 2021, however, investors grew optimistic that Bitcoin would soon emerge as a stable investment. Part of this growing valuation of the technology has been bolstered by the fact that only 21 million bitcoins will ever be mined. Bitcoin’s finite supply has boosted confidence among investors that it could act as a hedge against inflation. Audrey explained the cryptocurrency in a piece for the site in December:

Unlike paper currencies, Bitcoin is powered by blockchain technology, a decentralized digital database that tracks the whereabouts of every single coin in circulation. New transactions create new blocks of data that are linked together in a chain-like sequence. The interconnectedness of each block in the financial ledger means that all transactions are added in chronological order and are therefore irreversible.

There is no central authority that regulates Bitcoin. Instead, thousands of computers around the world called “nodes” verify transactions in a collective network, preventing any singular actor from falsifying data or counterfeiting coins. The process is transparent, efficient, and doesn’t require a middleman for account transfers.

But yesterday’s dip, one of many over the course of two weeks, complicates matters as compounding factors threaten to halt cryptocurrencies’ momentum.

On Monday, Musk tweeted that Tesla had not sold any of its Bitcoin. As its value plummeted Wednesday, Musk doubled down with a tweet indicating Tesla would nevertheless retain its holdings.

But despite his efforts to bolster it now, market analysts have criticized the eccentric business magnate for reducing public courage in cryptocurrency given his high-profile and erratic messaging. Last week, Musk announced that Tesla had suspended vehicle purchases using Bitcoin, ostensibly due to the “rapidly increasing use of fossil fuels for bitcoin mining and transactions, especially coal, which has the worst emissions of any fuel.” Bitcoin dropped 12 percent and the cryptocurrency market lost $300 billion in a single day following the announcement.

“Elon Musk is the best salesman in the world with a cult-like following. Whatever Elon Musk says is like divine words for a lot of people,” Luke Lloyd, an investment adviser for Strategic Wealth Partners, explained to The Dispatch. “But it’s not just about Musk. It’s what is perceived will happen when people like Musk get involved and either take a bullish or bearish stance towards crypto. Once Elon Musk added Bitcoin to the balance sheet of Tesla, many investors thought many other companies would follow.”

“Again, this all comes down to supply and demand. As long as demand rises and supply is limited, prices go up. If demand declines and supply is high, prices go down. Powerful people have powerful words that impact supply and demand,” Lloyd added.

On Tuesday, the Chinese government reaffirmed its ban on outside digital currencies to edge out competition while it produces its own—the Chinese yuan. With this government-controlled money poised to take over the market in the second largest economy in the world, investors are concerned about the residual impact it will have on decentralized assets, like most other cryptocurrencies.

Speaking to CNBC on Tuesday afternoon, Kyle Bass—chief investment officer of Hayman Capital Management—described the digital yuan as the “largest threat to the West that we’ve faced in the last 30 to 40 years.” The coin could lend China access to American markets, allowing “them to potentially export their digital authoritarianism,” Bass said.

The advent of the digital yuan marks a concerning development given Chinese Communist Party (CCP) control over local access to traditional cryptocurrencies. But some analysts do not believe it possesses the similarities with its decentralized counterparts necessary to take hold in Western markets.

“It’s bad news because it is limiting the demand over in China by essentially not allowing people to buy digital assets. China is trying to make the Chinese yuan the biggest player in the cryptocurrency space. China views cryptocurrency as a threat to the digital yuan,” Lloyd said. “But I don’t look at cryptocurrencies like Bitcoin as the same thing as government-issued digital assets. Bitcoin and other cryptocurrencies were created to be decentralized and not controlled by one individual or institution. China issuing the digital yuan is not trying to create a decentralized asset, but rather an asset that can be controlled.”

Fortunately for crypto-fans, some experts see Bitcoin and other coins’ declines as part of the natural cycle of a bull market, and thus temporary. “In each bull market cycle, a 20 to 30 percent decline in the price of Bitcoin from the new all-time high is typical. There are people taking profits and there are people—trading on leverage—who are forced to sell as Bitcoin goes down,” Stan Sater, a corporate technology attorney at Founders Legal, told The Dispatch. “The bull market is not over. It will probably keep going up.”

Flood Warnings Roil Gulf Coast

Flash flooding in parts of the Gulf Coast region has left millions of people living under flash flood warnings and thousands without power. Five weather-related deaths are being investigated in Louisiana.

The National Weather Service has issued flash flood warnings and watches to parts of Oklahoma, Arkansas, Texas, and Louisiana. Many of those warnings will remain in effect through Thursday morning and may be extended.

While some of the worst of the rain has moved past the Dallas area, Lamont Bain, meteorologist at the National Weather Service office of Fort Worth, told The Dispatch the area saw near-record levels of flooding over the weekend. In Dallas, White Rock Creek entered what’s called a “major flood stage,” meaning the river crested at 91.16 feet, nearly breaking the record set in 2018 which was 91.6 feet.

Moving east, the storms continue to ravage southeast Texas and Louisiana.

The city of Fannett, Texas, which is situated between Houston and Lake Charles, Louisiana, reportedly got 17 inches of rain as of Monday afternoon. The Houston region has seen a bit of a reprieve from the rain, but storms will return in forceas the weekend rolls around.

Tim Cady, meteorologist at the National Weather Service in Houston, told The Dispatch that rain is not the only thing that has caused damage in the area: “With the storms that rolled through [Tuesday] night we also had a couple fires that were caused by lightning strikes on top of all the rainfall we’ve been getting.”

Cady stressed that travel is difficult with flooded roads, and noted that there have been power outages in the area. However, unlike the outages caused by extremely low temperatures in February, which left 4.5 million homes and businesses without power, this bout of weather has caused more than 100,000 outages.

Louisiana Gov. John Bel Edwards issued a state of emergency. Alex Donato of the Lake Charles, Louisiana, National Weather Service office told The Dispatch that parts of that region have seen up to 18 inches of rain.

Flooding in Lake Charles is just the latest in a number of natural disasters the city has seen in the last year. Lake Charles was right in the crosshairs of Hurricane Laura in August of last year, and Hurricane Delta in October.

The severe flooding in the Baton Rouge area caused at least two deaths, and authorities are looking into others that may have been caused by the floods. More than 600 water rescues were reported in the region, according to the Weather Channel.

Meteorologists told The Dispatch the storms, depending on the exact region, should diminish after the weekend.

Worth Your Time

-

Like the arts? Buckle in for a grim read. “It doesn’t take a Leonardo-level intellect to figure out that the pandemic has been devastating for the arts economy,” William Deresiewicz writes in Harper’s. “Still, I don’t think most of us appreciate just how bad things are … What has been happening across the arts is not a recession. It is not even a depression. It is a catastrophe.” In grisly detail, Deresiewicz breaks down the situation: How precarious art incomes already were prior to the pandemic given how accustomed people have become to getting their content for free. How, to compensate for this, the art economy had grown to rely nearly solely on live events—plays, concerts, book tours, art shows—as its dominant income stream. The pandemic throttled that income stream overnight. And how, even as things now inch back toward reopening, industry titans and tech companies are busy restacking the deck to take an even bigger slice of the pie for themselves. “We need an art movement like the one we have for food,” he writes, “a movement for responsible consumption.”

-

In June 2019, Kamala Harris caused perhaps the most memorable moment of the Democratic primary when she criticized then-frontrunner Joe Biden for his 1970s record on busing as he worked alongside segregationist lawmakers in the Senate. Harris told a story about her own experience being bused to attend an integrated public school in California: “That little girl was me,” she said during the second night of the first Democratic debate. In a piece for Politico,reporter Edward-Isaac Dovere walks readers through Biden and Harris’ thorny relationship that followed that viral moment before the current vice president was able to charm her way onto Biden’s 2020 presidential ticket.

-

In meetings this week, California’s Instructional Quality Commission is debating a K-12 mathematics curriculum proposal that claims that “the concept of mathematics being purely objective is unequivocally false,” and that “students must develop a critical consciousness through which they challenge the status quo of the current social order.” The manual, which says junior high students should no longer be on track to take Algebra I in eighth grade, is titled “A Pathway to Equitable Math Instruction: Dismantling Racism in Mathematics Instruction,” and could be ratified later this year by the California school board. “This program is quite a comedown for math, from an objective academic discipline to a tool for political activism,” writes Williamson Evers, a senior fellow and director of the Center on Educational Excellence at the Independent Institute, in a Wall Street Journal op-ed. “Society will be harmed: With fewer people who know math well, how are we going to build bridges, launch rockets or advance technologically? Students will pay the heaviest price—and not only in California. As we’ve seen before, what starts in California doesn’t stop here.”

Something Heartwarming

Presented Without Comment

Toeing the Company Line

-

In this week’s Capitolism, Scott Lincicome brings us up to speed on the ongoing turmoil in the economic recovery, including the latest uptick in inflation reported by the Labor Department earlier this month. Check out Wednesday’s newsletter to learn more about how the pandemic, government policies, international factors, and even freak events have contributed to the “big and uncertain imbalance between supply and demand for all sorts of goods and services.”

-

In his midweek G-File, Jonah takes on “geopolitical structural antisemitism”—the perennial and perverse way international institutions treat Israel as one of the world’s worst human rights abusers. “The rules for Israel are different,” he writes. “Right now, China has a gulag archipelago of concentration and reeducation camps for Muslims. It is well into its fourth decade of ethnic cleansing in Tibet. Outrage over these facts has increased in the last year or so, but it would have to quintuple and quintuple again to reach the institutionalized outrage Israel is subjected to constantly. Saudi Arabia has been doing in Yemen what Israel is routinely—and falsely—accused of doing. Burma’s treatment of the Rohingya is far more brutal than the worst excesses—real or even alleged—of the Israel Defense Forces. How often do you hear speeches about that from the Alexandria Ocasio-Cortezes and Cori Bushes of the world?”

Let Us Know

What’s your take on Bitcoin? Do you believe cryptocurrency can act as a hedge against inflation? Does it strike you as too speculative an asset to invest in? Or is it just finance nerd stuff you can’t be bothered with?

Reporting by Declan Garvey (@declanpgarvey), Andrew Egger (@EggerDC), Haley Byrd Wilt (@byrdinator), Audrey Fahlberg (@FahlOutBerg), Charlotte Lawson (@charlotteUVA), Ryan Brown (@RyanP_Brown), and Steve Hayes (@stephenfhayes).

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.