Congress is hashing out the details of the next stimulus package, with both parties seeking to spend trillions but some disagreement over the specifics. Democrats are pushing for the continuation of expanded unemployment benefits, more stimulus checks, bailout funding for state governments, and more. Meanwhile, President Trump has long argued for a temporary payroll tax cut and Republicans leaders like Mitch McConnell are focused on liability protections for businesses reopening during the ongoing COVID-19 crisis.

Some prominent figures in the GOP are pushing another big idea, a “back-to-work bonus.” It sounds great on the surface but isn’t actually supported by many right-of-center policy experts.

Still, President Trump and his top economic adviser Larry Kudlow have touted their support for such a bonus. This temporary, taxpayer-financed sum would be given to businesses and/or workers who return to work in an effort to jump-start the economy.

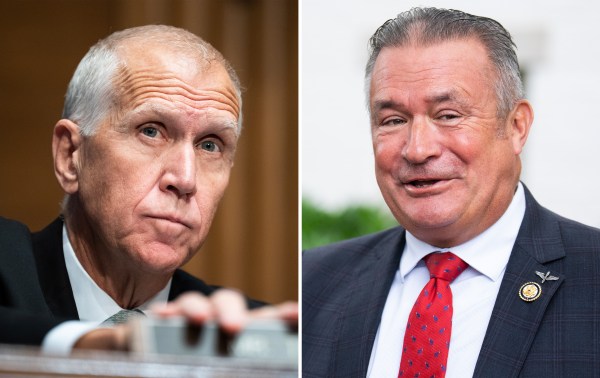

Republican Sen. Rob Portman has proposed giving workers who return to their jobs a $450 bonus for the first few weeks. Meanwhile, Rep. Kevin Brady, the top Republican on the House’s Ways and Means Committee, has offered up a plan to turn unemployment payments into a $1,200 “back-to-work bonus” of sorts. Rep. Dan Crenshaw, a prominent Texas Republican and conservative social media star, has also offered up a variant of this proposal.

What’s motivating this push? One of the key provisions of the $2 trillion CARES Act that passed in March was an unemployment insurance expansion of granting workers an extra $600 weekly in federally financed benefits on top of what states already paid.

This well-intentioned system created a giant disincentive to work that will hamper economic recovery if left in place. Why? Almost 70 percent of currently unemployed individuals can now earn more from staying on unemployment than from going back to work. This is obviously not a recipe for a thriving economy. Despite this distorted incentive structure, House Democrats want to extend these supercharged benefits through January 2021.

Free-market conservatives are understandably appalled at the prospect of smothering the labor market through the new year. The proposals for a back-to-work bonus have emerged as a course correction from Republicans hoping to restart the economy and awaken the labor market. Yet while the need to reduce and cap the supercharged unemployment benefits is clear, creating a new system that burns through taxpayer dollars in the other direction could be a mistake.

“We know that the [expanded unemployment benefits] created a whole host of problems, but I don’t think the solution is to layer on another problematic benefit,” Heritage Foundation Research Fellow Rachel Greszler tells The Dispatch. “This creates a lot of potential issues… one of which is just the inequity in this system.”

“If you are a worker who has been on the front lines this entire time, and you had some co-workers who were furloughed, well, not only did they make more than you while sitting at home [on unemployment benefits], now they come back to work and [get a bonus] when you’ve been there the entire time,” Greszler said. “That’s not equitable.”

“And it’s not an effective use of taxpayer money,” Grezler continued. “It seems like right now there’s no cost to providing these benefits and we can just pull the money out of thin air, but we know that in reality, some day the bill is going to come due — with interest. That’s going to mean higher taxes and [fewer] services for future workers.”

It’s important to note that the budget situation is already out of control even before this new spending gets passed. The federal government is set to run a roughly $3.7 trillion budget deficit this fiscal year, according to the Congressional Budget Office. That figure might sound abstract, but for context, it comes out to a whopping $25,820 (roughly estimated) per American taxpayer. And a $3.7 trillion deficit would make the $1.4 trillion deficit we ran at the peak of the 2008 financial crisis look puny.

Other free-market economists who spoke to The Dispatch largely agreed with Grezler’s perspective.

“We need to take a deep breath in terms of ‘stimulus,’ Cato Institute Senior Fellow Michael D. Tanner told me in an interview. “What’s going to fix the economy is not simply pumping money into it or some program. It’s going to be getting rid of the virus.”

As far as the back-to-work bonus itself is concerned, Tanner says it’s certainly better than the status quo of paying people more not to work, but he still raises an eyebrow at the proposal.

“I’m not crazy about [the bonus proposal], but as an alternative to the [supercharged] unemployment benefits I think it’s a step in the right direction,” Tanner said. “It does create a better set of incentives in terms of getting people back to work.”

“But getting a paycheck should be an incentive to get back to work,” he said. “This [bonus] is just a Keynesian stimulus by another name, a way of pushing more money into the economy. I’m skeptical of the history of that generally.”

Tanner said that money allocated for testing, contact tracing, or other measures that actually address the virus—the root cause of our economic distress—will do more to restore the economy than any of what he called the “bandaid” stimulus efforts. Other experts share this sentiment, and reject back-to-work bonuses as missing the point.

“This idea doesn’t make much sense,” R Street Institute Director of Fiscal and Budget Policy Jonathan Bydlak told me. “It’s important to remember that people were out of work in response to the virus, not because there was anything inherently wrong with the U.S. labor market. Sectors of the economy were forced to shut down in response, but prior to the virus, the fundamentals of the U.S. economy were actually very strong.”

“For this reason, there’s no real need to provide incentive for people to go back to work, and providing a bonus is unlikely to decrease unemployment or rebound the economy,” Bydlak said. “When businesses are able to safely reopen, jobs are likely to be plentiful. To the extent that they want to be involved, policymakers generally should focus on providing relief to get Americans through this exogenous shock, not try to stimulate at a time when the economy has been deliberately shut down.”

“Given our record deficit for this year, we need to be very careful that we do not undertake responses to the virus that undermine our ability to rebound once the virus is controlled,” Bydlak concluded. “Running deficits unnecessarily would only jeopardize the recovery and replace the coronavirus crisis with a fiscal one.”

Brad Polumbo (@Brad_Polumbo) is a freelance journalist and a contributor to The Dispatch.

Photograph by Olivier Douliery/AFP/Getty Images.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.