Happy Friday! We hope you have a great weekend! Be sure to tune into CNN at 9 a.m. ET Sunday to watch Jonah on State of the Union, but don’t forget to flip channels to NBC News by 10:30 a.m. ET to catch Steve on Meet The Press.

Quick Hits: Today’s Top Stories

- President Donald Trump signed an executive order on Thursday night setting previously unannounced tariff rates for dozens of countries. The order—which said the duties will take effect on August 7, an extension of the previous deadline of August 1—said that countries not mentioned would face a 10 percent baseline levy. For countries with which the U.S. has a trade deficit, the rate will be at least 15 percent. If goods are determined to have been transhipped to avoid taxation, the order went on, an additional 40 percent tax will be added. Also on Thursday, President Trump raised Canada’s tariff rate from 25 to 35 percent, excluding goods covered by the U.S.-Mexico-Canada Agreement (USMCA).

- Trump on Thursday announced plans to extend Mexico’s tariff deadline by 90 days, giving the country additional time to reach a trade deal with the White House. Trump had previously threatened to raise Mexico’s import tax to 30 percent on August 1, up from the 25 percent tariff on goods not covered by the USMCA. “The complexities of a Deal with Mexico are somewhat different than other Nations because of both the problems, and assets, of the Border,” Trump said in a post on Truth Social. He added that, in exchange for the deadline extension, Mexico had agreed to lift its non-tariff trade barriers on the United States.

- Several Arab nations—including Qatar, Saudi Arabia, and Egypt—demanded Hamas disarm and surrender in Gaza in a joint statement signed at a United Nations conference on Tuesday. The declaration—which was backed by the entire Arab League, the European Union, and 17 other countries—condemned Hamas’ October 7, 2023, attack on Israel, in a first for most of the Arab state signatories. It also called for a two-state solution, arguing that “governance, law enforcement and security across all Palestinian territory” should “lie solely” with the Palestinian Authority.

- The State Department announced Thursday that it would deny visas to Palestinian Authority officials and members of the Palestine Liberation Organization. In a statement, the department cited the groups’ alleged support of terrorism, incitement of violence, and attempts to prosecute Israel in international courts. The move comes as several U.S. allies, including the U.K. and France, have said they will take steps to officially recognize Palestinian statehood.

- Lithuanian Prime Minister Gintautas Paluckas on Thursday announced his resignation amid accusations of unethical business practices. Paluckas, who has been in office for less than a year, is facing an investigation after his sister-in-law’s company allegedly received EU funding before entering into a contract with Paluckas. The president of Lithuania previously gave the prime minister two weeks to either answer questions about his finances or resign. Paluckas continues to deny wrongdoing, saying he decided to step down because the scandals were “bogging down the work of the government.”

- Trump on Thursday sent letters to the CEOs of 17 top pharmaceutical companies—including Eli Lilly, Pfizer, and Novo Nordisk—calling for them to cut U.S. prices within the next 60 days. The letters included demands that the drugmakers offer “most favored nation” pricing for newly launched drugs and to Medicaid patients, which would tie the price of some pharmaceuticals sold in America to the lesser cost at which they are typically sold abroad. Should the companies refuse, Trump threatened to “deploy every tool in our arsenal” to protect Americans from unfair pharmaceutical pricing. The letters followed the president’s May executive order calling for most favored nation pricing and alluding to possible penalties for drug companies.

- The Federal Reserve’s preferred measure of inflation, the personal consumption expenditures (PCE) price index, increased 2.6 percent year-over-year in June, the Bureau of Economic Analysis reported Thursday—up from a 2.4 percent annual rate one month earlier. After stripping out more volatile food and energy prices, core PCE increased at a 2.8 percent annual rate in June, slightly higher than economists’ expectations. Consumer spending, meanwhile, rose 0.3 percent in June.

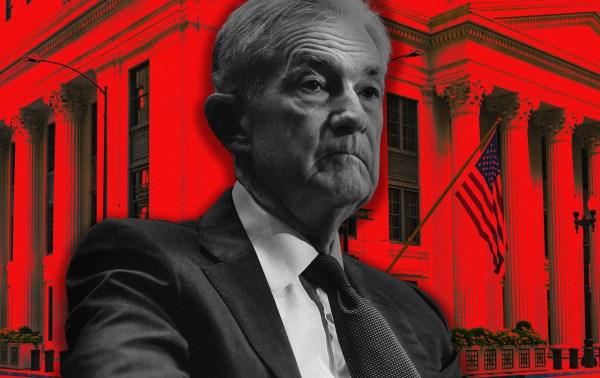

The Fed Confronts Tariff Turmoil

There’s a fundamental dilemma facing the Federal Reserve and its chairman, Jerome Powell, and it’s not necessarily related to President Donald Trump’s recent attacks on the central bank. Instead, members of the board of governors are debating whether the economy is still too “hot” to cut interest rates or it’s in the early stages of a cooling process, wherein cutting rates too slowly could hinder growth.

On Wednesday, the Fed chose to do, well, nothing. Powell announced plans to hold rates steady at a range of 4.25-4.5 percent for the fifth time in a row, following a 9-2 vote by the Federal Open Market Committee. Coming on the heels of the White House’s renewed calls for Powell to cut rates, the move was a sign that the central bank remains independent from the executive’s wishes. But the decision to keep interest rates unchanged has more to do with the profound uncertainty about the state of the U.S. economy, as inflation remains high and the threat of sweeping tariffs looms. On Thursday night, Trump announced a series of modified tariffs set to take effect in one week.

In recent weeks, it appeared the Trump administration may have been laying the groundwork to fire Powell. The Office of Management and Budget, headed by Russell Vought, initiated an investigation earlier this month into cost overruns for ongoing renovations of the Fed’s headquarters, which many observers interpreted as a potential pretext for firing the chairman for cause. The saga culminated in a highly unusual visit by Trump and Powell to the renovation site, during which the Fed chairman shook his head in disagreement as the president claimed that the project had further exceeded its $2.5 billion budget.

Trump, however, has repeatedly said that he has no current plans to fire Powell. But that didn’t stop him from venting his frustration after the Fed’s latest decision to leave rates unchanged. “He is TOO LATE, and actually, TOO ANGRY, TOO STUPID, & TOO POLITICAL, to have the job of Fed Chair,” Trump wrote on social media Thursday, blaming Powell for the move (which was, to be clear, made by the entire board). “He is costing our Country TRILLIONS OF DOLLARS, in addition to one of the most incompetent, or corrupt, renovations of a building(s) in the history of construction.”

The subject of Trump’s ire appeared unmoved. During his press conference following the Fed’s decision, Powell argued that there were no obvious signs that the economy was weakening enough to justify a rate cut. “Despite elevated uncertainty, the economy is in a solid position,” he stated. “For the time being, we are well-positioned to learn more about the likely course of the economy and the evolving balance of risks before adjusting our policy stance.”

Translated from Fed-speak: It’s simply too early to say whether possible cracks are emerging in a fairly strong economy. “Growth in the first half of the year was slow, which says you should cut interest rates, and inflation in the first half of the year was high, which says you should raise interest rates,” Jason Furman, a professor of economics at Harvard University and former chair of the Council of Economic Advisors, told TMD. A Wednesday report from the Bureau of Economic Analysis found that the U.S. economy grew at a 3 percent rate in the second quarter, reversing a 0.5 percent decline in the first quarter.

Both numbers, however, are largely due to the fact that imports spiked in the first quarter as businesses sought to stockpile goods in advance of increasing tariffs, and then fell sharply in the second quarter. Imports are subtracted from GDP as a way to calculate overall economic production, even if a “contraction” caused by a sharp rise in imports is more about mathematics than underlying economic reality.

These sorts of mixed messages have made the debate on the Fed board a battle between those who favor proactivity and those who, like Powell, are adopting a more reactive approach. Multiple members of the rate-setting committee disagreeing with a policy decision has not happened since 1993, a development which some experts greeted as an encouraging sign of healthy debate, as well as a reflection of the difficulty of the decision facing the Fed.

“I think it’s healthy,” said David Beckworth, the head of the monetary policy program at George Mason University’s Mercatus Center, pointing to the fact that other central banks like the Bank of England often feature more public division than the Fed. “To pretend these things are obvious is, I think, as a general matter wrong,” Furman agreed.

Christopher Waller and Michelle Bowman, the two dissenters, have argued that the Fed is at risk of being caught flat-footed by rising unemployment. “With inflation near target and the upside risks to inflation limited, we should not wait until the labor market deteriorates before we cut the policy rate,” said Waller in a speech at New York University earlier this month.

However, near target is not the same thing as on target. The Fed’s preferred inflation measure, the Personal Consumption Expenditures index, was released on Thursday by the Commerce Department, showing inflation at 2.6 percent, stubbornly above the Fed’s 2 percent target. In June, the measure rose 0.3 percent month-over-month, a slight uptick from May’s rate. Excluding volatile food and energy prices, the 12-month inflation rate was at 2.8 percent.

Why, then, does Waller think the time is ripe for a rate cut? As he argued in his NYU speech, there is some evidence that the U.S. economy’s “momentum has slowed significantly.” Waller pointed to a slower rate of growth for consumer spending, slowing retail sales, and decidedly uncertain business sentiment. He also noted that private payroll employment growth has dropped substantially, declaring that the numbers were “near stall speed and flashing red.”

The effect of Trump’s tariff policies on the economy is another major source of uncertainty for the board of governors. “The data point to very small goods price increases relative to the size of the tariff rates,” said Waller, predicting that any increase in prices caused by tariffs would fade after roughly a year. In his press conference, Powell was more uncertain. “Higher tariffs have begun to show through more clearly to prices of some goods, but their overall effects on economic activity and inflation remain to be seen,” he said. “But it is also possible that the inflationary effects could instead be more persistent.”

The decision to hold rates steady tamped down on investors’ expectations of a rate cut in September, with many anticipating that the Fed’s wait-and-see approach could last for some time yet. The Fedwatch tool, published by the CME group, put the chance of lower rates next month at around 38 percent as of Thursday afternoon.

Last night was also the deadline set by Trump for a host of countries around the world to either make trade deals with the U.S. or face steep tariffs. Just after 7 p.m. ET, Trump issued an executive order outlining a new tariff regime: A baseline rate of 10 percent will be imposed on countries with which the U.S. has a trade surplus, which is most countries in the world. But for countries with which the U.S. has a trade deficit, or that the administration determines are engaging in unfair trade practices, new tariffs are at least 15 percent and as high as 41 percent, outlined in a table that includes roughly 70 countries and territories and the European Union.

And some countries secured extensions ahead of Trump’s announcement. Mexico, the U.S.’s largest trading partner, received a 90-day extension just hours before tariffs were set to go into effect, although the pre-existing 25 percent tariff on all goods from Mexico not covered by the U.S.-Mexico-Canada (USMCA) trade agreement will remain. “Within this new world trade order, we have the best possible agreement,” Mexican President Claudia Sheinbaum told reporters. China had also already negotiated an August 12 deadline to reach a trade deal with Washington.

The pause with Mexico left Canada as the only major U.S. trading partner without either a trade deal or more time to continue negotiating. And later in the evening, Canada’s position only got worse. Trump announced that the U.S. would impose a 35 percent tariff on all goods not covered by the USMCA, citing Canada’s alleged “continued failure” to stop the flow of drugs across the northern border. The new rate went into effect this morning.

What does this all mean for the Fed? Essentially, even more uncertainty. If Trump’s latest duties take effect next week, the U.S. will have imposed significantly higher tariffs on the rest of the world. While economists debate the extent to which tariffs will raise prices and how long those inflationary effects will last, nearly all agree that the sweeping taxes on imports will be felt in some way by the American consumer.

With the tariff deadline having come and gone (and in some cases, been extended), the Fed continues to gaze at a murky economic picture. “Some of the trade issues have been settled, but some of them haven’t,” said Furman. “There’s a huge amount of uncertainty about how the trade stuff will affect the economy.” For now, Powell and most of his fellow committee members have decided that they need to wait.

Today’s Must-Read

How the Second Great Awakening Helped Make America

Toeing the Company Line

The EU Didn’t Cave to Trump on Trade. It Bought Time.

Trump’s EU Trade Deal Could Cork the U.S. Wine Industry

The Autopen Is Popular—and Bipartisan

There Is No Palestinian State

What We Got Wrong in July

Tired of All This Winning

Worth Your Time

- Writing for Law & Liberty, Dominic Pino offered a thoughtful critique of Derek Thompson and Ezra Klein’s book Abundance. “‘We’ is the main character of Abundance. Klein and Thompson must use the word hundreds of times in the book, as it often appears multiple times per page. By the end of a book, the reader should be able to confidently say who the main character is, but I have no such confidence. The end result is that the book isn’t about anyone, so it isn’t telling anyone to do anything,” Pino wrote. “Individuals are the ultimate decision-makers in a society. They are naturally part of groups (families) and often choose to organize themselves into other groups (corporations, governments, religious institutions, etc.) in ways that are healthy and beneficial. But individuals in the end have to choose to show up to work, use their brains to come up with new ideas, and persuade others that those ideas are worth developing. One reliable way to get other people to do things for you is to allow them to make money from doing it. And there is already a mechanism by which that happens: markets. People get paid for coming up with good ideas and providing goods and services that make other people’s lives better. The development and expansion of markets around the world have delivered more abundance than thousands of years’ worth of human thought possible.”

- This month, the federal government announced that an impostor used artificial intelligence technology to mimic Secretary of State Marco Rubio’s voice and writing style and contact foreign ministers and American politicians. “The Rubio incident is no longer a rarity. It is a warning shot,” Jennifer Ewbank argued for The Cipher Brief: “Indeed, that same week a foreign president, a scientist, actors, singers, a military officer, a group of high school girls, numerous senior citizens and more were also targeted. Adversaries, whether state-sponsored or criminal, are now using hyper-realistic deepfakes to reach targets in virtually every sector of society. Unlike traditional espionage, which seeks out specific intelligence information, deepfakes aim at something even more corrosive: trust itself. They work not by stealing secrets, but by deceiving targets and leaving behind doubt,” she wrote. “On the national level, the implications are profound. Deepfakes can drive wedges through an already polarized society. Imagine a synthetic video of a U.S. general announcing unauthorized troop movements, or an AI-generated call from a member of Congress confirming a fabricated scandal. Even if debunked, the damage would linger. Adversaries understand that doubt can be as powerful as persuasion, and that false narratives, repeated widely, can erode institutional credibility far faster than it can be repaired.”

Presented Without Comment

Reuters: Trump to Start Building $200 Million White House Ballroom in September

Also Presented Without Comment

Washington Post: GOP Senators Reject Trump’s Pitch To Use Tariff Revenue for ‘Rebates’

In the Zeitgeist

The first trailer for Blue Moon—a Richard Linklater drama starring Ethan Hawke, Margaret Qualley, and Andrew Scott—debuted this week. The film, which hits American theaters in October, first premiered at the Berlin International Film Festival with stellar reviews.

Let Us Know

Have you had any encounters with deepfakes?

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.