The U.S. has hit its debt ceiling, and Treasury Secretary Janet Yellen has enacted “extraordinary measures” to keep the government out of default—buying Congress a few months to come up with a solution. Republicans have vowed to vote to raise the debt ceiling only in return for spending cuts. Most have been reluctant to identify specific cuts, and some have said they would oppose cuts to entitlements or defense spending, leaving little actual room for meaningful reductions.

One factor that contributes to this problem is that Americans generally do not know how their tax money is spent. Worse, they think they know: Polls have shown that Americans consistently overestimate foreign aid spending, with the average respondent guessing that the U.S. spends 25 percent or more of its tax revenue on foreign aid. (The correct answer is 1 percent.) American voters also believe that children, working-age adults, and seniors receive the same share of federal spending, whereas the reality is that seniors receive more than half. More recently, a talking point on the right is that the U.S. should balance the budget rather than provide aid to Ukraine. But the U.S. allotted only $50 billion for Ukraine in 2022, compared to a $1.375 trillion deficit the same year.

This lack of understanding has a great impact on the political debate. When voters don’t understand how their tax money is spent, their fiscal political priorities become misguided. This influences their voting, encouraging them to elect representatives who champion symbolic sending cuts rather than structural reforms. Voters who believe that foreign aid, or Ukraine assistance, or education make up such a great portion of federal spending that the budget could be balanced if they were cut, are very unlikely to support the kind of entitlement spending reforms that will be necessary to balance the budget long-term.

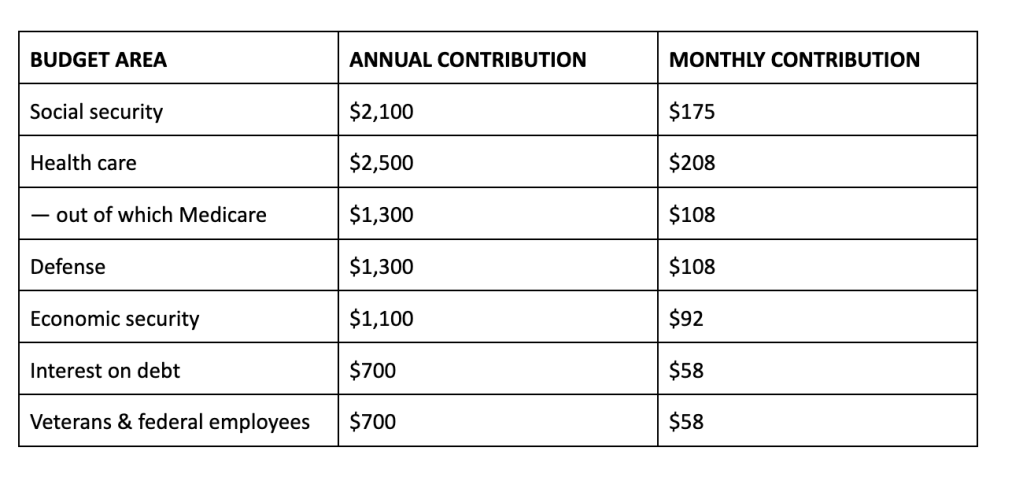

What if the IRS sent back a receipt to each taxpayer, showing how the tax money they personally have paid over the year has been spent? Here’s how it would work. The receipt would show much an individual taxpayer had contributed monthly and annually to each federal spending area. Since the government already knows how much each person has paid in taxes, and how much it spends on different areas, creating this receipt is actually rather straightforward. Suppose a taxpayer has paid $10,000 in federal taxes (including payroll taxes) over the year. This taxpayer’s receipt might look like this:

This receipt is based on the percentage the government spends on these different areas. The above is merely meant as an example and an actual receipt would also include other items. For added clarity, the receipt could also include a final line showing how much the deficit increased that year per taxpayer (annually and monthly).

In addition to sending all taxpayers an annual paper receipt, the government could also set up a tax receipt website. There are countless tax calculators on the internet that help people estimate how much they can expect to pay in taxes. This website would be similar, but would tell users not just how much they are paying but how that money is spent.

The website should also allow people to share their receipts, or parts of their receipts, on social media. This would help people realize how much or how little they have been paying toward any given budget area. Soon, Twitter and other platforms would be buzzing with users saying stuff like “Apparently I’m paying $100/month for our economic security programs, where’s that money going?”, or “I can’t believe the national parks only cost me $0.60/month, that’s a steal.”. People may still not agree on what and how much the government should spend money on, but at least now the discussion would be based on facts, as opposed to misguided beliefs on where American tax money is being spent. That makes for a far more constructive, healthy debate. The website would also be a useful counter to claims that insignificant programs could be cut to balance the budget. If you want to confirm for yourself that the Ukraine aid likely does not cost you any more than your Netflix subscription, just check the tax receipt website.

In fact, while a paper receipt would have to be issued by the government, this kind of website could be created by an organization. The U.S. is fortunate to be home to many competent think tanks advocating for fiscal sanity. Any one of them could make this happen.

The problem of voters misunderstanding how their tax dollars are spent is not unique to Americans. Psychologically speaking, humans tend to struggle to comprehend and interpret large numbers of the size that we don’t deal with in our everyday life. Federal spending, naturally, involves almost exclusively large numbers: Trillions, billions and millions. The difference between a million and a trillion is a factor of one million, but humans struggle to comprehend that. The $61.7 billion that will be spent on foreign aid in 2023 sounds absolutely massive. So does the $1.375 trillion deficit for the year of 2022. Basic math tells us that one of these numbers is more than 22 times bigger than the other, but the human mind struggles with the comparison.That is why it is not enough to tell people how much the government spends in total, as the numbers are meaningless to them. The federal government, in the interest of transparency, needs to tell people how much they pay toward each budget item.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.