The U.S. Food and Drug Administration’s January 5 decision to allow Florida to import prescription drugs from Canada opens the door for other states to increase supply in their markets and reduce costs for consumers as political pressure on the pharmaceutical industry builds.

But some lawmakers are also eyeing the groups that often help broker deals between pharmacies, drug companies, and health insurers: pharmacy benefit managers (PBMs).

Why did Florida petition to import drugs?

The FDA’s decision marks the first time it has authorized a state to import drugs in bulk from a foreign country. Eight other states have passed laws to do so but are awaiting federal approval.

In Florida’s case, these pharmaceuticals will be distributed to patients receiving care for chronic diseases through public programs. According to a statement from the office of Gov. Ron DeSantis, the medications include those for certain conditions—HIV/AIDS, mental illness, prostate cancer, and urea cycle disorder—and will be for individuals receiving care through the Agency for Persons with Disabilities, Department of Children and Families, Department of Corrections, and Department of Health, with plans to expand to Medicaid enrollees. But state authorities will need to provide drug-specific information for review and approval by the FDA, test for authenticity and compliance with the drug specifications and standards set by the FDA, relabel those drugs with FDA-approved labels, and submit reports to the FDA each quarter on cost saving and potential safety and quality issues.

Prescription drug prices are two to four times higher in the United States than in countries such as Australia, France, and Canada. Federal action to reduce consumers’ costs started under former President Donald Trump’s 2020 plan allowing states and Native American tribes to submit proposals to import drugs from other countries. Then a Biden administration executive order in 2021 encouraged the FDA to work with states and tribes to import safe and less expensive drugs from Canada.

Florida first applied for permission to import from Canada in November 2020. This month’s decision allows it to do so for two years from the date of the first shipment of imports. The program will then expand to include providing imported prescription drugs for Medicaid members across the state.

What do critics say?

The pharmaceutical industry objects to the initiative, citing concerns with safety, strain on law enforcement investigating counterfeit drugs, and questions about the actual cost reduction to the consumers. The industry states that the costs associated with the requirements for importation could counteract savings. The requirements for importation include a pre-import request, reporting, quality testing, and drug labeling according to FDA standards.

The Canadian government has criticized the initiative and responded by stating that it “has been clear in its position: bulk importation will not provide an effective solution to the problem of high drug prices in the U.S.”

Canadian officials have also said they will ensure there are no drug shortages or price increases for Canadians. “Canada has strong regulations in place to protect supply,” Canadian Health Minister Mark Holland said after the decision. “Canadians can be confident that our government will continue to take all necessary measures to protect the drug supply in Canada.” To this end, in order to protect drugs from shortages, Health Canada stated that the department “will not hesitate to take immediate action to address non-compliance, ranging from requesting a plan for corrective measures, issuing a public advisory or other forms of communication, to taking action on the licenses of regulated parties who contravene the export prohibition if warranted.”

Will this bring prices down?

Despite the debate on the efficacy of the initiative, other U.S. states may follow suit. But policy experts state that it is unlikely that there will be a noticeable difference to any consumer’s pocketbooks, particularly before November 2024. With the population of the United States 10 times larger than Canada’s and the Canadian government’s willingness to place limits on certain drug exports, it is more likely this gives insurance companies negotiation leverage with pharmaceutical companies. In addition, analysts believe that if states would use a multi-pronged approach to cost reduction for pharmaceuticals, such as affordability review boards and caps on co-pay costs, then consumers could see a positive impact.

This situation highlights the fact that prescription drug costs are lower in countries with government-run health care programs that negotiate prices for prescription medications. Some industry insiders say the United States’ complex prescription drug pricing system drives costs higher.

What are pharmacy benefit managers?

Pharmacy benefit managers have a major impact on pharmacy services by acting as intermediaries between pharmacies, plan sponsors (insurance companies and employers), pharmaceutical manufacturers, and drug wholesalers. Their core functions include the development and maintenance of the drug formulary (formulas that determine which drugs are covered by insurance and which are not, and how much they are going to cost), utilization management (guidelines for prior authorization, step therapy requirements, supply limits and various financial incentives such as deductibles, co-payments, and co-insurance), as well as price negotiations with drug manufacturers (including brand and generic drugs, and rebates/discounts), wholesalers, and pharmacies. Price transparency is a significant concern for consumers as net prices are known to the plan sponsor (through the contracting process) but are not publicly available.

PBMs also manage pharmacy networks and mail order pharmacies. And in some cases, PBMs own pharmacies and encourage the utilization of their pharmacies in insurance carriers’ networks.

Three PBMs control 80 percent of U.S. market share, calculated by processed prescription claims. These three largest PBMs are part of the three of the top health insurance companies in the United States: CVS Caremark (a subsidiary of CVS Health and Aetna), Express Scripts (owned by Cigna) and Optum Rx (owned by UnitedHealth Group).

Is the government intervening with PBMs?

In June 2022, the U.S. Federal Trade Commission opened an investigation into the effect of PBMs on the affordability and availability of prescription drugs to U.S. consumers. But at both state and federal levels, legislation regarding PBMs is gaining bipartisan support.

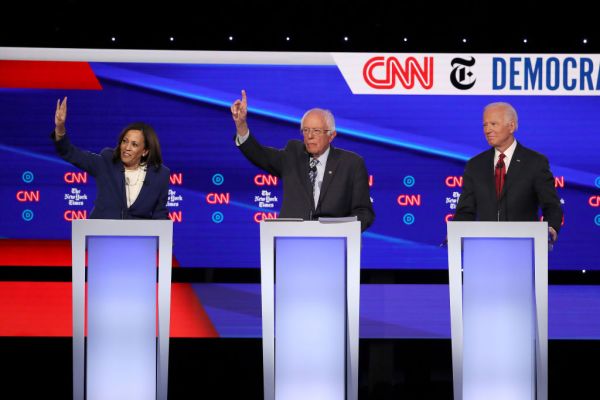

Two bills—the Pharmacy Benefit Manager Transparency Act of 2023 introduced by Sens. Maria Cantwell and Chuck Grassley and the Pharmacy Benefit Manager Reform Act introduced by Sens. Bernie Sanders, Bill Cassidy, Roger Marshall, and Patty Murray—are focused on price transparency and PBM oversight.

On December 11, 2023, the House passed the Lower Costs, More Transparency Act in a 320-71 vote. It includes price transparency and annual reporting requirements for hospitals, as well as clinical laboratories, imaging service providers, and ambulatory surgical centers that participate in Medicare. The bill also requires PBMs to provide semiannual reports to health plan sponsors, including information related to fees, rebates, and spending for covered drugs. Contracts with PBMs for employer-sponsored health plans must also allow health plans to be able to audit certain claims and cost information “without undue restriction.”

The bill requires pass-through pricing models and prohibits spread pricing for payment arrangements with PBMs under Medicaid. Simply put, spread pricing is the practice in which a PBM charges a managed care organization more for a drug than the amount a PBM pays a pharmacy. The PBM keeps the profit instead of passing the full payment to the pharmacy. Simplicity and transparency are the primary advantages of the pass-through model, so that payers can more easily separate and compare the drug cost and administrative fees from PBMs.

The bill is awaiting action in the Senate.

In addition, all 50 states have passed legislation in the past five years to regulate PBMs. A recent example is Florida’s Prescription Drug Reform Act, passed last year and effective as of January 1, which requires price transparency, a pass-through model instead of spread pricing, and provides protections for pharmaceutical customers, including requiring reporting of drug price increases for public access on the Florida HealthFinder/MyFloridaRx website.

Is government intervention the only way to address the role PBMs play in the market?

Recent business developments in the pharmaceutical industry are increasing competition and could bring consumers prices down. For example, Eli Lilly, Novo Nordisk, and Sanofi have reduced list prices for insulin products by 75 percent and instituted a monthly cost cap of $35 for both insured and uninsured patients.

Certain companies make their primary business finding drugs for consumers at reduced prices. GoodRx, for example, offers competitive prices to direct-pay patients for generic pharmaceuticals, and OptumRx recently developed a solution called Price Edge in an effort to lower out-of-pocket spending for patients. The RxPass Program by Amazon Pharmacy offers a $5 per month subscription using its own PBM for transactions. And Mark Cuban Cost Plus Drug Company offers generic drugs at cash prices. The growth of such companies is a result of for-profit businesses seeking to meet consumer demand for lower-cost drugs. But it could spark a larger move away from PBMs.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.