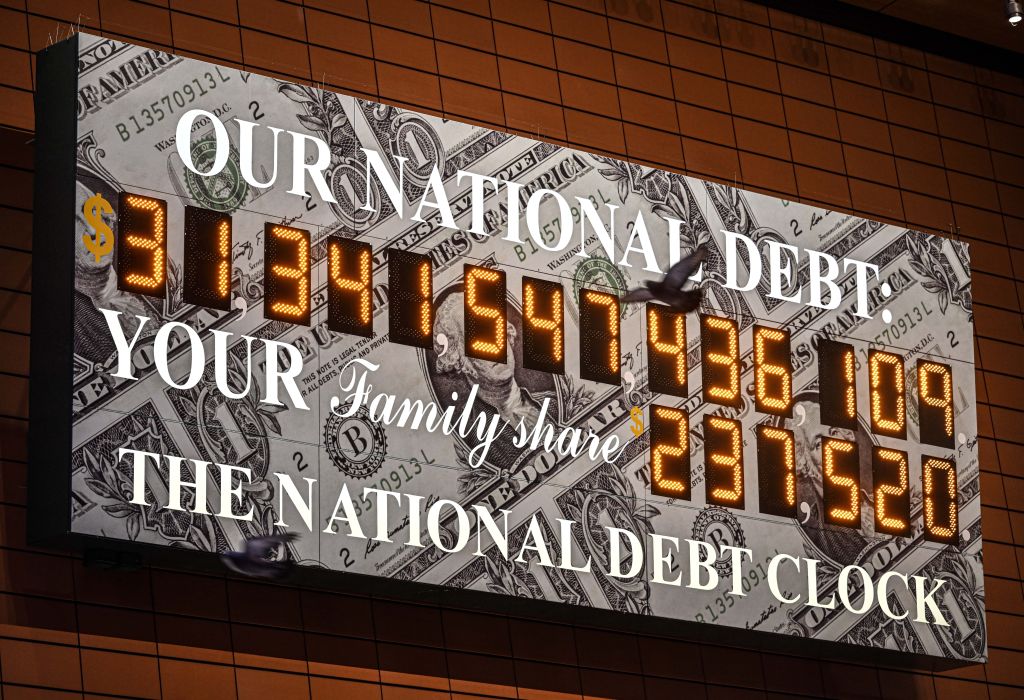

Happy Debt Ceiling Day to all who celebrate.

This morning Treasury Secretary Janet Yellen took “extraordinary measures” to continue paying Uncle Sam’s bills, a misnomer given that there’s nothing very extraordinary about it. By Josh Barro’s count, the Treasury Department has had to resort to extraordinary measures seven times in the past 12 years. That’s what happens when the ordinary way of making good on our obligations, i.e., Congress voting to raise the debt ceiling, is no longer ordinary.

Few occasions put me in a “late republic” mood the way Debt Ceiling Day does. It’s one thing for government to prove inept at solving crises that are foisted upon it, it’s quite another for government to manufacture those crises itself. Lunging from cliffhanger to cliffhanger, emergency to emergency, the Greatest Country in the World continues to tempt fate in the belief that nothing really bad can happen by racking up unsustainable debt and then trying to manage it through spasms of high-stakes standoffs.

Treasury’s arsenal of “extraordinary measures” isn’t limitless. If they run out this summer before the debt ceiling is raised legislatively, the U.S. government will no longer be able to pay all of its creditors. Global faith in the world’s most reliable debtor would tremble, markets would tank, American citizens who depend on federal payments to survive might be temporarily cut off, and our sovereign debt could be downgraded, requiring higher interest payments on that debt going forward.

It’s a fiscal doomsday scenario. Many a House Republican seems willing, even eager, to chance it.

Twelve years ago the new Republican majority in the House took the debt ceiling hostage to extract spending concessions from Barack Obama and struck a deal before the limit was breached. I covered that crisis at my old haunt, and while there were sweaty moments, I confess that I never believed they’d go nuclear. They didn’t want to breach the debt ceiling, they wanted to make a point about the urgency of curtailing runaway spending. Their point was made.

I don’t feel that way about the coming crisis. The nuts in the new House majority are really going to do it.

Trump is egging them on, probably because he thinks a Republican-driven fiscal calamity will be blamed by voters on Joe Biden, improving Trump’s odds of reelection in 2024. The true-blue deficit hawks in the House may believe that their failure to restrain spending after the near-miss of 2011 requires embracing the catastrophe this time. And the populist Joker wing, the Matt Gaetzes and Marjorie Taylor Greenes, are likely treating the standoff as a test of their resolve to disrupt business as usual in Washington: “The ‘elites’ think we don’t have the stones to breach the debt ceiling. Just watch.”

To avert a crisis like the one that’s approaching would require a speaker with nerve, command of his caucus, and no small amount of political skill. That is not the speaker we have, to put it mildly.

We’re barreling toward a cliff and the people in the driver’s seat have no intention of changing course. But there’s a way cooler heads can jerk the wheel in time.

Before we get to that, let’s take a moment to appreciate the stupidity and futility of this gambit.

Observing the 2011 standoff, one could believe that the Tea Party House majority sincerely viewed the national debt as a dire crisis that had to be addressed immediately, with brinkmanship if need be. Staunch deficit hawks like Mick Mulvaney said what they meant and meant what they said about unsustainable spending. Eight years later, Mulvaney was acting chief of staff to a Republican president who had abandoned any pretense of budget discipline. When Trump previewed his State of the Union address for a group of GOP supporters in 2019, Mulvaney reportedly addressed the speech’s conspicuous silence about budget deficits with two words to Trump’s audience: “Nobody cares.” There’ll never be a more succinct example of Republicans’ essential fraudulence on spending.

It is, in short, ridiculous to now watch post-Trump Republicans preen about spending, let alone move toward an avoidable debt ceiling debacle in the name of reining it in. In this case Marx was right: History repeats itself, first as tragedy and again as farce.

Under Trump, whose party enjoyed total control of government for half of his term in office, the national debt ballooned by $4.7 trillion—before the pandemic began. “When being fiscally conservative is rebellious and disruptive, they’ll strap on their green eyeshades,” Jonah Goldberg wrote yesterday of Republicans. “But when one of their leaders is in power, out comes the credit card.” Their alleged concern about spending is transparently little more than a cudgel with which to beat Democrats. If it wasn’t, they would have capitalized on the roaring economy in 2017 and 2018 to impose some fiscal restraint.

As a case in point, how seriously are we to take Chip Roy, a supposedly serious fiscal conservative and ardent champion of using the debt ceiling as leverage, when he’s babbling about “woke, weaponized, and wasteful spending”? It would be nice to be rid of wasteful spending, yes, but it ain’t wasteful spending that’s cannibalizing the federal budget. It’s entitlements. A debt ceiling breach would be reckless even if the goal were to force much-needed entitlement reform but forcing one to rein in “woke” spending feels like a progressive satire of conservative priorities.

If Republicans were sincere about balancing the budget, they wouldn’t resort to hostage-taking every time they decide that it’s time to tighten the national belt. The way to cut spending and make it stick is to do so incrementally and judiciously, writes Brian Riedl, not via the crash-diet tactics preferred by House conservatives. The party has “behaved like an overeating person who occasionally tires of being overweight and makes an impossible promise to lose 100 pounds in six months, before quickly realizing that such a promise is unrealistic and then returning to overeating,” he observes. If anything, the inevitable voter backlash to Republican brinkmanship this summer will make the GOP’s next spending binge worse as it tries to overcompensate for its prior austerity.

But lay all that aside. Imagine that, despite Roy’s blithe assurances, the standoff with Democrats leads to us hitting the debt ceiling. Would Republicans at least get some spending cuts out of it?

Almost certainly not. As we near doomsday and markets begin to panic, sane Republicans in Washington will begin to panic too. After the S&P 500 drops, taking millions of 401(k)s with it, pressure on McCarthy and the GOP to end the crisis immediately by passing a clean debt ceiling hike will grow immense. The federal government will be thrown into chaos as the White House scrambles for creative ways to instantly restore America’s creditworthiness. ”Mint the coin?” Declare the debt ceiling unconstitutional? Issue emergency premium bonds?

The House GOP has its own stopgap solution in mind for when the crisis strikes, a new law instructing Treasury on how to prioritize the funding of U.S. obligations once it runs out of its ability to borrow money. In theory that would protect America’s creditworthiness by ordering Yellen to make sure holders of U.S. securities receive their interest payments on time while debt ceiling negotiations drag on. In practice, though, it would create a political nightmare for the GOP by forcing the Treasury to freeze spending on federal programs like Medicaid so that foreign creditors like Chinese banks can get paid. “Any plan to pay bondholders but not fund school lunches or the FAA or food safety or XYZ is just target practice for us,” one Democratic aide recently told the Washington Post.

Prioritization might not be logistically possible given the enormous volume and complexity of payments the federal government makes. And even if it worked, it’s likely that U.S. securities would be downgraded anyway as global investors reassessed what they thought they knew about the full faith and credit of the U.S. government. Result: The feds would be forced to pay higher interest rates on treasuries in the future. Which, ironically, would make America’s debt burden worse.

In short, breaching the debt ceiling would be an unserious solution to a very serious problem masterminded by a thoroughly unserious party.

But there’s a way out. Maybe?

Have you heard of a discharge petition? If not, don’t worry. By summer, we’ll all be experts on the ins and outs.

A discharge petition is a procedural mechanism in the House to force a floor vote on a bill. Typically the speaker decides whether legislation comes to the floor, but if 218 members get together and sign a petition they can go over his head and work their will. Given that Kevin McCarthy reportedly promised the Freedom Caucus that he won’t try to raise the debt ceiling without spending concessions from Democrats, being able to pass legislation without the speaker’s support has suddenly become quite important to America’s fiscal stability.

Eighteen House Republicans represent districts won by Joe Biden in 2020. If six of them are willing to join with 212 Democrats, the debt ceiling can be raised whether McCarthy, Chip Roy, and Matt Gaetz like it or not.

Sounds easy. It isn’t, procedurally or politically.

A discharge petition can’t be filed at the last minute before the debt ceiling is breached. House rules require a waiting period—a long one. First it sits in committee for 30 legislative days, then signatories have to wait another seven legislative days before they can formally introduce it. The speaker then has two legislative days to schedule the motion for a vote.

Note that I wrote “legislative days,” not “days.” A legislative day isn’t a calendar day; it only counts if Congress is working, and long days that stretch into the next without an adjournment are counted as one. It’ll take months, in other words, for 39 legislative days to pass. And months are all we have before the debt ceiling is breached sometime this summer.

So why don’t six moderate Republicans get together with Democrats to file a discharge petition right now and start the wheels turning? It’d be a rare example of them demonstrating something resembling, well, balls.

The non-MAGA majority of the GOP House caucus talks a good game about balancing the Joker wing but all indications thus far are that they’ll continue to be cowed into submission by populists, as usual. You may, for instance, have seen Rep. Nancy Mace in one of her umpteen interviews this month complaining about the rules package that McCarthy negotiated with the Jokers or the fact that the party has prioritized pro-life legislation in the House despite the damage abortion did to Republicans in the midterms. In the end she was all talk. Mace voted for both the rules package and the abortion bills, just like she voted against impeachment in 2021 after weeks of rhetoric about how troubled she was by Trump’s “rigged election” nonsense.

The moderates always bend. Partly that’s because they’re “team players” who dislike it when the caucus is perceived as being at odds, in contrast to performance artists like Gaetz who relish the attention that comes with dissension. The moderates aren’t willing to take the party hostage and shoot it; populists like Gaetz are, so they tend to get their way. From that simple fact flows more or less everything you need to know about the GOP since 2016.

Mostly, though, the moderates are worried about their next primary. Representing a district won by Biden gives you a little more room to maneuver toward the center, but only a little. If you disappoint the right on a huge vote, you’ll never make it to the general election. And the debt ceiling crisis is the hugest vote by far of the coming term. Some 66 percent of Republican voters oppose raising the ceiling, ostensibly due to Very Serious fiscal concerns but in reality because they’re itching to spite the libs. However silly and unserious their motives may be, though, they’re a political fact of life.

Which is why even moderate Republicans sound chilly to the idea of a clean debt ceiling hike.

House Republicans from swing districts are flatly rejecting the White House’s position that there be no negotiations with Congress over raising the national debt ceiling, insisting that they won’t bend to the Democrats’ take-it-or-leave-it approach to avoid the first-ever debt default with no conditions attached.

The Republicans, many of whom hail from districts that President Joe Biden won or narrowly lost and are seen as the most likely to break ranks with their party’s leadership, said they are not willing to back a “clean” debt ceiling increase, insisting there must be some fiscal agreement first. That view is in line with House Speaker Kevin McCarthy, who is calling for negotiations with the White House before a possible default occurs later this year.

…

“I’m not in favor of Biden’s no-negotiating strategy, and I’m not inclined to help,” said Rep. Don Bacon, a Republican whose Nebraska district Biden carried, indicating Republicans campaigned against government spending and inflation. “The GOP can’t demand the moon, and Biden can’t refuse to negotiate. There needs to be give-and-take on both sides.”

The most prominent centrist Republican in the House might be Brian Fitzpatrick, who represents an evenly divided district in the swing state of Pennsylvania. “I will tell you that we will not allow our country to default on our debt,” he vowed recently. “We’re not going to default. We cannot allow ourselves to default.” Yet when asked by CNN about the prospect of short-circuiting the crisis by joining with Democrats, Fitzpatrick ruled it out. “I don’t think that a clean debt ceiling is in order, and I certainly don’t think that a default is in order,” he said.

Partnering with Democrats on a discharge petition for a clean debt ceiling hike would be a rare show of nerve by Fitzpatrick and his centrist colleagues. It would amount to “a bold challenge to the speaker’s authority, effectively wrenching control of the chamber out of his hands,” writes Andrew Prokop, correctly. It would strengthen Fitzpatrick’s hand in intraparty fights to come, signaling to McCarthy and the Jokers that the moderates need to be appeased too if anything’s going to get done. Yet here he is, not three weeks into the new term, offering no more resistance to a crisis than his mildly stated belief that default would be a bad idea.

He also voted against impeaching Trump twice, incidentally. Nearly every Republican in the House who’s willing to put the good of the country above their own career has already been purged, leaving us with milquetoast imitations. No wonder the party is where it is.

“It’s too soon for moderate Republicans to make a deal with Democrats,” you might say. “Doing so would give Hakeem Jeffries and the left leverage to refuse any negotiations with McCarthy on spending cuts. Fiscal hawks deserve a chance to force Dems to bargain with them.”

I don’t think it’s soon given the temporal reality of “legislative days.” Especially when you bear in mind that McCarthy and the Jokers he placed in positions of authority surely have some procedural tricks of their own to extend those legislative days and keep a discharge petition in limbo for a good long while.

But even if you think it’s too soon, consider that signing a discharge petition wouldn’t force Fitzpatrick and other centrists to support a clean debt ceiling hike in the end. If they can negotiate a spending deal in the meantime that’s amenable to 218 House Republicans and 60 senators, they can ultimately vote no on the bill brought to the floor by their petition and pass their preferred spending deal instead.

“Aha!” you say. “If Senate Democrats know that a clean debt ceiling hike is in the hopper in the House, they won’t agree to any deal on spending cuts. They’ll call Fitzpatrick’s bluff and dare him to vote against raising the ceiling once the country is on the brink of default.” That may be so, dear reader, but I have bad news: Senate Democrats are unlikely to agree to any compromise that would bail the GOP out of the mess it’s created. For them, it’ll be a clean hike or bust.

Compromising would incentivize further hostage-taking by Republicans. If they pay the danegeld once they’ll be paying it forever. That’s one reason not to do it. Another is that Democrats doubtless believe that breaching the debt ceiling will hurt Republicans politically more than it would hurt them, and they’re probably right. Granted, it’s usually the president’s party whom voters blame for hard economic times, but we’re staring at hard times regardless of what happens with the debt ceiling. When a recession comes, Democrats would love to be able to lay some or all of the culpability for it on Republican brinkmanship.

Their messaging machine will be firing on all cylinders through the first half of 2023 to make sure voters understand how reckless the right is being by urging on a debt ceiling crisis. In their panic about their next primary, Fitzpatrick and his ilk would do well not to overlook the politics of the next general election as well.

Besides, handing Democrats some leverage by joining them on a discharge petition now might—might—spook fiscal hawks in the GOP caucus into being more realistic about their demands instead of doing a charge of the Light Brigade into a national debt default. If Chip Roy and the rest know that they’re facing a moderate-imposed deadline for a clean debt ceiling hike, they may entertain offers that really could bring centrist Republicans aboard. And a deal approved by the centrists might—might—be something Senate Democrats would look at.

Ultimately, moderates will have to decide whether they’re willing to breach the debt ceiling if it comes to that or if they’re not. If they’re not, they need to start building an escape hatch now. The risk of failure is too high.

And although the House Republican leadership would never admit it, I think they agree.

I leave you with this curious fact: For all the hype about McCarthy caving to the hardliners in his caucus on rules changes, most notably reducing the threshold for moving to oust the speaker to just a single member, he and his team left the rules governing discharge petitions intact. They could have rewritten them or excised them entirely in order to deprive centrist Republicans of their ability to thwart the right’s bid to breach the debt ceiling. They didn’t. McCarthy must want an escape hatch in place too even if he’s unwilling to use it himself. Time’s a-wastin’.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.