Dear Capitolisters,

A few weeks ago, I debated Julius Krein, editor of American Affairs, on trade, industrial policy, and the future of the American economy. It was, I think, a telling and informative discussion (uncomfortable masks notwithstanding), and I invite you to watch the whole thing if you’re interested in the current debate about “free market fundamentalism” and the right’s recent embrace of economic interventionism. Toward the end, Krein and I got hung up on a point that I (incorrectly) assumed was relatively anodyne—the value of foreign direct investment (FDI) in the U.S. economy, regardless of its form (foreign companies acquiring existing U.S. assets or the “greenfield” creation of new ones). I was going to let the issue go, but then saw the claim that foreign acquisitions should be disregarded as valueless “non-investing” repeated elsewhere in another New Right critique of the allegedly problematic state of American investment (foreign or domestic) in the United States—a problem, of course, necessitating new federal government action.

In reality, FDI is not only an important and ever-growing part of the U.S. economy, but actually pretty great for American workers and their surrounding communities. And the apparent confusion surrounding this fact—and the oodles of research backing it up—thus makes FDI a perfect newsletter topic. So that’s what we’ll do today.

The Basics

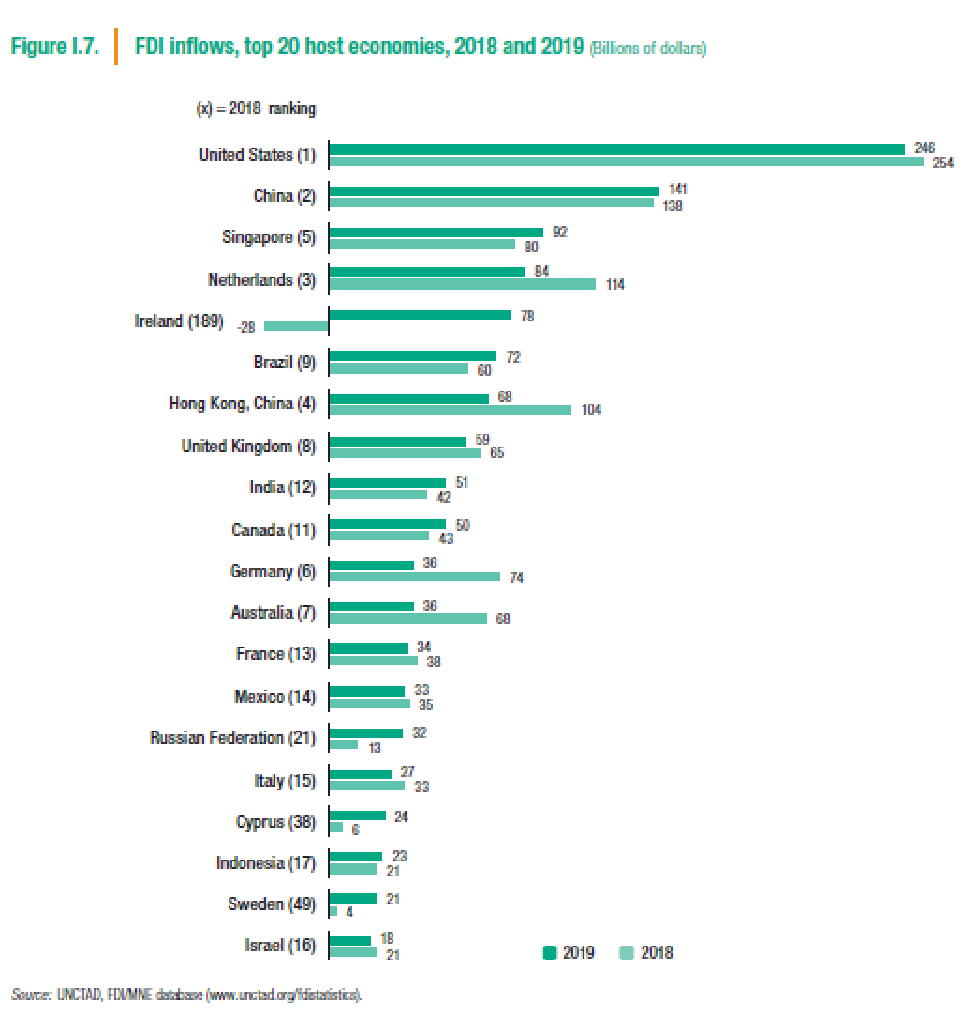

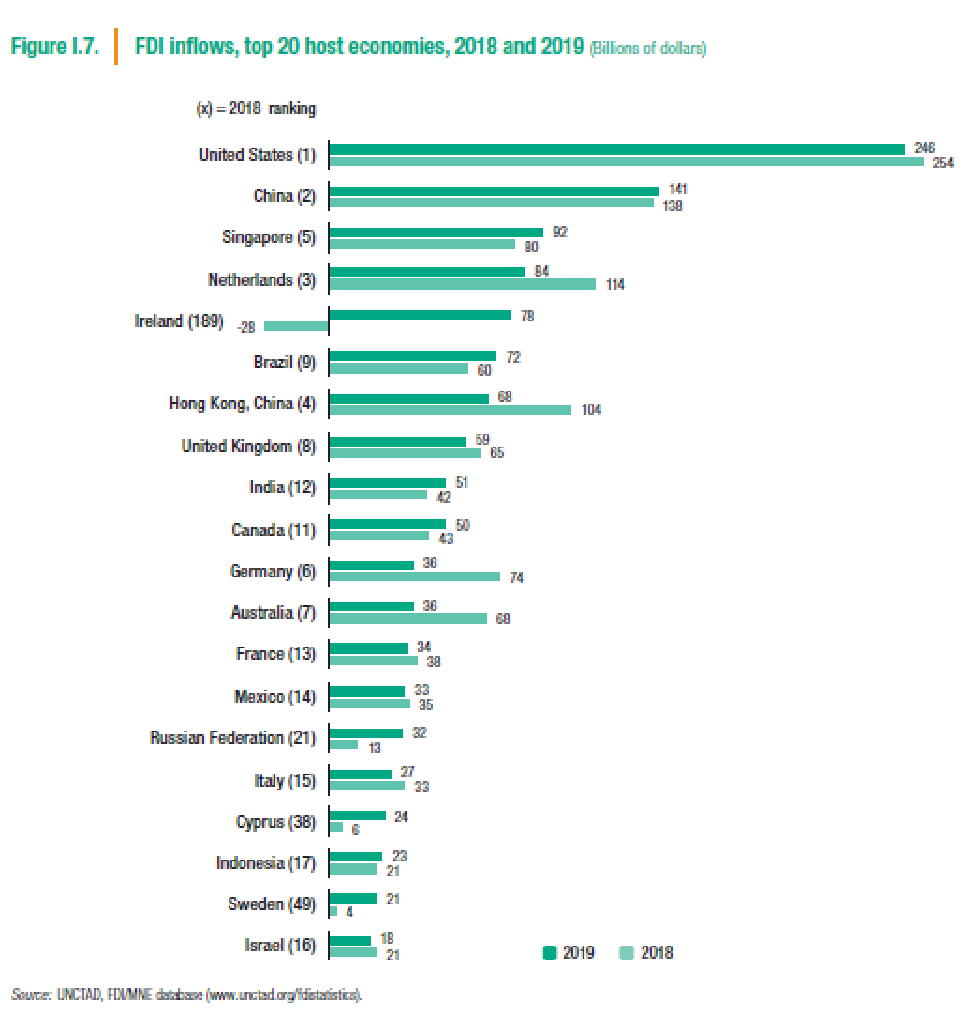

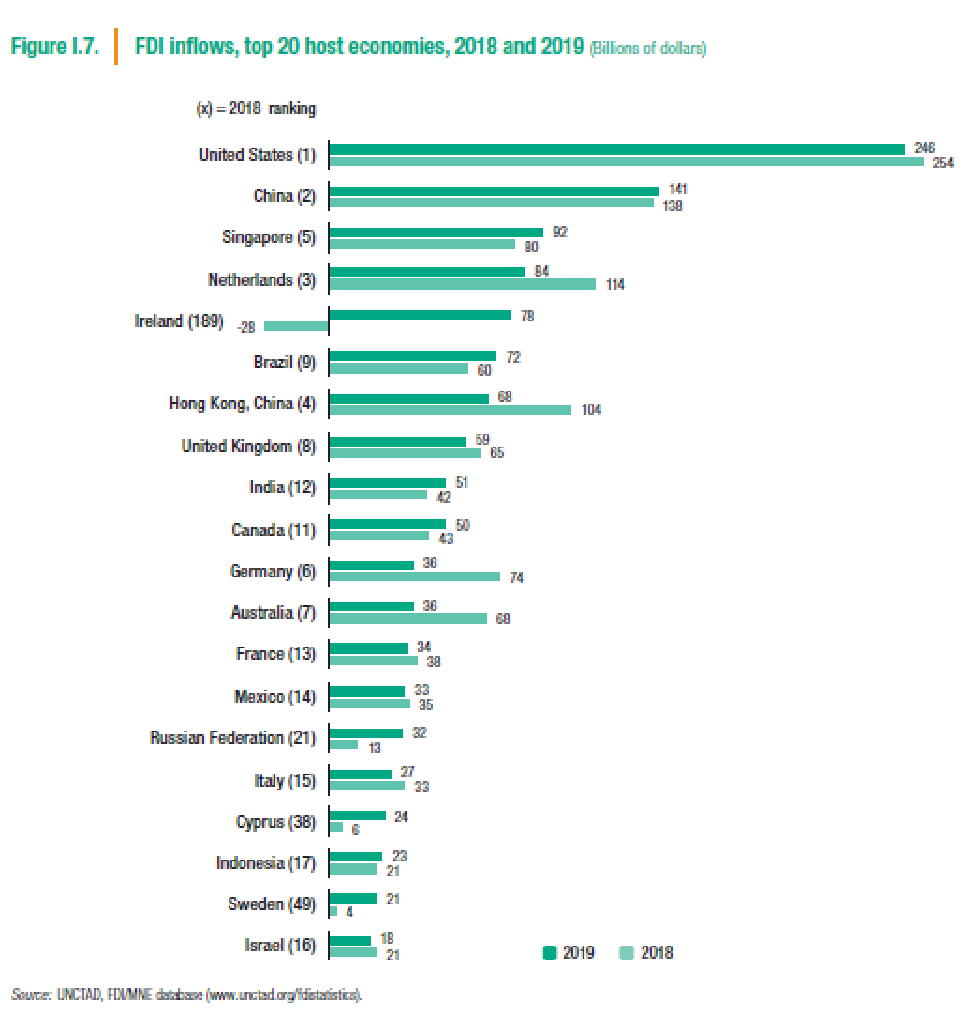

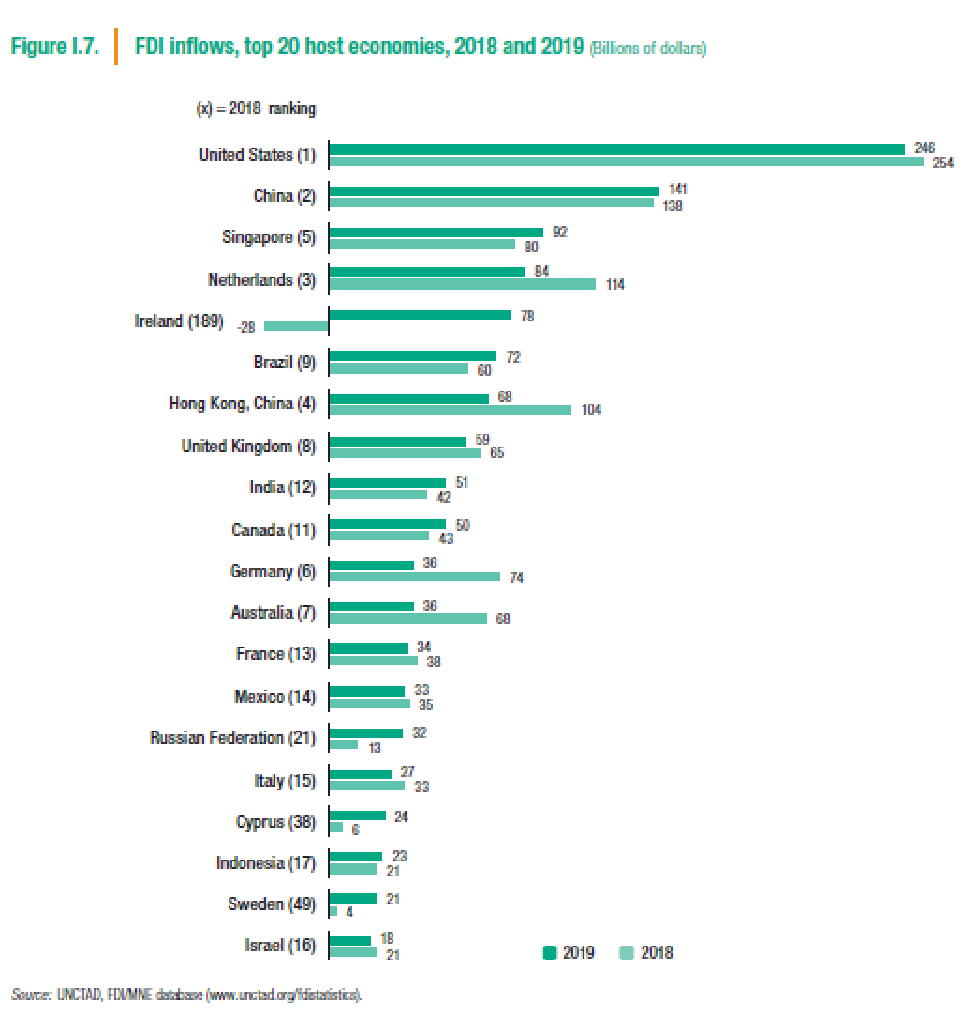

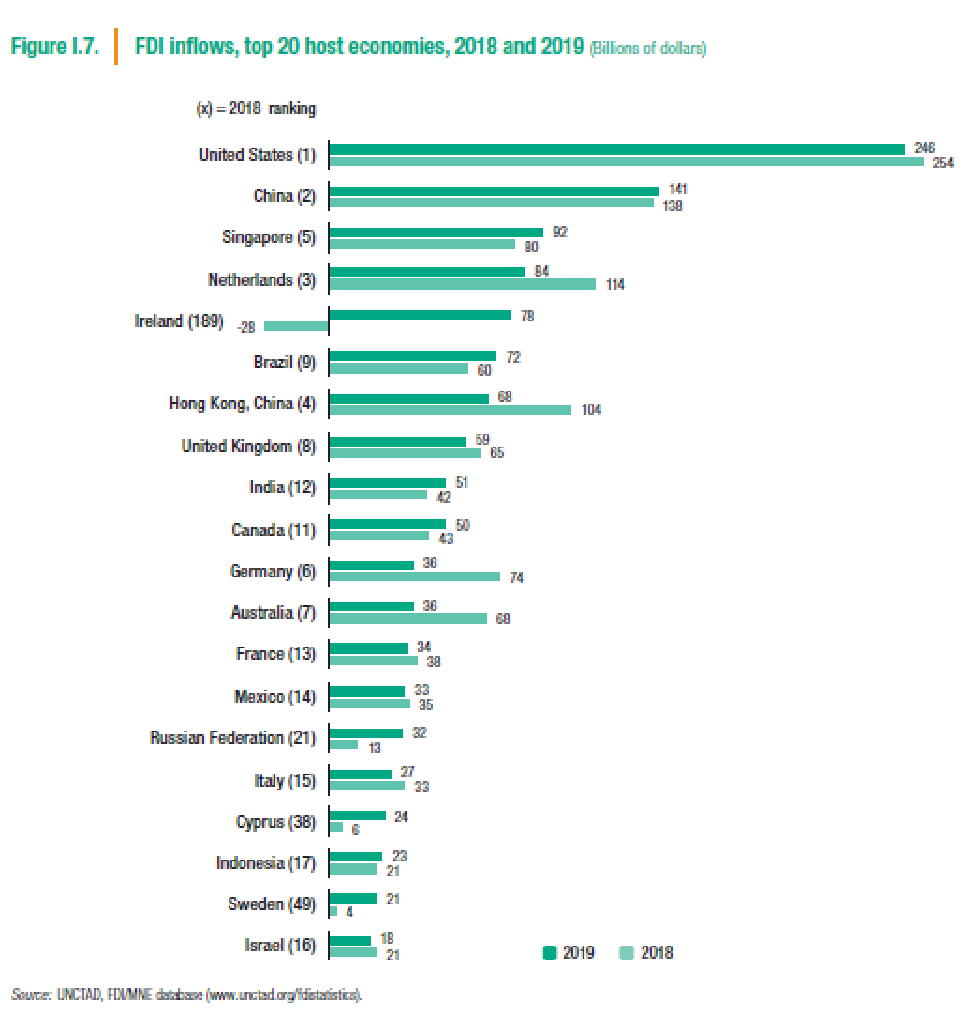

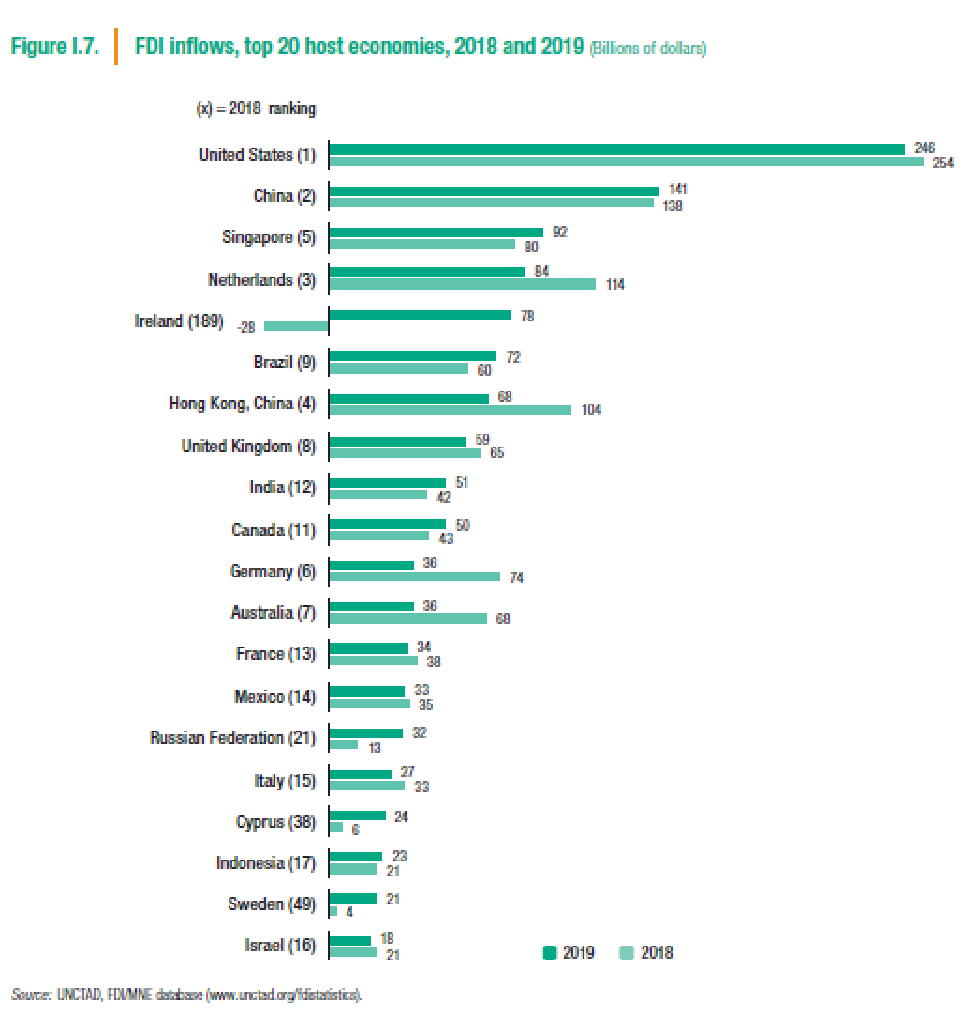

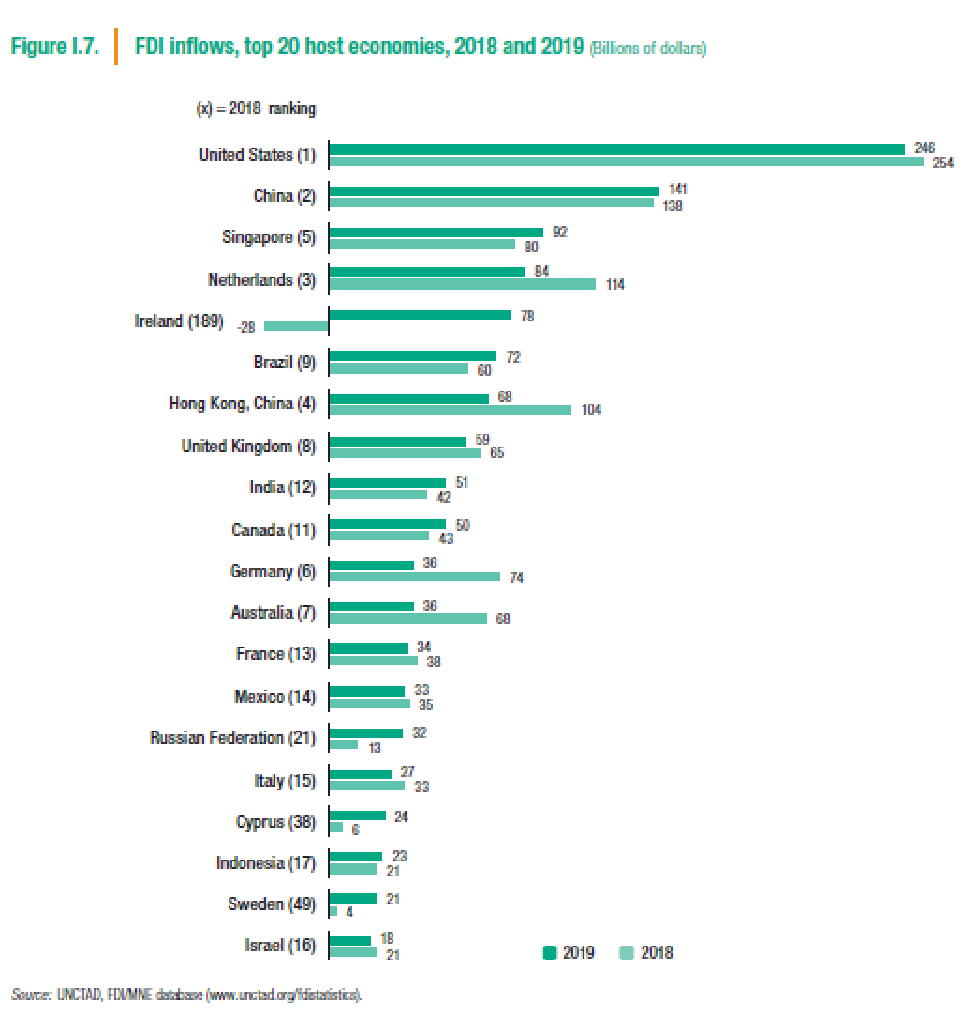

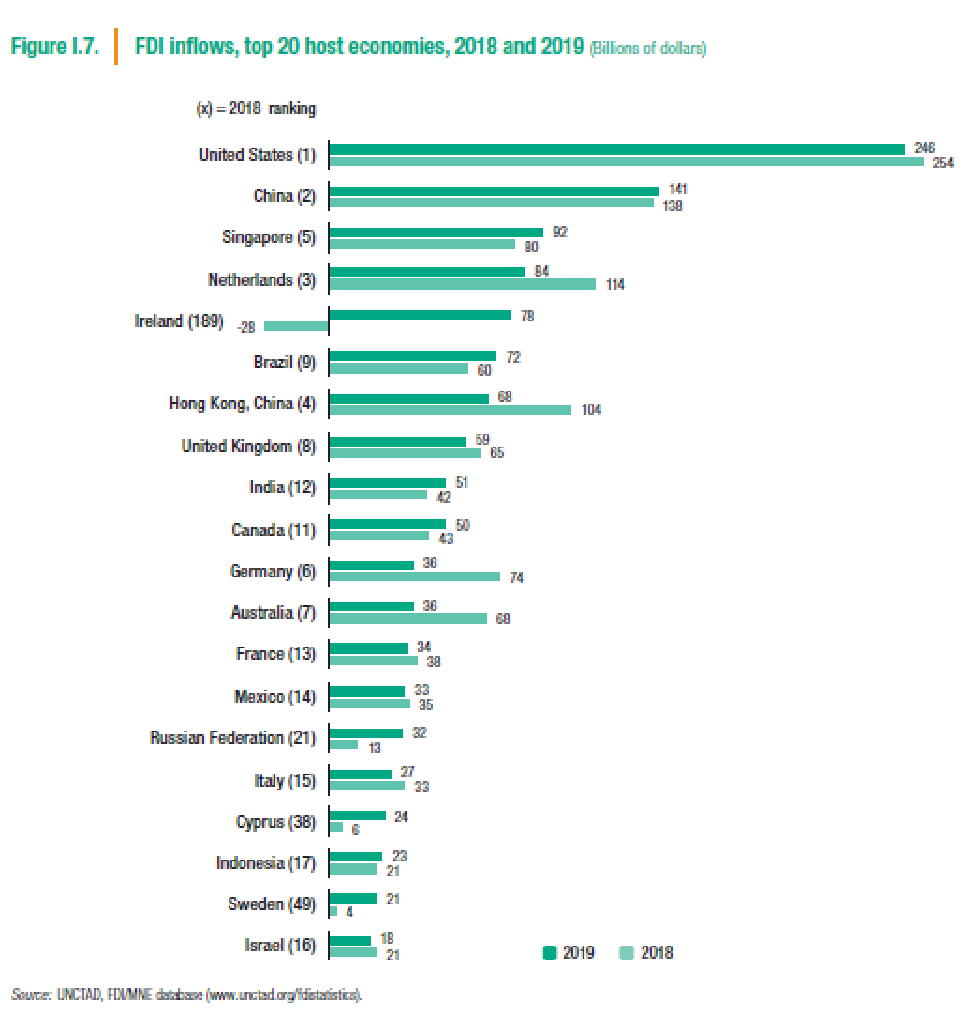

Before we get to the impact of foreign direct investment in the United States, let’s start with the basics. The U.S. Bureau of Economic Analysis (BEA), which tracks FDI, defines it as “cross-border investment associated with a resident in one economy having control or a significant degree of influence on the management of an enterprise resident in another economy”; BEA sets the threshold for this “significant” control/influence at 10 percent of the target company’s voting shares. This distinguishes it from “portfolio” investment, in which a foreign entity just buys some shares or debt issued by a U.S. company. Until last year (and for almost every year before that going back to the 1970s), the United States has been the top destination in the world for FDI—a pole position lost because of the pandemic and one that we’ll probably regain this year or next:

Total FDI in the United States fluctuates because of the presence or absence of anomalous corporate transactions (hence, two major outliers in 2015/2016 when “inversions” were all the rage), domestic policy (e.g., tax reform in 2017), and the state of the U.S. and global economies generally, but there are a few general takeaways from the topline data:

First, total FDI in the United States—pandemic aside—has been relatively steady over the last decade and in fact a little higher since the Tax Cuts and Jobs Act was implemented (in part for that very purpose). According to a 2020 U.S. Federal Reserve analysis, for example, FDI “climbed to a record high in 2018” after adjusting for the aforementioned transactions (gray bars in Figure 2(a) below)

As we discussed a few weeks ago, moreover, various studies indicate that the 2018 and especially 2019 numbers would be even better had President Trump not started a massive trade war in early 2018. (For more on that issue, see this 2018 piece on the harmful investment uncertainty unleashed by Trump’s trade policies.)

Second, contrary to nationalist concerns that FDI means we’re “selling America” (or whatever) to foreign adversaries, the bulk of U.S. FDI comes from traditional allies, including Japan, Canada, Germany, and the United Kingdom. Only a small share originates in China—a share that’s actually declining, thanks to heightened U.S. scrutiny of Chinese investment and bilateral tensions more broadly.

Third, BEA data show that a large chunk of annual FDI into the United States—ranging from 40 to 70 percent—is in manufacturing. As I showed in a recent paper, moreover, total FDI into the U.S. manufacturing sector continues to grow in real (inflation-adjusted) terms, and the United States is a top global destination for manufacturing investment:

Fourth, all of this FDI has resulted in a major presence of foreign multinationals in the United States. Total FDI assets (“stocks”) in the U.S. manufacturing sector alone hit $1.77 trillion in 2018, and BEA reports that majority-owned affiliates of all foreign multinationals employed 7.8 million American workers and contributed $1.1 trillion to U.S. gross domestic product that same year (the last year available). Much of this investment is, again, in manufacturing—particularly in the Rust Belt and South where there are a lot of major foreign automakers:

Finally, and important for today’s discussion, the same BEA data show that the vast majority of the new FDI into the United States each year is “acquisitions” (foreign ownership or control of at least 10 percent of a target company’s voting shares), while only a fraction is “greenfield” investment (“expenditures to either establish a new U.S. business or to expand an existing foreign-owned U.S. business”). In 2019, for example, about $4 billion of a total $194.7 billion were greenfield, down from $8.1 billion of $296.4 billion in 2018:

It’s this last point that some have recently targeted to downplay the conventional wisdom that FDI is generally “good” for the U.S. economy, regardless of its form. In our debate, for example, Krein implied that those foreign acquisitions were essentially meaningless paper-pushing instead of something to cheer or an indicator of the health of the American manufacturing sector.

FDI’s Impact

This view, I think, misses several critical points regarding FDI and its impact on the U.S. economy. For starters, the foreign acquisitions themselves have potential value in at least two important ways:

-

First, the influx of new foreign capital generates a clear financial benefit to the U.S. sellers of the acquired company—sellers who often don’t just cash out permanently and retire to the Caymans (or wherever) but instead reinvest that money in the U.S. economy. Maybe they build a big house; maybe they buy stocks; or maybe they even start a new company. As we discussed a few months ago, for example, the founders of Germany’s BioNTech—of Pfizer mRNA vaccine fame—started their venture using the cash they received from the 2016 sale of their first company to Japan-based Astellas Pharma in 2016. The rest, thank goodness, is history. Certainly, such successful subsequent investments aren’t assured when a foreign acquisition takes place, but it’s essential to note that this foreign money doesn’t simply disappear into the ether and, in fact, is often put to good and productive use—including in the United States.

-

Second, an acquisition—by providing U.S. owners with a market return on their investment—can signal to others that the industry at issue (e.g., automaking) is healthy and thus encourages them to invest in that same industry over the longer term. This outcome makes intuitive sense: Sales of existing homes encourage new homebuilding in the same general area (unless, of course, regulations prevent that investment). It’s also backed by some research (though this is admittedly mixed overall).

More importantly, focusing too much the initial acquisition ignores what foreign multinationals do after they make that investment. If, as is implied, foreign companies usually acquire U.S. firms and then do nothing with them, flip them like a house on HGTV, or perhaps even break them apart and sell off the pieces, then the critique of U.S. FDI might have some merit. The literature here, however, tells a much different story: Far from merely acquiring an asset, foreign parent companies typically improve their U.S. acquisitions and the domestic companies and communities in which they’re located.

Most of this improvement occurs outside of any “greenfield” investments, which BEA defines narrowly as the “establishment” of a new foreign affiliate in the United States or the “expansion” of that affiliate. “Expansion,” however, covers only the construction of a “new facility where business is conducted” and thus excludes other corporate spending once the foreign affiliate is established or expanded. So, for example, if Toyota bought an old GM plant in Michigan and the next day added a bunch of new equipment and hired a bunch of people, none of that subsequent activity would be included in “greenfield” FDI. (I actually called BEA—using an actual telephone!—about this just to be sure.)

This type of foreign affiliate activity, it turns out, is substantial. Drilling into another dataset at BEA shows that U.S. affiliates of foreign multinationals spend hundreds of billions of dollars per year in the United States on research and development and capital expenditures, with the biggest shares (again) going to manufacturing:

(There’s probably some overlap between the total capital expenditures and greenfield figures, but the former clearly dwarfs the latter so it doesn’t matter.)

The vast majority (about 90 percent) of these annual R&D and capital expenditures, BEA shows, were completed by domestic companies wholly or mostly (more than 50 percent) owned by multinationals, so they aren’t just a bunch of standard business transactions made by public companies that have like 10.1 percent (or whatever) foreign ownership but aren’t actually controlled by a foreign multinational. It’s almost all done by “real” foreign companies here in the U.S.

Second, there are plenty of things that foreign multinationals can do to improve acquired U.S. companies’ performance without spending another cent. This includes changes in management or business practices, the implementation of proprietary technologies, corporate restructuring (including, yes, layoffs), and hooking into multinational supplier, distribution, and consumer networks that the parent already had in place. (Foreign automakers here, for example, commonly import core parts and use R&D produced at their headquarters abroad.) Little, if any, of these major changes would show up as “FDI,” yet they can have major, positive effects on firm performance.

And they do. Summarizing his 2018 report on foreign affiliates’ activity in the United States, for example, Daniel Ikenson notes at the time that:

These international companies tend to be among the best in their industries, having succeeded in their home markets before taking their best practices and testing their mettle abroad. They have contributed disproportionately to U.S. economic performance over the years, as observed across a variety of objective measures. Even though these entities as a group comprise a mere 1.3 percent of all U.S. businesses, collectively they punch well above their weight, accounting for:

-

5.5 percent of all private‐sector employment

-

6.5 percent of U.S. GDP (private‐sector value added)

-

14.8 percent of U.S. private‐sector employee benefits

-

16.0 percent of new private‐sector, non‐residential capital investment

-

16.7 percent of private‐sector research and development spending

-

17.1 percent of all corporate federal taxes paid

-

23.5 percent of U.S. exports

-

24.3 percent higher worker compensation than the U.S. private‐sector average

Ikenson also shows that these companies are particularly impressive when compared to the U.S. economy overall:

Ikenson’s results are consistent with other analyses of foreign affiliates in the United States, which academic papers repeatedly show pay more, export more, and are more productive (significantly), on average, than similarly situated domestic firms.

One of the most recent and detailed of those papers found that foreign affiliates (more than 25 percent foreign-owned) in the United States pay their workers about 19 percent more than domestic firms on average, and about 7 percent more when comparing the same type of workers (e.g., engineer) across firms. The finding, which was not limited to manufacturing entities, indicates that foreign-owned firms in the United States not only tend to employ more skilled workers on average, but also pay workers with the exact same skills more than domestic firms do—a wage premium the study’s authors speculate is due to “belonging to a multinational network”; being “especially productive” companies; achieving certain economies of scale; or simply anchoring their wages to headquarter levels. (None of these factors are unique to greenfield FDI.) They calculate that U.S. workers would have been roughly $36 billion poorer in 2015 if all foreign affiliates in the United States had been magically replaced by domestic firms.

Thank goodness they weren’t.

Just as importantly, the study finds that foreign multinationals have a substantial impact on local communities and workers at non-foreign firms. In particular, an increase in employment at foreign-owned companies was found to significantly raise the value added (output minus costs), employment, wage bill, and earnings of workers at domestic-owned firms in the same locality. The authors estimate that every additional job at a foreign multinational generated approximately 0.5 jobs and $139,000 in value added at domestic firms in the same local labor market, as well as “annual aggregate wage gains for incumbent workers in the commuting zone of approximately $13,400”—benefits that justify, in their view, “trade and investment policies that encourage foreign firms to invest in the U.S.” These findings are again consistent with prior research.

Summing It All Up

The United States remains a global FDI magnet, reflecting the overall attractiveness of the U.S. market as a place to invest and do business. This investment, moreover, produces real economic benefits above and beyond those that would have been generated in its absence—regardless of whether it entails breaking ground on a new facility or acquiring one that already exists, and totally leaving aside what U.S. sellers do with the foreign capital they’ve just received. Surely, not every bit of FDI meets this standard, but the overall trends strongly refute the assumption that foreign acquisitions should be brushed aside as economically insignificant “non-investment” or that new regulations are needed to distinguish between “good” and “bad” foreign investment in the future. (Never mind the longstanding problems associated with such regulations.) Instead, study after study shows how FDI in the United States is pretty special, resulting in outsized economic performance and benefiting both Americans employed by foreign affiliates and their surrounding communities—even when it doesn’t involve additional post-acquisition investments.

In short, if you’re concerned about sagging business activity in the United States (regardless of whether you actually should be), you should be welcoming FDI with open arms, not pooh-poohing it.

Chart of the Week

The Links

Me on steel tariffs, antidumping abuse, and U.S. industrial policy in action (more on that last one).

Someworthwhilecommentary on the J&J vaccine pause.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

You are currently using a limited time guest pass and do not have access to commenting. Consider subscribing to join the conversation.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.