Dear Capitolisters,

Over the last few days, several high(ish)-profile industrial policy fans have decried the federal government’s thus-far-problematic implementation of the programs they’ve so vigorously supported. (Capitolism has covered a lot of these wobbles in recent weeks, so feel free to go here, here, or here to catch up.) Kicking things off in the New York Times was Ezra Klein, who was “thrilled to see industrial policy revived” yet deeply troubled that the two biggest federal industrial policy laws—the CHIPS and Science Act and the IRA—were being imperiled by progressive add-ons and existing regulatory impediments that raise costs and slow projects. “Even if no single standard or mandate is decisive on its own,” he worried, “the accumulation of them, in an industry [semiconductors] in which we’ve already fallen ruinously behind on cost, can do real damage”—even outright “failure.”

From the right came American Compass’ Oren Cass, who viewed the political strings attached to the CHIPS Act he’s championed as “not only counterproductive with respect to chip capacity, but also an embarrassment for the broader effort to re-establish the American tradition of industrial policy” and—I kid you not—“so bizarre that one suspects the White House is actively baiting its opponents into turning against the entire project of rebuilding American manufacturing.” Diabolical!

Finally, Substacker Noah Smith put a more optimistic spin on Klein’s lament. After acknowledging that the various conditions imposed on U.S. industrial policy projects are obviously political, that “political payout schemes do not tend to lead to productive enterprise,” and that numerous regulatory “roadblocks or veto points” could thwart recently announced U.S. industrial policy projects, Smith reassured his readers that these were mere speedbumps on the road to American industrial policy success:

So all the howling about permitting and onerous subcontracting requirements and “Buy American” provisions that you’re hearing right now—including from Ezra Klein and from Yours Truly—are just part of the process of figuring out how industrial policy works. We’re kicking the tires on our modern state to see what it does well and what it does poorly. Observing the results each step of the way, we’ll correct our course.

So in fact, while it’s important that industrial policy succeeds in a reasonable time frame, it doesn’t have to cruise to an unimpeded total success on the very first try. Just like for a tech startup, it’s ok to fail at first if you pivot nimbly.

On the one hand, I’m happy to see these (and other) industrial policy fans openly recognize some of the many, many obstacles to crafting and implementing effective industrial policy in the United States—obstacles that I and many other researchers on the right, left, and center have documented at (egregious) length over the last several decades.

But I gotta ask: What took them so long?

Welcome to the Party, Pals

Indeed, the problems identified by Klein, Cass, and Smith are, if not inherent in U.S. industrial policy, at the very least often associated with its long history in the United States. And they, among others, have long been documented by industrial policy skeptics and supporters alike (see links above).

First and most obviously is the problem of politics. In particular, scholars have for decades warned that textbook industrial policy plans are routinely undermined by elected officials and bureaucrats who prioritize political objectives over public policy ones. In the 1990s, for example, U.S. “critical technologies” industrial policy struggled in part “because decisions about R&D funding priorities inevitably become political, as groups and leaders vie to have their favorites supported.” Supercomputer policy suffered from its own political problems around the same time, as did all but one of the projects examined in the classic Brookings Institution book, The Technology Pork Barrel.

More recently, researchers have found that political connections and promises (e.g., President Obama’s commitments to his home state of Illinois) motivated the disbursement of American Recovery and Reinvestment Act funds for clean coal and green energy (and no, not just Solyndra). And we saw it again during the pandemic with troubled vaccine manufacturer Emergent BioSolutions, which spent heavily on lobbying and was, despite past failures, rewarded with a massive vaccine contract that it never fulfilled.

Of course, not every U.S. industrial policy project fails because of political meddling, but the risk of well-intentioned federal projects getting bogged down by costly distractions like child care mandates, protectionism, buyback restrictions, or profit-sharing demands—or by just basic political maneuvering—is large and ever present. And that’s because the policies themselves are products of a political, not market, process. Passing almost all legislation requires cobbling together support from a wide range of diverse constituencies—unions, corporations, environmental groups, whatever—and so bills will usually need to reflect some of their insular priorities. Making law also requires navigating various partisan and procedural rules, which often can affect substance depending on who’s in charge of what committee or legislative chamber. Politicians are, after all, self-interested humans and not public service robots, and they will invariably work to add—often buried in a thousand pages of “must-pass” complexity—provisions that advance their own electoral and constituent priorities. (Senate Majority Leader Schumer, to his credit(?), frequently and openly admits as much.)

These pressures are particularly powerful in today’s Congress, where majorities are slim, partisanship is high, and the normal legislative process has become especially broken. Thus, for example, the IRA’s overall effect on clean energy deployment will be blunted by not only last-minute protectionist and other shenanigans added by lynchpin Sen. Joe Manchin and others, but also the omission of important things like permitting reform because narrow congressional majorities demanded it be passed via budget reconciliation.

High-minded, guardrails-rich technocracy, this ain’t.

Implementation of any new industrial policy law, moreover, will require detailed rules and regulations that fill in gaps left (intentionally or otherwise) in the legal text—gaps that elected officials and well-paid lobbyists will also look to exploit for personal gain. (See, again, the IRA.) Enforcement invariably involves discretion too and usually comes with congressional oversight. Research thus shows that government agencies’ agendas often mirror those of the members of the congressional committees that oversee them—members that often actively seek out these committee assignments to steer those same regulatory agencies. Throw in some angry trading partners and a Biden administration quite openly gunning for reelection today, and the result is what literally anyone even remotely versed in this stuff would expect: a mess.

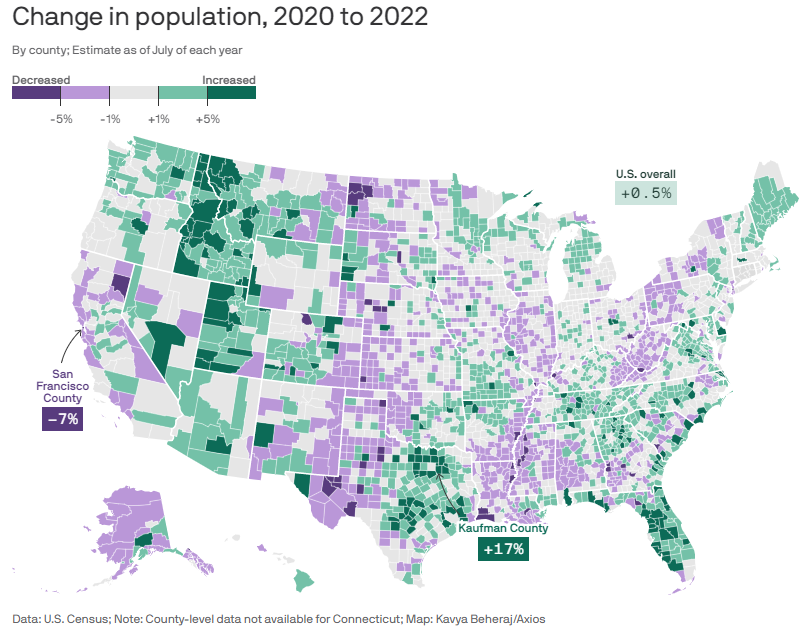

Second, industrial policy projects routinely run face-first into pre-existing policies that impede their effective implementation—policies that can’t simply be turned off like a light switch. As I noted a 2021 paper, for example, past U.S. industrial policy efforts were often stymied by Davis-Bacon “prevailing wage” rules, Buy America mandates, and the National Environmental Policy Act (NEPA) and state-level equivalents—some of the very policies that Klein, Smith, and other industrial policy champions acknowledge are today hurting the current industrial policy rollout. Meanwhile, I and other observers have warned about how longstanding U.S. labor, immigration, trade, and tax policies would needlessly raise the costs of or otherwise impede potential industrial policy projects, and—lo and behold!—those issues are creating problems today too. Other regulations, on things like land use and electrical transmission lines (see backlog chart below), have raised further concerns—and they, of course, were well-known too.

The durability of these meddlesome other policies—even in the face of ample evidence as to their problems and a near-consensus among academics that they should be reformed or scrapped—reflects several unfortunate realities about U.S. policy today: 1) Most of these other laws enjoy strong political support from influential domestic interest groups who will fight like crazy at all levels of government to keep them in place; 2) Passing any reforms through this highly divided Congress is difficult (at best); and 3) The federal bureaucracy, far from being “nimble,” often resists change and, as economist Arnold Kling recently explained, actually promotes “people who stick to the party line.”

Kling cites examples of health, financial, and intelligence officials failing to advance their organizations’ most basic policy objectives because of this “adverse selection” problem and other institutional dynamics. For my money, however, there’s no better example of the difficulty of reforming obviously-stupid-but-entrenched U.S. policies than the current baby formula debacle. Here we have a persistent, troubling, and uniquely American situation that is, per experts of all stripes, enduring because of misguided government policies (tariffs, FDA regulations, welfare contracts, etc.)—ones that the government temporarily suspended to alleviate severe shortages harming perhaps the most sympathetic population of them all (hungry babies!). But the tariffs are supported by the influential dairy lobby, and freer trade is political Kryptonite right now (sigh). Various FDA officials, meanwhile, have repeatedly asserted that the real regulatory problems—and the reason the U.S. remains vulnerable to another market collapse—weren’t that the agency was blocking perfectly good European formula at the U.S. border or that it uniquely (and expensively) regulated domestic formula like a pharmaceutical, but that it simply lacked funding and didn’t regulate hard enough.

As a result (and because of simple political gridlock), those bad formula policies are basically back to where they were a year ago, and long-term reforms appear unlikely, even as discrete shortages and higher prices have reappeared. Blech.

And this is a relatively simple regulatory issue involving just a couple agencies! By contrast, the laws, bureaucracies, regulations, standards, funds, and other issues implicated by new U.S. industrial policy efforts are insanely large and complex—something economist Tim Taylor highlighted recently when summarizing a new report from Deloitte on the same policies. The infrastructure law alone, for example, involves “more than 45 federal bureaus and 16 federal agencies and commissions” and funding for 369 programs, 160 of which are entirely new. The CHIPS Act and IRA, of course, have their own complexities. The policies’ “chances of success,” he rightly notes, will depend on navigating that stuff and on smoothing the “interactions between these programs”; solving the aforementioned labor shortages (he cites electricians) and regulatory hurdles; and somehow policing for fraud:

The “thieving squirrel” problem: You put seeds into the birdfeeder, but clever, agile, and highly motivated squirrels manage to eat a big share. The only answer is a birdfeeder designed to limit access and frustrate raiders. With funding levels this large, the problem of waste, fraud, and abuse is real. Especially for agencies that are disbursing sizable grants for the first time, controls baked in up front will be critical. Governments need to ensure proper compliance, reporting, and transparency—or risk rewarding the squirrels and undermining overall trust in the process.

The blithe assertion that the industrial policy challenges we’re now seeing will somehow motivate a quick legislative and regulatory adjustment ignores all of this. Indeed, Congress is struggling to pass a relatively modest permitting reform bill that Sen. Joe Manchin demanded for his IRA vote last year, and that both parties today say they want. Doing that again (and again and again) each time a new regulatory impediment crops up—at the federal, state, and local levels—and while industrial policies are already being deployed is beyond fanciful, especially given the aforementioned political and bureaucratic issues.

It also ignores that every industrial policy project, even successes but especially failures, has very real economic and political costs beyond simply a budgetary line item, and that—as the Technology Pork Barrel and other industrial policy surveys have repeatedly found—even widely known industrial policy boondoggles are exceedingly difficult to unwind once they’re put in place (see, e.g., ethanol, which has distorted past carbon capture subsidies, or the Jones Act, which is today hindering federal subsidies for offshore wind deployment). Even assuming current problems actually do lead to future reforms (color me skeptical), this is an incredibly wasteful way to discover policy answers that we all already knew before the current experiment began.

Regardless, the entire notion that unsurprising industrial policy problems are to be embraced as some sort of regulatory discovery process ignores the steelmanned case for why new subsidies or other government interventions are supposedly needed in the first place: to correct market failures that are generating problematic commercial outcomes like insufficient onshore semiconductor production. If such outcomes are, on the other hand, the product of misguided government policies that raise costs, depress investment, or otherwise distort the market, then the obvious solution isn’t to start with new industrial subsidies (or whatever) but to fix those other policies and then see whether a real market failure exists and how a targeted government intervention—with appropriate guardrails based on our long experience with such policies—might fix it.

Often, this last government intervention step won’t be needed because, as we’ve discussed a lot around here, markets and private parties are pretty darn good at producing solid commercial outcomes—if governments will let them. Indeed, Klein’s piece unintentionally hits on this when he praises a recent housing project in San Francisco that achieved (relatively) remarkable time and cost savings by utilizing private investment and avoiding byzantine, politicized state and local rules that severely bog down most affordable housing construction and block new and innovative production methods. “More profoundly,” he laments, “it is damning that you can build affordable housing so much more cheaply and swiftly by forgoing public money.” (Lessons abound!)

Maybe, after implementing various supply side reforms, more demand-side subsidies will still be needed for certain national priorities, but doing the latter before the former is like attaching an old garden hose to a fire hydrant, turning on the spigot full blast, and bragging to soaked onlookers that, well, now we know we need a bigger, stronger hose to put out the fire raging next door.

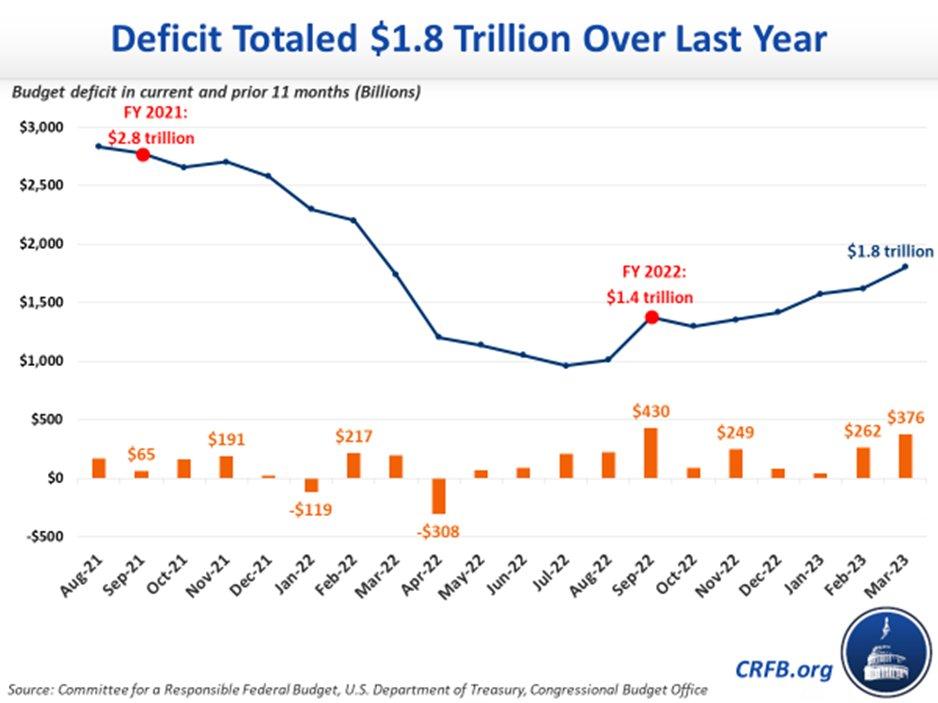

That, by the way, is basically what we just did:

If only someone could’ve warned us, et cetera, et cetera.

Summing It All Up

Smith dismissed my and other industrial policy skeptics’ criticisms as merely an “instinctive, tribalist reaction” to the current CHIPS Act problems. (I, in particular, “seized” on a Bloomberg editorial. Gasp!) Cass, meanwhile, groused that “libertarian Republicans who oppose any government interventions in the market are pointing gleefully at Biden’s mis-steps as proof that policies like the CHIPS and Science Act, PPP, and trade enforcement merely hand Democrats more power to misuse.” But, contrary to these and other online histrionics, the most common criticisms of U.S. industrial policy today are grounded as much in experience and common sense as they are in theory or ideology (not to mention “tribalism”). In my own case, I’m naturally more skeptical of government action than your garden variety wonk, but my personal views of industrial policy come less from reading Hayek or Friedman and far more from spending almost two decades advising multinational corporations and a handful of governments on how to navigate or implement industrial policies here and abroad, and then witnessing firsthand how the sausage is actually made (spoiler: not well).

Regardless, as Taylor notes, this skepticism isn’t exactly a minority or even ideological view:

Around the world and over time, “industrial policy” narrowly understood doesn’t have a great reputation. There are a few successes, and a distressingly large pile of failures. It’s worth remember[ing] that the resources committed to industrial policy–including money, capital, and human talent–could have been spent on other uses. For example, a big chunk of the $200 billion per year or so being spent on these programs could have gone into supporting pregnant mothers and infant children, or rebuilding public schools, or training a few hundred thousand electricians. Perhaps setting up a steady increase in taxes related to pollution and carbon emissions over time, and then letting the incentive effects of such taxes percolate through the economy, would be more effective–but spending more money is always a more popular way of seeking change.

It’s impossible to prove that industrial policy can’t ever work, for the same reasons that it’s often very difficult to prove a negative. Thus, even if this particular US industrial policy experiment fails, I expect that its supporters will just explain that with more money or commitment or vision or energy or an improved structure, it could easily have succeeded. So this post is just laying down a marker: When these pieces of industrial policy legislation were passed, the comments of supporters often suggested that this iteration of industrial policy was nearly as simple as tossing a log on the fire–virtually certain to succeed. If the programs are only mild success, or a considerable failure, the supporters should have to eat their words.

Given that industrial policy cheerleaders seem unaware of some of the most basic criticisms of industrial policy from libertarians and non-libertarians alike and are only today waking up to common industrial policy weaknesses that skeptics have been pointing out for decades, I’m not holding my breath.

Chart(s) of the Week

This is fine.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.