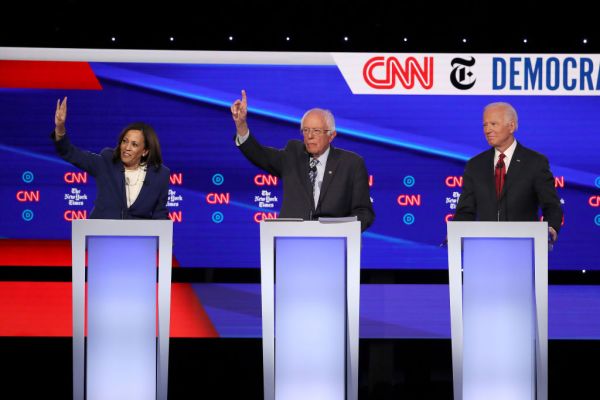

During the 2020 presidential campaign, Joe Biden promised $11 trillion in new spending increases over the next decade, dwarfing the $1 trillion to $2 trillion in new spending promised by previous Democratic presidential nominees Hillary Clinton, Barack Obama, and John Kerry. Many doubted that a Biden administration would really seek such a bold and historic expansion of government, given Biden’s more moderate, cautious, return-to-normalcy campaign themes, the election becoming a referendum on Donald Trump rather than economic policy, and his party’s miniscule congressional majority.

No one is doubting Joe Biden’s spending ambitions anymore.

In a dizzying first year in the White House, President Biden signed a $1.9 trillion “stimulus” package and a $550 billion infrastructure bill, and he persuaded Congress to pass a budget resolution setting the stage for $1 trillion in additional discretionary spending over the decade. Yet the president also failed to pass $4.5 trillion more spending in the American Jobs Plan and American Families Plan, much of which became the ill-fated Build Back Better plan.

The scale of this spending bonanza is magnified by the context around which it was enacted. The pandemic recession and resulting legislation had already brought a historic $3 trillion budget deficit. And the Congressional Budget Office (CBO) had previously projected $12 trillion in baseline deficits over the next decade, largely a result of escalating Social Security and Medicare shortfalls brought on by 74 million retiring baby boomers. At this point, the national debt held by the public is projected to rise from $17 trillion before the pandemic to $36 trillion a decade from now.

Bident began with the American Rescue Plan (ARP), which was designed to far exceed the size of President Obama’s 2009 stimulus bill. Economists on the left and right condemned its size and substance. At $1.9 trillion, ARP was not only the most expensive bill of the past 50 years, it also far exceeded the size that even Keynesian economists believed was necessary to close the $420 billion output gap. The result—as forewarned by Lawrence Summers and others—was an acceleration of the inflation rate that was already moving upward because of supply chain constrictions and Federal Reserve policy. ARP also gave state and local governments $350 billion for budget deficits that did not exist, plus $129 billion for K-12 education despite states still sitting on earlier federal education grants. The subsidies to the unemployed were so high—despite the pandemic receding and record-high job openings—that 26 states took the rare step of refusing federal assistance and canceling the bonuses before they expired. There was also a massive union pension bailout, and more relief checks even for families that had lost no income during the pandemic. Republican lawmakers—who had enacted a $900 billion relief bill just weeks earlier—tried to scale back this monstrosity. But Democrats refused to move an inch with a stubbornness that seemed more focused on showing Republicans they can play hardball than on getting the economic policies right.

Democratic criticisms of “Republican obstructionism” fell apart when the GOP next teamed up with Democrats to pass a $550 billion infrastructure bill. This bill was largely unnecessary, as state and local governments were already searching for ways to spend $500 billion in new federal funds. It was also poorly designed, spraying money across various interests without any real attempt to fix the excessive red tape that makes American infrastructure perhaps the world’s most expensive, bureaucratic, and wasteful. Nonetheless, Mitch McConnell and his Republican allies bet that passing a physical infrastructure bill would satisfy moderate Democrats like Sen. Joe Manchin, and thus kill the momentum for the other $4 trillion in proposals that fell under Biden’s comically loose definition of “infrastructure.”

Ultimately, the president’s remaining infrastructure proposals were pared down into a $2.4 trillion Build Back Better (BBB) proposal that passed the House on a party-line vote and then (at this point) failed to even receive a vote in the Senate.

Build Back Better ran aground for several reasons. First and foremost, the Biden White House misread its electoral mandate (which was essentially “don’t be Donald Trump”) and tried to pass an LBJ-size progressive program through a split Senate and razor-thin House majority. Democrats have focused their fire on Joe Manchin’s refusal to endorse BBB, but Democrats should have known better than to expect their progressive wish list to be rubber-stamped by a senator representing a deep-red state that Biden lost by 39 points. Furthermore, Manchin was merely the public face of what was likely five to -10 purple state Democratic senators with serious reservations about the bill.

Build Back Better was also substantively flawed. At a time when voters worried most about inflation and the pandemic, and Congress was dealing with spending fatigue, the president sought to move America closer to a Scandinavian-style social democracy. While several BBB provisions were individually popular, voters distrusted Congress, were exhausted from all the major spending bills, and worried that the bill would worsen inflation, deficits, or lead to middle-class taxes. Additionally, BBB became a large grab bag of unrelated proposals that lacked any unifying theme, and thus became difficult to message. Many Americans couldn’t name specifically what the proposal did.

Finally, Build Back Better exposed as fantasy the progressive “tax the rich” utopia. For years, progressives had promised that simply closing loopholes and taxing the wealthy could pay for the $12 trillion in baseline deficits over the decade, plus tens of trillions of dollars in additional European-style benefits. Yet when Democrats were given control of Washington, they could merely pass $2 trillion in upper-income taxes through the House, and even those policies still face an uphill battle in the Senate. The progressive tax dreams were defeated by basic math—years of vastly over-promising how much revenue can be raised from millionaires—as well as the basic politics of trying to turn half-baked ideas such as a wealth tax and taxing unrealized capital gains, into coherent, workable legislation.

Democrats may ultimately raise some taxes on corporations and upper-income families in 2022, but the ceiling on plausible “tax the rich” policies also caps their grand spending ambitions. While voters are less concerned about deficits than in the past, the enormous progressive spending plans far exceed the amount that the American people are willing to put on the national credit card. And even that is before the baseline deficits approach $2 trillion within a decade—or higher if interest rates rise and drive up the federal budget interest costs.

While Democrats control Washington, Republicans continue to struggle to find their footing on fiscal policy. The 2017 tax cuts—whatever their merits as economic policy—cost the GOP the last shreds of anti-deficit credibility that it had stitched back together during the Obama years. It is challenging to make a credible fiscal responsibility case against the $1.9 trillion American Rescue Plan less than three months after the GOP had enacted its own $900 billion “stimulus” plan with several similar policies. Republican aid in enacting the $550 billion infrastructure bill (with its fake offsets) also scored as one of the largest spending bills in decades. The predictable (and largely deserved) cries of hypocrisy left the GOP without much of an argument against the Democratic spending spree. And does anyone really believe Republicans will prioritize fiscal responsibility the next time they retake power?

The GOP lacked credibility fighting not only the cost of the Democratic spending spree, but also its contents. Much of the Biden agenda—including relief checks, unemployment bonuses, expanded child tax credits, and huge discretionary spending hikes—represented mere expansions of policies enacted by President Trump and congressional Republicans. Before Joe Biden signed an infrastructure bill, we had the repeated “infrastructure week” punchline under President Trump. And many of the policies in Build Back Better, such as expanded child tax credits, family leave, and child care subsidies fit well into the populist, big-government “family agenda” that younger Republican lawmakers began embracing under President Trump.

Thus, despite much of the fiery, partisan rhetoric, Republican economic policy has reverted back to the “Democrat-lite” era of the 1970s and 1980s. Fighting spending is unpopular and easy to demagogue, thus many Republicans are taking the easy path to popularity by putting a conservative veneer on the same old tactic of buying votes with new government benefits.

Republicans will need to rebuild their backbone on spending, because progressives are not backing down on their ambitions. A scaled-back version of Build Back Better may still be enacted, and President Biden has the remaining BBB proposals plus $3 trillion in remaining campaign promises covering Social Security, health care, education, and other initiatives. At some point sooner than many believe, all this spending and borrowing will bring significant middle-class taxes, and angry voters ready to punish whoever is responsible for the red ink.

Brian Riedl is a senior fellow at the Manhattan Institute. Follow him on twitter @Brian_Riedl.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.