Dear Capitolisters,

Over the last several years, prominent voices on the right and left have embraced “producerism”—the idea that U.S. economic policy should start prioritizing production and jobs over consumption, which has supposedly been the country’s economic lodestar for decades (thanks to libertarian “market fundamentalists,” of course). Jobs, so the theory goes, are much more than a paycheck, and people are much more than what they consume. Thus, the federal government should embrace policies—protectionism and nativism, especially, but certainly others—that elevate work above consumption and thus treat it as not merely a means to an end, but the end itself. Producerists are usually a bit coy about the economic tradeoffs of such policies—i.e., the higher prices and reduced consumption that accompany state-directed inefficiency—but former U.S. Trade Representative Robert Lighthizer, a proud producerist, let the mask slip at the American Economic Forum in August:

Lighthizer described the Trump administration’s trade policies as “tariffs, threats, negotiations, and industrial policy.” He said government subsidies throughout American history are a primary source of economic growth.

“Free trade is a philosophy of consumption,” Lighthizer said, describing it as “materialistic.” Free-traders “view us only as consumers,” he said, and “no country ever became great by consuming.” During the Q&A session that followed, Lighthizer said, “The best way to fix consumerism is to raise prices. Is consumption really a problem in America?”

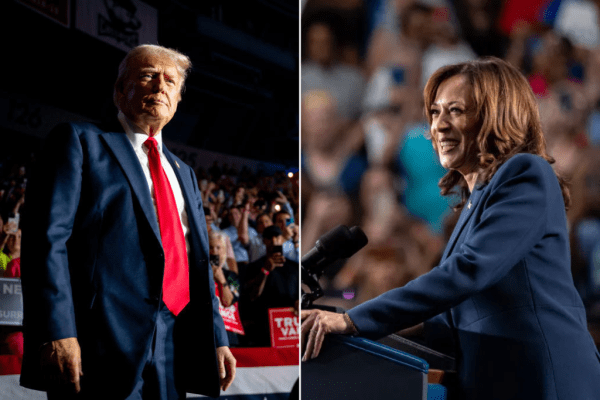

As National Review’s Dominic Pino observed at the time, Lighthizer was not treated as some loony radical by the conference attendees: He “received a standing ovation” and “was easily the most enthusiastically received speaker of the conference.”

And it’s not just national conservatives who embrace producerism and use jobs as the end-all-be-all metric for economic success. Indeed, the original impetus for this column wasn’t some natcon speech or whatever, but a string of tweets by White House Chief of Staff Ron Klain and left-leaning economist Dean Baker, who chided CNN’s Andrew “K-File” Kaczynski for daring to suggest that inflation is voters’ top economic priority:

This week’s election once again proved, of course, that plenty of non-economic factors can drive U.S. election results (in my non-expert opinion, parties probably shouldn’t nominate lunatics, antagonize key voting blocs, and/or hitch their wagon to a troubling, self-absorbed political albatross). But none of that political stuff changes the fact that, in our current era of abundant jobs and high inflation, it’s the latter that’s driving people’s views of the U.S. economy.

In short, we’re living the producerist dream, and almost everyone’s miserable.

The Labor Market Has Been Cranking

Klain and others surely have a point: From a producerist, jobs-centered perspective, the months leading up to the 2022 midterms have been stellar. In fact, the U.S. economy added another 261,000 jobs in October—well above expectations—and, just as importantly, September’s figures were revised up to 315,000 from an initial 263,000.

Meanwhile, the 3.7 percent unemployment rate remains below the (arbitrary, but still) generally accepted 4 percent threshold for “full employment”—even after all the Fed rate hikes and global turmoil. Even the “real” unemployment rate, which includes marginally attached workers and other things, is sitting on the pre-pandemic floor:

Producerists’ favorite sector, manufacturing, is also still overflowing with jobs and—even now—job openings (which have been above 800,000 since April 2021):

Other measures of the labor market also show that it’s still cranking along, if not scalding hot—a distinction that, as the New York Times’ Ben Casselman explains, might matter for the Fed but doesn’t matter for our normie purposes.

Finally, the growth in workers’ nominal wages—i.e., what shows up on your paycheck—continues to far exceed pre-pandemic trends:

So if the primary goal of your economic policy is just putting American butts in desk chairs and on assembly lines and generating lots of (nominal) production/output, then you deserve a big, fat mission accomplished.

… But So Has Inflation

The problem, of course, is that for most Americans, those nominal wage gains simply haven’t kept up with inflation over the last year or more. Instead, the prices of the stuff we actually buy with our paychecks has matched or outpaced any increase in the numbers on those paychecks, thus causing “real” (inflation adjusted) worker compensation to stagnate or decline since at least 2021. Wonky (“compositional”) issues have made it difficult for economists to nail down exactly who has seen real wage gains or losses (and by how much), but these charts from my go-to source—Harvard’s Jason Furman—provide a good summary of the depressing details:

As the American Action Forum’s Doug Holtz-Eakin noted last week, the picture isn’t much better if using the private sector wage data from ADP:

And even folks who once resisted the conventional wisdom regarding falling real wages have succumbed. Over at the Brookings Institution, for example: “Unfortunately, inflation has been higher than wage growth since mid-2021.” And the Center on Budget and Policy Priorities finds, “Overall, however, wage growth has not kept up with inflation in the last year.” So pretty much everyone agrees that, even though our paychecks have been growing, what they can actually afford is shrinking.

Of course, some American workers have seen real wage increases. Low-wage hospitality workers, for example, and “job switchers” too. But as Pew notes regarding the latter group, the outsized real wage gains for these workers means that most of us have gotten poorer on real terms over the last year or so, even after hefty increases in our nominal wages. Thus, “the median worker in the U.S. has not fared well financially in the current inflationary environment.”

As someone who just topped off a book on improving workers’ living standards and mobility (see the links for more!), I certainly support and celebrate job switchers’ good fortunes. But, just as certainly, they’re nowhere close to the majority of the American workforce. (Pew notes, in fact, that—at most—30 percent of the workforce changed jobs last year, but even that number’s probably much too high.)

So the post-pandemic story for most Americans has been the slow, steady erosion of their real-world earnings.

… And (Most) Americans Have Noticed

In a producerist world, Americans should welcome the aforementioned combination of abundant output and jobs and stunted consumption, but that’s most definitely not been the case. Consider, for example, recent trends in U.S. consumer sentiment, which gauges how Americans “how consumers feel about the economy, personal finances, business conditions, and buying conditions”:

And then there’s consumer confidence, which details Americans’ “attitudes, buying intentions, vacation plans, and consumer expectations for inflation, stock prices, and interest rates.”

Broader measures of Americans’ views of the country’s direction generally mirror these trends (even for self-identified Democrats).

This sour mood has unsurprisingly affected voters’ economic priorities in the midterms (though, again, people vote for lots of non-economic and non-policy reasons). Americans might have no idea what causes or fixes inflation, but they sure as heck know that they don’t like it. Bloomberg reported on Monday, in fact, that inflation and the economy were the most important policy issues for American voters this year:

And that Republicans were making hay about it:

And that even the Biden administration was secretly admitting that inflation was a big political problem for them. (Though, again, not as big a problem as Trump appears to be for the GOP.)

Other polls showed much the same: “When asked which is the most important issue for Congress to prioritize right now, inflation and the economy win out by a wide margin, with 42% selecting it as their top choice.” And, really, it’s not even that close:

That Americans prioritize inflation above other policy issues really shouldn’t come as a surprise. Most obviously, rising prices present a powerful, almost constant, and—because inflation affects the general price level—unavoidable reminder of one’s ability to make ends meet. As George Will noted last week, for example: “By mid-year, a typical household was spending $460 a month more than 12 months earlier for the same set of purchases.” Inflation, he adds, “infuriates everyone.” Business Insider recently provided a first-person account of this pain for a working mother:

Every week, when my usual budget was buying less and less, I found myself angrily placing more expensive grocery orders.… An increase of $5.64 might not seem like much, but given that I shop twice weekly, this increase comes out to more than $45 a month. That’s more than 18% — significant for any working family.

The daily burden of higher prices and reduced consumption is bad enough, but even worse, I think, is the expectation of even more price increases in the future—and all out of workers’ control. That uncertainty and insecurity will inevitably weigh on Americans’ views of not just their grocery bills but surely the economy more broadly, even if they’re satisfied with their job or just got a raise.

After decades of low inflation, it can be easy to forget all of this and instead focus on production and jobs, but the paramount importance of one’s actual consumption was always there—just not seriously imperiled.

Right now it is.

Adam Smith Was Right

Of course, you typically need a job to consume stuff and working can provide certain non-monetary benefits (though this is also oversold), but the last year-plus should hopefully remind us that, economically at least, production and employment remain a means to an end—not, as producerists would have us believe, the end itself. If the above stats don’t convince you, then consider a recent survey that found that our current inflationary environment has pushed 38 percent of Americans working full-time to look for a second job, and another 14 percent to plan to do so. For workers with children (and hence household consumption), the numbers were even more stark: 70 percent said their current pay wasn’t keeping up with rising costs, and 47 percent looked for a second job. Here’s one example:

Tiffany Perkins, a marketing professional at a Brooklyn private school, decided to take on a part-time job in September as a restaurant hostess. While she has always done side gigs like offering doula services, selling homemade beauty products, and participating in focus groups for extra money, it isn’t enough to cover her bills as the price of food and utilities rises.

“I budget to zero, I have a very tight paycheck to paycheck lifestyle. I’ve gotten used to it. I can do odd jobs, get a little extra money and be fine,” said Perkins. “Saving has always been difficult for me, I am a single mom so I’ve always been hand to mouth in prioritizing a certain lifestyle for my child and his future. As opposed to securing my immediate financial goals I always think more long term. I feel like I’ve always been in survival mode, but lately it’s survival times 10 because it just seems almost impossible.”

With the new commitment, she now works 7 days a week and admits to being exhausted, but she’s glad to be able to catch up on necessary expenses and afford to buy her son a gift for his birthday.

Perkins isn’t working just to work. She’s working so she can afford essentials for her family. Put another way, she’s working to consume—and “glad” when she can. In a producerist world, Perkins is better off now than she was a couple years ago when prices were lower and more stable. In the real world, not so much—and all the jobs in the world can’t change that.

If this principle all sounds familiar, it should. It goes back to perhaps the most essential takeaway from Adam Smith’s “An Inquiry into the Nature and Causes of the Wealth of Nations“:

Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to only so far as it may be necessary for promoting that of the consumer. The maxim is so perfectly self-evident that it would be absurd to attempt to prove it. But in the mercantile system the interest of the consumer is almost constantly sacrificed to that of the producer; and it seems to consider production, and not consumption, as the ultimate end and object of all industry and commerce.

As “absurd” as it is, questioning Smith’s wisdom has become commonplace.

It even receives a standing ovation.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.