Dear Capitolisters,

One of this newsletter’s persistent, albeit depressing, themes is that bad policy can linger for years, even decades, after it’s been proven ineffective at best and destructive at worst. There are plenty of examples of this problem—people have even written books about it—but there may end up being no better example than baby formula, a frequent topic of my 2022 scribblings.

Indeed, just as American store shelves are returning to some semblance of supply normalcy—thanks in no small part to the emergency liberalization of multiple U.S. restrictions on European and other foreign-made formula products—the federal government appears ready to reapply high, potentially prohibitive, taxes on the very imports that helped save the day.

Looking Back at the Baby Formula Crisis

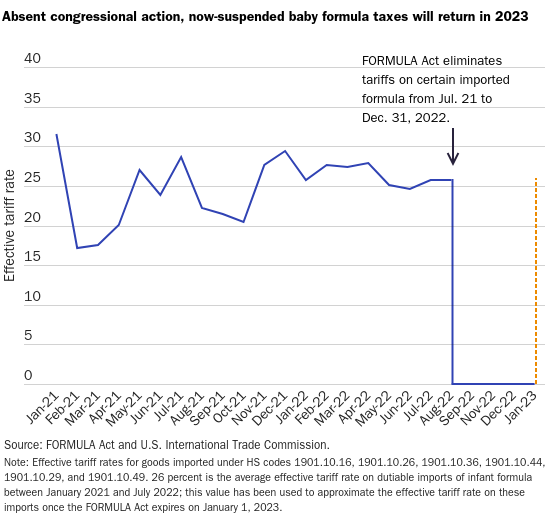

Before we get to that, however, a quick refresher as to how we got here (see this for details): The United States has—thanks to intense lobbying by the politically-powerful U.S. dairy industry—long imposed a complicated system of domestic regulations and “tariff rate quotas” on imports of milk, cheese, and other dairy products. Among those other products are infant formula and its base ingredient, dry milk, and import taxes averaged out to an effective rate of about 25 percent. When combined with the FDA’s onerous regulatory (“non-tariff”) restrictions, which subjected popular formulas approved by competent regulators abroad (the EU, U.K., New Zealand, etc.) to a laundry list of nitpicky rules, the trade restrictions effectively walled off the United States from all foreign formula brands—even ones that many American parents really wanted (and went underground to get).

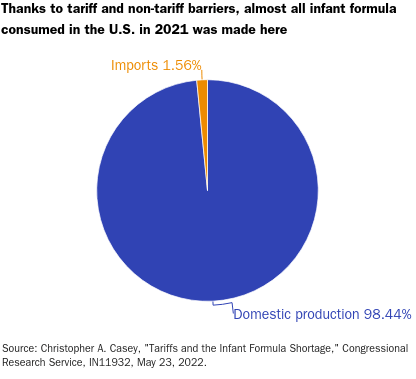

As a result, more than 98 percent of all formula consumed in the United States before the crisis was made here—an autarkic situation that Big Dairy and economic nationalists surely loved but also one that, consistent with reams of economic research on protectionism and supply chain resilience, made the U.S. market uniquely vulnerable to a big domestic supply shock.

That shock, of course, materialized when an Abbott Labs factory in Michigan was shut down for possible contamination issues, leading to extended periods of empty store shelves, panicked American parents, and frantic efforts by the federal government to alleviate the crisis.

Imports Helped Save the Day

As we discussed in July, imports were a big focus of the feds’ efforts. Via “Operation Fly Formula,” President Joe Biden commissioned military planes to fly in formula from Europe—more a photo op than a real improvement in the domestic supply situation but still a very visible acknowledgement of imports’ value (and protectionism’s problems, especially when a crisis hits). More important, Biden instructed the FDA to exercise its “enforcement discretion” to fast-track temporary approvals of certain foreign formula brands, so they could sell here without the well-supported fear of having their shipments seized at the border. The FDA ended up issuing temporary authorizations to a handful of foreign producers (mainly in Europe, the U.K., Australia, and New Zealand)—“creating,” in its own words, “more resiliency in the U.S. infant formula supply chain and reducing the risk of reliance on too few production facilities supporting the United States.”

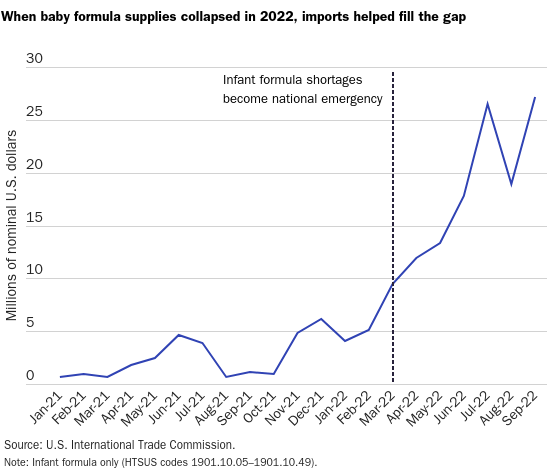

After much delay, Congress also acted, with the near-unanimous July passage of the hilariously named FORMULA Act (look it up!), which temporarily suspended all tariffs on infant formula through the end of 2022. Finally, the FDA in September recognized the need to keep these players in the U.S. market to ensure U.S. inventories remain stocked, so the agency extended the authorizations through October 2025.

As I’ve noted repeatedly, this is not ideal policymaking—deeper and more durable reforms of both international and domestic policy are needed—but it was at least something. And it was a clear recognition by the executive and legislative branches that freer trade could help stabilize the U.S. baby formula market and, more importantly, keep American babies healthy and fed. And the chart below shows that the government’s efforts did indeed boost imports—something the White House also acknowledges. (Per Reuters last week, “[n]ew brands have increased formula supply this year, with multiple foreign brands available on shelves and online, including Danone’s Aptamil and Bellamy’s Organic, a White House official said.”)

But We’re Not Out of the Woods Yet

That said, the domestic supply situation remains tenuous. According to USA Today, national inventory levels have improved but regional shortages remain, leaving many American moms still “frantically” searching for baby formula—more than nine months after the crisis began and much longer than most other supply chain problems (so much for protectionist “resiliency,” eh?).

And, Reuters noted, at least one major U.S. producer just recently predicted that disparate shortages will “persist” until at least spring 2023.

New Baby Taxes? Really?!

Given this situation, you’d think that Congress would’ve—at the very least—already extended the tariff suspension to align it with the FDA’s new deadline in 2025. (Full repeal is, of course, even better.) Yet as of yesterday, there have been a grand total of zero public movements—proposed legislation, Biden requests, congressional letters, etc.—to do so. Thus, even as past U.S. import restrictions predictably contributed to an abnormally deep and prolonged shortage of an essential product, even as imports helped improve the broken U.S. market for that product, even as the FDA has itself acknowledged the need to keep those imports in the U.S. market for at least two more years, and even as the U.S. market remains fragile and undersupplied, Congress is apparently willing to allow a 25 percent tax on baby formula imports to be reapplied in the coming days. Things could surely change in the next few weeks, I guess, but the outlook today doesn’t look good.

Assuming this outlook holds, it’ll be a depressing and troubling turn of events—but also one that’s utterly predictable. As I wrote back in July, it’s all but certain that both U.S. formula producers and Big Dairy, who each lobbied for and derive concentrated benefits from the old system, have been working overtime to ensure that it falls back into place now that the public crisis has passed. The rest of the American public, on the other hand, likely stopped paying attention to this mess months ago (unless, of course, they’re still searching for formula). Thus, given this common political dynamic, we shouldn’t be surprised if December 2022 comes and goes without any serious congressional attempt to stop the 25 percent #BabyTax from snapping back into place in January—despite the catastrophe that those taxes helped foment mere months ago (and the government’s own acknowledgment of that fact).

Alas, “frantic” parents don’t have lobbyists or trade associations on standby, and they’re too busy raising their kids and scouring the earth for formula to organize and hire one.

It’s Not Just Formula (Of Course)

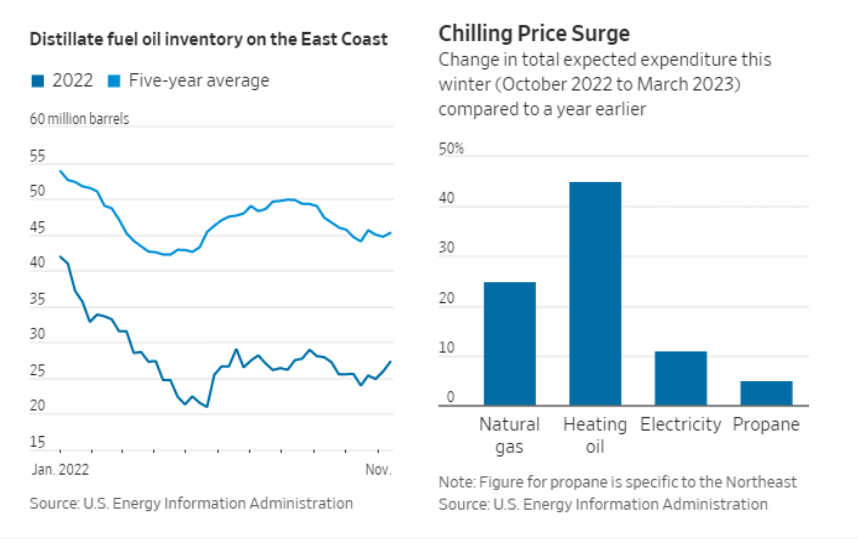

I’ll happily celebrate being wrong here, but there’s plenty of precedent to suggest I won’t be. As I write this, in fact, energy experts are warning that the good ol’ Jones Act could contribute to a full-on fuel crisis in New England this winter, but nobody (in a position to do something, at least) seems to care. In particular, a “perfect storm” of events—Russia, inflation, refinery closures, storage changes, etc.—have left local inventories of liquid fuels severely depleted and have thus caused prices to spike. But the Jones Act, by dramatically increasing the cost of U.S. shipping and shipbuilding, is effectively blocking locals from quickly obtaining additional (American-made) energy from the Gulf Coast.

Northeast governors and market players are now warning of a catastrophe (rolling blackouts, unheated homes, etc.) if there’s a serious cold snap that takes out remaining reserves, and they’re publicly asking for a winter-long Jones Act waiver to avert disaster. Yet, in typical fashion, the Jones Act lobby has flooded the zone in opposition, and neither Congress nor the Biden administration appears willing to expend the political capital necessary to fight them and ensure that this crisis never materializes—choosing instead, it seems, to wait until an actual crisis forces their hand, much like what happened in Puerto Rico a couple months back. Given that it takes weeks to transport fuel from the Gulf to the northeast (and to find ships to do it), however, an emergency waiver at that time may be too late. Blech.

Domestic policy suffers from similar afflictions. In October, for example, I wrote about how the COVID-19 pandemic emergency pushed numerous states to rescind occupational licensing restrictions on the interstate provision of telehealth and other services—restrictions that, thanks to domestic interest group pressure and good ol’ bureaucratic inertia (and despite the demonstrable benefits of eliminating them), snapped back the minute the crisis was over.

Or consider the recent failure of multiple ballot initiatives to modestly liberalize alcohol sales in Colorado, which has a famously liberal treatment of marijuana (and now psychedelics)—thanks, again, to furious lobbying by the industry folks that the regulatory system protects and enriches. R Street’s Jarret Dieterle explains the dynamic well, which applies far beyond booze in Colorado (emphasis mine):

After Prohibition… States either had the government take control of all alcohol sales or implemented a three-tier system that required producers of alcohol to be legally separate entities from wholesalers and retailers of alcohol. A century after the end of Prohibition, nearly every state in America still labors under one of these antiquated systems.

When the government mandates what roles certain players have in the marketplace, these players become reliant on these mandated roles and create opposition toward any efforts to upend the system. In modern-day America, both alcohol wholesalers and some alcohol retailers are determined to protect the status quo and prevent any reforms that could modernize and free the marketplace.

Right on cue, the key opposition force against the Colorado ballot initiatives was incumbent alcohol retailers in the state. They launched a sustained opposition campaign, arguing that passing the initiatives would be tantamount to putting small mom-and-pop alcohol stores out of business across the state.

In case after case, for both foreign and domestic policy (here’s another), government protection and subsidization of specific groups showers concentrated rents upon a lucky few, providing them with the financial resources and motivation to fight like hell to maintain those policies, regardless of their broader economic harms. Being human, moreover, politicians and bureaucrats have incentives to respond to these squeaky wheels with more government oil, and such motivations are often further amplified by partisan politics and groupthink. Indeed, despite the evidence above and near-consensus among experts that imports helped assuage problems caused by our overconcentrated U.S. baby formula autarky, some partisans recently offered the crisis as proof that we needed … more domestic manufacturing? (Political narratives gonna narrative, I guess.)

To be clear, none of this argues for a market free from all government intervention. But it once again provides a big, glaring example of why we should be really skeptical of government plans to boost a certain product or industry via tariffs, subsidies, or regulatory barriers. Unlike the market, which in all but the most extreme cases disciplines failures and produces consumption or production alternatives when they hit (often with ruthless efficiency), bad government policies not only can persist but can even rise from the dead after being suspended. Once you turn on that protectionist spigot, it’s really tough to turn off permanently—even when it means taxing baby formula in the wake of a yearlong baby formula crisis.

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

You are currently using a limited time guest pass and do not have access to commenting. Consider subscribing to join the conversation.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.