Happy Monday! We hope your Easter celebrations and Passover seders were everything you hoped they’d be.

Quick Hits: Today’s Top Stories

-

After a brief reprieve during which Russian forces began their pivot to eastern Ukraine, the shelling of Kyiv and other western Ukrainian cities resumed over the weekend, leading Kyiv Mayor Vitali Klitschko to urge Ukrainians who have fled the city to “stay [away] a little bit longer.” Kyiv Police Chief Andriy Nebytov claimed Friday more than 900 civilians have been found dead in the region since Russian troops withdrew, 95 percent of whom appear to have been killed by gunshot. Russian forces appear closer to capturing the southeastern city of Mariupol, but on Sunday, the few Ukrainian troops remaining in the city rejected Moscow’s offer to spare their lives in exchange for a surrender.

-

Dozens of people were injured in Jerusalem over the weekend as Israeli police clashed with Palestinians at a holy site—the al-Aqsa Mosque, the Temple Mount—important to both Muslims and Jews. Israel’s Foreign Ministry claimed its forces reopened the site for prayer after arresting hordes of “violent rioters” who were “descrating” it, while the Palestinian Foreign Ministry accused Israeli police of committing “barbaric” crimes against worshipers. Similar clashes erupted into an 11-day war in 2021, and tensions were heightened this year with Passover, Ramadan, and Easter being observed at the same time.

-

The Interior Department announced Friday afternoon that—in order to comply with a June 2021 injunction from Judge Terry Doughty of the Western District of Louisiana—the Biden administration will, on a limited basis, resume lease sales for oil and gas drilling on federal land. The Interior Department said it would make about 144,000 acres available for sale—an 80 percent reduction from the 733,000 acres nominated for leasing by energy companies—and increase the royalties energy companies pay on the value of the oil and gas extracted, from 12.5 percent to 18.75 percent.

-

Gov. Greg Abbott announced Friday he was ending his order—implemented earlier this month in response to the Biden administration’s decision to repeal Title 42—that required all commercial vehicles crossing the border into Texas from Mexico to undergo “enhanced” inspection from the Texas Department of Public Safety. Abbott said he felt comfortable revoking the directive after reaching border-security agreements with four Mexican states, but the governor was also under immense pressure from businesses and political interests hurt by the miles-long backups and traffic jams.

-

One month after a bipartisan group of senators sank Sarah Bloom Raskin’s nomination to serve as the Federal Reserve’s vice chair for supervision, President Joe Biden on Friday announced his intent to nominate Michael Barr—an Obama administration Treasury Department official who helped craft the Dodd-Frank Act—for the same position.

-

Twitter’s board of directors unanimously approved a “limited duration shareholder rights plan” on Friday, effectively adopting a “poison pill” intended to forestall a proposed takeover by billionaire Elon Musk. If anyone buys more than 15 percent of the company—Musk currently owns about 9 percent of Twitter’s shares—Twitter would automatically dilute his or her stake by issuing new shares at a discounted price. According to the board, the plan—which will be in effect for a year—doesn’t preclude Twitter from “engaging with parties or accepting an acquisition proposal if the Board believes that it is in the best interests of Twitter and its shareholders.”

-

Former President Donald Trump endorsed author and venture capitalist J.D. Vance on Friday in Ohio’s GOP U.S. Senate primary, arguing Vance is Republicans’ best chance to defeat likely Democratic nominee Rep. Tim Ryan and that he “gets it” now after having said “some not so great things” about Trump in the past. Ohio’s primary elections will be held on May 3.

-

Two teenagers were killed and at least eight others injured early Sunday morning in a shooting at a large party held at an Airbnb in Pittsburgh. Police believe there were multiple shooters, and have not made any arrests yet. Twelve people were shot at a mall in Columbia, South Carolina, on Saturday afternoon, and at least nine others were shot on Sunday at a lounge in Furman, South Carolina. No fatalities were reported in the latter two shootings as of Sunday evening.

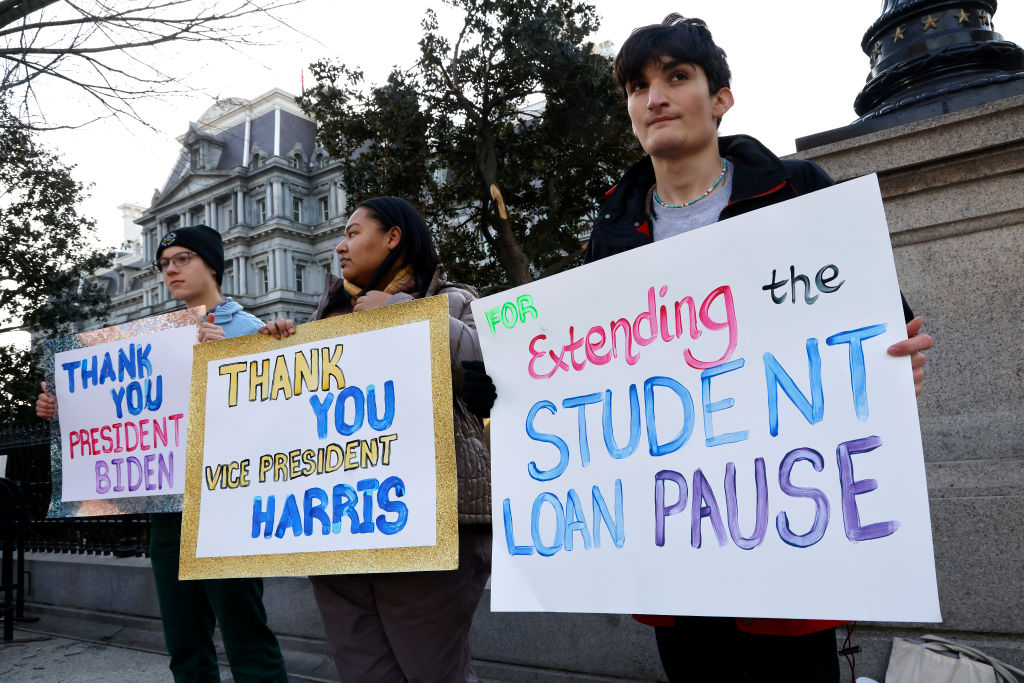

Student Debt Repayments Stay Frozen

Hear that noise? It’s the sound of a can being kicked down the road.

Earlier this month, President Joe Biden announced he was extending the federal student loan repayment freeze—first put in place by the Trump administration as a pandemic relief measure in March 2020—through August 31, 2022.

“We are still recovering from the pandemic and the unprecedented economic disruption it caused,” Biden said, pushing back the end of the moratorium a third time—and second time since claiming his August 2021 extension would be his “final” one. “Additional time will assist borrowers in achieving greater financial security and support the Department of Education’s efforts to continue improving student loan programs.”

About 43 million people in the U.S. have a combined total of $1.6 trillion in federal student loans, according to government estimates. But the job market has rebounded in a major way—there were more than 11 million job openings at the end of February, almost two for every unemployed worker—and COVID-19 restrictions are all but a thing of the past. Yet the Biden administration has not committed to resuming payments at the end of this latest extension. “[The moratorium] is either going to be extended or we’re going to make a decision” about canceling debt, White House press secretary Jen Psaki said on a podcast recently.

“The White House should just be honest about what they’re doing and announce they’ll turn the loan portfolio on after Election Day,” Trump-era Secretary of Education Betsy DeVos wrote.

Progressive Democrats praised the freeze extension, but argued it didn’t go far enough. “I don’t think those folks understand the panic and disorder it causes people to get so close to these deadlines just to extend the uncertainty,” Rep. Alexandria Ocasio-Cortez tweeted. “We should cancel them.” Sens. Elizabeth Warren and Bernie Sanders echoed the calls for wiping out borrowers’ debt entirely.

As a presidential candidate, Biden campaigned on forgiving “a minimum of $10,000” in student debt per borrower, and since taking office has supported legislation aimed at accomplishing that goal. But that won’t be happening in this current Congress, leading progressives and advocacy organizations to demand Biden wipe away students’ debt unilaterally with an executive order—something it’s far from clear he has the legal authority to do. Senate Majority Leader Chuck Schumer, who favors $50,000 in debt forgiveness, promised activists last week that the White House is getting closer to canceling debt on its own. “I have told the president this is one of the most important things he can do to help our economy,” Schumer said. “We want our young people to realize that they can have a good future.”

(It’s also potentially one of the most important things he can do to help Democrats’ political prospects, as Biden won about three in five college-graduate voters in 2020 as the country continued polarizing around educational attainment. He’s been bleeding support from young voters in recent months, and party strategists see student loan forgiveness as a last-ditch means of getting them back on the team before the midterms.)

Conservatives, of course, generally oppose student debt cancellation on the grounds that it’s unfair to those who have repaid their loans, and that it creates harmful incentives for both borrowers and schools. “Blanket forgiveness would compound the nation’s 40-year-high inflation rate, while disproportionately benefiting high-income borrowers—the very people who least need help and are reaping the benefits of the postsecondary education taxpayers provided them,” Republicans on the House Education & Labor Committee argued last month. “It also does nothing for future borrowers as it ignores the systemic problems plaguing the student loan program that created the vicious debt spiral and tuition-bubble we have today.” GOP Reps. Jim Banks and Bob Good introduced a bill a few weeks ago that would have blocked the administration from extending the moratorium again.

Large-scale student debt forgiveness would represent a massive cash infusion to America’s wealthiest households, and a comparative dribble for the rest.

Just 38 percent of Americans over 25 had a bachelor’s degree in 2021, according to the Census Bureau. An analysis published by the left-leaning Brookings Institution found nearly a third of all student debt is owed by the richest 20 percent of households, compared to just 8 percent held by the poorest 20 percent of households. Student debt forgiveness could help that lowest 20 percent, but the U.S. already has better-targeted ways to help. “Forgiving all student debt would be a transfer larger than the amounts the nation has spent over the past 20 years on unemployment insurance, the Earned Income Tax Credit, or food stamps,” Adam Looney, senior fellow of economic studies at the Brookings Institute, wrote in January. “In contrast to those programs, which serve deeply poor families, beneficiaries of student debt forgiveness would be higher income, better educated, and whiter than beneficiaries of just about all other programs designed to reduce economic hardship and promote economic opportunity.” College grads can still struggle to find well-paying jobs, of course, but the overall salary boost for college graduates over high school-only graduates is higher than it’s ever been, according to Looney.

The freeze itself is just as regressive, as it disproportionately benefits those higher-income borrowers, who are also least likely to have lost jobs during the pandemic. And it’s not like the freeze is free. Lost interest and payments are costing the government an estimated $4.3 billion a month, according to the Committee for a Responsible Federal Budget.

Progressive support for forgiving $10,000 of student debt stems from the fact that the people most burdened by student debt are those who never graduated, who are often only a few thousand dollars in the red but struggle to pay it back after failing to receive the salary boost that often comes with a degree. You hear the most about horror stories of students being straddled with hundreds of thousands of dollars of debt, but they’re far from representative. The average federal student loan debt balance last year was about $37,000. The most burdened borrowers are already eligible to be helped by certain income-based repayment programs, which cap monthly student debt payments at 10 percent of their discretionary incomes and eventually forgives the remaining balance, typically after 20 years. Since the debts can eventually be forgiven for these high-need borrowers, the benefits of even partial debt forgiveness would still go disproportionately to high-income borrowers.

But existing debt forgiveness programs are complex and unwieldy, and high-need borrowers are less likely to sign up. Beth Akers, a senior fellow at the American Enterprise Institute who focuses on the economics of higher education, argues the government should streamline them, keeping the core program of reduced payments and eventual loan forgiveness for borrowers who never reach higher incomes, and helping those borrowers enroll. “People are going to be making huge investments in themselves with the hope that it’s going to pay dividends in terms of future employment opportunities,” Akers said. “Let’s create a safety net there.”

Even if forgiving all student debt was a more efficient way to help the neediest borrowers, it’s just another way to kick the can. Students will keep attending college and accruing debt, but with the added precedent of forgiveness. “It changes the incentives for borrowers going forward,” Akers said. “If I’m sending my child to school this year, and they just saw that great President Biden just wiped away everyone’s student debt last year, I’m probably going to pay a little more for school than I would have otherwise. I’m probably going to borrow a little more for school than I would have otherwise. Colleges are going to say, ‘People are really willing to pay; I’m going to raise my prices a little bit.’ We just exacerbate the problems that we have with this one-time solution.”

This kind of policymaking has compounded for decades, resulting in today’s astronomical tuition figures. According to a DataStream analysis of Labor Department data, the cost of a college education has increased 1,200 percent since 1980, compared to overall inflation of 236 percent.

Some lawmakers are trying to slow—or reverse—that trend by driving down demand for a traditional four-year bachelor’s degree, pointing out that a college education doesn’t make sense for everyone. “The college-for-all mentality has been damaging. Not only does it burden young people with student loan debt, but it also dissuades people from working with their hands, which can be very rewarding,” Sen. Marco Rubio wrote last year. “We need to shift resources toward vocational education and pathways to success other than college.” Just last month, Gov. Larry Hogan announced Maryland would drop four-year degree requirements for “thousands” of state jobs, allowing potential employees to cite skills picked up from community college, the military, apprenticeships, or other jobs on their applications.

The pandemic may be accelerating some of these shifts: Total undergraduate enrollment in the United States reportedly declined 6.6 percent from fall 2019 to fall 2021.

Worth Your Time

-

Russia has reportedly made Ukrainian neutrality a precondition in any peace talks, but Kevin Williamson argues for National Review that conditional sovereignty is no sovereignty at all. “It is obvious that Russia’s attempt to dictate to Ukraine what alliances it may join and what kind of foreign relations it may pursue is a limit on Ukrainian sovereignty,” he writes. “But it is also a limit on American sovereignty, British sovereignty, German sovereignty, French sovereignty, and the sovereignty of every other NATO country. An alliance is a two-way relationship, and if Moscow has the power to foreclose it on one end, it has the power to foreclose it on the other end. We must not cede such power to Moscow. This is not new territory. Far from it. The proposition that Moscow should enjoy veto power over the foreign relations and defense policies of European nations that the Russians regard as being within their proper sphere of influence is not a recent development. It did not begin with Ukraine. It did not begin with NATO expansion—it precedes the existence of the modern form of NATO by many years.”

-

Yuval Levin has thoughts on how to curb the culture war. “People who disagree about abortion might nonetheless share a love of nature or of the New York Mets, or a devotion to the nursing profession, or a deep religious faith,” he writes for Comment Magazine. “If we let our society evolve in the direction of a single, all-encompassing cultural conflict, such people could find no way to overcome what keeps them apart, and would be left always approaching one another with suspicion. But if we come to see some separate spheres of life as distinct yet overlapping domains of human action, we can hope to better reflect the constructive complexity of our gloriously diverse free society, and so to build out spaces for common efforts, common enjoyments, and common loves despite our differences. That would mean not only putting up with people who vote differently than we do but also finding ways to admire them and learn from them—even if not about how to vote. It would mean recognizing the humanity of our neighbours, seeing that expertise in one arena does not imply authority in another, and grasping that setting bounds on the reach of our cultural combat is not just a pragmatic concession to civility but also a broader path to the fullest truth about the human person.”

-

In a review of Diana Schaub’s new book, Wilson Shirley draws a throughline between the oratory of Abraham Lincoln, Frederick Douglass, and Martin Luther King, Jr. “Returning to old texts like those from Lincoln and King is a worthwhile, and particularly American, thing to do,” he writes for American Purpose. “Even if the 272 words of the relatively brief Gettysburg Address—or Lincoln’s longer speeches—may take more time and reflection to understand than do the structures in Parliament Square, they’re worth the effort. America’s story—the good and the bad, but always the truth—is meant to be studied, if its promise is to endure. Schaub helps us remember—whether we’re walking up the steps of a memorial or through our daily lives as citizens—how lucky we are to live in a country that produced Lincoln, and how fitting and proper it is that we should still be moved by his words.”

Presented Without Comment

Also Presented Without Comment

Also Also Presented Without Comment

Toeing the Company Line

-

In his Friday G-File, Jonah argues Democrats are trying to sell molecular gastronomy to a general public that just wants to eat a sandwich. “Sometimes people care more about niche audiences than the general public,” he writes. “Whether it’s education, energy policy, immigration, or transgenderism, the progressive managerial class is performing for the praise and respect of other members of its class.”

-

On Friday’s episode of The Dispatch Podcast, Sarah, Steve, Jonah, and David break down the latest Consumer Price Index report and the impact inflation will have on both the 2022 and 2024 elections. Plus: What would Sweden and Finland joining NATO mean for the Western alliance? How might Russia respond?

-

On Easter Sunday, David’s French Press reminds readers the healing power of faith in times of fear and sorrow. “There are millions of Americans who are gathering around gravesites too soon. They’re placing their flowers and mementos, and they mourn,” he writes. “But there is a reason for comfort. There is a reason why believers speak the name of their friend, their father, or their mother and greet them in the present tense. There is a reason why they can look at that headstone and say, ‘Where, death, is your victory? Where, death, is your sting?’”

-

On the site today, Danielle Pletka argues that we pay mere lip service to human rights and that there are too few consequences for those who commit atrocities. Warning: The piece includes graphic images.

-

Also on the site, Chris Stirewalt looks back at Clint Eastwood’s Unforgiven, which marks its 30th anniversary this year. “It is a testament to Eastwood’s filmmaking and the acting of the supporting cast … that a movie could persist so long in moral ambiguity without becoming boring.

Let Us Know

Do you have student loans? Have you already paid them off? How should U.S. public policy balance questions of fairness and perverse incentives as policymakers address ever-increasing costs of higher education??

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

You are currently using a limited time guest pass and do not have access to commenting. Consider subscribing to join the conversation.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.