We officially are in the trenches. Friday’s employment report was the worst in modern history: More than 20 million jobs were lost in April; unemployment is at 14.7 percent. With comparisons to the Great Depression being made, it’s time we rethink the government’s role in supporting work.

The unemployment numbers are based on those who lost a job and report actively looking for work. Meanwhile, the U-6, a broader measure of unemployment that includes those who are underemployed with reduced hours and those who have stopped looking for work, reached a mind-boggling 22.8 percent last month, meaning that more than a fifth of the labor force has been compromised. For comparison, the U-6 rate was 7 percent in February 2020 and the peak during the Great Recession was 17.1 percent.

It feels quaint to remember that unemployment was at historic lows mere months ago, with job creation on a 113-month streak. But it took little time for COVID-19 to push the economy off the cliff, and now it feels even more quaint to think that we would get out of the pandemic and its economic ravages by the summer.

The crisis has morphed from stopping the bleeding—with PPP loans and expanded unemployment benefits—to having anything resembling a functioning economy for the foreseeable future with a vaccine not yet in sight. This will take a new set of policy prescriptions than what’s been tried thus far.

Arguably one of the most important economic priorities is to avoid having the mass temporary job loss we are experiencing now turn into mass long-term unemployment and workers giving up on work entirely, which has detrimental economic, social, and health consequences.

Following the Great Recession, the mean duration of unemployment increased from roughly 16 weeks to 41 weeks, the longest on record. The long-term unemployed—those jobless for 27 weeks or more—made up nearly half of the unemployed in the year following the recession’s end in 2009.

Extended involuntary time out of work creates obvious and severe financial burdens. But that’s just the tip of the iceberg. As my former colleague and former chair of the council of economic advisers Kevin Hassett testified back in 2013, long-term unemployment also coincides with higher mortality rates, suicide rates, divorce rates, educational problems for children, and mental illness. Time out of the labor force also leads to reduced wages if and when a worker is rehired, leading to a permanently compromised economic trajectory.

Policymakers should work overtime to avoid this outcome, keeping as many people at work as they can, and getting the rest back to work as soon as possible. The vast majority of workers filing for unemployment (88 percent) last month reported being on a “temporary” layoff, according to the Wall Street Journal. We should ensure that this is indeed the case by better supporting workers and businesses.

This starts by increasing incentives to return to work. Even prior to the pandemic, many low-wage workers didn’t make enough money to support a family, let alone compensate for the increased stress of providing essential services. In a new AEI paper, Aparna Mathur, Erin Melly, and I discuss the need to expand wage subsidies for low-wage workers as a means for increasing economic opportunity and as a more targeted and business-friendly alternative than raising the minimum wage. This is especially vital now to encourage work and should continue beyond the pandemic.

The recently discussed payroll tax holiday too would provide an automatic pay boost for those employed (no paperwork or jammed phone lines required!), which on top of an expanded EITC, would dramatically increase wages and arrive in each paycheck instead of waiting for tax filing or for Washington to mail out checks. The lost tax revenue eventually would have to be compensated for, as the programs funded by payroll taxes are already in tough financial straits, such as Social Security. But in a crisis, payroll tax relief is a rapid way to get money back into workers’ pockets.

Complicating the return to work is that some workers can earn more in unemployment than employment because of the supplemental $600 a month in emergency unemployment insurance benefits, expiring in July. There’s increasing evidence that this has encouraged employees to leave jobs for UI, and employers to furlough or lay off employees. This is compounding our difficulties. While additional UI support was needed (and more will likely be needed in the near future), the distribution of payments should be adjusted to encourage re-employment as soon as possible and when available, especially given that the economy may be moving in and out of hiring periods during the pandemic.

Evidence from the last recession suggests that extended benefits coincide with longer unemployment durations, even if employment is available. As such, there should be a surge of initial payment, but then benefits should scale down over time instead of being a uniform rate each month. Floated during the last recession was the idea of Personal Re-Employment Accounts, wherein the unemployed would receive a lump sum payment, helping to cover expenses and time spent retraining (such as learning to become contact tracers), with persons able to keep part of the money should they be hired as a rehiring bonus. This, combined with higher wages, would encourage work where work is available.

A second area of support is to keep payrolls intact as much as possible. The Payroll Protection Program should be fully funded, full stop. It makes little sense to be penny wise and pound foolish in creating an effective program and then chronically underfunding it. Estimates by AEI’s Glenn Hubbard suggest the program is underfunded by hundreds of billions. Here too, a payroll tax holiday could encourage employers to keep people on by cutting company expenses (employers and employees contribute equally to payroll taxes). Despite the increasing murmurs from Democrats such as Sen. Elizabeth Warren Warren, politicians should proceed with caution on adding business mandates, such as greater unionization or a higher minimum wage, that would additionally burden business (and thus reduce employment) in an already constrained time.

Finally, we should be doing all we can to create additional opportunities for work, including increased flexibility in government programs and increased flexibility on the part of employers. Wherever possible, employers should extend policies they implemented during the pandemic, opening up telework options and flexible schedules that have allowed many workers (and particularly mothers) to stay attached to the labor force. Increased access to paid leave would allow workers to heal or care for ill loved ones while staying connected to their jobs, instead of having to quit to deal with a short-term emergency. This, too, is of critical importance for women who constitute the vast majority of caregivers, and who have experienced a higher unemployment rate than men in the crisis.

On the government side, ours is largely a system of all-or-nothing, large benefits for the unemployed, little support for those employed. This bodes poorly for a pandemic with rolling periods of infection and unemployment. One way to change this is to expand workshare through unemployment insurance, which allows people to be partially employed and still collect partial unemployment insurance benefits. This would help to avoid layoffs, allowing for a larger share of workers to stay attached to their employers. Currently, only 27 states have workshare programs in place and they are chronically underutilized. The administration should champion the benefits of workshare, which seems especially suited to businesses reopening at partial capacity.

Another is disability insurance reform that similarly allows workers with extenuating health conditions to work on a reduced schedule and collect an adjusted disability insurance payment. Research by economist David Autor and others has shown a clear link between labor market conditions and disability rolls, showing that as job loss and long-term unemployment rise, people are more likely to apply for disability benefits, irrespective of any decline in the health of the U.S. working age population. Once on Social Security Disability Insurance, few people leave, meaning that it corresponds with permanently leaving the labor force. This is a fiscal concern given that the existing program is already overwhelmed, but it also fails to serve persons who could still work on a reduced schedule and earn more by working and receiving a supplemental check. Reforms to SSDI are long overdue to encourage re-entry and labor force attachment.

To be sure, one of the most jarring fears stemming from the pandemic is that a good share of the jobs might not come back—that it will accelerate the move to automation, that consumption may not rebound, that companies cannot continue on as they were before. To the extent there’s a shortage of jobs available, there may be a case for direct government hiring, of youth for whom time out of work early in their professional lives will have decades-long implications, or for the long-term unemployed. This could be done through a voluntary national service program run through state and localities, as I proposed in a National Affairs essay. National service has enjoyed long bipartisan support for creating national unity, supported by the likes of legend William F. Buckley Jr., who wrote an excellent little book dedicated to the idea called Gratitude.

In a pandemic, a voluntary service program could help to ward off the negative consequences of extended periods out of work by providing temporary employment. A nimble approach would be to compensate persons for one year of work at a nonprofit of their choosing or “service year fellowships,” as advocated for by Republicans John Bridgeland and Alan Khazei and recently highlighted by New York Times columnist David Brooks. This would provide for a greater dispersion of regional and service activities instead of a nationally managed program.

Some may argue we do not have the resources to do any of this, a federal debt crisis already looming. But a shattered labor force will make future economic growth even more evasive and our debt obligations infinitely harder to pay off. To be sure, America would benefit from a sign of commitment for tackling entitlement reform when the current crisis ends, as the lack of attention represents a threat to the workforce and economic growth (as if we needed something else to worry about). But leaving the driver of the debt in place while pulling back on our short-term emergency response would be foolhardy. No one benefits from mass long-term unemployment and a shrinking labor force, which will exacerbate the tragedy in which we find ourselves.

The reopening phase we are in will mean very little if there are no jobs available and no workers to be found.

Abby M. McCloskey is an economist and founder of McCloskey Policy LLC. She has advised multiple presidential campaigns.

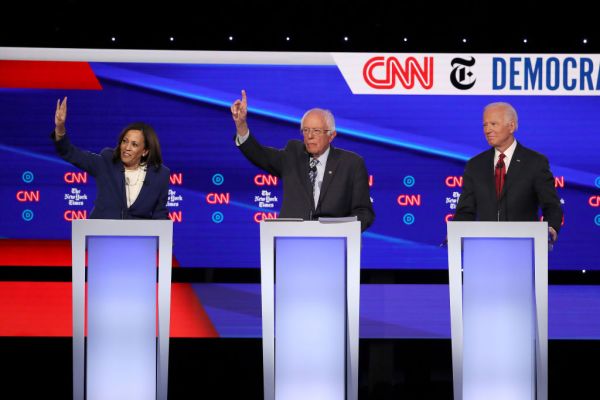

Photograph by Spencer Platt/Getty Images.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.