The unemployment rate in the United States—11.1 percent as of last month—is higher than it’s been at any point since the Great Depression (other than April and May). More than 1 million Americans have filed initial unemployment claims for 16 straight weeks; the record pre-pandemic was 695,000 in 1982. The International Monetary Fund projects the U.S. economy will contract by 8 percent in 2020, which would be the lowest annual figure dating back to World War II.

And yet, things could have been so much worse.

“The CARES Act was quite successful,” conservative economist Michael Strain told The Dispatch earlier this week. “The goal was to provide a bridge from normal economic times as they were in February to the other side of the shutdown, which is where we are now. We’re no longer shut down, we’re partially reopened. And that bridge needed to essentially replace the revenue that businesses were losing, replace the income that households were losing, and preserve the productive capacity of the economy to the extent possible.”

“If you look at the rebound in customer spending that the economy enjoyed in April and May, if you look at the rebound that the labor market enjoyed in April and May, and you look at what’s happened with business closures, I think you see that Congress really, they got it about right.”

Jason Furman, President Barack Obama’s chief economist, agreed. “Congress did a pretty good job in the CARES Act of solving the solvable economic problems,” he said. “Particularly in ensuring that disposable personal income did not collapse when the economy was shut down.”

The CARES Act—which passed the Senate unanimously on March 25 and was signed into law by President Trump two days later—pumped about $2 trillion into the economy over the past several months. The result, according to a Columbia University study, was remarkable. Without the CARES Act, an additional 12 million Americans could have plunged below the poverty line. Instead, the U.S. poverty rate is expected to rise only 0.2 points to 12.7 percent in 2020, despite record unemployment, if roughly 63 percent and 14 percent of the population access the legislation’s stimulus check program and expanded unemployment benefits, respectively.

But many of the package’s provisions came with a sunset clause. Pandemic unemployment compensation—which boosted typical benefits by $600 per week across the board—will end on July 31, reverting back to state-based systems that pay between $235 and $823 per week. The moratorium on the eviction of tenants in federally backed housing or housing financed through federally backed mortgages expires on July 25. The Paycheck Protection Program—which made more than $500 billion in forgivable loans available to businesses struggling to make payroll—was extended past its original end date in June, but is slated to close up shop on August 8.

Coupled with taxes finally coming due earlier this week and states across the country reinstituting some lockdown measures as new coronavirus cases surge, families that have just barely been scraping by are barreling once again toward an uncertain future—and experts are worried.

“We’re not prepared for this to just expire off a cliff at all,” said Annelies Goger of the Brookings Institution’s Metropolitan Policy Program. Strain called the confluence of factors “problematic.”

“You don’t want to withdraw that much income from the economy at once,” he warned. “That’s a huge amount of income to just evaporate on a dime,” Strain said, adding that while ending this benefit “would get people back to work faster,” it would also “result in a significant reduction in consumer spending.”

“If you pull back consumer spending that dramatically,” he continued, “then you end up putting the brakes on hiring because businesses would have less need for workers.”

An analysis from Ryan Nunn, Assistant Vice President at the Minneapolis Fed, found that allowing the $600 add-on to lapse would erase approximately $19 billion in liquidity from the economy—per week. A mid-June Morning Consult poll found 75 percent of voters believe these unemployment benefits should increase or stay the same, including 67 percent of Republicans.

In an email to The Dispatch, Furman estimated that letting expanded unemployment benefits expire on July 31 would subtract 2.5 percent of GDP on average in the second half of the year, cost an average of 2 million jobs over the next year, and raise the unemployment rate by up to 1.2 percentage points.

Congress is currently on recess—and has been since July 3—but addressing these points as part of a broader relief package will be priority No. 1 when lawmakers return to D.C. on July 20. Some of the provisions will likely expire, however, at least temporarily. Senate Majority Leader Mitch McConnell said at a stop in Corbin, Kentucky, on Monday that the package will come together “sometime within the next three weeks.” A Senate GOP aide told The Dispatch that ideas are currently being exchanged, but that real conversations “will begin in earnest when members return next week.”

House Democrats passed their version of Phase IV pandemic relief—the $3 trillion HEROES Act—on May 15. The package would have provided about $1 trillion to state and local governments, $200 billion for essential workers’ hazard pay, an additional round of stimulus checks, and an extension of expanded unemployment benefits. But the legislation included a laundry list of seemingly unrelated Democratic priorities as well. “The 1,800-page doorstop that Speaker Pelosi dropped last week was appropriately greeted as the legislative equivalent of stand-up comedy,” McConnell said on the Senate floor in May, making clear Congress’ upper chamber would not be taking up the bill.

A significant portion of the CARES Act’s funding hadn’t yet been spent when the House voted to tack on an additional $3 trillion back in May, and Republican lawmakers repeatedly stressed a desire to see how the pandemic unfolded—and the economy rebounded—before committing more money to relief efforts. But with nearly 20 million Americans still collecting unemployment and thousands upon thousands of businesses on the precipice of collapse, legislators on both sides of the political aisle now agree additional aid is needed. All they need to do next week is hammer out how much, and where it should go.

The price tag of the eventual package is not going to come in anywhere close to the Democrats’ $3 trillion opening salvo. “Senate Rs are interested in something targeted,” the GOP aide said. “The desire is to keep the next COVID relief bill to as close to $1 trillion as possible.” But $1 trillion is nothing to sneeze at. The American Recovery and Reinvestment Act that President Barack Obama signed into law in February 2009—and sparked the Tea Party movement that helped define the next half decade of politics in the process—clocked in at about $831 billion. So what will that money go toward?

A spokeswoman for Sen. Mitt Romney passed along a list of his priorities for the next relief package: “Further support for severely impacted employers, an extension and repair of the unemployment insurance program, proportionate assistance to state and local governments to help mitigate COVID-related revenue losses, liability protections, and a mechanism to rein in the federal debt once the pandemic is over.”

McConnell has drawn a line in the sand, making clear that a relief package will not pass the Senate without liability protections for businesses, schools, and the health care industry. “Nobody should have to face an epidemic of lawsuits on the heels of the pandemic that we already have related to the coronavirus,” he said.

Sen. John Thune will be pushing for tax relief on money earned in other states, particularly for health care workers who have traveled to coronavirus hotspots. Sen. Marco Rubio wants to help small businesses under 300 employees, not just with payroll, but with getting the personal protective equipment and technologies necessary to comply with reopening guidelines.

Sen. Rob Portman told The Dispatch he hopes to “build on” what Congress has already done to “continue to support our health care system, our schools, our employers and our families.” He will advocate for a $450 per week “return to work bonus” to incentivize Americans on unemployment—68 percent of whom are currently making more money than they would be by working, per a University of Chicago study—to rejoin the labor force.

That last point is key. A handful of Republican lawmakers, including Sen. Ben Sasse, threatened to block the CARES Act back in March over the additional $600 per week provision, citing a “perverse incentive for men and women who are sidelined to then not leave the sidelines and come back to work.” All 48 Republican senators present voted for an amendment to cap unemployment benefits at 100 percent wage replacement instead. But when that push failed, all 48 turned around and voted for the overall package, which again, passed unanimously. But with the deficit hitting a record $864 billion in the month of June alone, that type of capitulation may not repeat itself with some of the conference’s budget hawks this time around.

“I am one who is not in favor of a new massive spending bill,” Sen. Pat Toomey said in an interview. “I’m not a Keynesian, and I’m not convinced that the best thing for the economy is more trillions of dollars of spending.”

Toomey said Congress should be careful not to “exacerbate incentives to stay out of work.” He didn’t commit to any specific wage replacement percentages, but argued “it would be a good idea to revert to normal unemployment insurance. … That would not be a bad thing.”

But all that being said, Toomey understands this is Donald Trump’s Republican Party now, not Paul Ryan’s. “I wouldn’t be shocked if a package comes together that is on the order of a trillion dollars,” he conceded. “If the administration strikes a deal with Speaker Pelosi, then it’s very likely that that’ll end up passing and getting signed into law.”

Treasury Secretary Steve Mnuchin reportedly surprised some Republican lawmakers last week when he demonstrated the Trump administration’s openness to extending a pared down version of expanded unemployment benefits—“no more than 100 percent” wage replacement—in the next package. Toomey said he thinks there could be “significant Republican opposition in the Senate” if the package ends up at the $1 trillion figure.

Contrary to what the past 20 years of governance may indicate, deficits do still matter, Strain says. “I don’t take the attitude that we should just open the spigots and [say], ‘Oh, you want X, and you want Y? Let’s do X and Y,’” he argued. But at the same time, lawmakers need to head off some of the worst possible outcomes of the coming economic cliff. “If there are ways to hasten the recovery, and preserve the productive capacity of the economy, and get businesses back going, and get people back to work quickly, we should be spending money on those. And this is the right time to do that.”

McConnell has said for months that this upcoming coronavirus relief bill will be the “final” one, placing significant pressure on lawmakers to anticipate the movements of a virus that has thus far proven unpredictable.

“I mean, it’s hard,” Strain said with a laugh. “They have to figure out, how do we deal with a stop-and-start economy? … There’s a lot happening and it’s hard to predict all of it. We all thought that the summer heat would kill the virus and that it would come back in the fall, that we would have a respite this summer. What happened to that? We’re still kind of flying blind.”

Goger thinks lawmakers should build more flexibility into the legislation, and not repeat the one-size-fits-all approach of the CARES Act. “This might continue happening for, who knows, another 18 months at least?” she said. “We need to start creating policy that’s very specific to who is it reasonable to expect to return to in-person jobs where they’re exposed to people all the time, versus who we want to protect because they are at high risk.”

“I would love to see some acknowledgement that a lot of those that were displaced were in jobs that [require] a lot of physical interaction with others,” she continued. “And yet we haven’t really had any relief that focuses on, how can we find those folks some remote jobs or other opportunities without putting their life at risk.”

The CARES Act essentially shoveled money out the door in an attempt to prop up the economy as it existed in February 2020. But the coronavirus has reshaped the world economy, and many of the changes it has wrought may be permanent.

“I think that it’s hard to tell what closures are structural versus temporary,” Goger noted. “Even for the employers to tell! A lot of times they start with a temporary layoff and then that gets converted to a permanent one.”

And while those permanent layoffs may, in the long run, move us to a more productive and efficient economy, in the immediate term, those laid off workers will need a place to land—and possibly a remote one.

That requires a functioning internet connection, digital literacy, access to training programs, and information on how to manage job search online. “I hope [the next coronavirus package will] focus a little bit more on not just providing a temporary stopgap, which is what the first round of relief did, but really start building for the next two years of uncertainty,” Goger said. “We haven’t invested anything in the relief package for job training programs, career counseling, those kinds of programs. In some cases they’re getting budget cuts right now.”

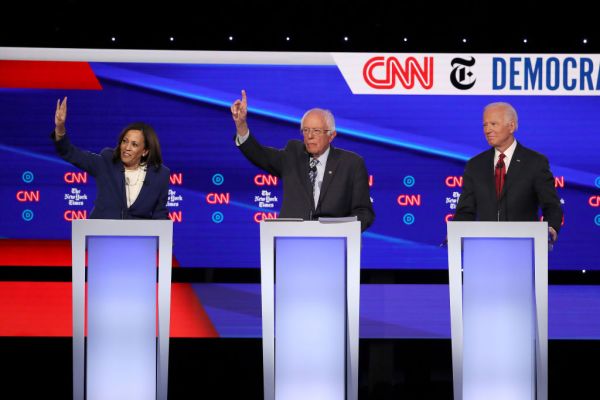

Photograph by Erin Schaff/Getty Images.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.