Losing track of the trillions? It is easy to do in the spending frenzy now underway in Washington. Even budget veterans are finding it hard to keep up, and it appears most in Congress stopped counting some time ago. But obliviousness is no excuse for steering into a budgetary dead end. Before going any further, the nation’s leaders need to take stock of the fiscal implications of recent decisions and their planned initiatives to ensure future taxpayers are not overwhelmed by debt.

Downplaying budgetary reality is a bipartisan affliction. For two decades, Democrats and Republicans have prioritized ideological ambitions over fiscal prudence. But the confluence of the pandemic response and Democratic control of government has created an environment that might supercharge the deterioration.

President Biden’s first big achievement was the $1.9 trillion COVID response plan, passed by Congress with no offsetting spending cuts or tax hikes. It is stacked on top of $4 trillion in emergency legislation approved in 2020.

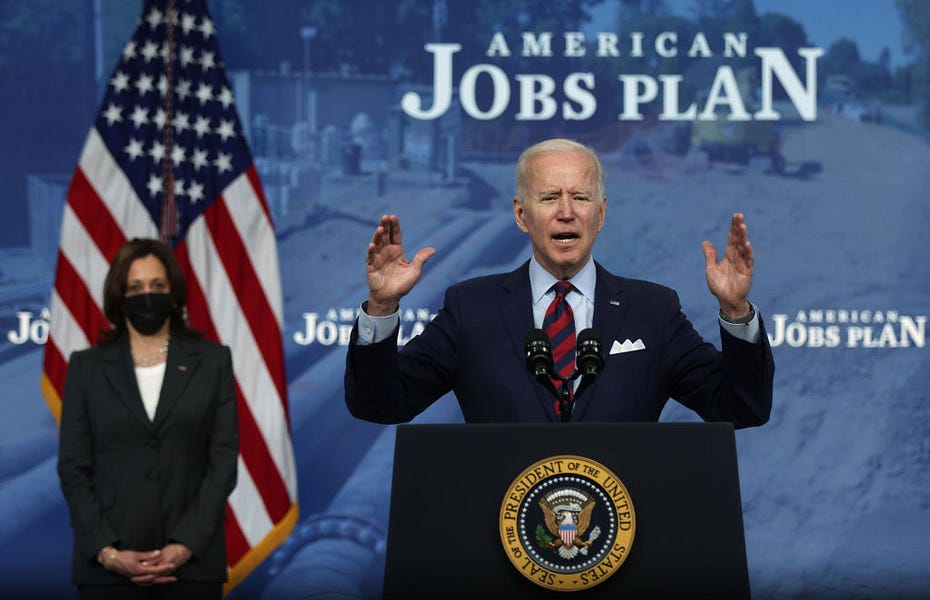

The president’s next push is for a 10-year, $2.7 trillion infrastructure bill, which he is tying to a $1.6 trillion 10-year tax increase. If approved, the combined package would add more than $1 trillion to cumulative federal debt through 2031, although the administration says the plan would begin cutting annual deficits after 15 years.

Administration officials are already signaling that their first two initiatives will not exhaust their ambitions; they are planning a third measure, focused on health coverage, child care subsidies, and other social welfare support. Its precise fiscal effects have not been disclosed.

All of this is occurring after four years of deficit neglect by President Trump. He cut taxes by $1.5 trillion over a decade and downplayed spending restraint. To get approval for increases for national defense, he agreed to multiple deals providing equivalent add-ons to domestic accounts. Even before the pandemic hit, he presided over a deteriorating fiscal outlook, with the annual budget deficit widening from 3.1 percent of GDP in 2016 to 4.6 percent in 2019.

The best data on what these decisions will mean for the federal budget come from the Congressional Budget Office (CBO), which released its latest forecast just before Congress passed the president’s COVID response plan. The nonpartisan agency projected the federal government would run a 10-year deficit of $12.3 trillion, and federal debt would climb to 107 percent of GDP in 2031, up from 100 percent this year. The new COVID law will add $1.9 trillion to the government’s borrowing, and the infrastructure plan, as proposed, would add another $1 trillion, pushing the 10-year deficit to around $15.2 trillion. The cumulative effect of these plans will push federal debt above 110 percent of GDP at the end of 10 years. By comparison, federal debt was less than 40 percent of GDP at the end of 2008.

CBO also released updated 30-year projections last month, which are even more alarming. The agency expects federal debt to soar as population aging and rising medical care costs push up spending for the government’s largest entitlement programs—Social Security, Medicare, and Medicaid. By 2051, federal debt will exceed 200 percent of GDP.

The Biden administration argues its agenda will not make the outlook worse because it is offset with tax hikes on big companies and high-income households, and with higher economic growth.

The case is unpersuasive. While some infrastructure investment might push productivity up, a big spending plan will displace some commitments that would have occurred anyway, especially by state and local governments. One element of the Biden plan is $100 billion for building new public schools, and $213 billion for home construction. These are domains that traditionally have been the responsibilities of other levels of government, and the private sector.

More important, the tax hikes will close off options. If new revenue is raised to pay for new spending, and not to cover previous commitments, then there will be less room to raise taxes to prevent the debt spiral CBO is projecting. The Biden administration may claim that the rich can be tapped again, to close the fiscal gap it inherited. But that assumes there is no political ceiling on how high tax rates can go.

The alternative to more revenue is structural reform of the major entitlement programs. The probability of this occurring with Democrats fully in charge of the government is even lower than piling on yet higher tax rates on the rich.

Biden officials believe the pandemic has created an opportunity to expand the federal government’s role in American life. They are ignoring the trillions of dollars in previously enacted commitments that have yet to be tied to reliable revenue sources. Raising taxes for new initiatives will only make it harder to pay for obligations entered into years, and sometimes decades, ago.

The president did not cause the nation’s fiscal problems, but that does not matter. He is now responsible for minimizing the possibility that excessive debt will emerge as a crippling economic challenge. He can still advance his agenda, but he must do so while first ensuring the government he inherited, and bequeaths, is solvent and sustainable.

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.