Dear Capitolisters,

These days, it’s hard to get people to agree on almost anything, especially in Washington. But say that the U.S. economy—and “Western-style” (or “neoliberal”) capitalism more broadly—is in terrible shape, and you’re bound to get a bunch of nodding heads. As Jonah just noted, for example, a wide swath of politicians and pundits on the right and the left (including the ones in the White House) have soured on several of the U.S. economy’s longstanding pillars—openness, dynamism, risk-taking, organic growth, etc.—and embraced inward-looking planning and protectionism because, as the theory goes, the old approach produced weakness abroad and misery at home.

Leaving aside the small facts that these modern thinkers, as Politico hilariously noted Monday, have struggled to actually define and implement their alternative to American “neoliberalism” (or whatever vague/dumb term you prefer), and that there’s really never been a golden era of Friedman-esque “free market fundamentalism,” these critiques all suffer from the same, massive flaw: For all its warts and problems—and yes there are plenty—the U.S. economy isn’t actually a basket case and, in fact, remains globally dominant by all sorts of metrics. Why doesn’t anyone think so?

A Brief Overview of Continued American Economic Dominance

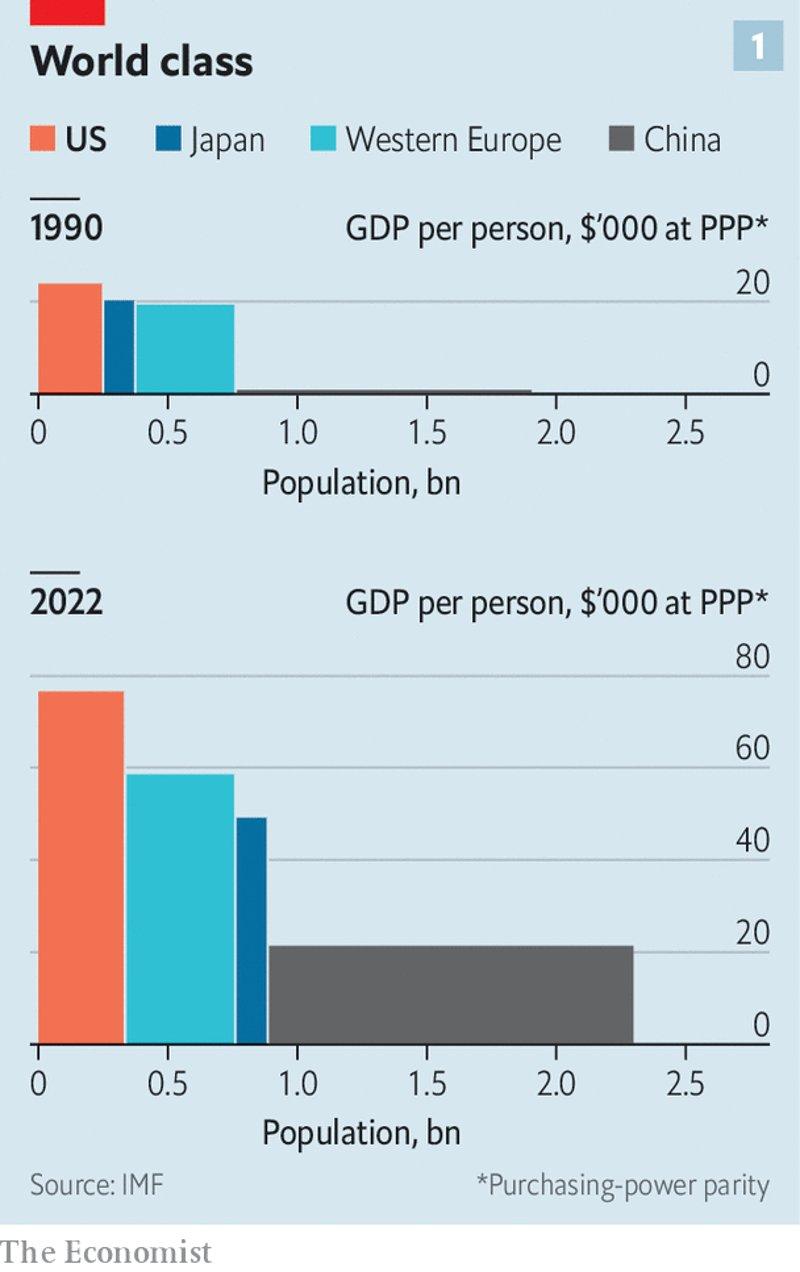

Jonah already noted that great piece in The Economist last month on current U.S. economic dominance, but please allow me to supplement his excerpt with some charts (of course) and a few more data points. (Editor’s note: Publish your draft columns faster, dude.) Here, for example, we see the stellar growth and magnitude of Americans’ economic output (per capita gross domestic product, adjusted for purchasing power—and how China’s economic heft is mainly derived from its giant population, not individual wealth or productivity:

The U.S. economy is also growing faster than its wealthy peers. For example, its already large share of “G7” (Canada, France, Germany, Italy, Japan, the United Kingdom, and the United States) output has also increased substantially in recent decades:

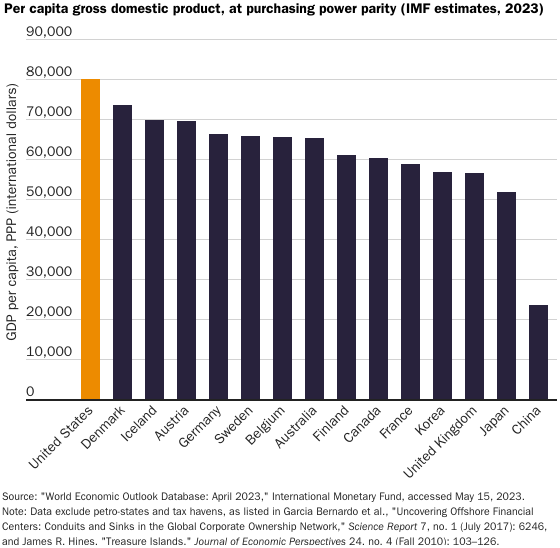

Excluding petrostates and tax havens (both of which have skewed GDP data), the United States in 2023 is the wealthiest country on earth—by a lot:

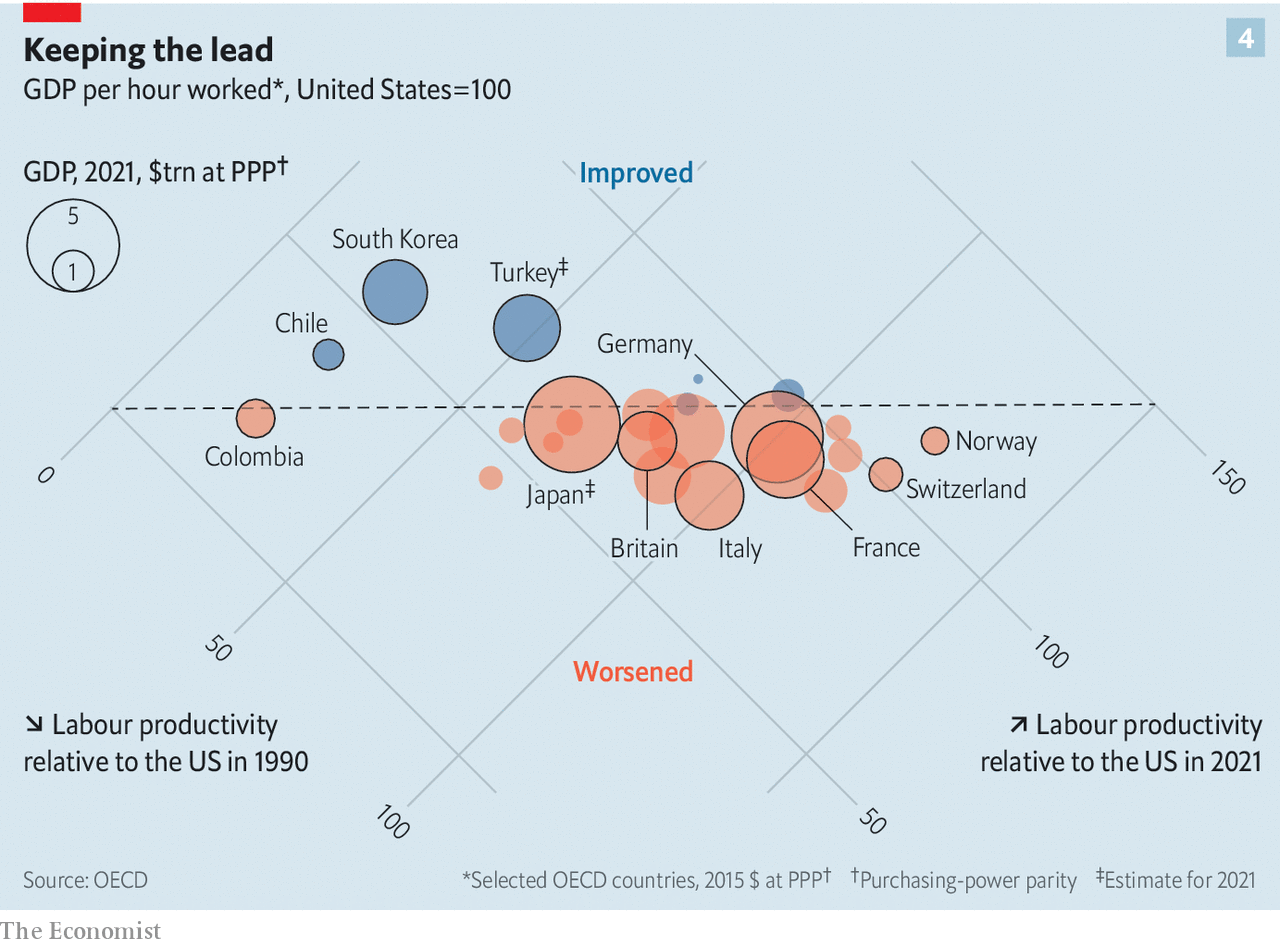

Much of this, The Economist notes, is owed to Americans’ increasing productivity relative to many other countries:

Americans are getting richer because they are getting more productive more quickly than workers in other rich countries. … [B]etween 1990 and 2022 American labour productivity (what workers produce in an hour) increased by 67%, compared with 55% in Europe and 51% in Japan. … Since [the mid-2000s] American productivity growth has fallen back towards its long-run average of about 1.5%. But it is still faster than in most other rich countries, and still driven by the technology sector.

And those gains, the piece documents, are in large part owed to our open, dynamic, flexible, and uniquely-American system.

National Review’s Dominic Pino provided some other telling data points from The Economist’s rundown:

• In 1990, the U.S. share of world GDP was about 25 percent. Today, despite China’s rise and Japan’s fall, it remains about the same.

• The poorest U.S. state, Mississippi, has a higher average income than France.

• The U.S. has almost 33 percent more workers today than it did in 1990. Western Europe and Japan only have 10 percent more.

• More American workers have graduate and postgraduate degrees than workers in Western Europe or Japan.

• Over 20 percent of patents registered abroad belong to American companies, more than China and Germany combined.

• The top five corporations by R&D spending are all American.

• Putting $100 in the S&P 500 in 1990 would leave you with over $2,000 today. That’s four times more than if you had put it in any other wealthy country’s stock market.

• Incomes in the lowest quintile in the U.S. have risen by 74 percent, adjusted for inflation, since 1990.

Here are some more data points from The Economist—some of which we’ve discussed here in past columns:

America spends roughly 37% more per pupil on education than the average member of the OECD, a club of mostly rich countries. When it comes to post-secondary students it spends twice the average. …

As a share of its working-age population, roughly 34% of Americans have completed tertiary education. … Only Singapore has a higher rate. …

America is home to 11 of the world’s 15 top-ranked universities in the most recent Times Higher Education table. …

Despite having had little federal climate policy worth speaking of until recently, America’s industrial carbon-dioxide emissions are 18% below their mid-2000s peak….

America also has far and away the world’s deepest and most liquid financial markets, providing efficient, if occasionally unstable, channels for financing businesses and sorting the winners from the losers. Stockmarket capitalisation runs to about 170% of GDP; in most other countries it comes in below 100%. Funding for potentially high-growth startups is particularly bountiful: about half of the world’s venture capital goes to firms in America. …

The aftermath of covid-induced confinement has fired the American drive for reinvention as never before: 5.4m new businesses started in 2021, an annual record and a 53% increase from 2019….

But wait, there’s more. Over at The Atlantic, San Diego State’s Jean Twenge explains how millennials, whose troubled economic position is often used to indicate American decline, are actually doing pretty great these days—in large part because they’ve simply followed the same, slow (and uneven) improvement in incomes and wealth that all previous American generations have followed:

By 2019, households headed by Millennials were making considerably more money than those headed by the Silent Generation, Baby Boomers, and Generation X at the same age, after adjusting for inflation. That year, according to the Current Population Survey, administered by the U.S. Census Bureau, income for the median Millennial household was about $9,000 higher than that of the median Gen X household at the same age, and about $10,000 more than the median Boomer household, in 2019 dollars. The coronavirus pandemic didn’t meaningfully change this story: Household incomes of 25-to-44-year-olds were at historic highs in 2021, the most recent year for which data are available. Median incomes for these households have generally risen since 1967, albeit with some significant dips and plateaus. And like each generation that came before, Millennials have benefited from that upward trend.

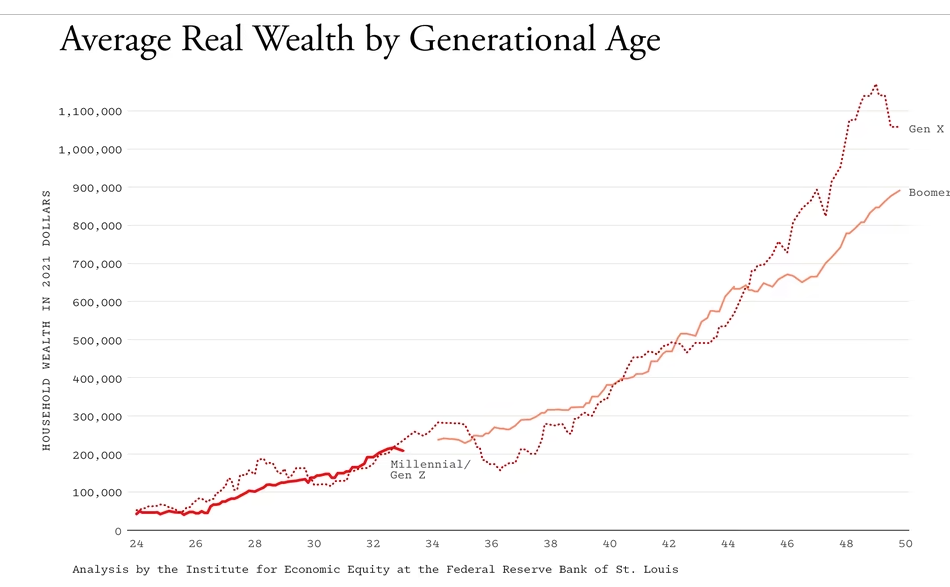

She adds that “individual income shows largely the same thing” as the household chart above, and that these gains have been experienced across racial groups (though levels, of course, vary). She then chronicles how millennials are getting more education (“one of the main reasons Millennials are doing relatively well financially”); buying houses (“only slightly behind Boomers’ and Gen Xers’ at the same age: 50 percent of Boomers owned their own home as 25-to-39-year-olds, compared with 48 percent of Millennials”); and building wealth (“Recent analysis by the Fed, including data through the middle of 2022, has shown average Millennial wealth to be neck and neck with the wealth of Gen X at the same age.”):

Others have found much the same thing. Overall, both the Great Recession and changing lifestyle trends (getting more education, for example) may have delayed the millennial generation’s economic ascent, but it is undoubtedly ascending today—similar to (if not better than) the rise of previous American generations before it.

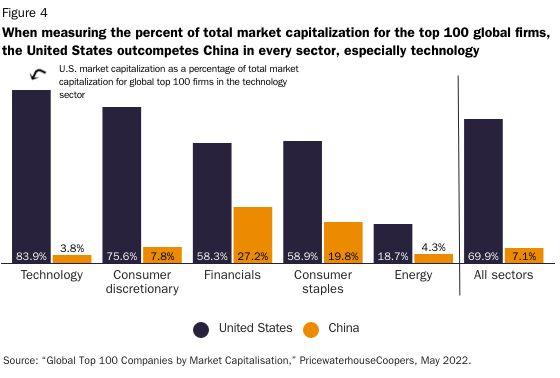

Other data points—on income mobility, single parent poverty, below-median wages (especially of late), married couple incomes (cost-adjusted), social spending—are also impressive, and I’ve covered many more in past newsletters on American wages, inequality, consumption, and other hot policy topics. Here’s one more chart from my new China paper on American corporate and tech prowess (something the trendy artificial intelligence race is today confirming again):

Overall, the picture is prettaay, prettaay good.

As The Economist, Pino, and Twenge note (and as I’ve noted here repeatedly), this doesn’t mean that everything is perfect in the United States. You can certainly find data points—drug use and life expectancy, employment prospects for less-educated men, depressed millennial childbearing, incessant political strife, etc.—that demand our attention and in many cases policy reforms. But, as Pino put it, “[F]or most people, there’s no economy better than America’s. Zooming out from day-to-day politics, it’s clear that the U.S. free-market system is doing something right. America’s more managed peers in Europe and Japan just aren’t doing as well.” Indeed, it’s all enough for the New York Times’David Brooks to express “amazement” at how well American capitalism is doing (after adding, I should note, that American social spending increased from 14 percent to 18 percent of GDP between 1990 and 2019): “We’ve lived through a wretched political era. The social fabric is fraying in a thousand ways. But American capitalism rolls on.”

Indeed it does.

Why So Miserable?

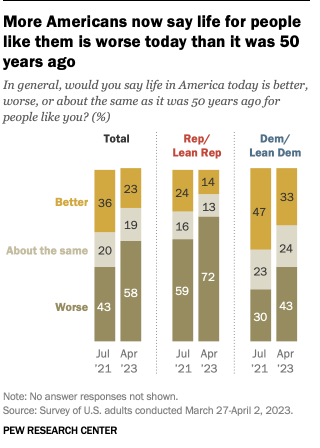

Despite all of this, the endless supply of economic doomerism from policy entrepreneurs on the left and right indicates at least some level of bottom-up demand therefor. And, while one recent survey showed American workers historically happy with their situation, other polls on the U.S. economy aren’t so rosy. A widely discussed new survey from Pew, for example, found a solid majority of Americans—including a whopping 72 percent of Republicans—saying that “life for people like them” is worse today than it was in the mid-1970s:

And that same poll found declining shares of Americans of both parties expressing just “some” level of confidence in the nation’s future:

Plenty of other polls show similarly pessimistic views among a large share of the American populace.

So what’s going on here? How can the U.S. economy be romping compared to its global peers, yet full of people pining for the 1970s(!) and led by a bipartisan chorus of politicians promising a “new economic order”? I’ve covered some of the possible reasons why economic pessimism sells in past newsletters—on the hedonic treadmill and static thinking, for example,—but today lemme offer a few more.

Most obviously, Americans’ views on the state of the U.S. economy reflect a wide variety of economic and non-economic factors that they personally prioritize—or want to be seen as prioritizing—but don’t necessarily show up in broad, imperfect measures of economic well-being like per capita GDP. As I discussed last year, for example, 2022 election polling showed large majorities of Americans’ displeasure with inflation driving their view of the U.S. economy, even though it was booming at the time and many people were doing pretty well (or, at least, treading water).

It’s similarly understandable for someone to say that “life” in 2023 stinks if he just lost a job or family member, is worried about his local community or social circle, or values things like declining religiosity over rising material well-being. Poll questions like this are notoriously messy for this very reason, and their results can diverge dramatically from the results of questions that probe people’s specific financial condition (as opposed to “the economy” more broadly). Indeed, National Review’s Noah Rothman described this exact dichotomy when looking at the results of a recent, deep-dive poll on Gen Z:

Young people believe the country is in a state of disarray, but seven in ten rate their personal financial situation highly. Young people take a dim view of the future, but most believe their personal financial situation will improve and they will be homeowners in the neighborhood of their choice in that grim tomorrow. Despite the worryingly high numbers of young people who report debilitating apprehension, majorities say they are not lonely, depressed, or hopeless. They’re not worried about being shot or assaulted, and they don’t lie awake at night worrying that “something awful might happen.”

This is nothing new. Surveys frequently find a gulf between a respondent’s view of her own financial situation and her views of the economy, economic policy, or American society more broadly. And economists have long explored how individuals’ economic sentiments are driven by things—including media coverage and election results—that are unrepresentative of or totally disconnected from the U.S. economy as a whole.

One of those things is relative status: A person might be doing better than his parents or better than he was doing a decade ago, but if his peers are doing even better still, he might still pine for the “good ol’ days.” Twenge explained how this psychology affects still-despondent millennials, especially when combined with modern media:

Human beings are hardwired to care deeply about status, and we assess it in two different ways. At any given moment, we look around to see how we’re doing compared with our peers. And we reflect on our own past and future status as well: Are our lives getting better? Are we better off than our parents, and will our children be better off still? Both of these forms of status affect our well-being. A number of factors inherent in modern society may have pushed many Millennials toward a distorted view of each.

Before social media, and before the proliferation of lifestyle and reality TV, the only rich individuals most people encountered were from the particularly well-off families in their town. Now the rich (or at least those who appear to be rich) fill our feeds and our screens, providing a skewed view of how other Americans live. The Kardashians cannot, in fact, be kept up with. Online, everyone else’s life looks more glamorous than our own. The resulting sense of “relative deprivation,” as it’s known among psychologists, no doubt afflicts Americans of all ages—but Millennials have spent their entire adulthood in this milieu, and remain more online than older generations.

Meanwhile, negativity in the news—which, studies show, has become much more pronounced in recent years—has colored perceptions of generational progress. A seemingly endless array of articles and news segments have repeated the idea that Millennials have gotten the shaft economically, an idea that social media amplifies further. (When government economists worry that Millennials might be a “lost generation” as to wealth, it generates news; when they later say that Millennials have greatly narrowed the wealth gap, the coverage is quieter.)

Maybe this phenomenon really is worse for people today, but Virginia Postrel recently documented that the same exact things were happening centuries ago in Elizabethan England: The early stages of modern commerce rapidly enriched almost everyone (as measured by the number of items in their homes), yet many people still felt worse off because their neighbors were doing even better. Fast forward to today:

Similarly, if in the mid-20th century an American family was solidly middle class (say, the third quintile of income) and its children went to college, they’re likely now in the top two quintiles of income. If they didn’t go to college, they’re much less likely to have risen and may be relatively worse off than their parents. Either way, however, they have a lot more stuff, including goods and services that were unimaginable 50 years ago. But, like the Elizabethans, contemporary Americans who feel poorer than their former economic peers resent their relative decline, while the upwardly mobile mistake their rise for personal superiority. Both groups tend to forget what the recent past was really like. And commentators decry the terrible state of things.

As Johan Norberg explained in Reason a few years ago, that forgetfulness is a big reason why nostalgia sells and why every generation—here and abroad, dating back to ancient Mesopotamia!—has pined for one or two generations before it:

Memories are notoriously unreliable. When schoolchildren returning from summer holiday are asked to name good and bad things from the break, their lists are almost equally long. When the exercise is repeated a couple of months later, the list of good things grows longer and the bad list gets shorter. By the end of the year, the good things have pushed out the bad from their memories completely. They don’t remember their summer anymore; just their idealized image of it. It is difficult for any version of the present to compete with that.

Combine all of this with a general human attraction to bad news, and it’s little wonder that many people think today’s U.S. economy stinks; or, as Postrel wrote two decades ago, that Americans thought the same that year, and Adam Smith warned of it two centuries before that:

“The annual produce of the land and labour of England … is certainly much greater than it was, a little more than a century ago, at the restoration of Charles II,” Smith wrote in The Wealth of Nations. “Though, at present, few people, I believe, doubt of this, yet during this period, five years have seldom passed away in which some book or pamphlet has not been published … pretending to demonstrate that the wealth of the nation was fast declining, that the country was depopulated, agriculture neglected, manufactures decaying, and trade undone. Nor have these publications been all party pamphlets. … Many of them have been written by very candid and very intelligent people, who wrote nothing but what they believed, and for no other reason but because they believed it.”

Finally, many voters’ views of the U.S. economy, Western capitalism, and“neoliberalism” are likely derived from the political elites with whom these voters most strongly align. I wrote about this phenomenon years ago when examining U.S. trade polling during the Trump years, and a brand new paper confirms many of my conclusions. Randall Holcombe expands (and improves) the discussion in his new book, Following Their Leaders: Political Preferences and Public Policy. He shows how tens of millions of American voters anchor themselves to a candidate or party based on certain core issues and then adopt the rest of the party/candidate’s positions out of political convenience. Kevin Corcoran summarizes Holcombe’s findings and why voters do this:

Holcombe reviews a wide range of literature that helps explain why most policy preferences are derivative for most people. Among the relevant factors is the endowment effect—people value their political identities simply by having them and will be reluctant to change them. There is also the bandwagon effect—when it seems like most members of your identity group, peer group, or social circle are going in a particular direction, most people go along, particularly when there is nothing instrumental to gain by dissenting. The desire to reduce cognitive dissonance is also at play.

With both parties run by gerontocrats who lament our modern economy and promise to Make America Great Again (or whatever), it’s no surprise that tens of millions of Americans tell pollsters the same type of stuff, regardless of the economy’s actual state.

Summing It All Up

The U.S. economy will always have challenges, and U.S. economic policy will always need updating. But the system’s pillars—economic, legal, and political—have produced a sort-of “perpetual national wealth machine” that sputters at times but eventually roars back even stronger than before. We can debate and adjust taxes, regulations, redistribution, and other facets of the American system, but the one thing we shouldn’t do is abandon or “fundamentally transform” its core elements out of some bogus belief that we’re falling behind our global peers (if not failing outright). Avoiding that calamity is easier said than done, given the power of nostalgia, given that a dynamic economy makes changes in relative status inevitable, and given that there will always be political elites eager to seize on and manipulate those and other forces for their own personal gain. Yes, we have problems. Yes, there will be bad times. But the biggest threat to long-term American prosperity comes not from our system but from those now seeking to abandon it. It’s therefore essential that we keep harping on America’s economic reality, regardless of what the current “consensus” now claims – and what it rewards at the ballot box.

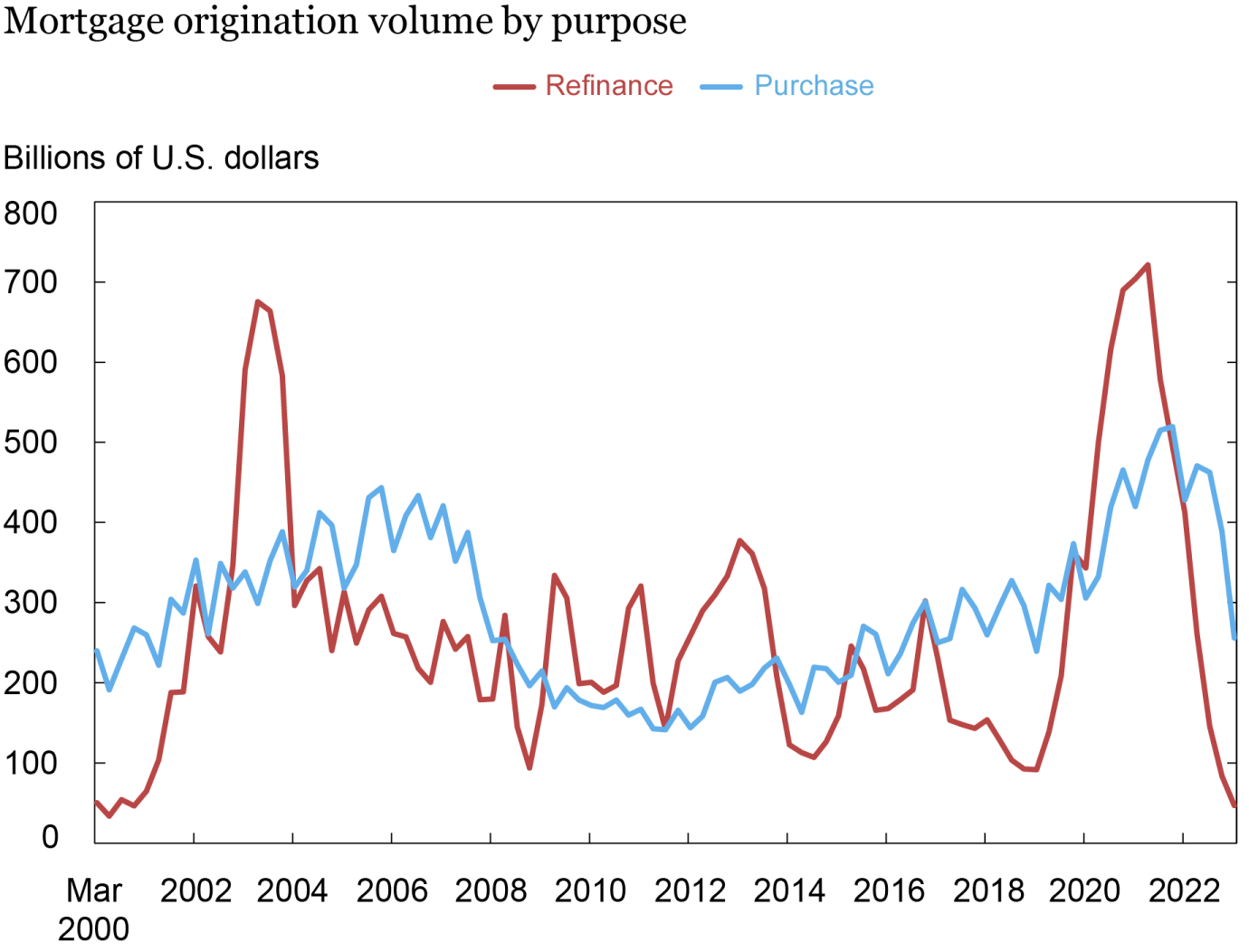

Chart(s) of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.

With your membership, you only have the ability to comment on The Morning Dispatch articles. Consider upgrading to join the conversation everywhere.