Jonah’s great G-File on my colleague Ryan Bourne’s great book, The War on Prices, got me also thinking about prices (as one does). In particular, Jonah’s riff on “hamburguesa” prices—ones set by politicians that are obviously fake and terrible to outsiders—has me wondering why politicians still embrace price controls, wage floors and ceilings, rent controls, interest-rate caps, and similar regulations, despite better alternative policies and decades of evidence that mucking around with prices generates numerous harms and unintended consequences. To an economic policy wonk, it makes little sense. And yet, as Bourne documents in his book and elsewhere, price-related measures aren’t just persisting today but actually proliferating. So, what gives?

In a recent Cato blog post, Bourne offers up his own ideas for why price regulations—universally disdained by economists, thanks to centuries of failure—persist: Voters don’t like high prices, are ignorant of history and knock-on (second order) effects, and demand quick-fix solutions from politicians attracted by the invisible nature of price regulations’ costs. And, he adds, everyone has apparently deluded themselves into thinking that this time the results will be different.

Bourne’s guesses strike me as possible, if not likely, for certain price regulations at certain times—anti-gouging laws during hurricanes, for example. Where there are plausible “market failures” or real-world disasters, I can totally see where price controls become an immediate and attractive political tool, despite their economic drawbacks. But I think this leaves out a wide range of price regulations that lack such conditions and may have a less savory origin: politicians’ intense desire to cover up their or their partisan teammates’ past policy mistakes, which prices are inconveniently revealing.

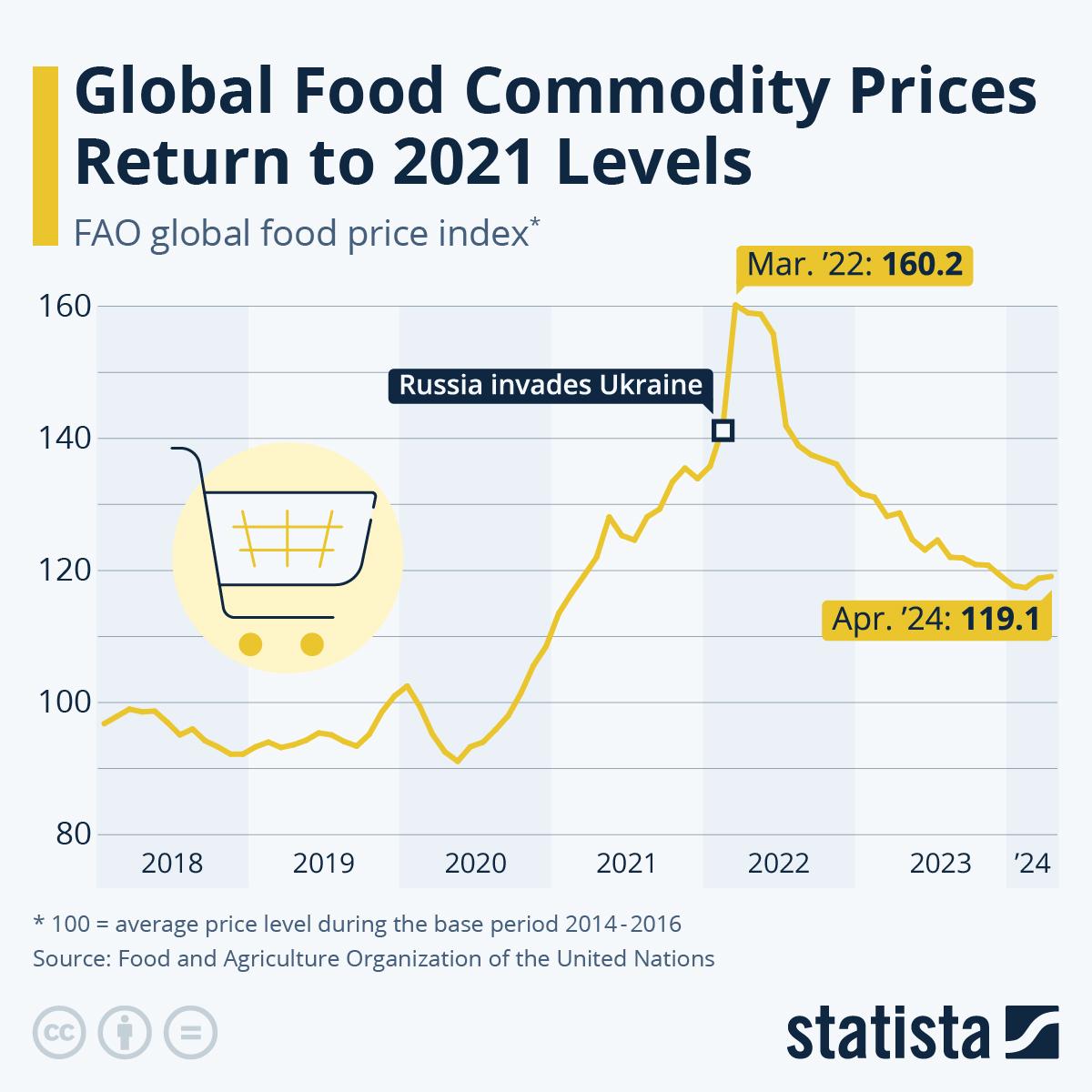

These revelations, as we discussed here in Capitolism two years ago, materialize because prices “are a giant neon sign about what’s going on in a particular market,” quickly conveying massive amounts of fragmented knowledge via a single, easily understood, and highly visible number. Thus, “High prices … tell difficult truths about supply and demand and, more importantly, government policies affecting each.”

And often politicians backing those policies simply can’t handle the truth.

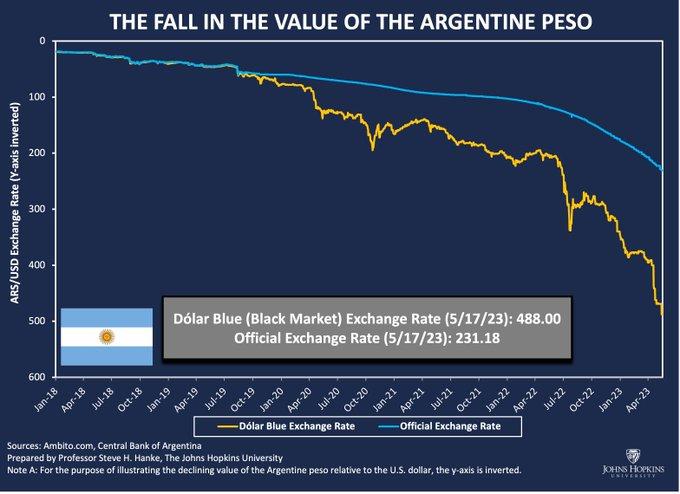

We see this most clearly in basket-case countries like Venezuela (which Jonah mentions) and Argentina, where years of reckless monetary and fiscal policy generated runaway inflation that desperate public officials tried to “fix” with price and rent controls that ultimately made things even worse—shortages, black markets, hoarding, hyperinflation, and more, plus the social ills that typically accompany such misery—for the vast majority of the citizenry. (As Bourne recently noted on Twitter, Argentinian President Javier Milei’s nascent efforts to undo some of these price controls are already producing some positive results.)

But this recipe isn’t limited to developing countries battling self-inflicted hyperinflation. In Bourne’s book, for example, we learn the following U.S. history lessons (some of which we’ve also discussed here at Capitolism):

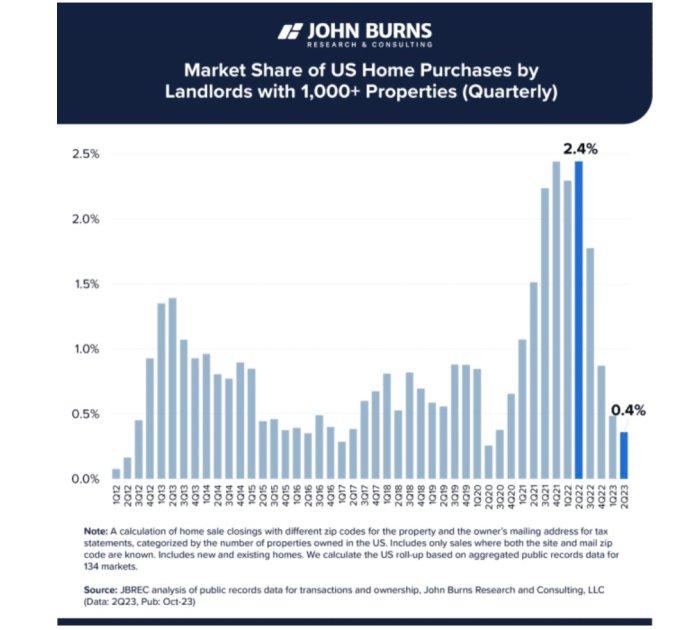

- State and local regulations restricting housing construction in high-growth areas (e.g., San Francisco, San Jose, and New York City) have increased home prices and rents, leading to various forms of rent controls that perversely caused even more damage to the housing market (shortages, black markets, misallocation, higher prices, etc.).

- Convoluted and incomplete energy price controls of the 1970s caused prices of unregulated products to increase, leading to … even more price controls. For example, the 1973 Emergency Petroleum Allocation Act (EPAA) didn’t regulate the “new” oil (i.e., oil produced above 1972 levels) and imported oil, so those higher-priced products ended up dictating U.S. gasoline prices. Thus, Congress responded with the 1976 Energy Policy and Conservation Act (EPCA), which amended the EPAA and expanded price controls to the “new” oil too. Subsequent studies show that the EPCA actually ended up increasing both world market and domestic crude oil prices, and the whole mess was (thankfully) abandoned in the early 1980s.

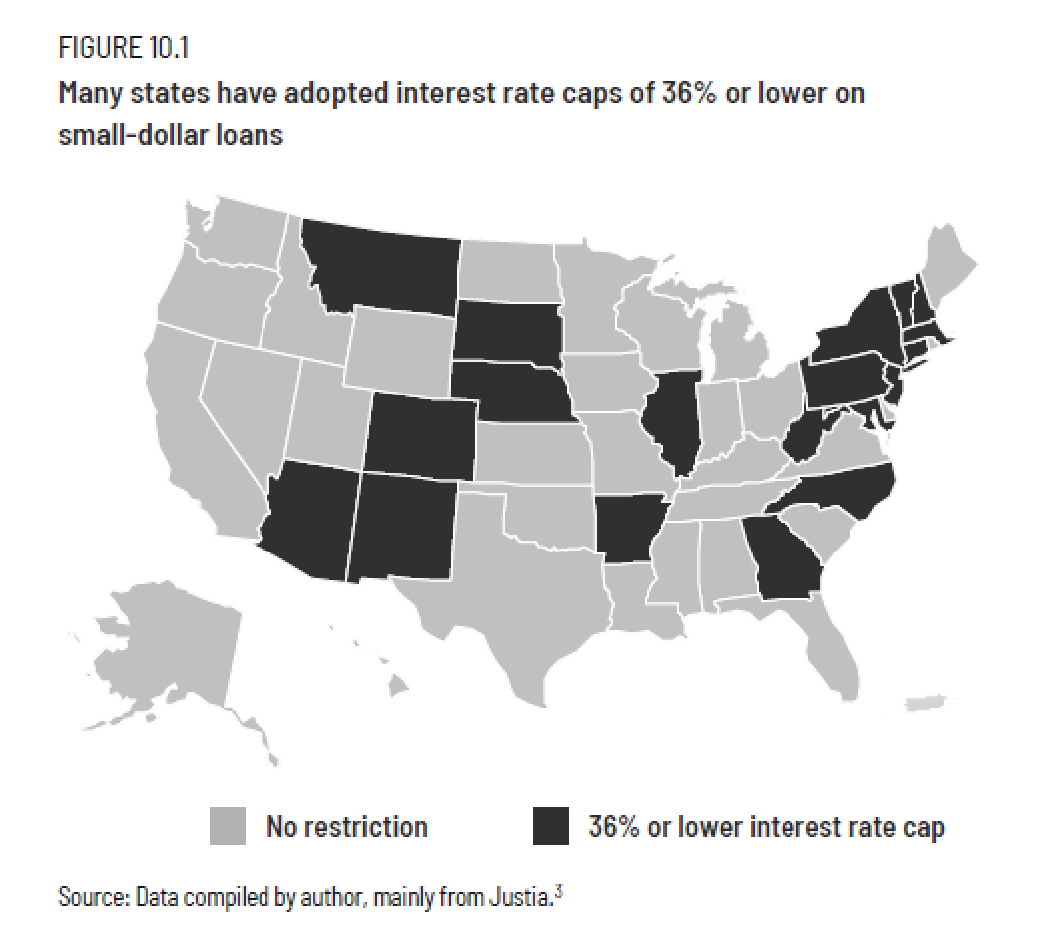

- Financial regulations increased lenders’ compliance costs, restricted the supply of credit, and reduced financial sector innovation, burdening riskier borrowers with interest rates that were needlessly higher than they’d otherwise be. So, naturally, states and federal legislators responded by capping interest rates that … further restricted access to credit in ways that harmed these very borrowers.

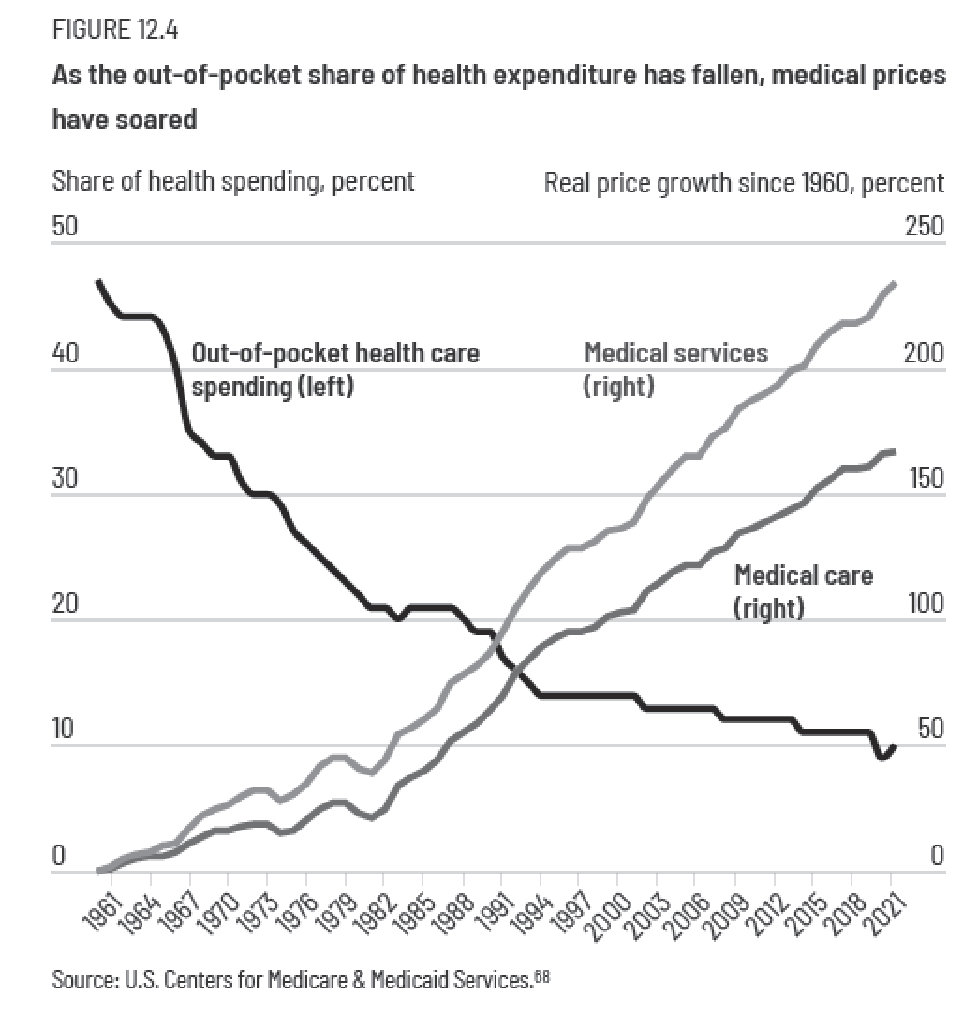

- The U.S. health care system—far from the “free market” it is often (and bizarrely) claimed to be—is full of price controls (e.g., in the government programs that account for 49 percent of U.S. health spending), supply-side restrictions (e.g., on scope of practice or telehealth), and other policies (e.g., tax rules that encourage employer-sponsored insurance and make consumers less price-sensitive). These policies result in excessive prices—public and private—for various health care procedures and costlier health insurance. Congress and various health care wonks, naturally, have responded to these serious price pressures with demands for even more price controls.

There are, of course, many more examples outside of the book. In just the last few years, for example, we’ve seen U.S. politicians propose:

- Federal “anti-gouging” restrictions on the sale of infant formula, which—as we have repeatedly discussed—was subject to federal trade, regulatory, and welfare measures (including price controls) that severely restricted supplies and fueled the 2022 infant formula crisis.

- Caps on gasoline refiners’ profits—another “anti-gouging” initiative—in California, which of course leads the nation in taxing and regulating fossil fuels into high-priced oblivion.

- Federal price controls on insulin, despite all sorts of laws and regulations that drive insulin prices “sky high.”

- Caps on college and grad school tuition and student loan costs, despite strong evidence that federal subsidies and other policies fuel at least some of the recent spike in those same costs.

- Aluminum “reference prices” to help U.S. manufacturers that faced higher raw materials costs thanks to Trump’s (now Biden’s) aluminum tariffs.

- New restrictions on bank and credit card fees, which increased substantially after the Dodd-Frank “Durbin Amendment” restricted debit card fees.

I could easily go on. In case after case, escalating prices of important goods and services revealed the problems with politicians’ favored laws and regulations, and they responded not by reforming or abandoning those bad policies but by simply trying to make the price signals disappear—and, of course, by ignoring the additional problems that will inevitably follow the price controls. It is, as CEI’s Iain Murray once brilliantly described, “the political equivalent of The Simpsons’ Bolivian tree lizard clean-up plan.”

It’s hard to say whether the price controllers are as innocent and ignorant as ol’ Principal Skinner was in that delightful Simpsons clip, but there are plenty of reasons to think that at least some of them aren’t—that they understand the economic problems they’ve created and that price controls will create in the future. We even have historical evidence of this very thing, thanks to the Nixon tapes and a great 2016 paper on how 1970s wage and price restrictions came to be. As the authors document, President Nixon implemented his 1971 “New Economic Policy”—comprehensive wage and price controls, coupled with expansive monetary and fiscal policy—for political reasons, knowing that they’d cause serious economic problems down the road. Nevertheless, Nixon’s staff convinced him that he needed to champion these policies both to keep prices and unemployment in check in the run-up to the 1972 presidential election and to cover up his administration’s changes to U.S. monetary policy (i.e., abandoning the Bretton Woods Agreement and taking the U.S. off the gold standard). Some of the quotes in the paper—including from a prescient Milton Friedman—are truly amazing and worth reading yourself, but here’s the short version from the paper’s conclusion:

Treasury Secretary John Connally faced an impending crisis resulting from balance of payments deficits and loss of gold reserves. He persuaded a reluctant President to suspend gold convertibility by combining the suspension of convertibility and floating of the exchange rate with a package of policies intended to stimulate the domestic economy and hopefully reduce the stubborn rate of unemployment. Connally correctly foresaw that the public would pay far greater attention to the domestic changes, especially Nixon’s bold approach to fighting inflation by imposing wage and price controls, than to the international changes.

Thus, desperation politics caused a U.S. president who in July 1971 called wage and price controls “a socialist scheme, a plan to socialize America” to impose “the first and only peacetime wage and price controls in U.S. history” just one month later. Nixon understood the effects of his wage and price controls but chose to implement them anyway—and suffer the longer-term economic costs—for his own short-term political gain.

Surely, not every U.S. politician is Richard Nixon (ha), but it’s easy to see how many of them could be similarly motivated. Real policy reform is a much bigger political challenge than offering up a sugar high of price controls. Elected officials risk serious reputational damage when admitting policies they once championed are failing outright or otherwise imposing economic costs they claimed would never materialize. Just as importantly, targeted taxes, subsidies, and regulations (price and otherwise) invariably create new political constituencies that financially benefit from these policies and will thus fight like hell to ensure they stick around, even after the policies’ bigger problems are apparent. Couple those common political dynamics with, as Bourne notes, the delayed/hidden costs of price-related regulations and good ol’ voter ignorance, and the measures remain a politically attractive way for elected officials to avoid blame while promising a clear and simple—though obviously terrible!—solution to something people seriously dislike.

For this reason alone, we should expect American politicians to continue waging their wars on prices, even as the casualties—and hamburguesas—pile up.

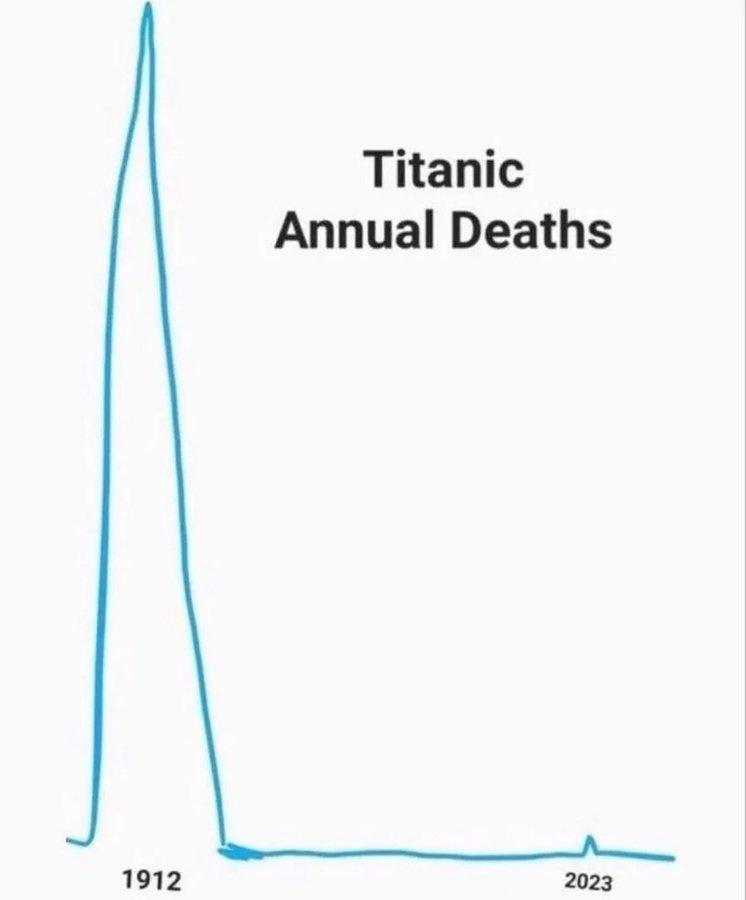

Charts of the Week

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.