Happy Thursday! We have news that eight-year-old you would have loved: Hasbro announced yesterday that, starting this fall, you’ll be able to put a 3D-printed version of your own head on any of the toy company’s signature action figures.

Only $59.99 (plus tax) to transform into the Red Ranger, G.I. Joe, or Princess Leia? Total steal.

Quick Hits: Today’s Top Stories

-

The Bureau of Labor Statistics reported Wednesday the Consumer Price Index increased 1.3 percent from May to June, and 9.1 percent year-over-year—the fastest rate of annual inflation since November 1981. Gasoline prices accounted for a significant portion of the jump, but core inflation—which excludes food and energy prices—was still up 5.9 percent year-over-year.

-

President Joe Biden landed in Israel on Wednesday, kicking off his first trip to the region as president. In an interview with an Israeli TV station, he reiterated that the United States would not remove the Iranian Revolutionary Guard Corps’ designation as a foreign terrorist organization, even if that prevents his administration’s negotiators from reviving the 2015 Iran nuclear deal. He also said he wouldn’t rule out U.S. military action to prevent Iran from obtaining a nuclear weapon “if that was the last resort.”

-

Sri Lankan Prime Minister Ranil Wickremesinghe imposed a state of emergency and curfew on Wednesday as protests continued to rage after President Gotabaya Rajapaksa fled the country on a military aircraft and appointed Wickremesinghe to act on his behalf. Parliamentary Speaker Mahinda Yapa Abeywardena said Rajapaksa reiterated his intention to resign, and that a new president would be elected next week.

-

Rishi Sunak—the United Kingdom’s former Chancellor of the Exchequer whose resignation last week helped trigger Prime Minister Boris Johnson’s resignation—finished first on Wednesday in the initial ballot of Conservative members of Parliament to determine Johnson’s successor, with Trade Minister Penny Mordaunt, Foreign Secretary Liz Truss, Equalities Minister Kemi Badenoch, House of Commons Foreign Affairs Committee Chair Tom Tugendhat, and Attorney General Suella Braverman also receiving enough support to move on to the next round of voting on Thursday.

-

The Food and Drug Administration issued an emergency use authorization on Wednesday for a COVID-19 vaccine developed by Novavax, a Maryland-based biotechnology company. The two-dose vaccine—which has been available in Europe for months, and does not rely on mRNA technology like Pfizer and Moderna’s—was authorized as a primary immunization series for adults, not as a booster shot. The Biden administration announced Monday it had purchased 3.2 million doses of the shot, to be delivered in the next few weeks.

-

The Department of Health and Human Services issued guidance to U.S. pharmacies on Wednesday clarifying that—due to antidiscrimination statutes that apply to recipients of federal funding—they cannot, in certain circumstances, deny patients access to prescribed medications used in abortions, regardless of state law. A handful of doctors and patients have reported instances of pharmacists restricting access to certain drugs used to treat autoimmune disorders in recent weeks over concerns they could cause miscarriages.

-

The Treasury Department reported this week the federal government ran a budget deficit of $89 billion in June 2022, a 49 percent decrease from June 2021 due primarily to pandemic-related stimulus programs expiring and tax revenues increasing as more Americans returned to work. Outlays for the month fell 12 percent year-over-year—from $623 billion to $550 billion—and government receipts increased 3 percent.

-

The Euro and U.S. dollar reached parity on Wednesday for the first time in 20 years, with recession fears and fallout from the Russia-Ukraine war depreciating the value of Europe’s currency against the relative “safe haven” of the dollar.

-

The Senate voted 66-28 on Wednesday to confirm Michael Barr—an Obama-era Treasury Department official who helped craft the Dodd-Frank Act and stand up the Consumer Financial Protection Bureau—to serve as the top bank watchdog at the Federal Reserve.

Inflation: Still Very, Very Bad!

There’s no two ways about it: Yesterday’s Consumer Price Index (CPI) numbers flat out stunk. The annual rate of inflation reached 9.1 percent in June—the highest level since November 1981, when Dodgers southpaw Fernando Valenzuela was awarded National League Rookie of the Year—and prices were up 1.3 percent from May to June alone. With hourly earnings up about 5 percent since June 2021, Americans’ real wages—adjusted for inflation—have fallen 3.6 percent over the past year, faster than at any point in the past four decades.

With each of the Bureau of Labor Statistics’ last few monthly updates, optimists could—if they so choose—comb through the heaps of topline dreck and dig out a few nuggets of hope to cling to. The April report was the last before some disinflationary base effects would begin to kick in, and “core” CPI—which strips out more volatile energy and food prices—came in at a more or less normal level. In May’s report, even the headline figure fell, and the month-over-month data was at its lowest point since January 2021. Some economists began cautiously predicting inflation had already peaked.

But yesterday’s release was pretty much all dreck, no nuggets. The month-over-month number for June was 30 percent higher than May’s, and more than four times the April figure. Core inflation ticked back up, as did services inflation, and upward price pressures have clearly trickled into parts of the economy largely untouched by supply chain snarls and rising energy costs. Rent, for example, went up in June more than it has in any month since 1986. If extrapolated out to a full year, book prices rose in June at an 19.2 percent annual clip. So did the prices of bread, processed seafood, juice, footwear, linens, and used cars. “There just wasn’t a lot in this report to give anyone comfort about anything,” Jason Furman, Harvard University economist and former chair of President Barack Obama’s Council of Economic Advisers, told The Dispatch. “Almost all of the news in [it] was bad.”

That’s not to say there are no trends out there pointing to some future disinflation—there are. But as Furman pointed out on Twitter yesterday, you wouldn’t be able to find any of them in yesterday’s CPI report, you’d have to look elsewhere. Last week’s jobs numbers, for example.

“I really thought wage growth was going to pick up this year, and it hasn’t,” Furman said. Although that sounds like a negative, an escalating wage-price spiral—where rising prices and wages continuously feed into each other—would make inflation much more entrenched, and much harder to stamp out. “Ultimately, it’s just hard to have very, very high inflation on a sustained basis in prices without having very high wage inflation,” Furman continued. “And with all the worries about the economy at this point, it’s sort of hard to see how wage growth starts to pick up. So I do see that as really reassuring.”

There’s some quasi-positive news on the goods side as well. Several large retailers, for example—like Macy’s, Target, and Walmart—have discussed needing to slash prices to offload excess inventory as consumer demand wanes. As fears of a global recession grow, various commodity prices—including wheat, lumber, corn, cotton, and certain metals—have plunged in recent weeks. Perhaps most encouragingly of all, gas prices—which accounted for about half of June’s topline monthly figure—are down about 8 percent from their June highs. Most of that relief should show up in the next report, not this one.

That was the White House line on Wednesday. “While today’s headline inflation reading is unacceptably high, it is also out-of-date,” President Joe Biden said in a statement, noting the approximately 40-cents-per-gallon decrease at the pump since mid-June wasn’t fully reflected in the report. “Those savings are providing important breathing room for American families.”

While it’s certainly true $4.63-per-gallon gasoline is preferable to $5.01-per-gallon gasoline, that’s still quite expensive—and even additional declines would do little to assuage concerns that inflation has fully entrenched itself throughout the economy. “Energy could easily be a negative in July, so it’s not horrific, like we’re going to have 1.3 percent inflation per month for the rest of time,” Furman said. “It’s plausible that some of the bad news in this report was just quirks. The problem is that core inflation rose at an annual 9 percent rate. Even if this percentage point was this quirk, and that percentage point was that quirk, well, you’re still left with seven percent.”

“It’s possible there was some volatile thing [in June] that’s not going to repeat,” he added. “But the services thing, that’s pretty stable.”

Which brings us back to our friends at the Federal Reserve, who have spent the past few months trying to destroy enough aggregate demand to slow the price increases without destroying so much aggregate demand they tip the economy into a recession. But after Wednesday’s numbers, they may be left with no choice. “I think it is unlikely—very unlikely—that we will see inflation come down to target range without a significant economic downturn,” former Treasury Secretary Larry Summers said yesterday at the Economic Club of New York.

Investors seemed to internalize the same message. Before yesterday’s CPI report, the odds of the Fed matching last month’s 0.75-percent interest rate hike at their next meeting were more than nine in 10, according to the CME FedWatch Tool. By Wednesday night, the odds of a full 1.00-percent hike—which, according to Bloomberg, would be “the largest increase since the Fed started directly using overnight interest rates to conduct monetary policy in the early 1990s”—were 78 percent. The Bank of Canada did just that on Wednesday.

San Francisco Fed President Mary Daly reiterated her support on Wednesday for another 75-basis-point increase, but some of her colleagues were more audacious. “Everything is in play,” Raphael Bostic—president of the Atlanta Fed—told reporters. One asked if “everything” included an unprecedented 100-basis-point boost.

“It would mean everything,” he replied.

War Grinds on in Ukraine

When we last provided a full update on the war in Ukraine around the 100 day mark, Russia was making “incremental, grinding, and costly” territorial gains in the Donbas, the eastern region of Ukraine that Russian forces set their sights on after failing to roll over the rest of the country. Meanwhile, Ukrainian troops were inflicting heavy losses on advancing Russians and, in some places, launched limited counterattacks.

At first glance, not much has changed. Russian forces still control a swathe of territory from southern Ukraine up through the eastern Donbas region to the north of Kharkiv, and they’re still trying to complete their conquest of the Donbas while Ukrainian forces push back, particularly in the south. In contrast to the sweeping advances and retreats at the war’s outset, not much territory is changing hands. Analysts at the Institute for the Study of War report Russia’s military machine is taking an “operational pause”—probably to regroup, reform units depleted by casualties, and let troops rest. “Largely speaking, we haven’t even yet started anything in earnest,” Russian President Vladimir Putin boasted last week.

“Over the last couple months the war’s slowed to basically a fight of attrition,” Raphael Cohen—director of the RAND Corporation’s strategy and doctrine program—told The Dispatch. “Even though Russia has made gains, particularly in Luhansk province [in the Donbas], it’s fairly small and fairly slow, and ditto with Ukrainian gains in the south.”

That doesn’t mean the violence has stopped. Russia is still bombarding Ukrainian positions and making “limited probing” attacks, according to ISW—testing the waters for future offenses. And Russian forces have also escalated attacks on civilians in recent weeks. A strike on apartment buildings in eastern Ukraine over the weekend killed at least 47 people—including a child—Ukrainian emergency services said Wednesday. Officials have urged civilians to evacuate that region of the Donbas.

Ukraine has also stepped up long-range strikes, targeting ammunition depots, command posts, and other key military targets behind the front lines. Ukrainian presidential adviser Oleksiy Arestovych said on social media that Ukraine has used U.S.-provided HIMARS—a long-range, truck-mounted precision rocket launch system—to carry out 30 strikes in recent days.

“The occupiers have already felt very well what modern artillery is, and they will not have a safe rear anywhere on our land,” Ukrainian President Volodymyr Zelenskyy said in a video address Tuesday. “They have felt that the operations of our reconnaissance officers to protect their Homeland are much more powerful than any of their ‘special operations.’”

Putin professed to be unfettered by Ukrainian resistance. “We are hearing that they want to defeat us on the battlefield,” he said Thursday. “Let them try.”

But U.S. officials have praised Ukrainian forces for effective use of the eight HIMARS systems delivered so far—and four more are on the way as part of the United State’s most recent $400 million military aid package. “They’re going after targets that have major effect on the battlefield,” a senior military official told reporters last week.

Both Ukraine and Russia are still burning through ammunition and equipment and taking casualties. “The question becomes—who blinks first?” Cohen said, noting that the West’s broader military industrial base can more sustainably replenish Ukraine’s supply while Russia is largely on its own replacing spent items. An exception: Iran plans to provide Russia with “up to several hundred” military drones, U.S. National Security Adviser Jake Sullivan said Monday. “Theoretically Russia has a deeper pool of personnel to draw on than Ukraine does because Russia has a larger population,” Cohen added. But Russian leaders have so far been unwilling to shoulder the political cost of declaring mass mobilization to add troops.

While Russia takes its “operational pause,” it’s moving Ukrainian civilians out of occupied territories into Russia. Putin signed a decree this week creating a “fast-track” to Russian citizenship for all Ukrainians, a move the West sees in a less friendly light. Secretary of State Antony Blinken said Wednesday Russia has interrogated, detained, and deported between 900,000 and 1.6 million Ukrainian civilians—including 260,000 children: “President Putin’s ‘filtration’ operations are separating families, confiscating Ukrainian passports, and issuing Russian passports in an apparent effort to change the demographic makeup of parts of Ukraine.”

Zelensky put the total at 2 million. “They are trying to take them to remote areas of Russia,” he claimed, “to make it as difficult as possible for them to return to their homeland.”

Russia is “deliberately turning Donbas into ashes” with its pounding artillery strikes, Luhansk Gov. Serhiy Haidai told the Associated Press. “And there will be just no people left on the territories captured.”

Worth Your Time

-

In Wednesday’s Morning Dispatch, we linked to a Washington Post fact check and an interview with Ohio’s Republican Attorney General Dave Yost casting doubt on the veracity of a recent viral story—of a 10-year-old rape victim in Ohio traveling to Indianapolis to terminate her pregnancy after Ohio’s new abortion restrictions went into effect—because various child services agencies in the state were unaware of such a case, which would have been subject to mandatory reporting requirements. Tragically, we learned yesterday the story appears to be true—and now that more evidence has emerged, we regret how we initially framed the issue. “Gershon Fuentes, 27, whose last known address was an apartment on Columbus’ Northwest Side, was arrested Tuesday after police say he confessed to raping the child on at least two occasions,” Bethany Bruner, Monroe Trombly, and Tony Cook reported for The Columbus Dispatch yesterday. “Columbus police were made aware of the girl’s pregnancy through a referral by Franklin County Children Services that was made by her mother on June 22, Det. Jeffrey Huhn testified Wednesday morning at Fuentes’ arraignment. On June 30, the girl underwent a medical abortion in Indianapolis, Huhn said. … During Wednesday’s hearing, Assistant Franklin County Prosecutor Dan Meyer requested Fuentes be held without bond. He said Fuentes is not believed to be in the country legally and there are questions about his identity. Huhn testified that detectives spoke to Fuentes, through an interpreter, and Fuentes admitted to having sexual contact with the girl.”

-

Domestic and foreign oil producers drilling more would certainly help bring gas prices down, but that’s only part of the equation. An arguably bigger and longer-term obstacle to reining in fuel prices, Kevin Crowley and Jennifer Dlouhy note in Bloomberg, is the United States’ dwindling refining capacity. “The US hasn’t built a full-scale refinery since 1977. Designing and constructing the labyrinth of pipelines, tanks, and distillation columns would easily cost $10 billion and take as long as a decade,” they write. “During the pandemic, plants that distill crude into gasoline, diesel, and jet fuel shut down around the world, and construction of new ones was postponed. The closures were especially acute in the US, where old facilities suffered irreparable damage from breakdowns and hurricanes while others were converted to produce renewable diesel. … ‘My personal view is there will never be another new refinery built’ in the US, [Chevron CEO Mike] Wirth said in an interview with Bloomberg TV in June. ‘You’re looking at committing capital 10 years out, that will need decades to offer a return for shareholders, in a policy environment where governments around the world are saying, ‘We don’t want these products.’”

Presented Without Comment

Also Presented Without Comment

Also Also Presented Without Comment

Toeing the Company Line

-

Klon Kitchen guest hosted Wednesday’s episode of The Dispatch Podcast, talking with Robert O’Brien—former national security adviser to President Trump—about how the United States can protect itself from Chinese economic espionage and protect Taiwan from Chinese aggression. Plus: What is the future of the war in Ukraine? And what was it like working as Trump’s national security adviser?

-

In this week’s Capitolism (🔒), Scott looks at two examples—in Germany, and in Sri Lanka—of how playing it safe can be costlier and more harmful than taking risks. “Regulators’ focus should be on risk mitigation, not risk elimination,” he argues. “Private actors [should be able to] freely act (and innovate) without express government approval unless regulators convincingly demonstrate that the action at issue is very likely harmful to society on net.”

-

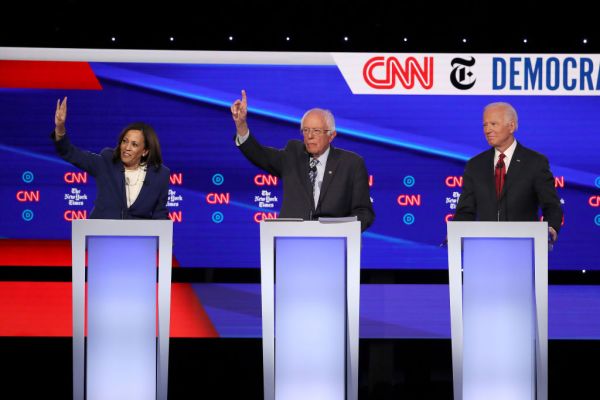

Wednesday’s G-File (🔒) is about Vice President Kamala Harris. “The woman is just terrible at her job,” Jonah writes. So terrible, he argues, that even the “librul lamestream media” has been brutal on her. “Contrary to every hard-learned expectation I had going into this presidency, her failures are a unifying force in American politics.”

-

Georgetown professor and Dispatch contributor Paul Miller joins Jonah on The Remnant today to tackle everyone’s favorite buzzwords: Christian nationalism. They dig into what drives humans toward nationalism, why it’s intertwined with Christianity in America, and what—besides the Declaration of Independence—should hold the U.S. together.

-

Is a judge about to tell Elon Musk that actually, yes, he has to buy Twitter now? David and Sarah discuss that question on the latest Advisory Opinions—plus Boycott, Divest, Sanction laws, an abortion travel case, and the Texas res judicata case (featuring pronunciation help from a Latin expert, thank God).

-

On the site today, Charlotte covers Biden’s pivot to the Middle East, Melissa Langsam Braunstein writes about the anti-Israel Boycott, Divestiture, and Sanction movement, and Andrew Fink analyzes Putin’s cynical usage of the globalism card.

Let Us Know

Do our readers who lived through the runaway inflation of the 1970s and early 1980s have any tips for those of us who are experiencing this menace for the first time?

Please note that we at The Dispatch hold ourselves, our work, and our commenters to a higher standard than other places on the internet. We welcome comments that foster genuine debate or discussion—including comments critical of us or our work—but responses that include ad hominem attacks on fellow Dispatch members or are intended to stoke fear and anger may be moderated.